Defining and Entering Family Allowances

This topic discusses how to define and enter family allowances.

Note: Since January 1, 2009 the setup parameters on the Family Allowance Data page are no longer supported. The values on the Child Allowance Data page are still used, although the Adoption Allowance Amount and Birth Allowance % Method fields are no longer supported.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCH_CA_STAT_SET01 |

Set up family allowance data. The system delivers company CA1 as an example of a government-approved setup. |

|

|

GPCH_CA_STAT_SET02 |

Set up child allowance data. |

|

|

GPCH_CA_DATA |

Enter the family allowance payment data for individual employees. |

Enter dependent's name, address, and personal information on the Dependents Data component in PeopleSoft HCM.

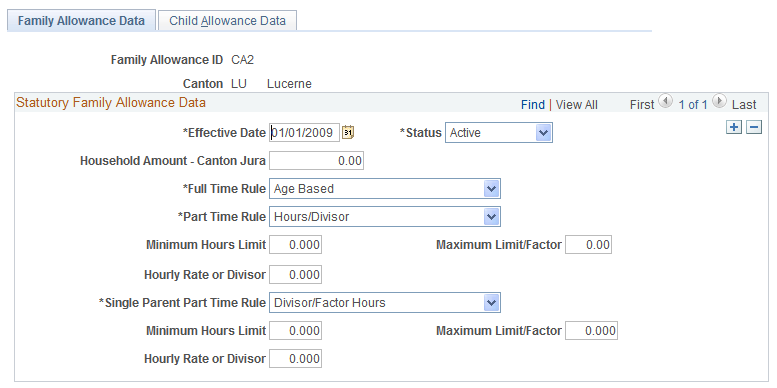

Use the Family Allowance Data page (GPCH_CA_STAT_SET01) to set up family allowance data.

The system delivers company CA1 as an example of a government-approved setup.

Navigation:

Family Allowance Data page

Note: The Family Allowance Data and Child Allowance Data pages reflect rules that are designed to protect child and education allowances. These rules vary from canton to canton. Consequently, they are not irrevocably installed in Global Payroll and can be defined dynamically.

Field or Control |

Description |

|---|---|

Household Amount - Canton Jura |

Not active currently. |

Full Time, Part-Time, and Single Parent Part-Time Rule

In granting family allowances, the cantons distinguish between full-time employment, part-time employment, and part-time employment for single-parent families. Different sets of rules are applied accordingly. You can view the appropriate rule for the applicable fields Full Time Rule, Part Time Rule, and Single Parent Part Time Rule.

Fields beneath the Part Time Rule apply to employees who are not specified as single parents. Fields beneath the Single Parent Part Time Rule apply to employees who are specified as single parents. You can identify a person as a single parent on the Family Allowance page.

Field or Control |

Description |

|---|---|

Minimum Hours Limit |

The lower limit or minimum number of hours allowed to qualify for receiving the family allowance. |

Maximum Limit/Factor |

For information only. The hourly rate or divisor determines the upper limit. |

Hourly Rate or Divisor |

For part-time employees, the allowance is calculated as follows: Allowance * STD HOURS * 4.3333 / Divisor. For hourly paid employees, the calculation is: Allowance * ACTUAL HOURS / Divisor. |

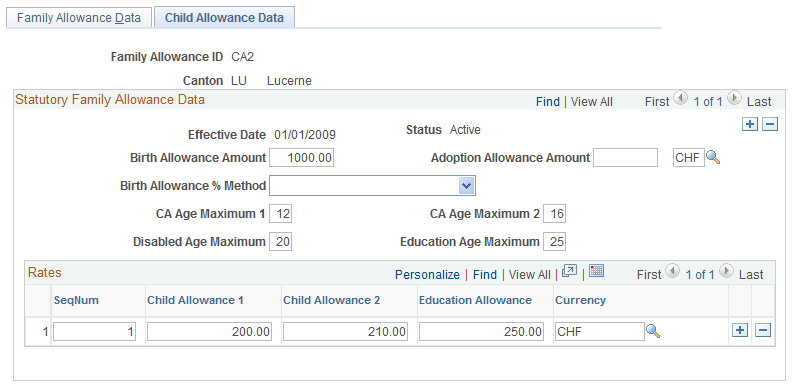

Use the Child Allowance Data page (GPCH_CA_STAT_SET02) to set up child allowance data.

Navigation:

Child Allowance Data page

Statutory Family Allowance Data

Field or Control |

Description |

|---|---|

Birth Allowance Amount |

The amount granted at the birth of a child. |

Adoption Allowance Amount |

Not supported. |

Birth Allowance % Method (birth allowance percent method) |

Not supported. |

CA Age Maximum 1 (child allowance age maximum 1) |

Enter the age until which the amount in Child Allowance 1 is paid. For example, in Zurich 170 CHF is paid until the age of 12. PeopleSoft maintains this amount. |

CA Age Maximum 2 (child allowance age maximum 2) |

Enter the age until which the amount in Child Allowance 2 is paid. For example, in Zurich 195 CHF is paid until the age of 16. PeopleSoft maintains this amount. |

Disabled Age Maximum |

Indicates the maximum age for which allowances are paid for disabled children. |

Education Age Maximum |

Indicates the maximum age for which education allowances are payable. |

Rates

Field or Control |

Description |

|---|---|

SeqNum (sequence number) |

Shows the sequence of user input of dependent data in the HR pages; for example, spouse = 1, child 1 = 2. |

Child Allowance 1 |

The numeric amount to be granted for children with an age <= CA Age Maximum 1. |

Child Allowance 2 |

The numeric amount to be granted for children with an age <= CA Age Maximum 2. |

Education Allowance |

The numeric amount to be granted as the education allowance. |

Currency |

The currency code for the education allowance. Note: The system only supports the CHF currency. |

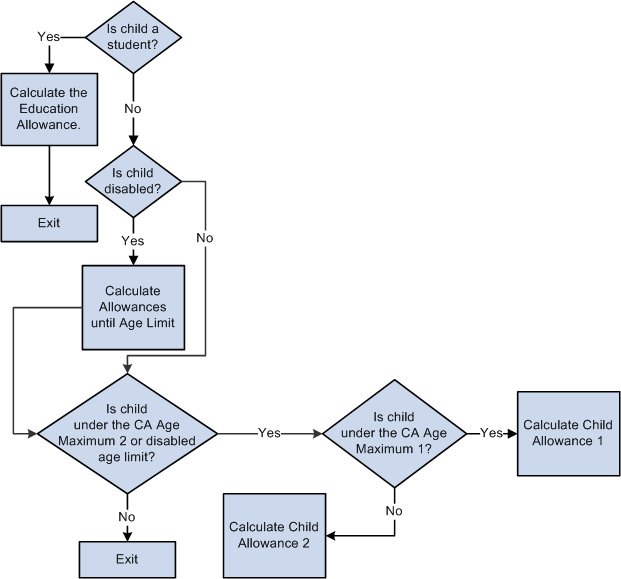

Logical Order of the Child Allowance Process

When processing the child allowance, the system applies the following processing logic involving age, education, and disability considerations:

Logical Order of the Child Allowance Process

Use the Define Family Allow Data CHE (Define Family Allowance Data CHE) page (GPCH_CA_DATA) to enter the family allowance payment data for individual employees.

Navigation:

Define Family Allow Data CHE page - Standard Data (1 of 3)

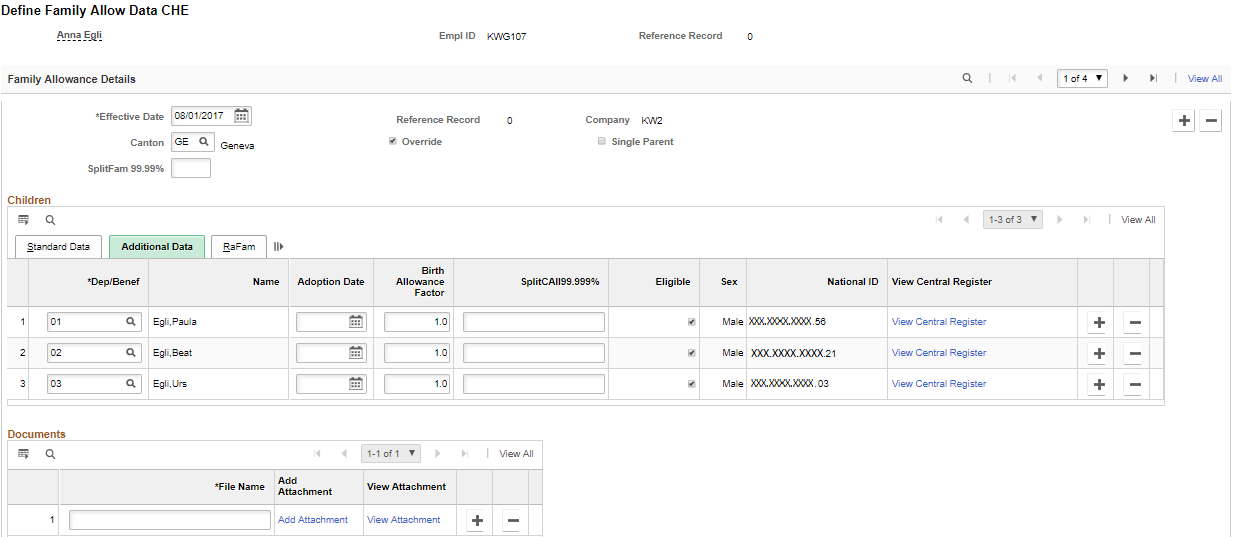

Define Family Allow Data CHE page - Additional Data (2 of 3)

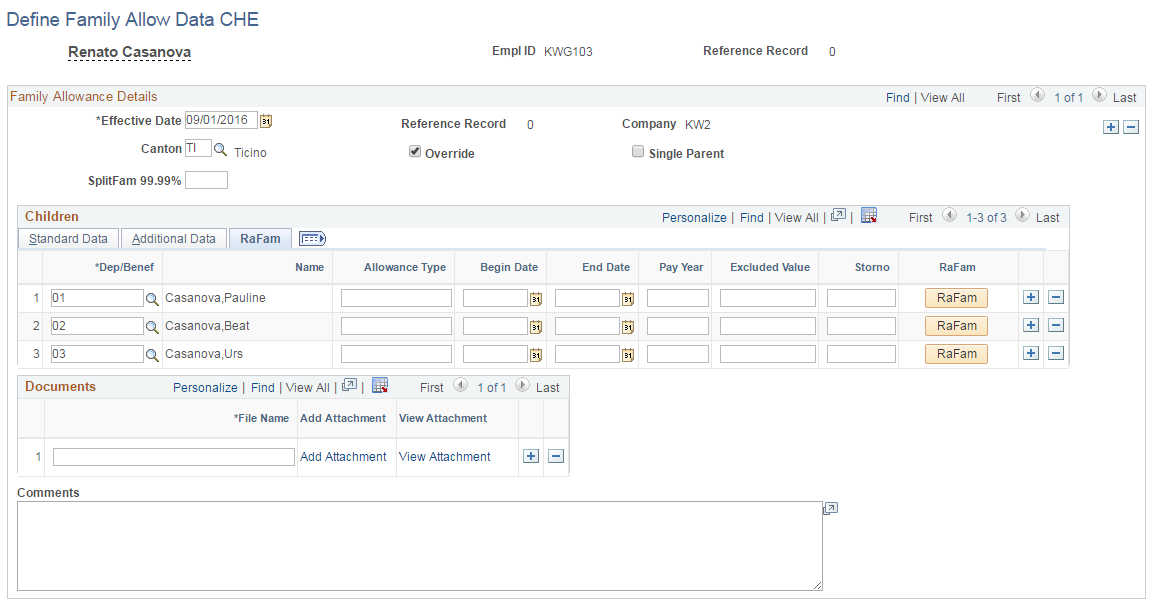

Define Family Allowance Data CHE page RaFam (3 of 3)

Clicking the RaFam button displays the RaFam Details page.

Family Allowance Details

Field or Control |

Description |

|---|---|

Canton of Employment |

Displays the canton for the employee. |

Override |

Select to override the employee's canton. If the work location is located in a different canton than the canton that pays the allowance. |

Single Parent |

Not supported since January 01, 2009, however used for XML TAG Particulars/SingleParent. |

Reduced HH All (reduced household allowance) |

Not supported since January 01, 2009. |

Children

The employee's dependents or beneficiaries who are already registered appear in this group box.

Field or Control |

Description |

|---|---|

Dep/Benef Name |

The current number (internal) and name of the dependent or beneficiary (dependent/beneficiary name). |

FamRel |

Family relation is derived from Relationship to Employee and Gender of Employee (in brackets Standard code). |

|

Female Employee |

Male Employee |

Child |

Entry in HCM |

|---|---|---|---|

|

Mother (10) |

Father (20) |

Kind |

C Child |

|

Stepmother (11) |

Stepfather (21) |

Stepchild |

SC Stepchild |

|

Fostermother (12) |

Fosterfather (22) |

Fosterchild |

FC Foster Child |

|

Grandmother (14) |

Grandfather (24) |

Grandchild |

GC Grandchild |

|

Sister (13) |

Brother (23) |

Sibling |

SB Sibling |

Field or Control |

Description |

|---|---|

Disabled |

Select if the dependent or beneficiary is disabled. |

Student |

Select if the dependent or beneficiary is a student. |

Diff Allowance |

Difference Allowance (see NonResident). |

|

Acquired Right |

Child allowance. The acquired right will apply to all families with at least three children under 16 years of age on 31 December 2021, provided the number of children and the type of allowances remain the same. |

Numerous |

Qualifies a child for numerous allowance (child# >= 3) |

|

Non Resident |

Defines whether Difference Allowance is national or international. |

Birthdate |

Displays the birth date of the child. Field is masked if masking for National ID is active. |

Legal End Date |

The date for when benefits are scheduled to end. |

Reduced Begin Date |

The date for when benefits starts. Only required in case of mid month eligibility which does not go along with the hire date. Child allowance gets prorated in case this date is not the last day of a month. Allowance doesn’t get prorated for mid period LOA if the begin date is first day of the processed month. |

Reduced End Date |

The date for when benefits are scheduled to end in individual cases. This entry is required for students. Child allowance gets prorated in case this date is not the last day of a month. Allowance doesn’t get prorated for mid period RFL if the end date is last day of the processed month. |

Adoption Date |

If date is filled and falls into processed month, then payroll generates Earning CH_CA_02 (Adoption allowance). In case adoption gets calculated, there is no creation of birth allowance CH_CA_01 |

Birth Allowance Factor |

The default value is 1. In the case of multiple births (such as twins) enter a factor for each child, according to the rules of the canton. |

SplitAll 99.999% |

This % is applied to the standard amount. May be used to create birth allowance only (%=0.001) in case of a death borne child. |

Eligible |

Select if the dependent or beneficiary has a child allowance. Used only for additional children or rows on this page; otherwise, leave this field deselected. |

National ID |

Child’s National ID |

View Central Register |

Link to Central Register for child allowances. |

RaFam

RAFAM (eAHV) -XML creation follows the current online data. Any change in online data is reflected with next XML creation, regardless of whether payroll ran in between or not.

Field or Control |

Description |

|---|---|

Allowance Type |

This override value is used for eAHV XML creation. |

Begin Date |

This override value is used for eAHV XML creation. |

End Date |

This override value is used for eAHV XML creation. |

Pay Year |

If this value is filled and is same as the processing year, the system adds this child information to the XML even if there is no calculation for the parent in the reporting year at all (This triggers XML correction for previous year, although the emplid is not calculated in the current year at all). |

Exclude Value |

XML for child gets excluded from current XML file. |

Storno Value |

The current XML gets reported with Storno attribute. |

RaFam |

Clicking this button shows the XML data history and (if available) data ready to be sent next. |

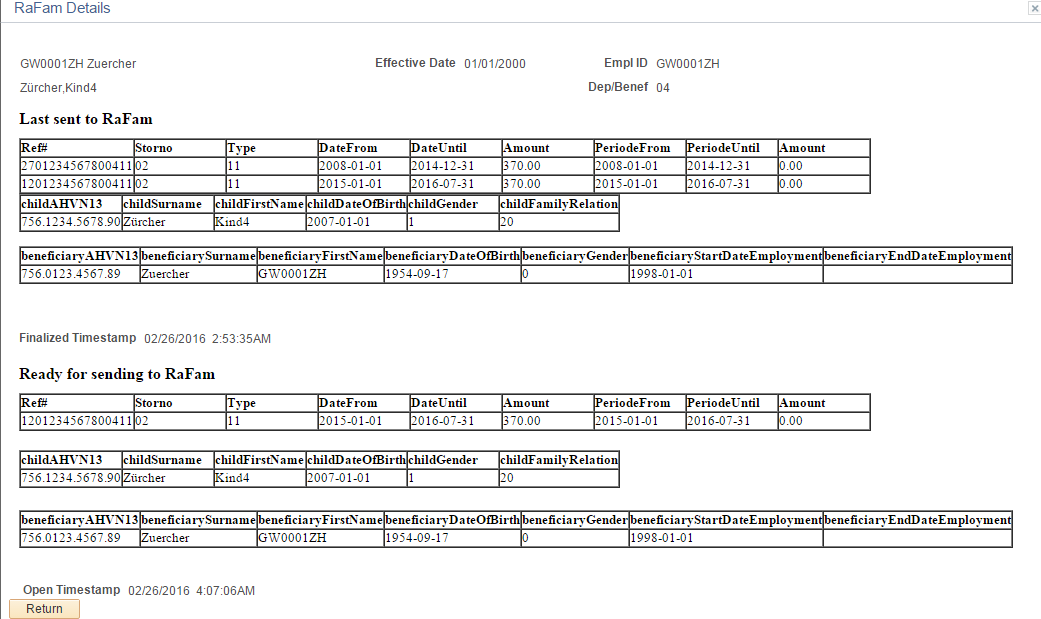

RaFam Details Page

This page displays the most recent XML data sent to RAFAM ( = completed) and (if already processed) the XML for this child that will get reported with the next sending.

Field or Control |

Description |

|---|---|

Last sent to RaFam |

Details the most recent data sent to RaFam It includes Allowance details (Ref#, Storno, Type, DateFrom, DateUntil, Amount, PeriodFrom, Period Until, Amount), Child details (childAHVN13, childSurname, childFirsName, childDateOfBirth, childGender, childFamilyRelation) and Benificiary details (beneficiaryAHVN13, beneficiarySurname beneficiaryFirstname, beneficiaryDateOfBirth, beneficiaryGender, beneficiaryStartDateEmployment, beneficiaryEndDateEmployment). |

Ready for sending to RaFam |

Details of most recent XML ready for sending to RaFam for the same allowance details as described above. |

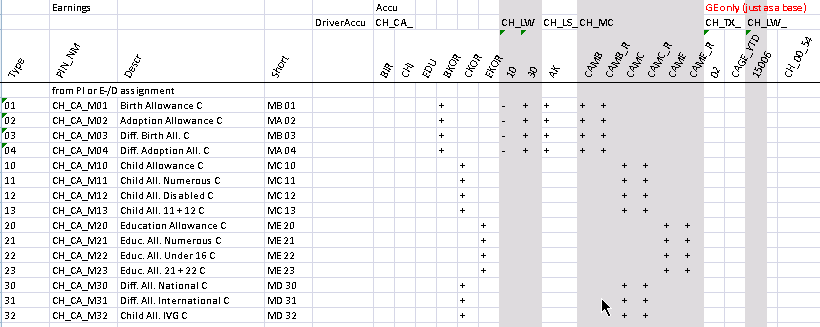

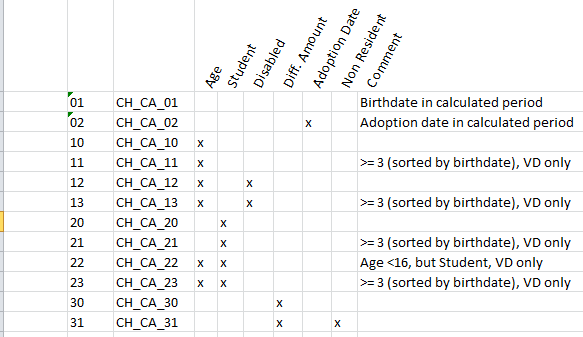

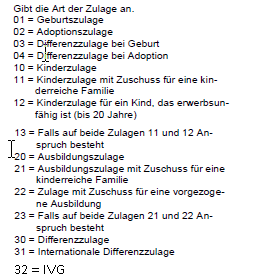

Earnings Generated for Various Entries

Earnings Generated for Various Entries

Where the codes 01 to 31 follow the official XML Codes ( = Allowance Types).

Earning Codes

Additional Manual Earnings

Additional Manual Earnings