Setting Up Reference Periods

To set up reference periods, use the Reference Period component (WP_AGRT_PERIOD). This section provides overviews of reference periods and payroll information and discusses how to set up reference period and define payroll mapping.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

WP_AGRT_PERIOD |

Create and approve reference periods. |

|

|

WP_AGRT_PERIOD_SEC |

Define payroll data required by the profit sharing calculations. |

Profit sharing calculations are based on company or establishment accounting data over a period known as a reference period. Typically, reference periods are for a year and match the fiscal year. However, you can create reference periods for any period to suit your organizational requirements.

At the end of the reference period, when company information is available and employee salaries are finalized, the administrator schedules the profit sharing processes to calculate and distribute the global fund.

Agreements can cover one or more reference periods, depending on the agreement type and the agreement setup:

Worker's participation agreements (intéressement des salariés) are typically for three years.

If the reference period is a year, you create three reference periods, one for each year. However, if the reference period is three months, you define 12 reference periods for the agreement (4 reference periods a year * 3 years).

Profit-sharing agreements (participation aux résultats) can have a fixed duration or an unspecified duration.

If the duration is not defined, the administrator can create any number of reference periods.

You set up reference periods for an agreement only after the agreement is signed by all the relevant groups and the status is set to Approved.

To define reference periods for an agreement, you need to:

Define how the Manage Profit Sharing business process imports information from your payroll system.

This is defined for each reference period. The distribution calculations require employee payroll information, which is imported when the Extract Eligible Employees process runs.

(Optional) Define the Carry Forward and Carry Over amounts for each reference period.

This applies to profit-sharing agreements only. When part of the global fund remains after distribution to employees, you can specify that the surplus is added to the fund for the next reference period. Equally, a surplus in the previous reference period can result in an amount being added to the current reference period. These values are automatically calculated by the system, but you can override the calculated values before running the remaining processes.

This section discusses:

Importing data from PeopleSoft Global Payroll for France.

Importing data from other payroll systems.

When you set up a reference period, you must define where employee payroll information is stored because this is required for distributing the global fund.

The amount that an employee receives from profit sharing can be based on one or more of these parameters:

Gross salary.

Days worked in the reference period.

Number of eligible employees.

For the Distribute Global Funds process to calculate the profit share based on salary and days worked, it requires each employee's gross salary and total days worked during the reference period.

These values must take into account absences. Generally, absences reduce the employees' gross salary and the total working days for the period. However, the following types of absence must not be deducted from the employees' total working days count and their gross salary amount:

Paid vacations.

Maternity leave.

Adoption leave.

Work accidents (except accidents that occur on journey between home and workplace).

Absence due to occupational illness (maladie professionnelle).

The gross salary includes all compensation and benefits, before contributions such as the social security contribution and retirement contribution are deducted.

See Computation Page.

This payroll information is imported from one of two sources:

Global Payroll for France.

A record in the database that has been populated from other payroll systems.

The system checks the employee's job data, as of the reference period end date, to determine which source to use for the import. If the Payroll System field on the Job Data - Payroll page is Global Payroll, the system imports from Global Payroll for France. If the Payroll field is set to any other value, the system imports from a record in the database.

Importing Data from Global Payroll for France

PeopleSoft provides the following elements in Global Payroll for France for use with the Manage French Profit Sharing business process:

Accumulators to track employees' gross salary for the reference period.

Accumulators to track the number of days worked in the reference period.

Earnings from profit share or worker's participation agreements.

The accumulators automatically include the paid absences that must be included in the salary and number of days worked. PeopleSoft delivers separate accumulators and earnings for profit sharing and worker's participation agreements to allow for agreements that are based on different data. However, if your agreements are based on the same employee payroll information, you can remove the unused accumulators from the section PAR SE PARTICIP. This section is used to trigger the calculation of the accumulators used for the profit-sharing distribution.

See Setting Up Sections.

Importing Data from Other Payroll Systems

If you don't have Global Payroll for France installed, you must populate a record in your database with employee payroll information. PeopleSoft delivers the record PS_WP_EXT_PAYDATA for this purpose.

The table below lists the fields in the PS_WP_EXT_PAYDATA record:

|

Field Name |

Type |

Length |

Description |

|---|---|---|---|

|

WP_AGREEMENT_ID |

Char |

5 |

Agreement ID. |

|

PERIOD_ID |

Char |

12 |

Reference Period ID. |

|

EMPLID |

Char |

11 |

Employee ID. |

|

EMPL_RCD |

Number |

3 |

Employee Record ID. |

|

GROSS_PAY |

Number |

6.2 |

Employee's relevant gross salary for the reference period. |

|

DAYS |

Number |

3 |

Employee's relevant working days for the reference period. |

|

CURRENCY_CD |

Char |

3 |

Currency code for the gross salary amount. |

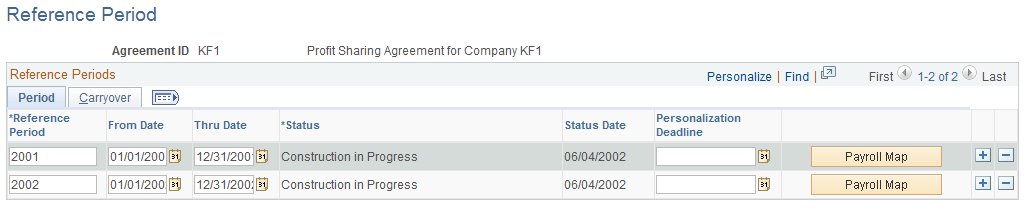

Use the Reference Period page (WP_AGRT_PERIOD) to create and approve reference periods.

Navigation:

This example illustrates the fields and controls on the Reference Period page - Period tab. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Reference Period |

Enter the reference period ID. The system populates a reference period ID that you can override. |

From Date and Thru Date |

Enter the period start and end dates. The system automatically populates these dates based on the agreement approval date or the dates of existing reference periods. You can override these default dates. If you haven't created reference periods for the agreement, the system populates the date fields for the year previous to the approval date, as follows:

The agreement approval date is defined on the Agreement page. If there are existing reference periods, the system populates the date fields starting the new reference period immediately after the end of the latest period with the same duration as the existing period. |

Status |

When you add the period initially, the system sets the status to Construction in progress and changes it to Computed when you run the Process Interest and Payment Application Engine process (HR_WP_PAYMT). After reviewing the profit sharing amounts calculated by the process, change the status to Approved. Once you set the status to Approved, you can't make other changes to the reference period. Note: Employees can view their fund information only when the reference period status is Approved. |

Personalization Deadline |

Enter the last date on which employees can change the investment method or interest reinvestment options using the Agreement Personalization component or the self-service transactions. After this date, employees cannot change these agreement settings and funds can be transferred to the financial organization specified or paid through your payroll system. If employees receive a payment or a transfer is completed before the personalization deadline, the system doesn't allow employees to update their agreement settings from this payment or transfer date. Note: If you don't define a date, the system automatically prevents employees updating their agreement settings once the first reference period is approved. |

Payroll Map |

Click this button to define the location of payroll information. Profit sharing calculations depend on data imported from your payroll system. |

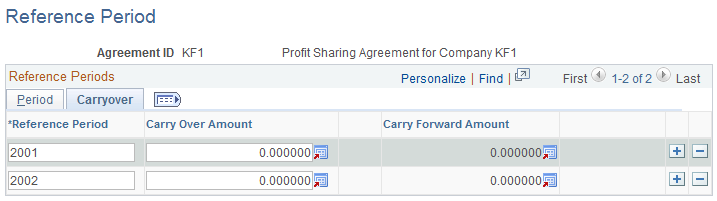

This example illustrates the fields and controls on the Reference Period page - Carryover tab. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Carry Over Amount |

This field shows the amount carried over from the previous reference period. The Compute Global Fund process adds this amount to the global fund calculated. |

Carry Forward Amount |

This field is for profit-sharing agreement types only. It shows the surplus amount that will be added to the global fund for the next reference period. This is calculated by the Distribute Global Funds process if you selected the Carryover option on the Investment page. |

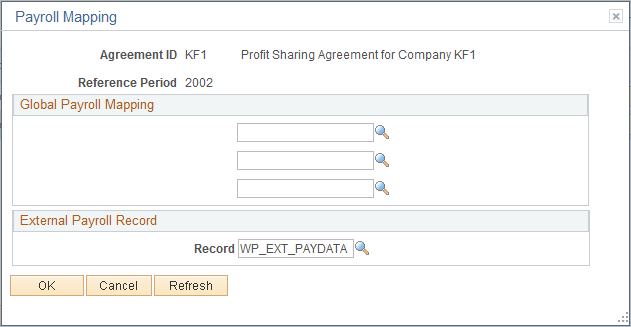

Use the Payroll Mapping page (WP_AGRT_PERIOD_SEC) to define payroll data required by the profit sharing calculations.

Navigation:

Click the Payroll Map button on the Reference Period page.

This example illustrates the fields and controls on the Payroll Mapping page. You can find definitions for the fields and controls later on this page.

Use this page to define the location of payroll information that is required for profit sharing. If you make changes to this page after running the Extract Eligible Employees process, you must rerun the process to take account of the modifications. You can't make changes to this page once the reference period status is Approved.

Note: If your organization uses Global Payroll for France and other payroll systems, define both Global Payroll Mapping and External Payroll Mapping. If you define both group boxes, the system uses the Payroll System field in the employee's job data to determine which source to use for the import.

Global Payroll Mapping

The system displays this group box if you have Global Payroll for France installed.

Field or Control |

Description |

|---|---|

Gross Salary Accumulator |

Select the accumulator defined in Global Payroll for France that stores employees' gross salary. PeopleSoft provide the following accumulators as standard: PAR AC SAL PART SG for profit-sharing agreements. PAR AC SAL INT SG for worker's participation agreements. These accumulators store employees' gross salary during the reference period. This includes paid absences and some unpaid absences, such as maternity leave. The employees' gross salary is used by the Distribute Global Funds process to calculate employees' funds. |

Working Days Accumulator |

Select the accumulator defined in Global Payroll for France that track employees' working days in a reference period. PeopleSoft provide the following accumulators as standard: PAR AC PRE PART SG for profit-sharing agreements. PAR AC PRE INT SG for worker's participation agreements. These accumulators store employees' working days, including paid absences and some unpaid absences, such as maternity leave. This is used by the Distribute Global Funds process to calculate employees' profit-sharing amount. |

Payment Earning |

Select the earning defined in Global Payroll for France for the payment of profit-sharing or worker's participation amounts. This earning is generated during payment processing. PeopleSoft delivers the following earnings as standard: INTERESSEMEN for profit-sharing agreements. PARTICIPATIO for worker's participation agreements. |

External Payroll Mapping

If you use an external payroll system for some employees you must populate a record with payroll information required for the profit-sharing calculations.

Field or Control |

Description |

|---|---|

Record Name |

Select the record that stores your payroll information. PeopleSoft delivers the PS_WP_EXT_PAYDATA record that has the correct structure. If you use a different record make sure that the record has the same field names, types, and length as those defined in PS_WP_EXT_PAYDATA. |