Setting Up Special Accumulators

To set up special accumulators, use the Special Accumulator Table (SPCL_EARNS_TABLE) component.

This section provides an overview of special accumulators and discusses how to enter special accumulator information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

SPCL_EARNS_TABLE |

Enter special accumulator information. |

Sometimes you need to define an employee's earnings based on specific types of earnings rather than total gross earnings. Special accumulators act like a bucket, accumulating only the earning types that you want included when determining the employee's earnings.

Special accumulators are used during deduction calculations and limit testing. You might have a benefit deduction that you base on an earnings amount other than total gross.

For example, you might use a special accumulator to identify all the separate earnings to include when accumulating employee earnings for 401(k) deductions.

Typically, you want to define a special accumulator for qualified savings plans, such as 401(k), that are subject to limit testing.

You first name the special accumulator using the Special Accumulator Table. The next step is to tie specific earnings types to that special accumulator.

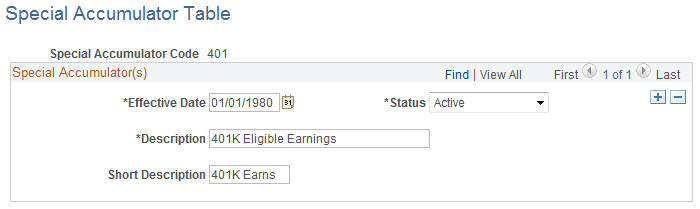

Use the Special Accumulator Table page (SPCL_EARNS_TABLE) to enter special accumulator information.

Navigation:

This example illustrates the fields and controls on the Special Accumulator Table page. You can find definitions for the fields and controls later on this page.