Processing PIS Payments

This topic provides an overview of PIS payment processing, lists prerequisites, and discusses how to run PIS processes.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPBR_RC_PIS_PRO |

Run the PIS Processing Application Engine (GPBR_PISP_AE) process. |

PIS processing encompasses four separate processes:

Identifying employees for payment.

Generating PIS payment data.

Canceling PIS payments.

Reversing PIS payments.

To run any of these processes, you must enter the establishment ID for the designated (centralized) establishment and the reference year from which PIS is to paid.

Identifying Employees for Payment

Upon receipt of the Release of Resources file from CAIXA, which lists employees who are scheduled to receive PIS payments, you run a validation process that identifies discrepancies between the data in the file and your system records.

The validation process checks to see if each employee listed in the file is covered by a PIS agreement, and checks the employee's birth date, name, and address. The validation process generates an output file that includes values for the additional company fields that you selected on the PIS Parameters BRA page. It also generates a log that identifies discrepancies between data in the CAIXA file and the system.

Following are common reasons for discrepancies:

Incompatible MCPIS with responsible Establishment – The MCPIS ID or the CNPJ ID for the responsible establishment that is listed in the file does not match the ID that is stored in the system.

PIS Issue PIS=0011 – The company's name, municipal name, federal unit, neighbor, CEP, phone, or fax number listed in the file does not match the data in the system.

Employee not found using PIS code as search key – The employee is not found in the system, using the PIS ID listed in the file.

(An employee's PIS ID is entered on the Biographical Details page in PeopleSoft HR.)

More than one employee with the same PIS code – The same PIS ID is assigned to more than one employee in the system.

PIS Issue PID=0023 – The employee's name or birth date, as listed in the file, does not match the data in the system. (The NAME_FORMAL field is used for the validation.)

Employee with no PIS agreement – The employee is selected for payment in the system (the PIS/PASEP check box on the Payee Parameters page is selected) but not in the file, or vice versa.

Reconcile any discrepancies that are reported in the log, run the identification process again, and send the output file to CAIXA.

Generating PIS Payment Data

Based on the information that you return to CAIXA, that institution sends a new file that lists only those employees who are to receive PIS payments, along with the payment amounts, and the type of payment (income or allowance). When you receive this file, run the PIS - Payment process.

If the information in the file matches the information in the system, the process assigns the earning element that is identified on the PIS Parameters BRA page to each employee who is to be paid. You can view the payment instructions for an employee on the Element Assignment by Payee page. The payment month that you enter on the run control page determines the begin and end dates on the Element Assignment Payee page. (Alternatively, you can use the Payee Assignment by Element page to view all assignment instructions that were created for the PIS earning element.)

The process generates a log that identifies employees for whom assignment instructions could not be generated as a result of discrepancies between data in the CAIXA file and the system. Many of the discrepancies are similar to those encountered during the employee identification process. Additional reasons for discrepancies follow:

Override exists for employee - indicates that assignment instructions for the earning element that is selected on the PIS Parameters BRA page already exist for the listed employee.

The payment was not made for this employee - indicates the payment could not be made for a specific employee.

The payment was not made - this message appears in the summary section and indicates that one or more employees are in error.

Canceling PIS Payments

The cancellation process has the effect of revoking PIS payment instructions (the earning assignment) for employees who are not entitled to receive payment. This situation can happen, for example, when an employee is terminated after the list of payees is validated but before the payment date. You use the same file that is used by the payment process to cancel the payment instructions before running the payroll process.

The cancellation process produces an output file that you send to CAIXA to inform them of scheduled payments that were not made.

Reversing PIS Payments

This process reverses the earning assignment that the PIS payment process generated for the employee. It does this by inserting a second assignment for the reverse amount. Assignment instructions for the offsetting entry must match the original instructions. You may need to run this process, for example, if you specified the wrong month on the run control page when initiating the PIS payment process.

The process generates a log that identifies discrepancies. Many of the discrepancies are similar to those encountered during the PIS payment process.

Following are some additional reasons for discrepancies:

Reversal amount in file is different than in the system - indicates that there is a difference between the reversal amount according to the file and the amount that was paid to the employee.

Reversal was not made for this employee - indicates the reversal could not be generated for a specific employee.

The reversal process was not made - this message appears in the summary section and indicates that one or more employees are in error.

Before you can run the PIS processes described in this section, follow the setup steps for PIS processing.

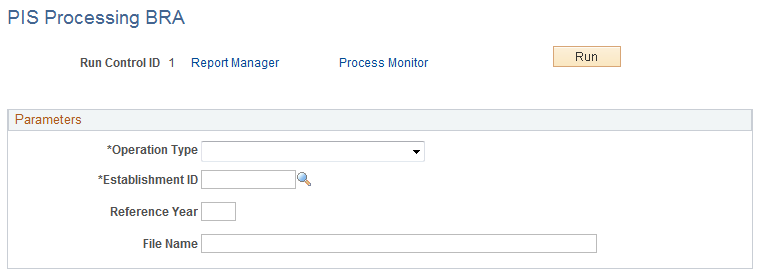

Use the PIS Processing BRA page (GPBR_RC_PIS_PRO) to run the PIS Processing Application Engine (GPBR_PISP_AE) process.

Navigation:

This example illustrates the fields and controls on the PIS Processing BRA page.

Field or Control |

Description |

|---|---|

Operation Type |

Select the process to run:

|

Establishment ID |

Select the establishment. You can only select from those establishments that have been identified as centralized on the Centralization Data page. |

Reference Year |

Enter the year from which PIS payment can be made. |

Payment Month |

This field appears when you select the payment or reversal process in the Operation Type field. Enter the month to which the element assignment instructions apply. |

Reversal Report |

This field appears when you select the reversal process in the Operation Type field. |

File Name |

Enter the complete path to the file. |