Creating ACA Form Data for Forms 1094-C and 1095-C

This section provides an overview of ACA data extraction required to generate Forms 1094-C and 1095-C.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ACA_DTEX_RUNCTL |

To extract, clean up, or finalize data needed for forms transmittal. |

|

|

ACA_ALE_XMIT_PART1 (ALE Member tab) ACA_ALE_XMIT_PART2 (ALE Monthly Data tab) |

To view the employer transmittal data after the data extraction process. |

|

|

ACA_EMP_XMIT_PART1 (ALE Member tab) ACA_EMP_XMIT_PART2 (Monthly Employee Data tab) ACA_EMP_XMIT_PART3 (Covered Dependent Data tab) |

To view the employee transmittal data after the data extraction process. |

|

|

ACA_EMP_DATA_LOAD |

To review/modify employee CI loaded monthly codes. |

|

|

ACA_EMPMDATA_LOAD |

To review/modify employee CI loaded monthly amounts. |

|

|

ACA_DEP_DATA_LOAD |

To review/modify employees or covered individual CI loaded monthly flags. |

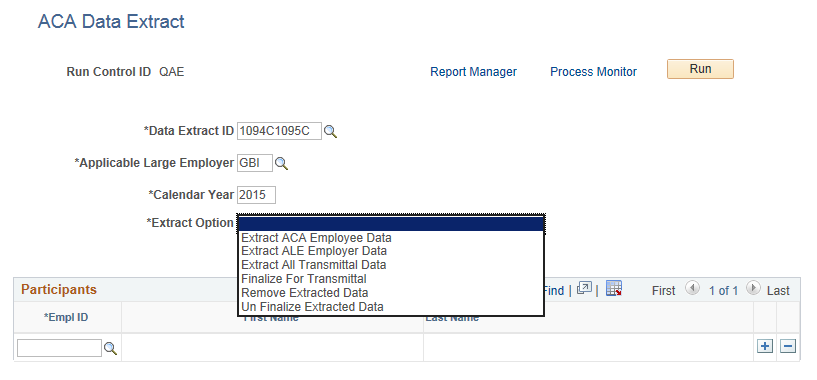

Use the ACA Data Extract page (ACA_DTEX_RUNCTL) to extract, clean up, or finalize data needed for forms transmittal.

Navigation:

This example illustrates the fields and controls on the ACA Data Extract page.

Field or Control |

Description |

|---|---|

Data Extract ID |

Enter the Data Extract ID that defines data to be extracted. |

Applicable Large Employer |

Select the ALE Member for the data extract. |

Calendar Year |

Enter the tax filing year. |

Extract Option |

The options available are:

|

Note: If an extract has already been run for an ALE/Calendar Year, the same extract ID should be used for that calendar year. Otherwise, an error message will be generated.

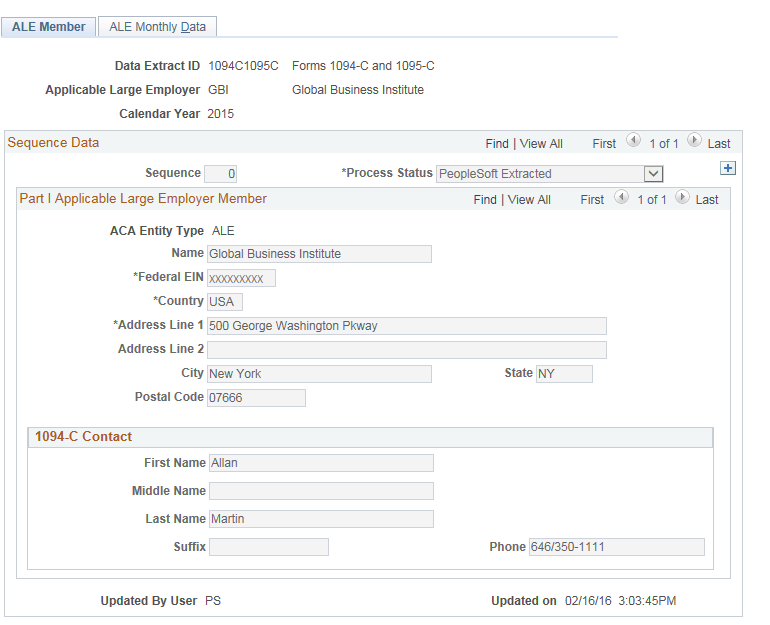

Use the ACA Employer Transmittal Data page (ACA_ALE_XMIT_PART1 and ACA_ALE_XMIT_PART2) to view or modify the employer transmittal data after the data extraction process.

Navigation:

This example illustrates the fields and controls on the ACA Employer Transmittal Data page - ALE Member tab.

Field or Control |

Description |

|---|---|

Process Status |

Defines the status of Data Extract, such as, PeopleSoft Extracted, User Modified, Merged with Data Load, VOID, Finalized for Transmittal, and Transmittal Created. You can add a ‘User Modified’ row to modify data before creating the 1094-C transmittal file. |

Note: Address is extracted based on the country format.

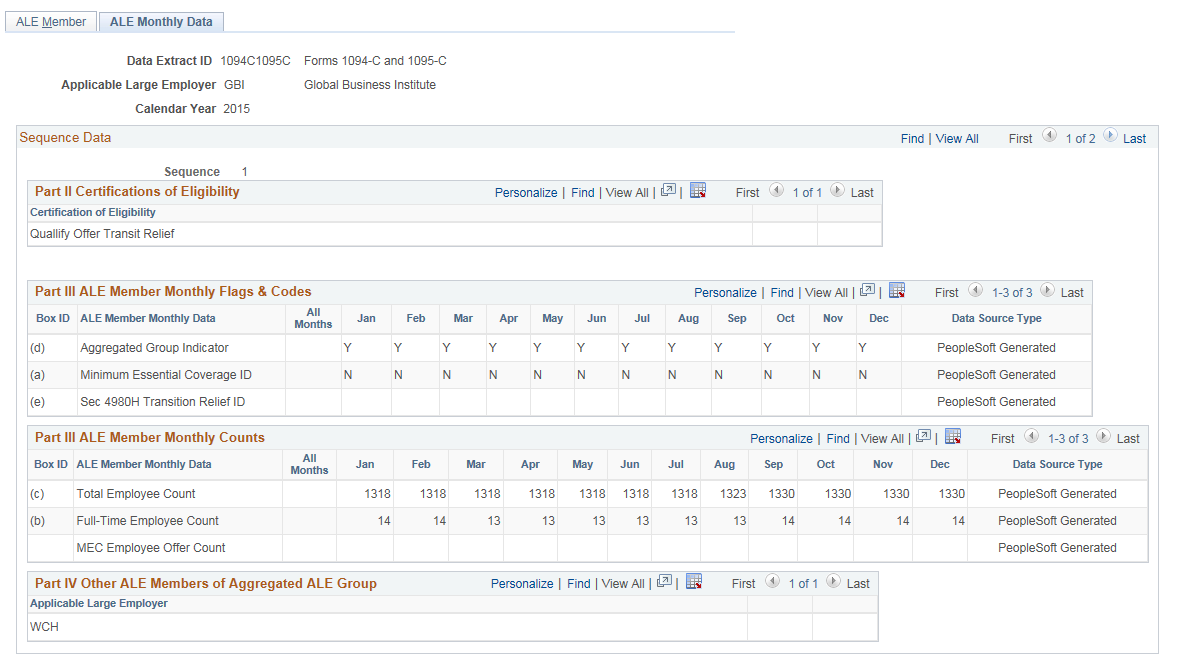

This example illustrates the fields and controls on the ACA Employer Transmittal Data page - ALE Monthly Data tab.

Use the ACA Employee Transmittal Data page (ACA_EMP_XMIT_PART1, ACA_EMP_XMIT_PART2 and ACA_EMP_XMIT_PART3) to view or modify the employee transmittal data after the extraction process.

Navigation:

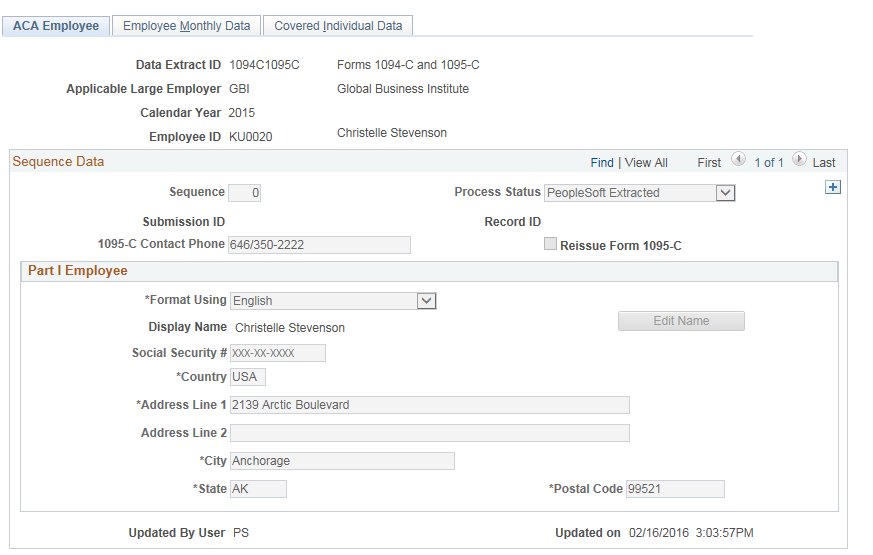

This example illustrates the fields and controls on the ACA Employee Transmittal Data page – ACA Employee tab.

Note: Employee Address is extracted based on the address type table order (ADDR_TYPE_TBL component) that you have set up.

Field or Control |

Description |

|---|---|

Reissue Form 1095-C |

Between the time when Form 1095-Cs is furnished to employees but the Transmittal File has not been submitted to IRS, administrator can reissue Form 1095-C to their employees. Add a user modified row with the changes required and select the Reissue check box to indicate this data row is for issuing a reissue form. Once changes are verified, set the Process Status to Finalized for Transmittal and run the Create XML File (Reissue) process. |

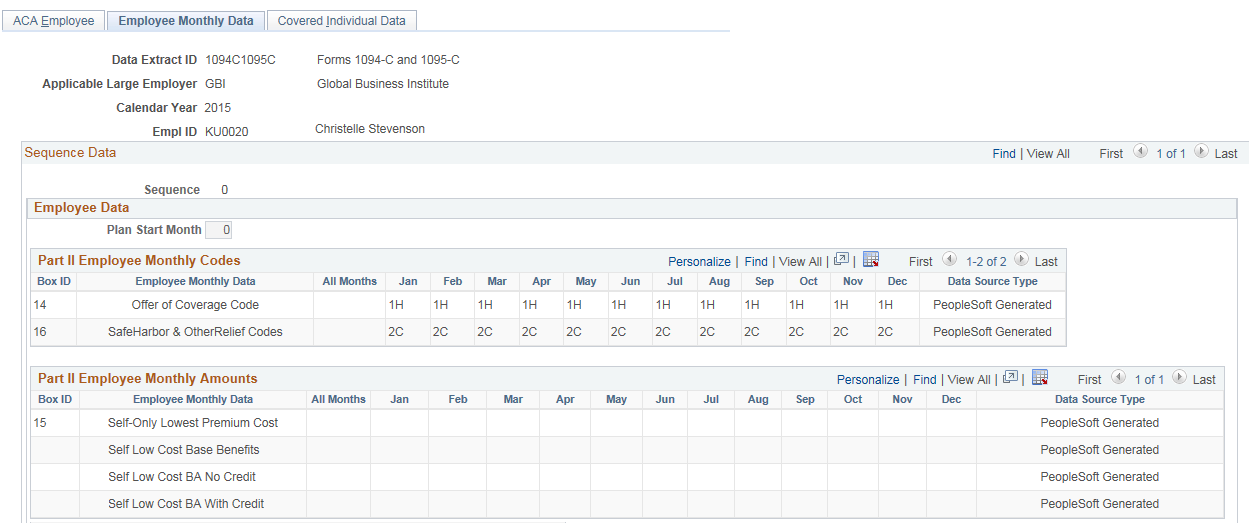

This example illustrates the fields and controls on the ACA Employee Transmittal Data – Employee Monthly Data tab.

Field or Control |

Description |

|---|---|

Plan Start Month |

This is an optional field for 2015. The system defaults it to ‘00’. |

Box ID 15: Employee Monthly Data |

The data from the first row Self Only Lowest Premium Cost populates the corresponding box in the Form 1095-C. The Self Low Cost Base Benefits, Self Low Cost BA No Credit and Self Low Cost BA With Credit are three working rows used to calculate cost and credits. |

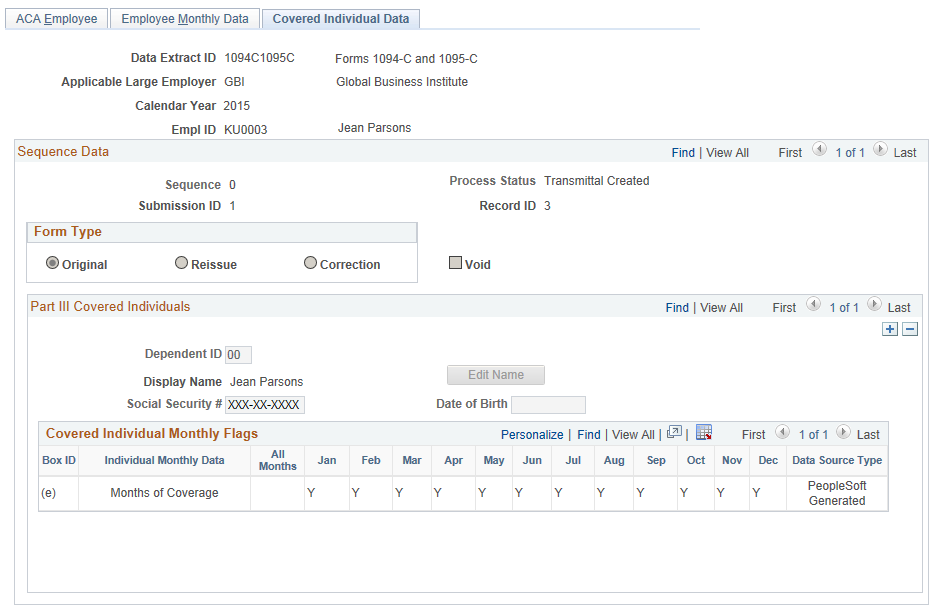

This example illustrates the fields and controls on the ACA Employee Transmittal Data page – Covered Individual Data tab.

If you have third-party data in a Microsoft Excel spreadsheet, you can use the following component interfaces to load employee Form 1095-C data:

CI_ACA_EMPDATA_SRC loads line 14 and 16 of 1095-C

CI_ACA_EMPMDATA_SRC loads line 15 of 1095-C

CI_ACA_DEP_DATA_SRC loads Covered Individual Data, part III of 1095-C.

The component interface simplifies the process of loading your data and performs the required validations during the process.

For more information, see PeopleTools documentation for PeopleSoft Component Interfaces.

The data thus loaded can be viewed and modified on the following pages:

Review Employee Data Load

Review Employee Amount Load

Review Covered Individual Load

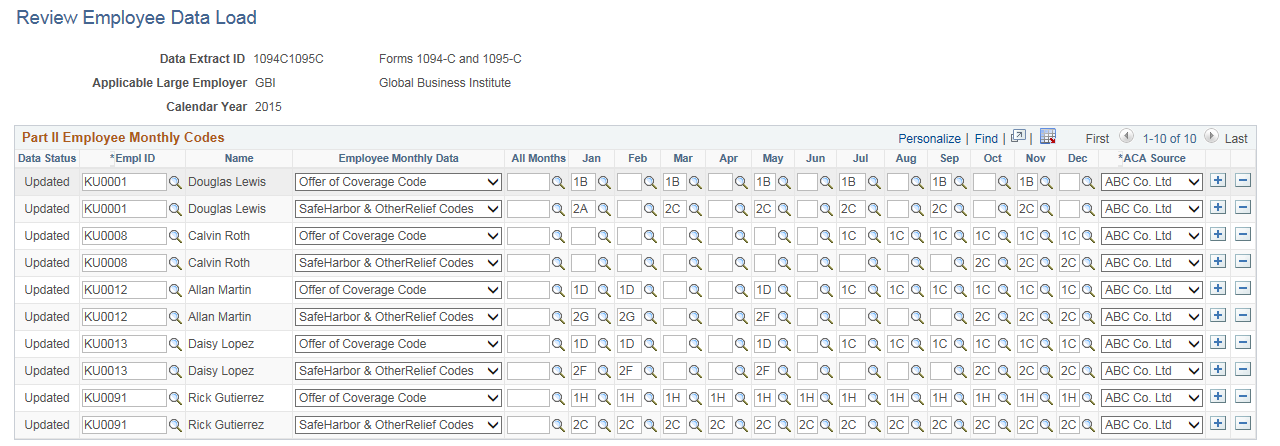

Use the Review Employee Data Load page (ACA_EMP_DATA_LOAD) to review/modify employee CI loaded monthly codes.

Navigation:

This example illustrates the fields and controls on the Review Employee Data Load page.

Field or Control |

Description |

|---|---|

Data Status |

Display/modify the status of the data reviewed. The options available are Error, Initial Load, Merged, Updated, Void, and Warning. |

ACA Source |

Display/modify the source of data loaded using Excel-CI Load. |

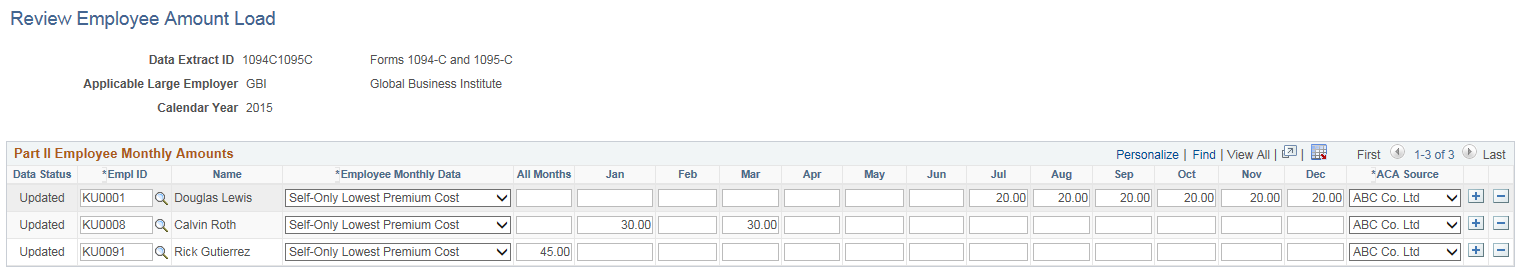

Use the Review Employee Amount Load page (ACA_EMPMDATA_LOAD) to review/modify employee share of lowest cost monthly premium for self-only minimum value coverage.

Navigation:

This example illustrates the fields and controls on the Review Employee Amount Load page.

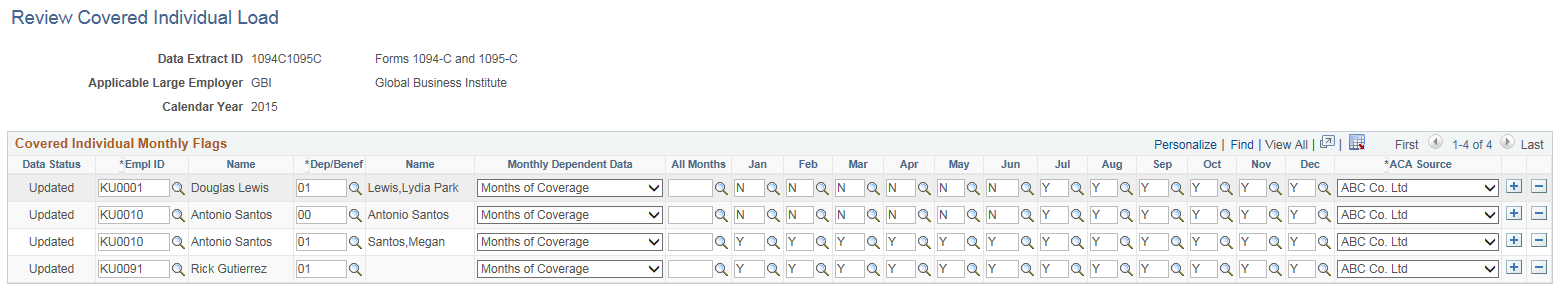

Use the Review Covered Individual Load page (ACA_DEP_DATA_LOAD) to review/modify data for employee or covered dependent enrollment to employer-sponsored self-insured health coverage.

Navigation:

This example illustrates the fields and controls on the Review Covered Individual Load page.