Generating Document for the Collection of Federal Revenues (DARF) Reports

To set up parameters for DARF reporting, use the DARF Parameters BRA (GPBR_PARM_DARF) component.

This topic provides an overview of DARF reporting and discusses how to produce DARF reports.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPBR_PARM_DARF |

Enter DARF parameters for a company. The parameters are used when producing the DARF report. |

|

|

GPBR_RC_DARF |

Generate a company's DARF report. |

You can use Global Payroll for Brazil to produce a monthly report (GPBRDA01, Documento de Arrecadação de Receitas Federais) that shows each company’s or company employee’s tax payment as well as any late charge that are due for the reported month.

Enter DARF parameters (by company) before running the DARF report.

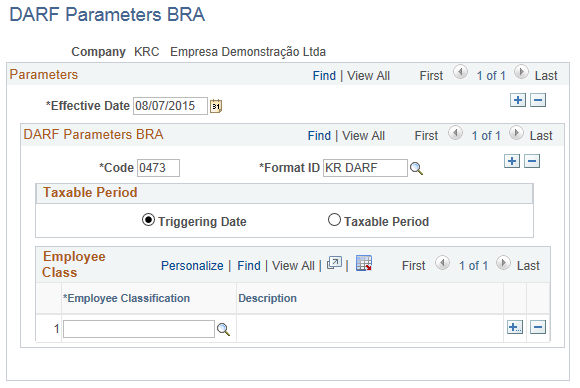

Use the DARF Parameters BRA page (GPBR_PARM_DARF) to enter DARF parameters for a company.

The parameters are used to produce the DARF report.

Navigation:

This example illustrates the fields and controls on the DARF Parameters BRA page.

Note: For each effective date, code, format ID, and taxable period combination, specify the classes of employees to be included in the DARF report.

DARF Parameters BRA

Field or Control |

Description |

|---|---|

Code |

Enter the code of the tax being paid. These codes are maintained by the IRS (Receita Federal). |

Format ID |

Specify the ID of the format used for this report. Choose from the list of elements to add to, subtract from, or both, the amount of tax withholding payable by the employee. Format IDs are defined on the Element Lists BRA Page. |

Taxable Period

Field or Control |

Description |

|---|---|

Triggering Date |

Select this option for the system to populate the Begin Date and End Date fields of the DARF period to be identical to withholding period date on the DARF Report BRA Page. |

Taxable Period |

Select this option to make these fields required for entry on the DARF Report BRA Page to run the DARF report: WIthholding Period, Date Due, as well as the Begin Date and End Date of the DARF period. |

Employee Class

Field or Control |

Description |

|---|---|

Employee Classification |

Select one or more classes of employees to be included in the DARF report. Employee classes are defined on the Employee Labor Classification page (EMPL_CLASS_TABLE). See Defining Additional Employment Setup Data for more information. |

Use the DARF Report BRA page (GPBR_RC_DARF) to generate a company's DARF report.

Navigation:

This example illustrates the fields and controls on the DARF Report BRA page.

Use this page to specify values that are displayed on the DARF report.

DARF Generation

Field or Control |

Description |

|---|---|

Establishment ID |

Enter the ID of a centralized establishment for the DARF report. The selected establishment identifies the company that is printed on the DARF report. See Also Centralization Data Page |

Code |

Select the code of the tax being paid, which gets displayed on the report. |

Withholding Period |

Specify the end date of the assessment period to be displayed on the report. For example, you may enter January 31 for the month of January. |

Due Date |

Specify the due date, for example, February 15 for the assessment month of January, of the tax payment to be displayed on the report. |

Fine Percentage, Fine Factor, Interest Percentage and Interest Factor |

Enter percentage or factor numbers for calculating late fines and interests. Numbers entered in these fields (percentage or factor number) are used to calculate fine and interest values that are displayed on the report. |

DARF Generation

Field or Control |

Description |

|---|---|

Element List |

Displays the element associated with the code that is selected on this page. |

DARF Period

Enter the period (a month) to which the tax payment pertains. For example, you may enter January 1 through January 31 as the DARF calculation period.

The system automatically populates the begin and end dates with the date that is specified as the withholding period on this page, if the Triggering Date option is selected on the DARF Parameters BRA Page. These dates are not prepopulated, if the Taxable Period option is selected.

Establishment ID

If you wish to print the report for some but not all establishments for the identified company, specify them here.

Employees

If you wish to print the report for a refined list of employees, specify them here.