Viewing Social Insurance Data

This topic discusses how to view social insurance data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCH_SI_SYSTEM1 |

View contribution limit data for Swiss social insurance. This page displays the standard values that apply throughout Switzerland, although there are extra fields for the canton of Schaffhausen. |

|

|

GPCH_SI_SYSTEM2 |

View contribution limits for ALV and accident insurance. |

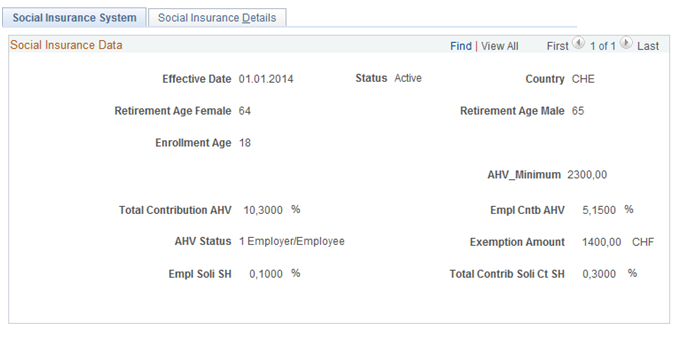

Use the Social Insurance System page (GPCH_SI_SYSTEM1) to view contribution limit data for Swiss social insurance.

This page displays the standard values that apply throughout Switzerland, although there are extra fields for the canton of Schaffhausen.

Navigation:

Note: The PeopleSoft system delivers and maintains the data on the display-only Social Insurance component.

Social Insurance System page

Field or Control |

Description |

|---|---|

Retirement Age Female |

Displays the age at which women may retire and therefore draw a pension. |

Retirement Age Male |

Displays the age at which men may retire and therefore draw a pension. |

Enrollment Age |

Displays the age from which retirement and survivors' pension insurance (AHV) contributions are paid. |

AHV_Minimum |

AHV_AVS Salaries below this amount are (optional) exempted from AHV_AVS. |

Exemption Amount |

Displays the monthly amount below which no AHV contributions are required for pensioners. |

EE Soli SH (employee solidarity, canton Schaffhausen) |

Displays the employee contribution as a percentage for solidarity tax, which is deducted only in the canton of Schaffhausen. |

Total Contrib Soli Ct SH (total contributions solidarity, canton Schaffhausen) |

Displays the combined employee and employer contributions as a percentage for solidarity tax, which is deducted only in the canton of Schaffhausen. |

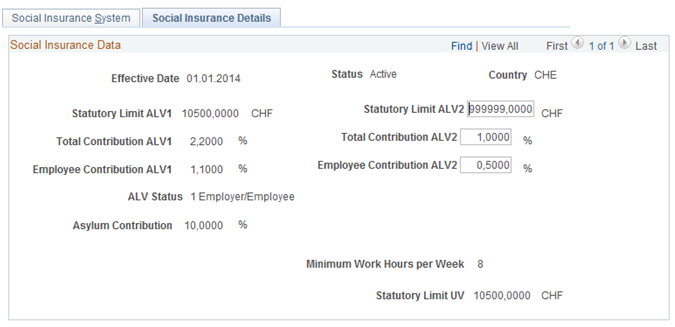

Use the Social Insurance Details page (GPCH_SI_SYSTEM2) to view contribution limits for ALV and accident insurance.

Navigation:

Social Insurance Details page

Field or Control |

Description |

|---|---|

Statutory Limit ALV1 |

Displays the statutory limit of insurance for ALV. |

Statutory Limit ALV2 |

Displays the statutory limit of insurance for ALVZ. |

ALV Status |

To set the default value for a company here, you should override it at the company level. |

Asylum Contribution |

Displays the deduction for the asylum fund. Asylum contributions are basically source taxes for asylum seekers, expressed as a percentage of gross earnings. This deduction must be made every month and deposited in an account as ordered by the Federal Ministry for Refugees. GP Switzerland provides the deduction CH_AS_D10 which can be keyed in Earnings-/Deduction- assignments a/o Positive Input. The deduction is of type Base * %, where Base = AHV_AVS salary = CH_AH_D11_Base and % = CH_AS_PCT as maintained in this page. |

Minimum Work Hours per Week |

Displays the lowest number of working hours per week for liability insurance. |

Statutory Limit UV (statutory limit accident insurance) |

Displays the maximum monthly gross salary that can be insured. |