Generating Source Tax Reports

This topic discusses how to generate source tax reports.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCH_RC_AL07 |

Create a report that documents the calculation process by defining all contributions and deductions. A plus sign (+) in the report indicates that the amount is added. A minus sign (-) indicates that the amount is deducted. When there is no symbol, the value is not included in the calculation. |

|

|

GPCH_QST_EMA_Proposed |

View Source Tax EMA proposals |

|

|

ViewGen |

View Authority Response |

|

|

GPCH_RC_TX01 |

Run the Source Tax Year report (GPCHTX01), which displays net salary as well as employee source tax contributions. For the cantons of Geneva and Waadt, the report prints on an official form and is normally required once a year. |

|

|

GPCH_RC_TX02 |

Run the Source Tax Month report. |

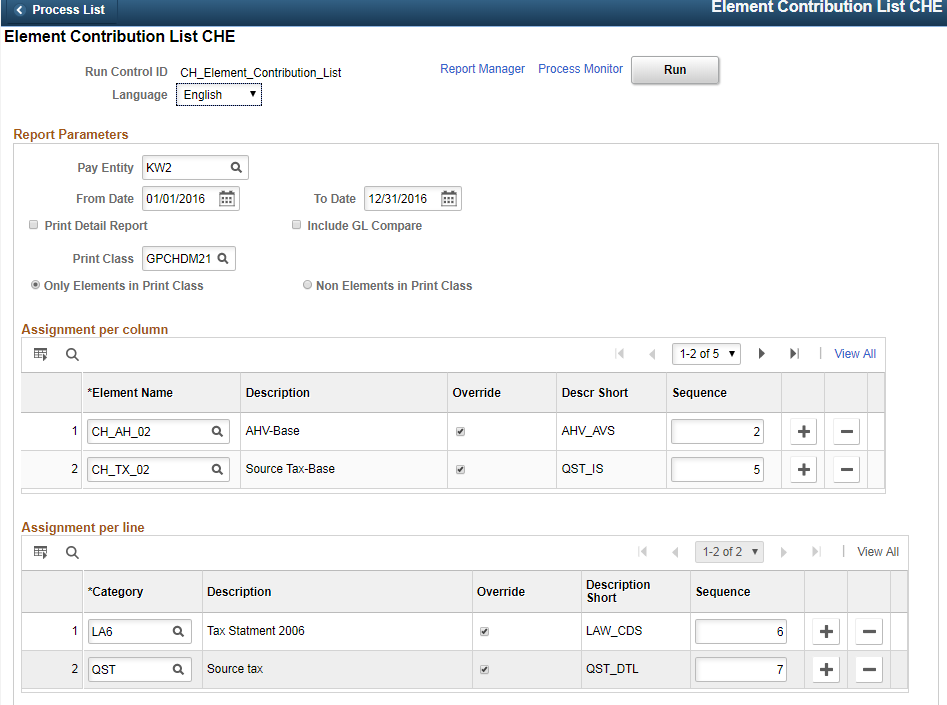

Use the Element Contribution List CHE page (GPCH_RC_AL07) to create a report that documents the calculation process by defining all contributions and deductions.

A plus sign (+) in the report indicates that the amount is added. A minus sign (-) indicates that the amount is deducted. When there is no symbol, the value is not included in the calculation.

Navigation:

This example illustrates the fields and controls on the Element Contribution List CHE page. You can find definitions for the fields and controls later on this page.

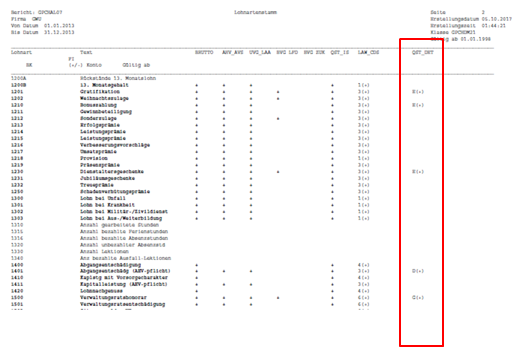

Define Category ‘QST’ under categories and this will create an overview of Source Tax assignments as shown here (other parameters see Chapter 11 Managing Social Insurance for Switzerland CHE Page)

Source Tax assignments

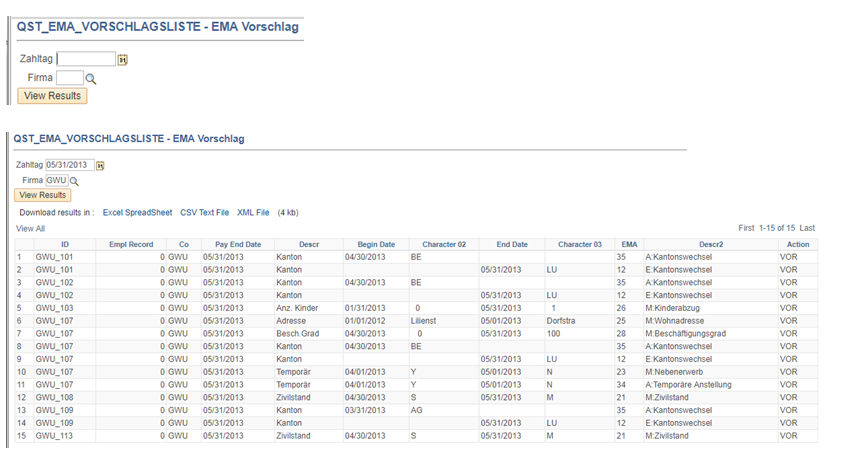

Use the PSQuery GPCH_QST_EMA_Proposed to view EMA proposals.

Navigation:

PSQuery

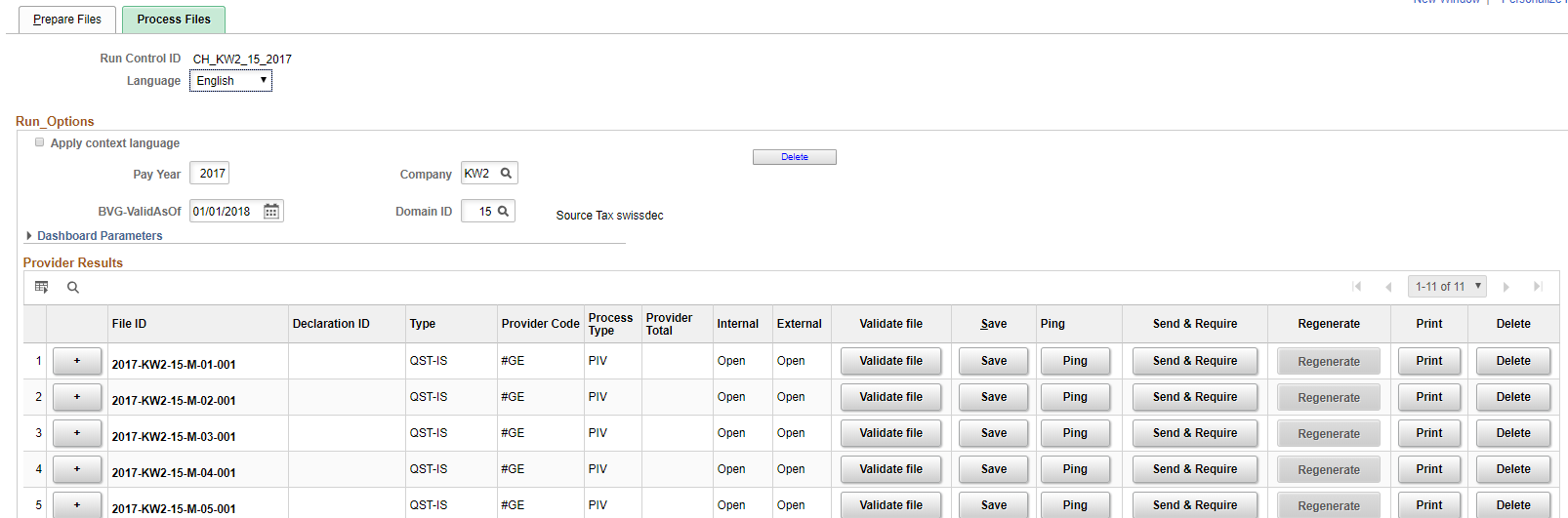

Use ViewGen to review Authority response (Get Result)

Navigation:

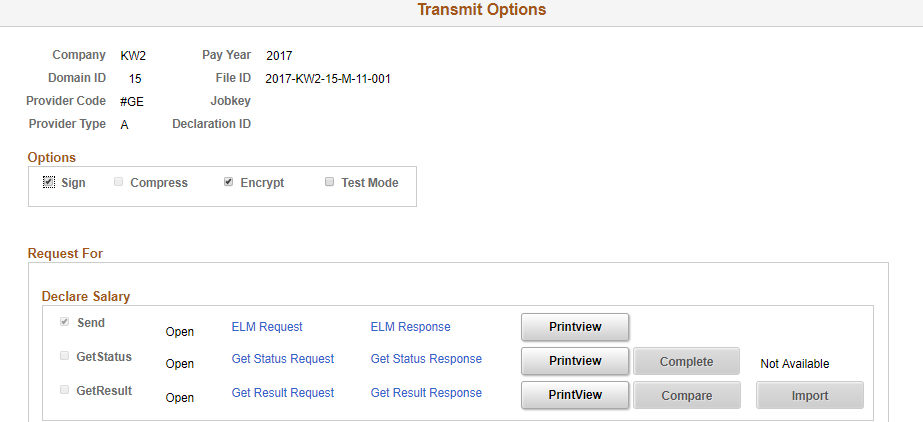

Monthly XML CHE / Processing page

Transmit Options

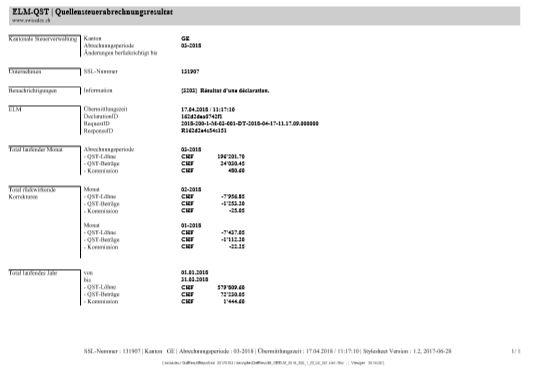

PrintView on GetResult will create these PDFs shown below.

Recap-mode (all cantons besides VD (and GE from 2019))

“Inhaltliche Rückmeldung” (VD (and GE from 2019))

Important! The following report got replaced by the Swissdec XML and may be now used only for internal purpose. Oracle will no longer support changes to this report.

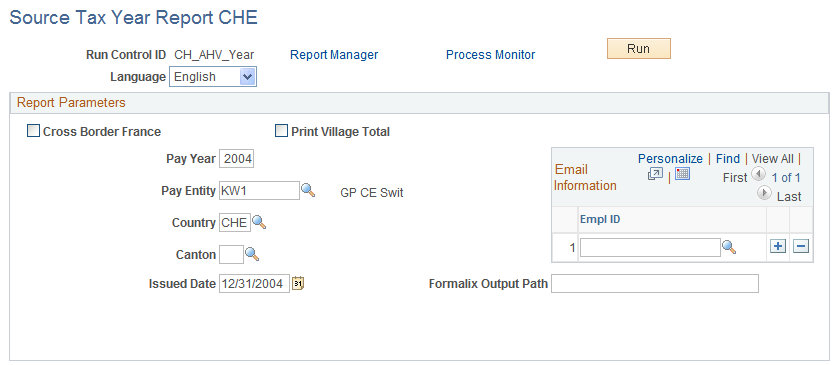

Use the Source Tax Year Report CHE page (GPCH_RC_TX01) to run the Source Tax Year report (GPCHTX01), which displays net salary as well as employee source tax contributions.

Both reports got replaced by the Swissdec XML and may be now used only for internal purpose. Oracle will no longer support changes to these reports.

Navigation:

Source Tax Year Report CHE page

Field or Control |

Description |

|---|---|

Cross Border France |

Select to include French border workers in the report. |

Print Village Total |

Select this check box if you want to print totals for the tax administration refund and the consolidated tax debt for each village; otherwise that total will only show per canton. This is required for cantons where you send the tax report directly to the village rather than to the canton office. |

Canton |

Select a canton to run the report for that canton only. If there is a required report for that canton, it will also be created. For example, if you choose the canton of Geneva, the system creates the Attestation Quittance report in French. And if you choose the canton of Tessin, the system creates the Attestato-Ricevuta report in Italian. If you do not select a canton, the report is printed for all cantons along with the required reports. |

Issued Date |

Date that shows as issue date on the statements per person (FR, TI) and the XML (GE, VD). |

Formalix Output Path |

Not supported as of 2009. |

Important! The following report got replaced by the Swissdec XML and may be now used only for internal purpose. Oracle will no longer support changes to this report.

Use the Source Tax Month Report CHE page (GPCH_RC_TX02) to run the Source Tax Month report.

Navigation:

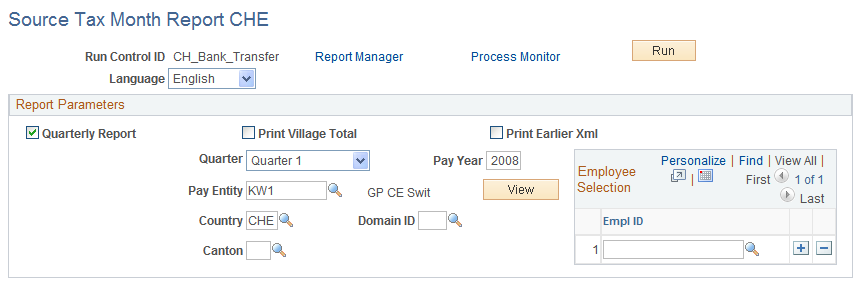

Source Tax Month Report CHE page: Quarterly Report check box selected

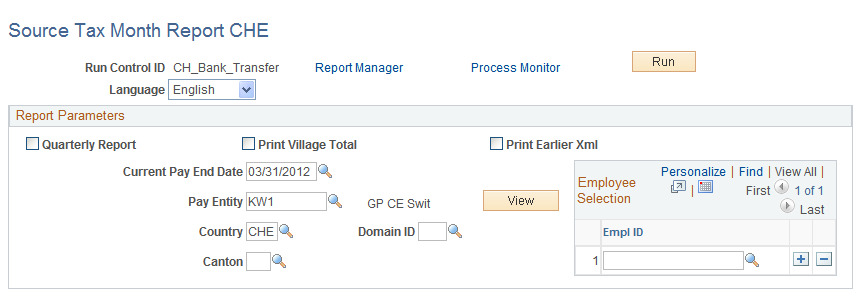

Source Tax Month Report CHE page: Quarterly Report check box deselected

Field or Control |

Description |

|---|---|

Quarterly Report, Quarter and Current Pay End Period |

If you select the Quarterly Report check box, the system displays the Quarter field. You can then select the quarter for which you want to include data on the report. If you want to run monthly source tax reporting, do not select the Quarterly Report check box. The system displays the Current Pay End Period field. The system then requires that you enter a current pay end date. Note: If you don't select a canton, the system creates a monthly report for all cantons, which have the FAK Month check box selected on the Canton (FAK/Source Tax) page. To access this page, select Setup HCM, Product Related, Global Payroll & Absence Management, Taxes, FAK/Source Tax (Company) CHE. If you select a canton, the system generates a monthly report regardless of the settings on the Canton (FAK/Source Tax) page. |

Print Village Total |

Select this check box if you want to print totals for the tax administration refund and the consolidated tax debt for each village; otherwise that total will only show per canton. This is required for cantons where you send the tax report directly to the village rather than to the canton office |

Print Earlier Xml |

Select this check box to launch an BI Publisher report for a special source tax type. Currently, this feature is only used with Source Tax for artists. |

Canton |

Select a canton to run the report for that canton only. The system creates Canton-specific appendixes for yearly tax reporting only. |

Domain ID |

Select a domain ID when you are launching a BI Publisher report for a special source tax type. This ID is needed to merge the domain setup into BI Publisher. Currently, this feature is only used with Source Tax for artists. |

View |

Click this button to view and print the official report for the quarter after you run the process. This will show the most recent XML, means in case of manual override the values of the override. Currently, this feature is only used with Source Tax for artists. |