Setting Up Prorate and Rounding Rules

This topic provides an overview of rounding rule usage and proration calculation, and discusses how to define prorate and rounding rules.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

WCS_ROUND_TBL |

Set up rounding rules to determine calculated funding amounts for funding adjustments and proposed amounts for variable compensation and salary plans. |

|

|

WCS_PRORATE_TBL |

Set up rules for proration analysis and factor calculation. |

This section discusses:

Multiple Currencies

Rounding approach

Decimal precision

Multiple Currencies

eCompensation Manager Desktop has the capability to handle multiple currencies. This allows managers to view data and submit pay and bonus recommendations in their local currencies. However, for the system to manage to an overall budget, amounts entered in a currency that is different than the base currency that is used for budget purposes are converted to the base currency for the funding process (defined in the cycle definition) and stored in that base currency.

When these amounts are needed for display in a currency other than the base currency, the system converts the stored amount to the needed paid currency. All currency conversion is based on PeopleSoft-delivered currency conversion functionality.

Rounding Approach

Another configurable aspect of eCompensation Manager Desktop is the ability for the system to round input amounts to user-defined increments, or accept them in increments of .01. These increments can be defined by currency.

The rounding rule is applied uniformly throughout the application at a number of critical spots in the process:

During the budget build process rounding rules apply to calculated funding amounts for variable compensation and salary plans.

During the funding adjustment phase any employee-level funding adjustments input by the compensation administrator need to be rounded in accordance with the appropriate rule.

During the manager self-service phase proposed values need to be rounded in accordance with the appropriate rule.

During the load process posted proposed amounts are rounded in accordance with the appropriate rule.

Rounding takes place by plan against the proposed values (for example, merit increases are calculated separately from promotions). For example, Japan (JPY) values may be rounded to increments of 100.00 while South Korean (KRW) values may be rounded to increments of 500. Rounding rules are defined for salary and monetary variable compensation plans separately, which are defined in the cycle definition.

In the case of salary values, there is an underlying assumption that the current base salary amount is properly rounded. The Cycle Build process automatically rounds annual rates to 2 decimal places for calculation purposes.

For example, if values are rounded to the nearest 1.00, a funded percentage of 3 percent on a base salary of 35,122.00 JPY would be 1053.66 JPY. In this case the system would round the funded amount to 1,054 JPY. If the starting base salary was 35,122.00 JPY, the new base salary would be 36,176.00 JPY not 36,175.66 JPY.

|

Rounding Rule |

Starting Base Salary |

Funding Percentage |

Rounded Value |

New Base Salary |

|---|---|---|---|---|

|

Nearest 1.00 |

35,122.00 |

3 percent |

1,054 |

35,122.00 + 1,054 = 36,176.00 |

Rounding takes place based on the paid currency of the individual. This means that values viewed in a currency other than the paid currency of the employee may not appear as a rounded value.

Decimal Precision

For employees populations with different currencies decimal precision is important in the rounding function. Because funding and proposal amounts are calculated and rounded in their base currency, and are stored in the planning currency in the compensation cycle processing tables, employee populations with mixed currency codes can cause incremental balance issues during conversion.

Without decimal precision, the proposal amount might not post the correct rounded proposal amount. All proposal amounts on summary pages in PeopleSoft eCompensation Manager Desktop are displayed with 2 decimal points despite the fact that some funding and proposal amounts on certain pages can contain up to 6 decimal places. Funding and proposal amounts calculated and entered for employees with different currencies will properly update the organizational funding summaries.

PeopleSoft eCompensation Desktop Manager enables you to configure proration rules to suit your business needs. A prorate rule is used to apply a formula to calculate a percent value that represents the employee's eligibility for the compensation cycle. A proration factor of 1.00 would signify that the employee is eligible for the entire period. This proration factor is applied to adjust the calculated funding amounts during the build process. On the Compensation Cycle Definition – Salary page you enter the following information:

Earliest eligible start date.

Full period start date.

Eligible end date.

The system calculates the proration factor by reviewing the employee's job history for the eligible period and accumulating the number of periods that meet the specified proration rule formula.

|

Period |

Description |

|---|---|

|

Eligible Period |

The time between the Earliest Eligible Start Date (1) and the Eligible End Date (3) that a person is eligible. |

|

Full Period |

The time between Full Period Start Date (2) and Eligible End Date (3). |

The maximum prorate factor is the time from the Eligible Period divided by the Full Period. If the Earliest Eligible Start Date is the same as Full Period Start Date then the prorate factor is 1.0000. If the Earliest Eligible Start Date is prior to the Full Period Start Date then the prorate factor can be greater than 1.0000.

For example, a typical merit cycle might be from 1/1/2009 to 12/31/2009 (12 months) with a hire cutoff date of 10/1/2008.

This cycle would calculate the prorate factor from 10/1/2008 through 12/31/2009 (15 months), giving those that were hired before the normal cycle (12 months) a prorate factor of up to 1.25 (15 months / 12 months = 1.25) to make up for the time they worked in addition to the typical merit cycle.

Note: To highlight employees who have a proration factor greater than 1, the system displays a warning message which is written to the WCS Message Log table and to the log file during build processing.

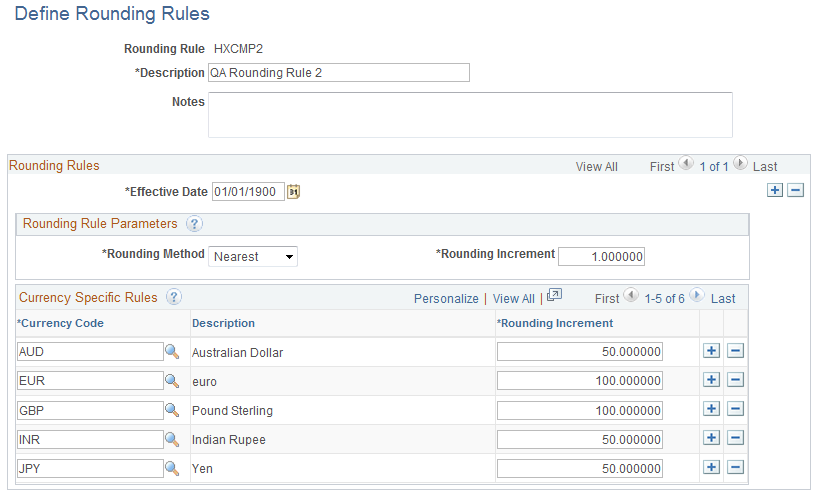

Use the Define Rounding Rules page (WCS_ROUND_TBL) to set up rounding rules to determine calculated funding amounts for funding adjustments and proposed amounts for variable compensation and salary plans.

Navigation:

This example illustrates the fields and controls on the Define Rounding Rules page.

Field or Control |

Description |

|---|---|

Rounding Rule |

Identifies the rounding rule. You enter the characters in this field in the Add mode before you access the page. The maximum length is six characters. |

Rounding Rules

Field or Control |

Description |

|---|---|

Effective Date |

Select or enter the date the rule becomes effective. |

Rounding Rule Parameters

Field or Control |

Description |

|---|---|

Rounding Method |

Select one of these values to indicate the method with which the system should round values that are input and calculated:

|

Rounding Increment |

Enter the increment by which you want the system to round input amounts. Rounding increments must be 1000, 500, 100, 50, 10, 5, 1, 0.1, or 0.01. |

Currency Specific Rules

Field or Control |

Description |

|---|---|

Currency Code |

Select the currency for which you want to apply the rounding rule. The system displays the description to the right of the currency. |

Rounding Increment |

Enter the rounding increment that you want the system to use for the corresponding currency. Rounding increments must be 1000,500,100,50,10,5,1,0.1, or 0.01. |

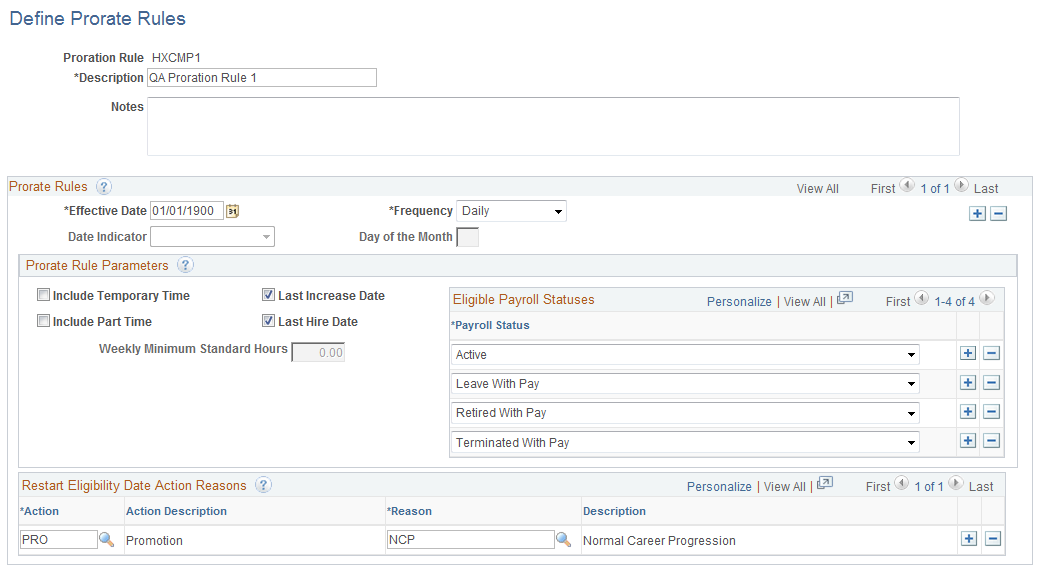

Use the Define Prorate Rules page (WCS_PRORATE_TBL) to set up rules for proration analysis and factor calculation.

Navigation:

This example illustrates the fields and controls on the Define Prorate Rules page.

Field or Control |

Description |

|---|---|

Proration Rule |

Identifies the proration rule. You enter the characters in this field in the Add mode before you access the page. The maximum length is six characters. |

Prorate Rules

Field or Control |

Description |

|---|---|

Effective Date |

Select or enter the date the rule becomes effective. |

Frequency |

Select one of these values to indicate the frequency with which the system should apply the proration rule:

|

Date Indicator |

Use this field only when the proration frequency is set to Monthly. Select one of these values to indicate when the system should use the proration rule:

|

Day of the Month |

If you select Day of Month in the Date Indicator field, you must also enter the day on which the proration rule is used. This number cannot be greater than 28. |

Prorate Rule Parameters

Field or Control |

Description |

|---|---|

Include Temporary Time |

Select to include the proration rule in calculations involving temporary time. If this check box is deselected, the Regular/Temporary field on the employee's Job Data - Job Information page for which the proration rule is being applied must have an employment status of Regular to be considered eligible. |

Include Part Time |

Select to include the proration rule in calculations involving part-time pay. If this check box is deselected, the Full/Part field on the employee's Job Data - Job Information page for which the proration rule is being applied must have an employment status of Full-Time to be considered eligible. |

Last Increase Date |

Select to indicate that the eligibility date for compensation adjustments starts with the date the employee's pay was last increased. Note: The system uses the Last Increase Date field in conjunction with the fields in the Restart Eligibility Date Action Reasons group box. The last increase date will only restart based on the action reasons that are specified. |

Last Hire Date |

Select to indicate that the eligibility date for compensation adjustments starts with the date the employee was last hired. |

Weekly Minimum Standard Hours |

This field is only used when the Include Part Time check box is selected. The system only makes proration calculations on time if the employee is part time and the weekly standard hours are greater than or equal to this number. |

Eligible Payroll Statuses |

Select the payroll status for which the system should apply the proration rule. You can select multiple statuses by clicking the Add a new row button. |

Restart Eligibility Date Action Reasons

Field or Control |

Description |

|---|---|

Action and Reason |

Select an action and reason to indicate why eligibility should be restarted. The system displays descriptions next to the action and reason that you select. To add multiple actions and reasons, insert additional rows. |