Defining Pay Entities

Note: This topic discusses the first two pages of the Pay Entity component. The other pages in the Pay Entity component, including the Retro Limits page and the Supporting Elements Override page are discussed elsewhere in this documentation.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_PYENT_NAME |

Enter address information for a pay entity. |

|

|

GP_PYENT_PRCS_DTL |

Enter processing details for a pay entity. |

A pay entity is the organization that is responsible for paying payees. You can also use a pay entity to define the type of currency for processing calculations. The pay entity is a legal definition of an organization from a absence and payroll perspective. In many cases, an organization and a pay entity are identical. Absence Management doesn't define a relationship between an organization and a pay entity. If several organizations are held by the same holding organization, the holding organization can be the pay entity, or one organization can have several subsidiaries that are individual pay entities. The system defines most accumulators by pay entity.

Batch Processing

Batch processing uses the data on the Processing Details page to determine which elements to load. Only elements that are defined for All Countries (on the Element Name page) and those defined for Specific Country, where the country equals the pay entity country are loaded.

If any element with a different country has been referenced, the batch program logs an error. Depending on that element's importance, the process might cease. If it cannot continue, it issues the following message:

Element %1 (PIN %2) not loaded into UPINA. (N/A for country: %3).

If the process can continue, it issues one of these messages:

Element %1 (PIN %2) - and data for the element - not loaded into the process. (N/A for country: %3)

Element %1 of parent element %2 on Process List %3 is not found in %4. (PIN number %5)

Note: Reasons other than country assignment can prevent an element from being loaded.

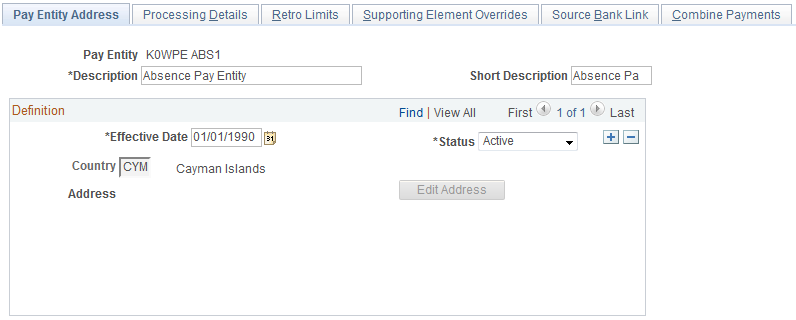

Use the Pay Entity Address page (GP_PYENT_NAME) to enter address information for a pay entity.

Navigation:

This example illustrates the fields and controls on the Pay Entity Address page.

Field or Control |

Description |

|---|---|

Country |

Select the country where your pay entity is located. |

Address |

Click the Edit Address link to enter the pay entity address. The system displays the appropriate address fields for the selected country. Address information fields aren't required; therefore, you can enter only the information that applies to your organization's pay entity. Leave other fields blank. |

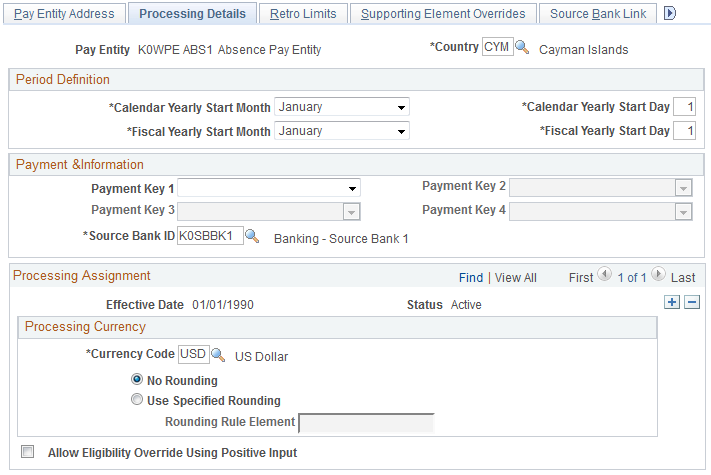

Use the Processing Details page (GP_PYENT_PRCS_DTL) to enter processing details for a pay entity.

Navigation:

This example illustrates the fields and controls on the Processing Details page.

Warning! Do not modify fields above the effective-dated area of the page after implementation. Doing so can destroy the integrity of retroactive and accumulator calculations.

Field or Control |

Description |

|---|---|

Country |

Select the processing country for this pay entity. |

Period Definition

Field or Control |

Description |

|---|---|

Calendar Yearly Start Month and Calendar Yearly Start Day |

Enter the start date for the pay entity's calendar year. This date becomes the default start date for accumulators that are based on calendar year, unless you specify otherwise in the accumulator definition. |

Fiscal Yearly Start Month and Fiscal Yearly Start Day |

If your pay entity operates on a fiscal year that's different from the calendar year, enter the start date of the fiscal year. This date is used as the default start date for accumulators that are based on fiscal year, unless you specify otherwise in the accumulator definition. |

Payment Information

Field or Control |

Description |

|---|---|

Payment Key 1−4 |

The Payment Key fields are not applicable to Absence Management. |

Source Bank ID |

This field is required. You must create a "dummy" Source Bank ID and enter it in this field. |

Processing Currency

The processing currency defined at the pay entity level is the unit to which other currencies are converted before calculations are made.

Field or Control |

Description |

|---|---|

Currency Code |

Select the default processing currency, which the system uses for calculations and reports and as the default for any element without an associated currency. Note: If the effective date changes during a pay period, the system uses the currency that's effective at the end of that pay period. Any change of currency should coincide with the beginning of a pay period. |

No Rounding |

Select to prevent rounding in currency conversion. |

Use Specified Rounding |

Select to have the system run a rounding rule for currency conversion, regardless of the value's source (for example, positive input, accumulators, or historical rules). |

Rounding Rule Element |

If you selected Use Specified Rounding , enter the rounding rule element that you want to use for rounding. |

Eligibility Override allowed via

Field or Control |

Description |

|---|---|

Positive Input |

This check box does not apply to Absence Management. The default setting for this check box is cleared. |