Managing and Viewing Payroll Information

This topic lists the pages used to manage and view payroll information as employees.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Direct Deposit Page |

PY_IC_DD_LIST |

View current direct deposit information. |

|

Add Direct Deposit Page Change Direct Deposit Page |

PY_IC_DD_DATA |

Add or change direct deposit information. If the bank is in the United States, indicate whether funds are actually going to a non-US bank. |

|

Delete Confirmation Page |

EO_DEL_CONFIRM |

Delete direct deposit information. |

|

Pay Statement Print Option Page |

PY_IC_DD_SUPP |

Indicate whether you want a printed copy of the pay statement mailed to your home address. The default is set to yes. |

|

PY_IC_W4_DATA_2020 |

Complete and submit Form W-4 as an employee. If you work for multiple companies, select the employer for whom you want to change tax information. Workflow associated with this page sends an email notification to the employee verifying the W-4 details. The W-4 Withholding Certificate self-service transaction does not work when WWW_AUTHENTICATION is used. With WWW_AUTHENTICATION, users receive a message on the final confirmation page that their password is invalid and are unable to save the W-4 changes. To use the W-4 Withholding Certificate self-service transaction, you must use a different authentication method. |

|

|

Pay Inquiry Page |

PI_IC_CHK_DATA |

(For Payroll Interface users only) View paycheck information for any confirmed pay period. |

|

(USA) W-2 Reissue Request Page |

PY_IC_W2_DATA |

Request to have a new W-2 form sent to your home or work address as an employee. Workflow associated with this page generates an email confirmation to the employee. |

|

Voluntary Deductions Page |

PY_IC_DED_LIST |

View a list of current voluntary deductions. |

|

Add Voluntary Deduction Page Change Voluntary Deduction Page |

PY_IC_DED_DATA |

Add, change, or stop voluntary deductions. |

|

(USF) Add Distribution Information Page |

W3_GVT_PY_ALOT_IC |

Enter details of the account from which the voluntary deduction is taken. |

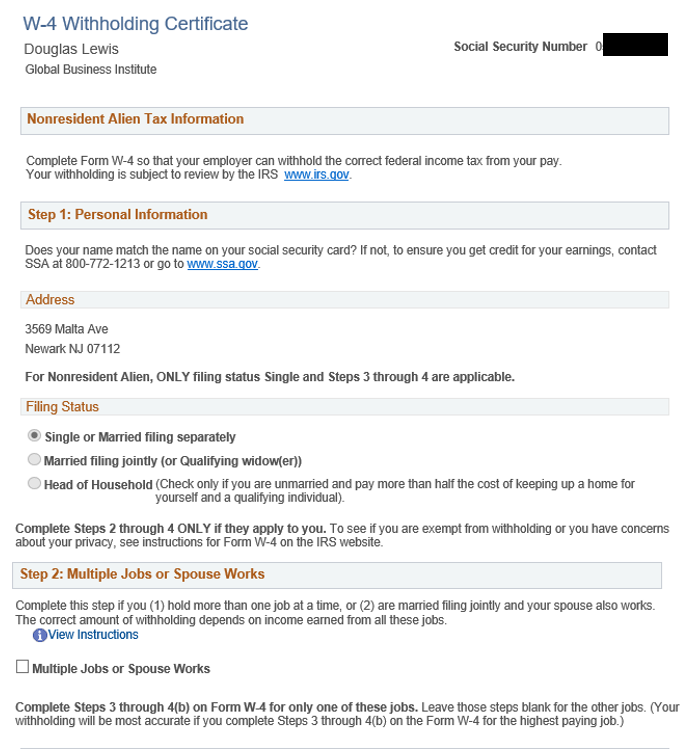

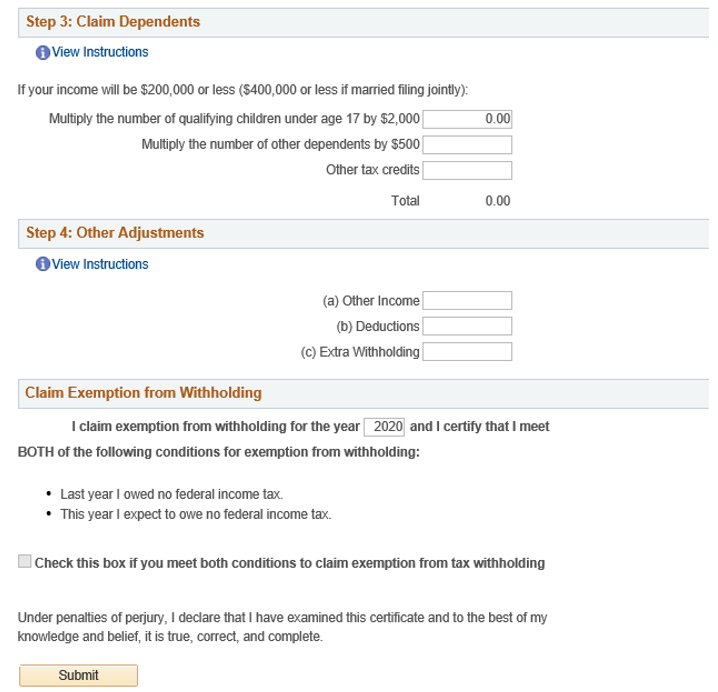

Use the W-4 Withholding Certificate page (PY_IC_W4_DATA_2020) to complete and submit Form W-4 as an employee.

Navigation:

This example illustrates the fields and controls on the W-4 Withholding Certificate page (1 of 2).

This example illustrates the fields and controls on the W-4 Withholding Certificate page (2 of 2).

If the special tax withholding status for the employee is set as nonresident alien on the Federal Tax Data page, some section labels are changed on the pages to reflect that.

Note: Payees in 1099-R companies are not allowed to update their Federal Tax Data on the W-4 Withholding Certificate page.

Considerations for Nonresident Aliens

The following behaviors apply when the employee with the Nonresident Alien special tax withholding status makes updates on the W-4 Withholding Certificate page:

The default filing status is set to Single or Married filing separately, and the rest of the Filing Status options are not editable. This is because nonresident aliens are required to file as single.

The employee is not allowed to select the checkbox to claim exemption from federal income tax withholding in the last section of the page.

Instructions for filling out Form W-4 are available for review.