Calculating Charges

This section discusses how to calculate charges automatically, and manually for individual participants.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BILL_RUNCTL |

Calculate charges automatically and create billing charge records for a selected billing calendar. |

|

|

BILL_CHRG_ADD |

Manually post new billing charge records to the system. |

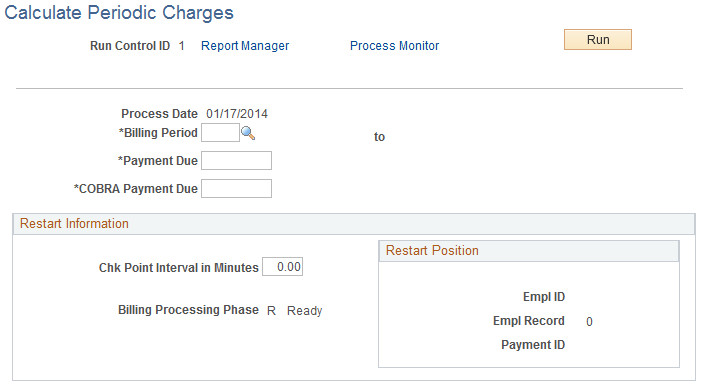

Use the Calculate Billing Charges page (BILL_RUNCTL) to calculate charges automatically and create billing charge records for a selected billing calendar.

Navigation:

This example illustrates the fields and controls on the Calculate Billing Charges page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Billing Period |

Select the period that indicates the billing calendar for which you want to calculate benefits billing charges. Note: You can rerun the Billing Calculation process until you run the Statement Print process for that billing period. |

Payment Due and COBRA Payment Due |

Automatically populated with the dates that were defined for this billing calendar. These fields can be modified if necessary. |

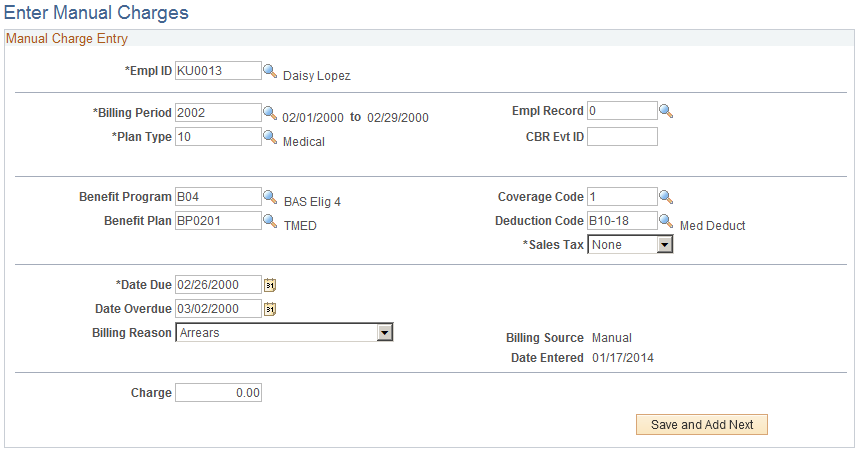

Use the Enter Billing Manual Charges page (BILL_CHRG_ADD) to manually post new billing charge records to the system.

Navigation:

This example illustrates the fields and controls on the Enter Billing Manual Charges page. You can find definitions for the fields and controls later on this page.

You can use this page to enter a partial charge for an employee's first billing period and start automatic billing for that employee in the next billing period. You can also use this page to enter a partial month billing for the last billing period.

If you enter a Billing Charge record manually for an employee, the Billing Calculation process does not automatically calculate the same billing period's charges for that employee. The Billing Calculation process never deletes manual charge entries, even when the process is rerun for a particular billing period.

Field or Control |

Description |

|---|---|

Empl ID (employee ID) |

Enter the ID of the employee who is to be billed. |

Billing Period |

Select the billing period from the billing calendar. |

Plan Type |

Determine the plan type. |

(CAN) Sales Tax |

Canadian users can enter charges that represent various Canadian sales taxes that are associated with another benefits charge. For example, a billing charge for a medical plan may have a Canadian sales tax associated with it. You enter this tax as a separate charge and identify the type of sales tax here. This field can be used for the Goods and Services Tax (GST), the Provincial Sales Tax (PST), the Provincial Premium Tax (PPT), the Provincial Sales Tax on Insurance (PSTI), and the Harmonized Sales Tax (HST). Note: You always enter sales tax as a separate charge, because this is the only way that the system can track it. On all Benefits Billing pages dealing with benefits charges, sales tax charges are identified with their sales tax type. |

Charge |

Enter the total charge for this employee and billing period. |

Note: After you save a charge entry record, you cannot directly change the amount of that charge. Any changes must be made through the Adjust Charges page.