Setting Up US Same-Sex Spouse for Benefits Eligibility and Enrollment

This topic describes how to set up health plans and spousal life insurance plans for the US same-sex spouse feature.

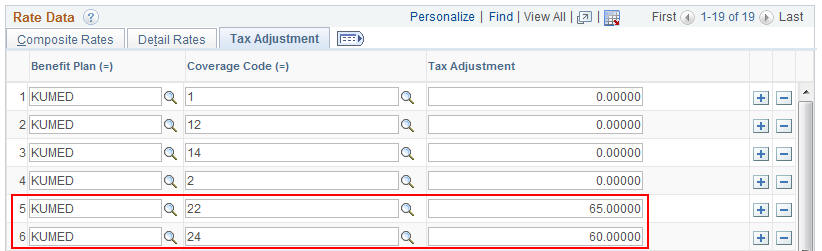

For Health Plans, define tax adjustment rates for coverage codes 22 and 24. Other coverage codes do not require tax adjustment rates.

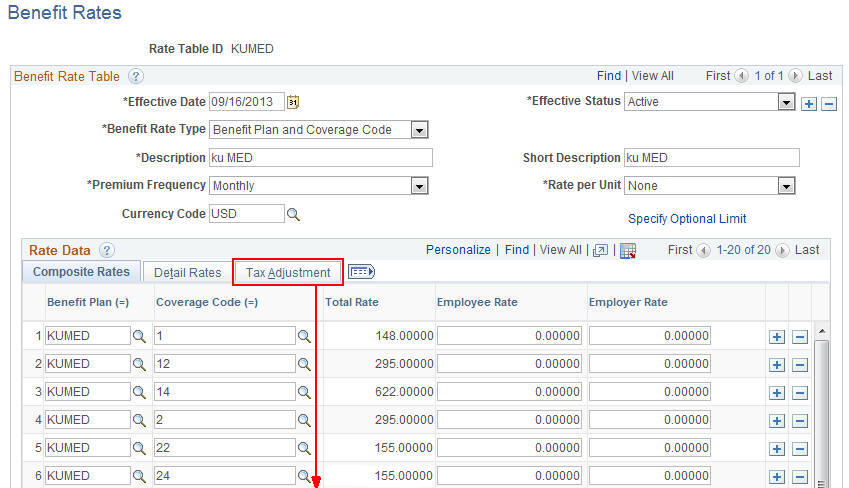

This example illustrates the fields and controls on the Benefit Rates page.

This example illustrates the fields and controls on the Benefit Rates — Tax Adjustment page.

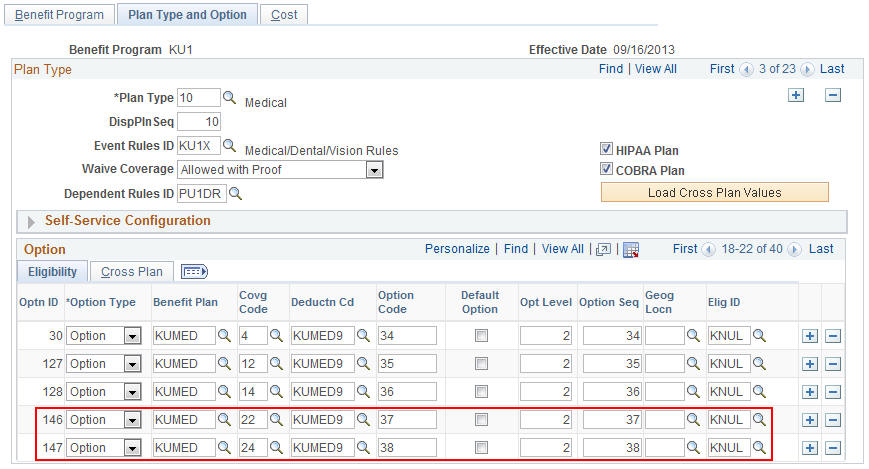

On the Benefits Program Table for Health Plans, add options for coverage codes 22 and 24.

Note: Since coverage codes associated with same sex and heterosexual marriage can be identified, the same Benefit Rates Table can be used for both, but with a different set of tax adjustment rate entries accordingly.

This example illustrates the fields and controls on the Benefit Program — Plan Type and Option page.

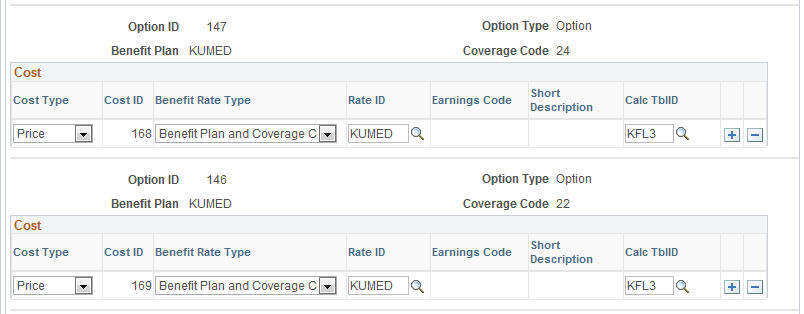

This example illustrates the fields and controls on the Benefit Program page for coverage codes 22 and 24.

Life Insurance 2X plans do not use health coverage codes. Set up separate benefit plans for same-sex spouse in order to use different benefit rates for spouse and same-sex spouse.

Note: The following screenshots provide sample setup for spousal life insurance plans.

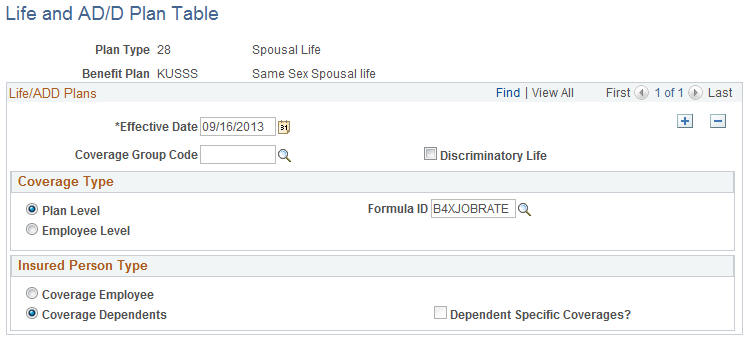

This example illustrates the fields and controls on the Benefit Plan Table page.

This example illustrates the fields and controls on the Life and AD/D Plan Table page.

Additionally, create a new benefit rate ID on the Benefit Rates Table with tax adjustment amounts for same-sex spouse.

This example illustrates the fields and controls on the Benefit Rates page.

Add option entries for same-sex spouse using a separate benefit plan and different benefit rate ID.

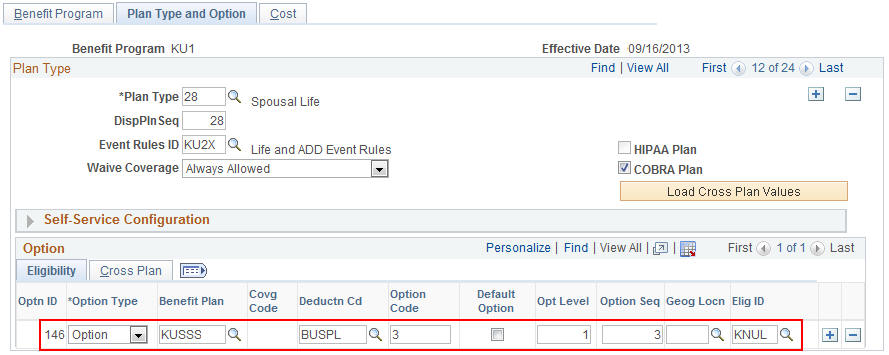

This example illustrates the fields and controls on the Benefit Program — Plan Type and Option page.

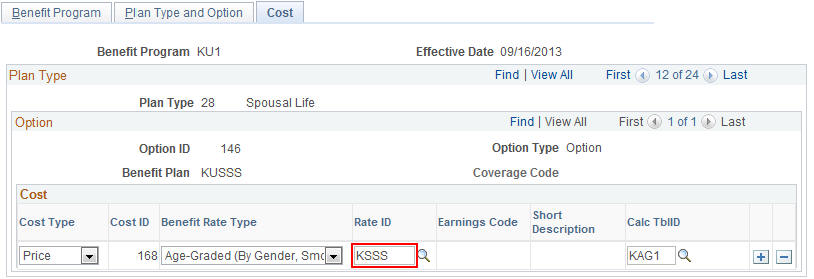

This example illustrates the fields and controls on the Benefit Program — Cost page.