(CAN) Entering Claims

This section provides an overview of claims processing and discusses how to enter claim data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

HC_CANAD_DATA_ENTY |

Enter a new health care claim and provide details for each claim line item. |

|

|

Modify Health Care Claim - Heath Care Participant |

HC_CANAD_PARTIC |

Make changes to claim data before you process a payment for a health care claim. |

|

Modify Health Care Claim - Claim Details |

HC_CANAD_PARTIC2 |

Change detailed information about a particular participant health care claim. |

|

Create Retirement Counsel Claim CAN |

RC_CANAD_DATA_ENTY |

Enter new retirement claims with a detailed level of information. |

|

Modify Retirement Claim CAN-Comments |

RC_CANAD_PARTIC |

Review basic claim and comment information for a specific claim. |

|

Modify Retirement Claim CAN- Claim Details |

RC_CANAD_PARTIC2 |

Change detailed information about a particular participant retirement counseling claim. |

Canadian employers use the Canadian Health Care and Canadian Retirement Counseling Data Entry pages. Canadian pages operate much like the U.S. pages described in the preceding sections. Additional Canadian data entry pages allow for multiple line items per claim.

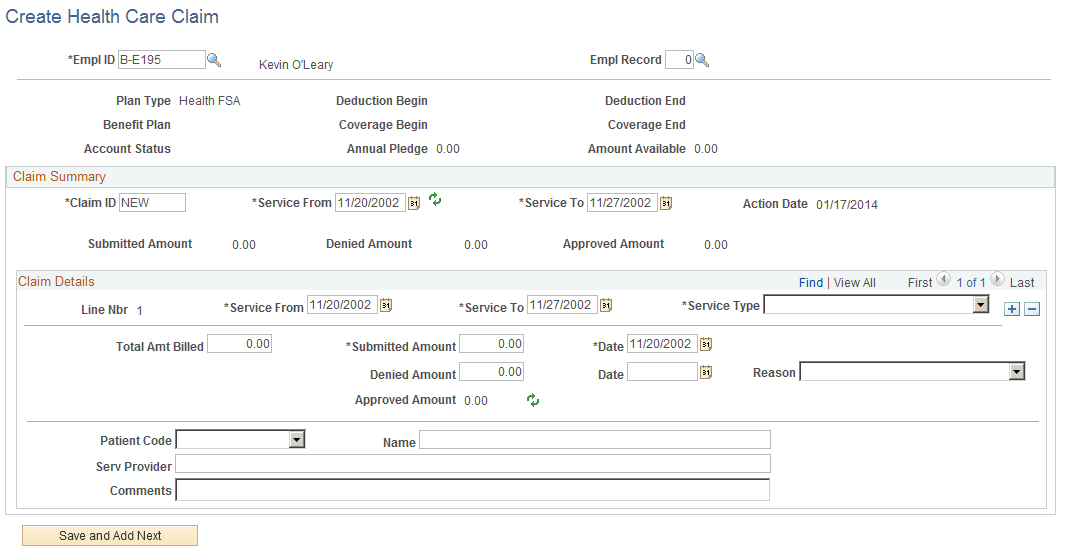

Use the Create Health Care Claim page (HC_CANAD_DATA_ENTY) to enter a new health care claim and provide details for each claim line item.

Navigation:

This example illustrates the fields and controls on the (CAN) Create Health Care Claim page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Service From and Service To |

These dates represent the earliest and latest entries of the detail line items. When you finish entering these dates, access the Health Care Claims Entry page. |

Total Amt Billed (total amount billed) |

Enter an amount for each claim line item. |

Patient Code |

If the claim is for an employee, enter Employee. Other values are Dependent, Spouse, and [None]. If the relationship is Dependent or Spouse, enter the name of the related person. |

Revenue Canada requires that Canadian Retirement Counseling claims be paid directly to the service provider, not the claimant. For this reason, the Canadian Retirement Counseling page requires the entry of a provider ID. This provider information appears on the check stubs for the claimant, along with employee claim information. Special care is required in situations that involve partial payments.