Defining Company Parameters for the RAIS Report

This topic discusses how to define a company’s RAIS parameters.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPBR_PARM_RAIS |

Define basic parameters for RAIS reporting. |

|

|

GPBR_PARM_RAIS2 |

Select the elements that define the monthly remuneration values for RAIS reporting. |

|

|

GPBR_ABS_RAIS |

Define absence parameters for RAIS reporting. |

Use the RAIS Parameters page (GPBR_PARM_RAIS) to define basic parameters for RAIS reporting.

Navigation:

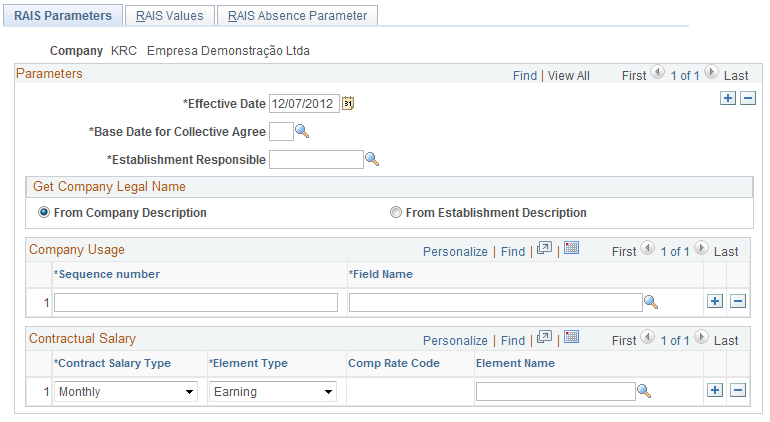

This example illustrates the fields and controls on the RAIS Parameters page.

Field or Control |

Description |

|---|---|

Base Date for Collective Agreement |

Enter the month of the negotiations for the collective agreement. |

Establishment Responsible |

Identify the establishment that is responsible for managing the collective agreement on behalf of the company. |

Get Company Legal Name

Identify which name is to appear on the RAIS report: the name of the company or the name of the establishment selected in the Establishment Responsible field.

Company Usage

Use these fields if you want to include additional data in the report for each employee, such as EMPLID (employee ID) or DEPTID (department ID). This data can help you research and verify employee data in the report. You can select any field from the PS_JOB record. When you produce the report, the system includes the first 20 positions of the data from the selected (combined) fields, truncating data that exceeds this limit.

Contractual Salary

For each salary type that your company uses, identify the earning elements, rate codes (or both) that are used to calculate the contractual salary.

Field or Control |

Description |

|---|---|

Contract Salary Type |

Select from the following: Commission, Daily, Fortnight, Hourly, Monthly, Per Task, or Weekly. (Define a payee's contract salary type on the Job Information page in PeopleSoft HR.) |

Element Type |

Select from the following: Earning or Rate Code. |

Note: Rate codes read the value that is entered on the Compensation page in PeopleSoft HR.

Use the RAIS Values page (GPBR_PARM_RAIS2) to select the elements that define the monthly remuneration values for RAIS reporting.

Navigation:

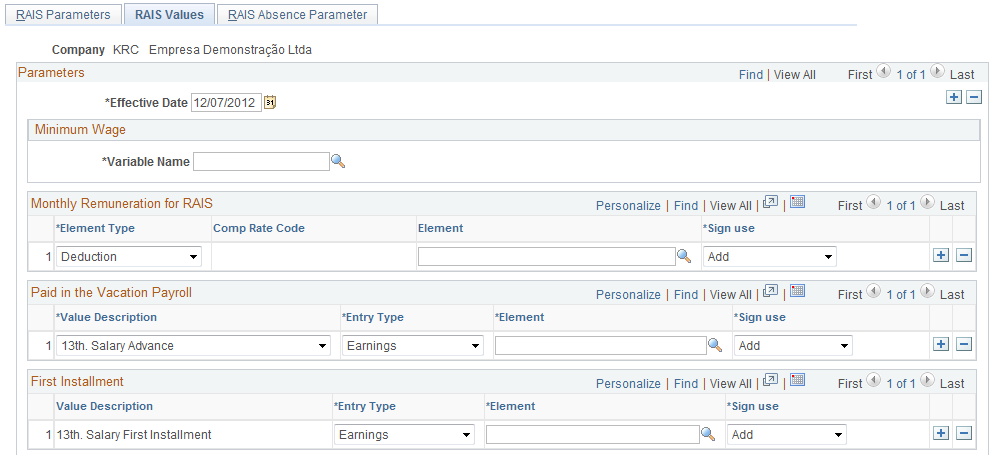

This example illustrates the fields and controls on the RAIS Values page (1 of 2).

This example illustrates the fields and controls on the RAIS Values page (2 of 2).

The sections of the RAIS Values page correspond to sections of the RAIS report. Select the elements that provide the values for each section.

Field or Control |

Description |

|---|---|

Variable Name |

Select the variable that stores the current minimum wage. PeopleSoft delivers, but does not maintain, the variable FP VR SAL MIN NAC for the national minimum salary. |

Monthly Remuneration for RAIS

Field or Control |

Description |

|---|---|

Element Type |

Options are Deduction, Earning, Monthly Rate, and Rate Code. |

Paid in the Vacation Payroll

List the earning elements that are used to pay the 13th salary advance for vacations, and the earning or deduction elements that return the difference between the 13th salary advance and the recalculated first installment.

Field or Control |

Description |

|---|---|

Value Description |

Options are 13th. Salary Advance and Diff 13th. Salary Payment. |

First Installment

List the earning and deduction elements that are used to pay the first installment of the 13th salary.

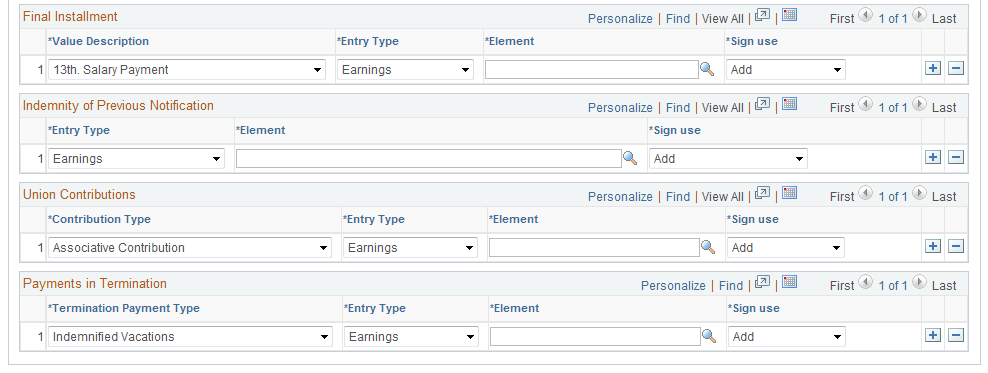

Final Installment

List the earning and deduction elements that are used to pay or adjust the final installment of the 13th salary.

Field or Control |

Description |

|---|---|

Value Description |

Options are 13th. Salary Payment, 13th. Salary Indemnity Term (13th salary indemnity termination), 13th. Salary Prop. Termination (13th salary proportional termination), and Differ 13th. Salary. |

Indemnity of Previous Notification

These fields apply to employees who are terminated before the end of their contract and to employees who receive less than 30 days notice when the union requirement is 30 days notice. Select the earning or deduction elements that are used to calculate the pay difference between the contract end date and the 30-day notice period.

Union Contributions

Use these fields to identify the earning or deduction elements that are used to calculate employee deductions for union contributions.

Field or Control |

Description |

|---|---|

Contribution Type |

Options are: Associative Contribution, Confederative Contribution, Union Contribution, and Welfare Contribution. |

Payments in Termination

Use these fields to identify the earning or deduction elements that are used to calculate employee payments in termination.

Field or Control |

Description |

|---|---|

Termination Payment Type |

Options are: Bank of Hours, FGTS Fine, Indemnified Vacations, Union Adjustments, and Other Compensations. |

Use the RAIS Absence Parameter page (GPBR_ABS_RAIS) to define absence parameters for RAIS reporting.

Navigation:

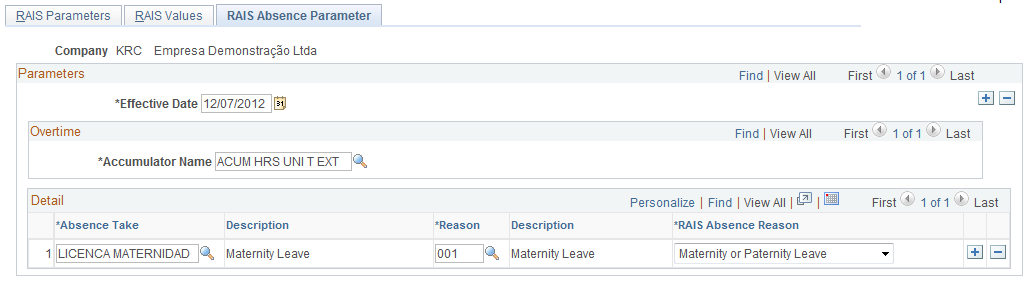

This example illustrates the fields and controls on the RAIS Absence Parameter page.

Field or Control |

Description |

|---|---|

Accumulator Name |

Select the accumulator that stores the number of days or hours worked for RAIS reporting purposes. |

Detail

Use the Absence Take Element andAbsence Reason fields to identify the five most frequent types of absences in terms of days. Link each of these absence types to the corresponding RAIS absence reason.

Field or Control |

Description |

|---|---|

RAIS Absence Reason |

Options are Illness not related to work, Illness related to work, Mandatory Military Service, Maternity or Paternity Leave, Route Labor Accident, or Typical Labor Accident. |