Reviewing Benefits Setup for US Same-Sex Spouse

This topic describes the benefits setup for US same-sex spouse delivered with the system.

The Benefits product provides new coverage codes, for example, for same sex marriage, which can be linked to a separate set of Benefits Tax Adjustment Rates used to calculate the taxation differences between states and locals vs. Federal. These tax adjustment rates required for same-sex spouse are defined in the Tax Adjustment field, in the Tax Adjustment tab of the Benefits Rate Table.

The new coverage codes for same sex marriage allow the Covered Person Type of US Same Sex Spouse. The new Covered Person Type is associated to a new Relationship with the same name US Same Sex Spouse. A dependent or beneficiary is defined in HR personal data by means of a Relationship. Hence all the same-sex spouse setup eventually gets associated with the set of adjustment rates used to calculate necessary state and local tax adjustments.

Depending on the benefits plan type, the following new setup is recommended to implement the US same-sex spouse enhancement:

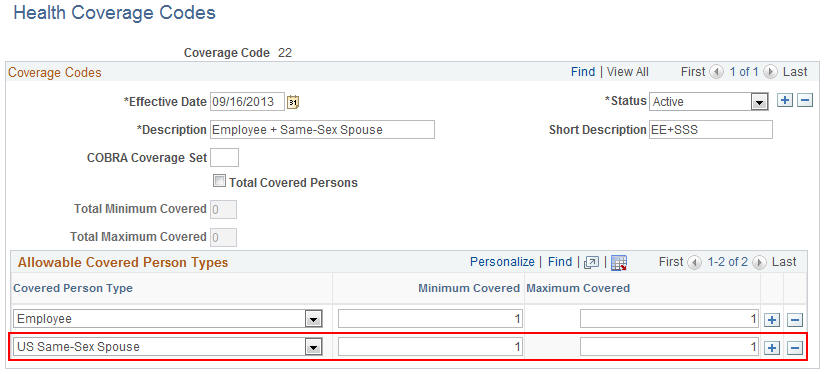

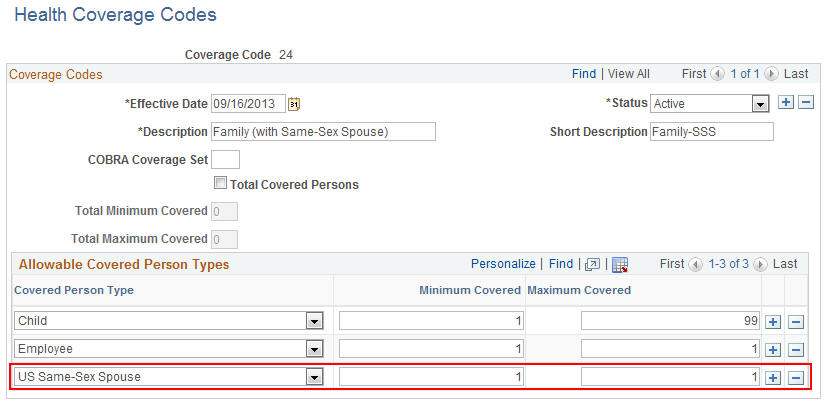

For health plans, new coverage codes are set up for the US same-sex spouse relationship, distinguished by the covered person type US same-sex spouse. Coverage codes 22 and 24 are delivered with the system.

For life plans, customers are required to set up new benefit plans for same-sex spouse and associate different sets of benefit rate IDs.

Use the translate value SS for the Covered Person Type of US same-sex spouse.

This example illustrates the fields and controls on the Maintain Translate Values — Covered Person Type page.

Use the translate value SS for the US same-sex spouse relationship.

This example illustrates the fields and controls on the Maintain Translate Values — Relationship page.

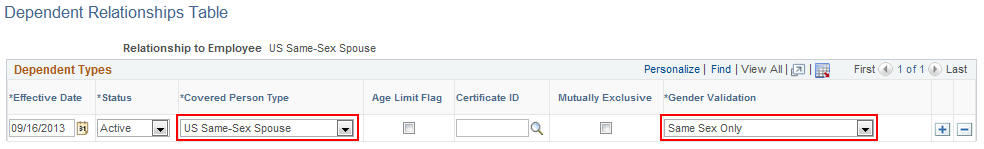

The dependent relationship uses Covered Person Type = US Same-Sex Spouse and Gender Validation = Same Sex Only.

This example illustrates the fields and controls on the Dependent Relationships Table page.

Use the coverage codes 22 and 24 for the options - employee + same-sex spouse, and family (with same-sex spouse).

This example illustrates the fields and controls on the Health Coverage Codes page for coverage code 22.

This example illustrates the fields and controls on the Health Coverage Codes page for coverage code 24.

For all setup related to the US same-sex spouse feature, an effective date of September 16, 2013 is used.

In Tax Update 13-E, Payroll for North America delivered updates to the Taxable Gross Definition table that includes a new Taxable Gross Component ID SSS. The new Taxable Gross Component ID is used in identifying dollar amounts representing benefits provided to an employee’s same-sex spouse, which are excluded from U.S. federal taxable wages, but which continue to be included in the definition of taxable wages for state and local tax jurisdictions that do not recognize same-sex marriage. The Taxable Gross Definition table entries delivered in Tax Update 13-E have an effective date of 09/16/2013. The Benefits product uses the same date in the setup to match with Payroll for North America.

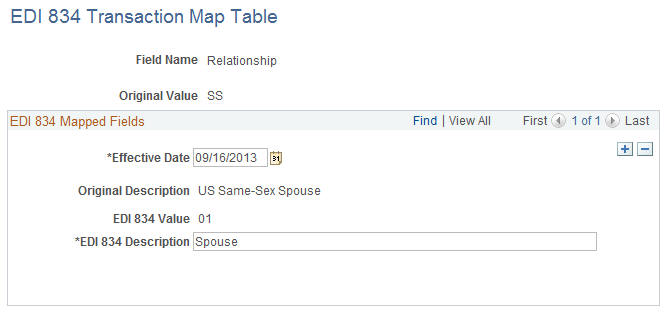

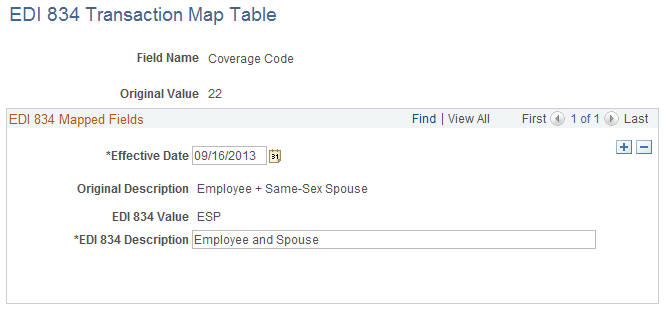

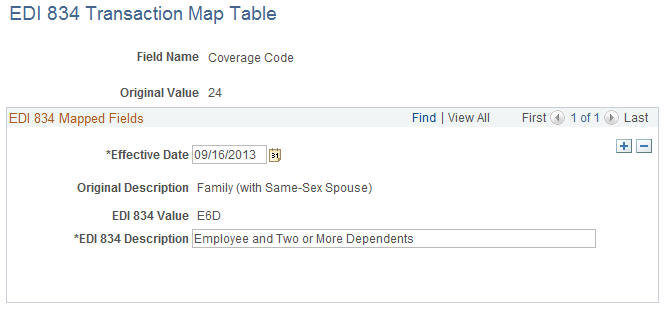

The following values have been set up in the EDI 834 Transaction Map Table:

Mapping values 22 and 24 in the Coverage Code field.

This example illustrates the fields and controls on the EDI 834 Transaction Map Table page for coverage code 22.

This example illustrates the fields and controls on the EDI 834 Transaction Map Table page for coverage code 24.

Mapping value US Same Sex Spouse in the Relationship field.

This example illustrates the fields and controls on the EDI 834 Transaction Map Table page for the mapping value US Same Sex Spouse.