Extending Earnings and Deductions

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_PIN |

Name the element and define its basic parameters. |

|

|

GP_PIN_USR_FLD_SEC |

Define user fields to create unique instances of an element. |

|

|

GP_ERN_DED_CALC |

Define calculation rules for an earnings element. |

|

|

GP_ERN_DED_RND |

Specify rounding and proration options for the components of an earnings element. |

|

|

GP_ERN_DED_AC_ADDL |

Indicate the accumulators (already defined in the system) to which the earnings element contributes. |

|

|

GP_ELM_DFN_SOVR |

Override the value of certain supporting elements that are used by the definition of the earnings element or override the supporting elements when they are not part of the earnings. This page is also used to override deductions. |

|

|

GP_PIN |

Name the element and define its basic parameters. |

|

|

GP_PIN_USR_FLD_SEC |

Define user fields to create unique instances of an element. |

|

|

GP_ERN_DED_CALC |

Define calculation rules for a deduction element. |

|

|

GP_ERN_DED_RND |

Specify rounding and proration options for a deduction element. |

|

|

GP_ERN_DED_AC_ADDL |

Indicate the accumulators (already defined in the system) to which the deduction element contributes. |

|

|

GP_ELM_DFN_SOVR |

Override the value of certain supporting elements that are used by the definition of the deduction element or override the supporting elements when they are not part of the deduction definition. |

|

|

GP_PIN |

Select the GEN NONTAX E element delivered by Global Payroll for Thailand as a template. |

|

|

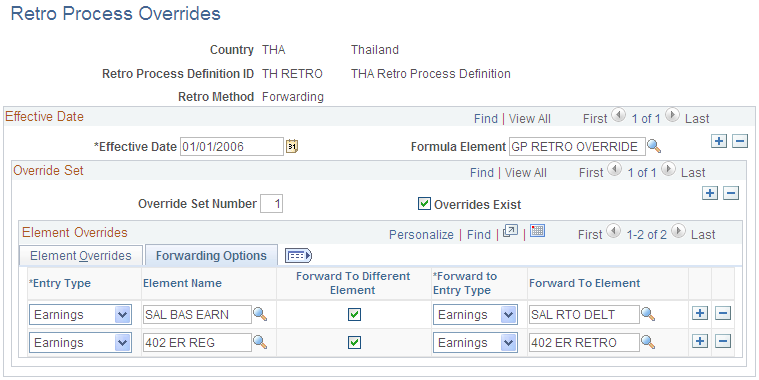

Retro Process Overrides Page |

GP_RTO_OVR_DEFN |

Specify the elements that are to be forwarded when the standard retro method is forwarding. Define overrides to the standard corrective retro method. Override the Retro Recalculation Option defined on the earnings and deduction definition pages. |

|

Element Group Name Page |

GP_PIN |

Name the element group and define its basic parameters. |

|

Element Group Members Page |

GP_ELEMENT_GROUP |

Insert elements into element groups. |

|

Section Name Page |

GP_PIN |

Name a section and define its basic parameters. |

|

Definition Page |

GP_SECTION |

Select elements that constitute a section. |

|

Payee Sections Page |

GP_PYE_SECTION |

Create a payee section for a process list. |

Follow these steps to create taxable earnings:

Define the earnings name.

Specify the earnings name, security level, and overrides.

Define the user fields.

Specify the user fields for this earnings element.

Define the calculation rule.

Specify the components that make up the calculation rule for the earnings.

Define the rounding/proration rule.

Specify the rounding and proration rules for earnings elements.

Define accumulators.

Select the accumulators to which this earnings element contributes.

Create supporting element overrides.

Create supporting element overrides at the element definition level.

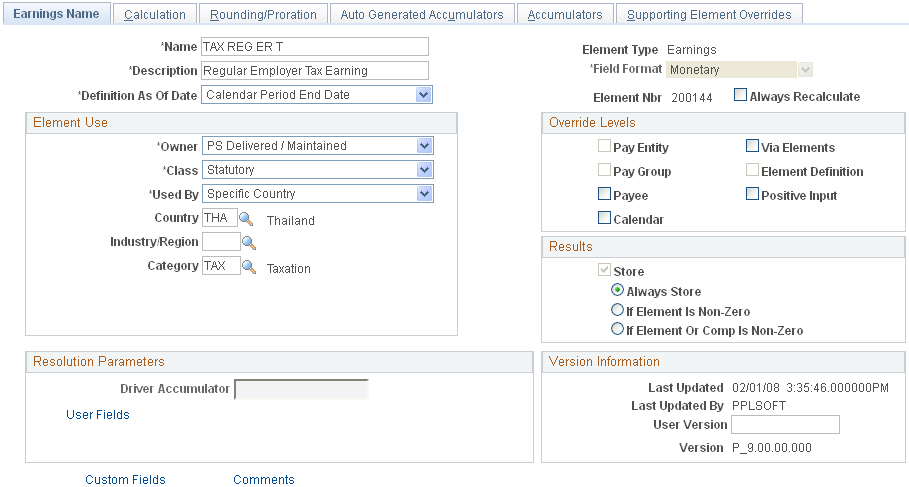

Use the Earnings Name page (GP_PIN) to name the element and define its basic parameters.

Navigation:

This example illustrates the fields and controls on the Earnings Name page.

Give your earnings element an appropriate name and description based on the naming conventions of your company.

Carefully define the override levels.

Do not select the Always Recalculate check box. Selecting this check box causes repeated recalculations of the earnings, making the calculated result inaccurate.

Give your earnings element an appropriate category.

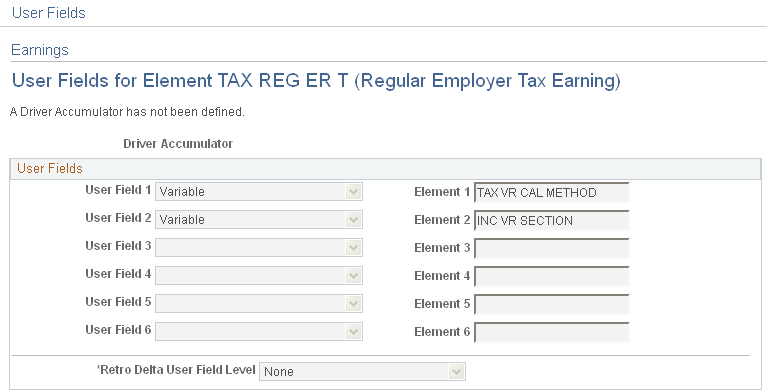

Use the Earnings - User Fields for Element <Element Name> page (GP_PIN_USR_FLD_SEC) to define user fields to create unique instances of an element.

Navigation:

Select the User Fields link on the Earnings Name page.

This example illustrates the fields and controls on the Earnings - User Fields for Element <Element Name> page.

For all taxable earnings elements, the User Field of Variable with the TAX VR CAL METHOD element must exist in the User Field group box.

Note: If the selected Element includes the Payroll Result record GP_RSLT_ERN_DED, then the User Fields are unavailable for entry.

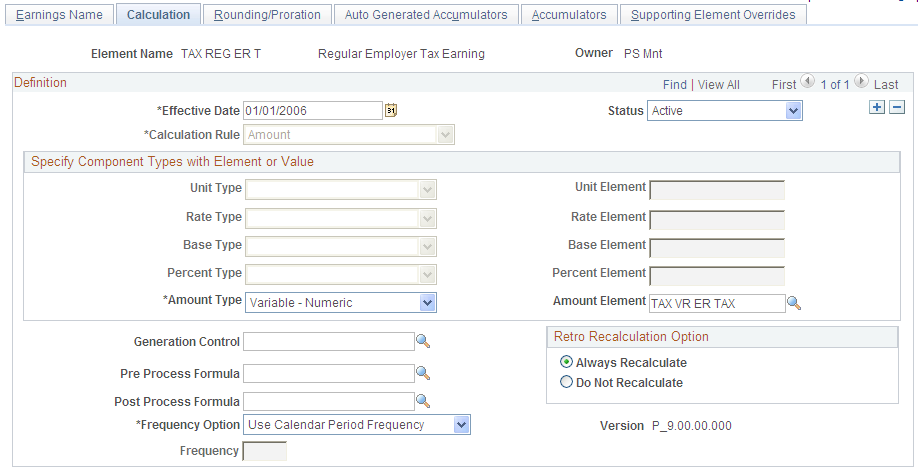

Use the Earnings - Calculation page (GP_ERN_DED_CALC) to define calculation rules for an earnings element.

Navigation:

This example illustrates the fields and controls on the Earnings - Calculation page.

Choose a calculation rule, then define each calculation component. The values for the Calculation Rule field are:

Amount.

Base * Percent.

Unit * Rate.

Unit * Rate * Percent.

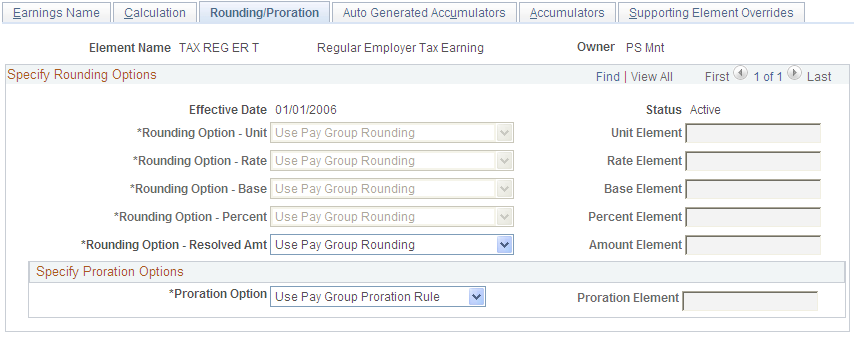

Use the Earnings - Rounding/Proration page (GP_ERN_DED_RND) to specify rounding and proration options for the components of an earnings element.

Navigation:

This example illustrates the fields and controls on the Earnings - Rounding/Proration page.

Global Payroll for Thailand does not deliver rounding rules, use the core Global Payroll rounding rule to define rounding rules for your earnings element.

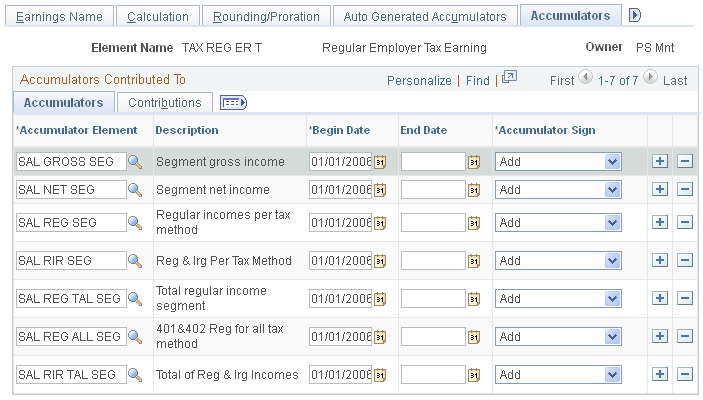

Use the Earnings - Accumulators page (GP_ERN_DED_AC_ADDL) to indicate the accumulators (already defined in the system) to which the earnings element contributes.

Navigation:

This example illustrates the fields and controls on the Earnings - Accumulators page.

Based on your requirements, consider adding your earnings element into the accumulators listed in the following table. PeopleSoft does not maintain these accumulators which is why they have an NM (not maintained) suffix . PeopleSoft delivers these accumulators only for you to add you newly created elements into. Use the NM accumulators only when you create new earnings elements. If you add existing elements directly into accumulators without the NM suffix (PS Delivered/Maintained accumulators), a conflict may occur between your modification and any new patches from PeopleSoft.

|

Accumulators |

Sign |

Usage |

|---|---|---|

|

SAL GROSS NM |

Add |

Gross pay accumulator. Add all newly created earnings elements into this accumulator. |

|

SAL NET NM |

Add |

Net pay accumulator. Add all newly created earnings elements into this accumulator. |

|

SAL RIR NM |

Add |

Add taxable earnings elements into this accumulator. |

|

SAL RIR TAL NM |

Add |

Add taxable earnings elements into this accumulator. |

|

SAL REG NM |

Add |

For regular income earnings, add to this accumulator. |

|

SAL REG TAL NM |

Add |

For regular income earnings, add to this accumulator. |

|

SAL IR NM |

Add |

For irregular income earnings, add to this accumulator. |

|

SAL IR TAL NM |

Add |

For irregular income earnings, add to this accumulator. |

|

SI BASE NM |

Add |

For a social security fund contribution base earnings, add to this accumulator. |

|

SI BASE PRO NM |

Add |

For earnings elements that project social security fund contributions in the remaining periods, add to this accumulator. |

|

PF BASE NM |

Add |

For provident fund contribution base earnings, add to this accumulator. |

|

PF BASE PRO NM |

Add |

For earnings elements that project provident fund contribution for the remaining periods, add to this accumulator. |

|

SAL REG PRO NM |

Add |

For earnings elements that project regular income in the remaining periods, add to this accumulator. |

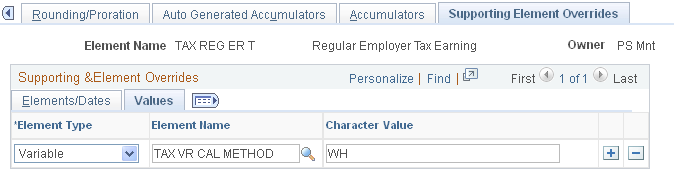

Use the Earnings - Supporting Element Overrides page (GP_ELM_DFN_SOVR) to override the value of certain supporting elements that are used by the definition of the earnings element or override the supporting elements when they are not part of the earnings.

Note: Also, use this page to override deductions.

Navigation:

This example illustrates the fields and controls on the Earnings - Supporting Elements Override page, Values tab.

Global Payroll for Thailand uses the TAX VR CAL METHOD variable to determine the tax calculation method for individual taxable earnings elements. If your new element is used only under one tax calculation method, you can assign this tax method at the element definition level using the Supporting Element Overrides page.

Global Payroll for Thailand uses the TAX VR CAL METHOD variable to determine the tax calculation method for individual taxable earnings elements. If your new element is used only under one tax calculation method, you can assign this tax method at the element definition level using the Supporting Element Overrides page.

The possible Character Values for the TAX VR CAL METHOD variable are:

WH: Global Payroll for Thailand uses the withholding tax calculation method for this earnings element.

GA: Global Payroll for Thailand uses the gross up all cycle tax calculation method for this earnings element.

GO: Global Payroll for Thailand uses the gross up one cycle tax calculation method for this earnings element.

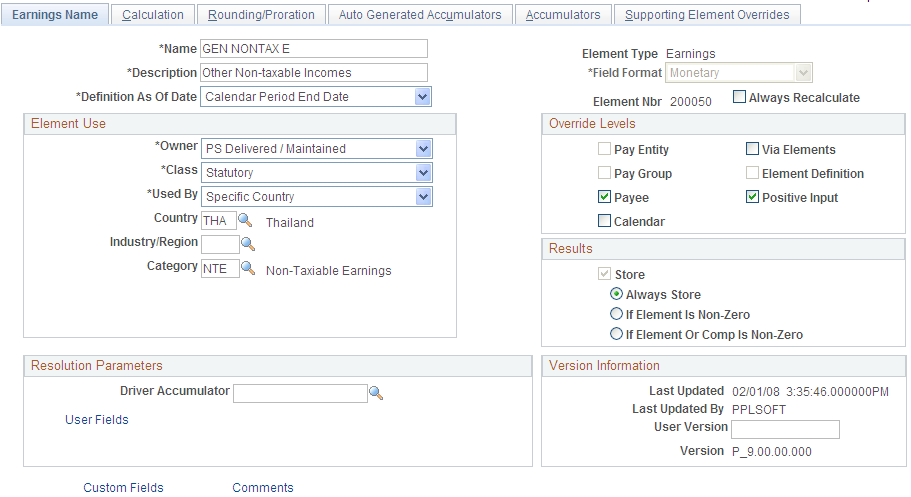

To create non-taxable earnings, use the same steps that you used to create taxable earnings, with the following exceptions:

Do not add the TAX VR CAL METHOD variable to the User Field field on the Earnings - User Fields for Element <element name> page.

Do not add any non-taxable earnings into these taxable income accumulators:

SAL RIR NM

SAL RIR TAL NM

SAL REG NM

SAL REG TAL NM

SAL IR NM

SAL IR TAL NM

When you create non-taxable earnings elements, you can use the GEN NONTAX E element delivered by Global Payroll for Thailand as a template.

Use the Earnings Name page (GP_PIN) to select the GEN NONTAX E element delivered by Global Payroll for Thailand as a template

Navigation:

This example illustrates the Earnings Name page with the GEN NONTAX E selected as the template to use.

Follow these steps to create taxable deductions:

Define the deduction name.

Specify the earnings deduction, security level, and overrides.

Define user fields.

Specify the user fields for this deduction element.

Define the calculation rule.

Specify the components that make up the calculation rule for the deduction.

Define any rounding or proration rules.

Specify the rounding and proration rules for deduction elements.

Define accumulators.

Select the accumulators from which this element deducts.

Create supporting element overrides.

Create supporting element overrides at the element definition level.

Define arrears.

Define the method to store deductions when the system is not able to take from a current pay run because of insufficient net pay.

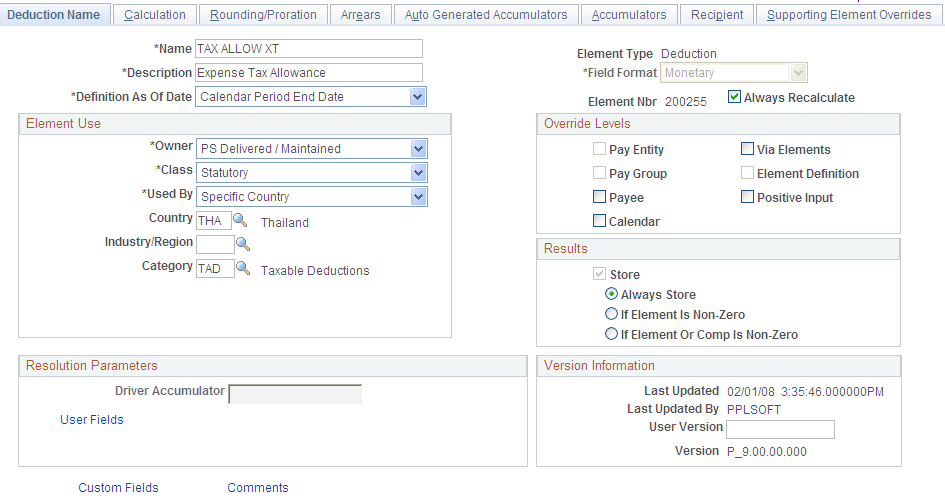

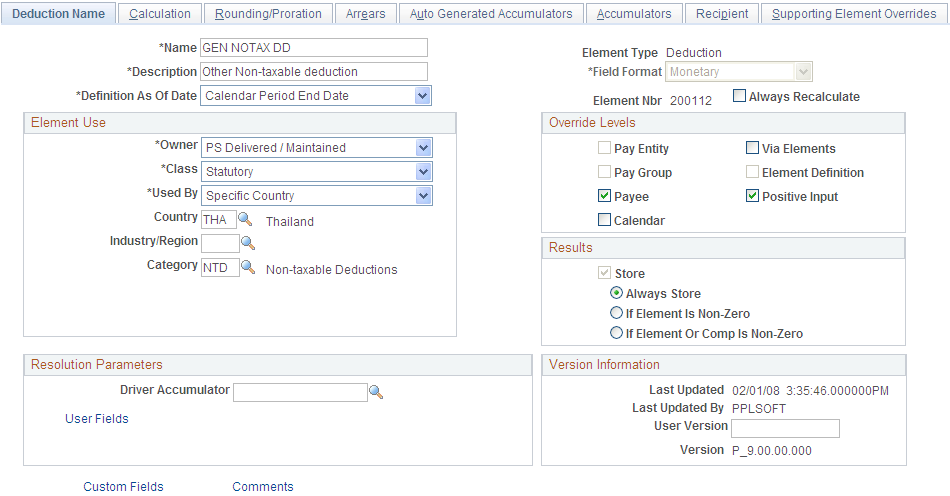

Use the Deduction Name page (GP_PIN) to name the element and define its basic parameters.

Navigation:

This example illustrates the fields and controls on the Deduction Name page.

Give your deduction element an appropriate name and description, based on the naming conventions of your company.

Carefully define the override levels.

Do not select the Always Recalculate check box. Selecting this check box causes repeated recalculations of the deduction, making the calculated result inaccurate.

Give your deduction element an appropriate category.

Use the Deductions - User Fields for Element <Element Name> page (GP_PIN_USR_FLD_SEC) to define user fields to create unique instances of an element.

Navigation:

Select the User Fields link on the Deductions Name page.

This example illustrates the fields and controls on the Deductions - User Fields for Element <Element Name> page.

You must enter the variable TAX VR CAL METHOD in the User Field for each taxable deduction element .

Note: If the selected Element includes the Payroll Result record GP_RSLT_ERN_DED, then the User Fields are unavailable for entry.

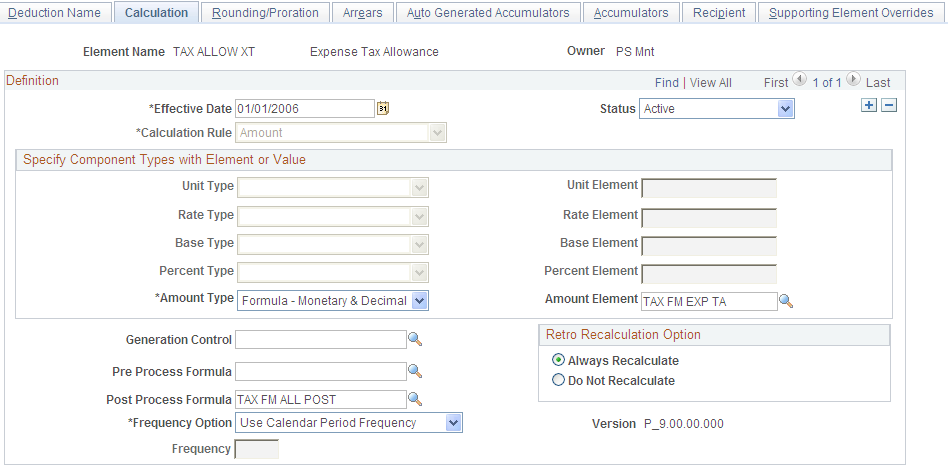

Use the Deductions - Calculation page (GP_ERN_DED_CALC) to define calculation rules for a deduction element.

Navigation:

This example illustrates the fields and controls on the Deductions - Calculation page.

Choose a calculation rule, then define each calculation component. The values for the Calculation Rule field are:

Amount.

Base * Percent.

Unit * Rate.

Unit * Rate * Percent.

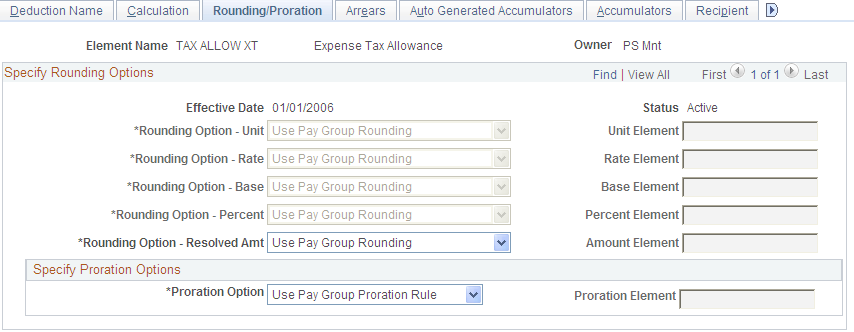

Use the Defining Rounding/Proration page (GP_ERN_DED_RND) to specify rounding and proration options for a deduction element

Navigation:

This example illustrates the fields and controls on the Deductions - Defining Rounding/Proration page.

Global Payroll for Thailand does not deliver any rounding rules, use the core Global Payroll rounding rule to define rounding rules for your deduction element.

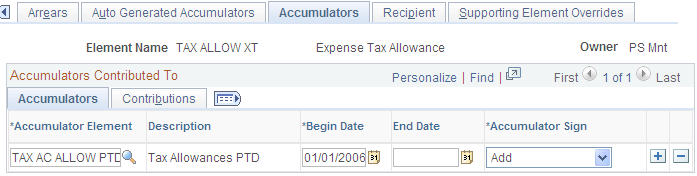

Use the Deductions - Accumulators page (GP_ERN_DED_AC_ADDL) to indicate the accumulators (already defined in the system) to which the deduction element contributes.

Navigation:

This example illustrates the fields and controls on the Deductions - Accumulators page.

Based on your requirements, consider adding your deduction element into the accumulators listed in the following table. Based on your requirements, consider adding your earnings element into the accumulators listed in the following table. PeopleSoft does not maintain these accumulators which is why they have an NM (not maintained) suffix . PeopleSoft delivers these accumulators only for you to add you newly created elements into. Use the NM accumulators only when you create new earnings elements. If you add existing elements directly into accumulators without the NM suffix (PS Delivered/Maintained accumulators), a conflict may occur between your modification and any new patches from PeopleSoft.

|

Accumulators |

Sign |

Usage |

|---|---|---|

|

SAL NET NM |

Subtract |

Net pay accumulator. Add all new deduction elements into this accumulator. |

|

SAL RIR NM |

Subtract |

Add taxable deduction elements into this accumulator. |

|

SAL RIR TAL NM |

Subtract |

Add taxable deduction elements into this accumulator. |

|

SAL REG NM |

Subtract |

For deductions that are subtracted from regular income, add to this accumulator. |

|

SAL REG TAL NM |

Subtract |

For deductions that are subtracted from regular income, add to this accumulator. |

|

SAL IR NM |

Subtract |

For deductions that are subtracted from irregular income, add to this accumulator. |

|

SAL IR TAL NM |

Subtract |

For deductions that are subtracted from irregular income, add to this accumulator. |

|

SI BASE NM |

Subtract |

For deductions that reduce the social security fund contribution base, add it to this accumulator. |

|

SI BASE PRO NM |

Subtract |

For deductions that reduce the social security fund contribution base when projecting the remaining periods, add to this accumulator. |

|

PF BASE NM |

Subtract |

For deductions that reduce the provident fund contribution base, add to this accumulator. |

|

PF BASE PRO NM |

Subtract |

For deductions that reduce the provident fund contribution base for the remaining periods, add to this accumulator. |

|

SAL REG PRO NM |

Subtract |

For deduction elements that are counted when projecting regular income in the remaining periods, add to this accumulator. |

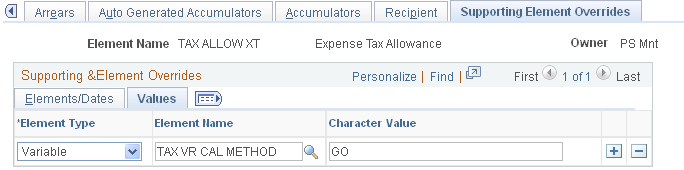

Use the Deductions - Supporting Element Overrides page (GP_ELM_DFN_SOVR) to override the value of certain supporting elements that are used by the definition of the deduction element or override the supporting elements when they are not part of the deduction definition

Navigation:

This example illustrates the fields and controls on the Deductions - Supporting Element Overrides page, Values tab.

Global Payroll for Thailand uses the TAX VR CAL METHOD variable to determine which type of taxable income the current taxable deduction element is subtracted from: withholding, gross up all cycle, or gross up one cycle. If your new element is used only under one tax calculation method, you can assign this tax method at the element definition level using the Supporting Element Overrides page.

Note: Since taxable deductions are subtracted from irregular taxable earnings using the same tax calculation method, whenever you add a taxable deduction to a given employee using positive input, you must make sure enough irregular taxable income exists to allow the deduction.

The possible Character Values for the TAX VR CAL METHOD variable are:

WH: Global Payroll for Thailand uses the withholding tax calculation method for this earnings element.

GA: Global Payroll for Thailand uses the gross up all cycle tax calculation method for this earnings element.

GO: Global Payroll for Thailand uses the gross up one cycle tax calculation method for this earnings element.

To create non-taxable deductions, use the same steps that you used to create taxable deductions, with the following exceptions:

Use the deduction name GEN NOTAX DD.

Do not add the TAX VR CAL METHOD variable to the User Field field on the Deductions - User Fields for Element <element name> page.

Do not add any non-taxable deductions into these taxable deduction accumulators:

SAL RIR NM.

SAL RIR TAL NM.

SAL REG NM.

SAL REG TAL NM.

SAL IR NM.

SAL IR TAL NM.

This example illustrates the fields and controls on the Deduction Name page for the GEN NOTAX DD deduction.

Global Payroll for Thailand uses a forwarding method for retroactive processing. The forwarding method calculates the differences between the original and recalculated pay runs. The differences between the new and old calculations are carried forward to the current calendar period as an adjustment to elements specified by the user and can be a positive or negative amount. The amount carried forward is considered irregular income for tax calculations. The system uses the same tax calculation method for the forwarded amount and retro processed regular income.

Global Payroll for Thailand delivers retro process functionality for two earnings elements:

The SAL BAS EARN earnings element for basic salary income under section 40(1) in Thailand.

The 402 ER RETRO earnings element for the retroactive delta of the regular income earnings element 402 ER REG.

If you want to add the retro process feature to an earnings, you must perform some additional set up. For example, after a new rate code is added, you must add the associated earnings elements for the new rate code.

If you want to add retro functionality for new earnings elements, you must do the following:

Add retro processing earnings elements.

Set up retro process overrides.

Add earnings elements to the EG-Common element group.

Add earnings elements to the TAXABLE EARNINGS section.

Adding Retro Processing Earnings Elements

To support retro processing, you must add a new earnings element to store the retro amount. Use the Earnings Name Page to set up the new earnings element using the SAL RTO DELT element as an example.

Set Up Retro Process Overrides

Select the elements to be forwarded on the Retro Process Overrides page

This example illustrates the fields and controls on the Retro Process Overrides page.

Global Payroll does not assume that every element in a process list should be forwarded, even when the retro method is forwarding.

Adding Earnings Elements to the EG-Common Element Group

Add all retro processing forward to earnings elements to the EG-Common element group using the Element Group Members page.

Note: The EG-Common element group is marked as PS Delivered/Customer Modified, which means that customers can add members to this element group. When applying a new patch for Global Payroll for Thailand, the element group will not be overwritten.

Adding Earnings Elements to the TAXABLE EARNINGS Section

Add new earnings elements to the TAXABLE EARNINGS section using the Section Name page.

To add new earnings elements to the section, select the Customer Control Indicator check box on the Section Name page. Then, on the Section-Definition page, add the earnings elements to the Section Element List region of the TAXABLE EARNINGS element section under the SAL RTO DELT element.