Understanding Banking

Understanding Banking

This chapter provides an overview of banking and discusses:

How to define electronic funds transfer (EFT) formats.

The Global Payroll for China banking process.

How to generate the EFT Payment file.

Understanding Banking

Understanding Banking

Before you run banking recipient processes, you need to define and set up:

Source (company) bank (China Construction Bank, Shanghai branch (CCBS)).

Source bank table data.

Payees' banks (beneficiary bank).

Payee's bank account table.

Net distribution table specifying the distribution details for each payee.

This section discusses:

Banking in China.

Banking setup.

Banking preparation process.

Banking in China

Banking in ChinaIn China, salary payments are made by direct deposit, in cash, or by check. In cases in which direct deposit is selected, the company chooses any commercial bank as the payment bank. Global Payroll for China takes advantage of Global Payroll core application functionalities to process direct deposits.

Banking Setup

Banking Setup

In Global Payroll, banking setup starts in the core application and continues in Global Payroll for China. Oracle strongly recommends that before reading this chapter, you read about the banking feature in the Global Payroll core documentation.

These steps summarize the banking setup in Global Payroll for China:

Define bank information, such as bank name and ID.

Though some countries have their own validation rule for branch ID, China does not have a standard for bank branch code at the country level. Thus, Global Payroll for China uses the core PeopleSoft Enterprise Global Payroll banks and branches feature without any enhancement.

Note. In Global Payroll, bank information must be defined for all banks, including those that are to be used as source banks and those that are used by payees.

Define source bank account information.

Define a deposit schedule.

Define a payee's bank account information and net pay distribution details.

China does not have its own account-numbering standard and validation rule for bank account numbers at the country level. Thus, Global Payroll for China uses the core PeopleSoft Enterprise Global Payroll source bank accounts feature without any enhancement. In China, companies generally allow their employees to have only one bank account for salary payments and, therefore, only one net distribution per payee.

Note. Even if only one net pay distribution exists per payee, you have to define the distribution for each payee.

Accepted Chinese payment methods are:

Cash

Direct Deposit (bank transfer)

Check

Note. Bank information setup and general source bank setup are discussed in the application fundamentals PeopleBook for Human Resources Management (HRMS). All other aspects of banking setup, such as deposit schedules and payee bank account information, are discussed in the Global Payroll core documentation.

See Also

PeopleSoft Enterprise HRMS 9.1 Application Fundamentals PeopleBook, "Setting Up Banks and Bank Branches"

PeopleSoft Enterprise Global Payroll 9.1 PeopleBook, "Defining Banking Instructions"

PeopleSoft Enterprise Global Payroll 9.1 PeopleBook, "Defining Banking Instructions," Defining Deposit Schedules

Banking Preparation Process

Banking Preparation Process

After you've set up banking and assigned recipients to deductions, you can run the Global Payroll for China banking preparation process.

The Global Payroll for China banking preparation process includes:

The core banking preparation process.

China-specific payment processes.

Combine payments process.

Payment ID and number assignment process.

See Also

PeopleSoft Enterprise Global Payroll 9.1 PeopleBook, "Processing Payroll"

Defining Electronic Funds Transfer Formats

Defining Electronic Funds Transfer FormatsThis section discusses the Electronic Funds Transfer (EFT) format used by Global Payroll for China to transfer funds between banks electronically.

Page Used to Define the EFT Format

Page Used to Define the EFT Format|

Page Name |

Definition Name |

Navigation |

Usage |

|

Electronic Transfer Formats |

EFT_NAME |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Banking, Electronic Transfer Format, Electronic Transfer Format |

Define the EFT file that complies with the file format used by China Construction Bank, Shanghai branch to transfer funds to other banks. |

Defining the EFT Format

Defining the EFT FormatAccess the Electronic Transfer Formats page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Banking, Electronic Transfer Format, Electronic Transfer Format).

Because Chinese banks don't have a standardized banking format, Global Payroll for China delivers only one banking format used by China Construction Bank, Shanghai branch as an example. You need to create a File Layout and update Create Payment EFT File Application Engine program (GPCN_EFT) appropriately so that they will meet your bank's requirements.

Electronic File Format

The EFT file format defined by China Construction Bank, Shanghai branch is made up of a header section and a body section. The EFT file is created as an ASCII file with the fixed name gpcn_bank.txt.

This table illustrates the four rows of the header section of the banking file.

|

Row |

Description |

Data Source |

Example |

|

1 |

Company Name |

Account name on Source Bank page. If the length is less than 31, the rest is filled with "=". The data has to be alphanumeric. |

ABCD (China) COMPANY LIMITED=== |

|

2 |

Total Lines |

Total number of lines in the body section of the banking file in six digits plus "=" repeated 25 times. |

000004========================= |

|

3 |

Total Payment Amount |

Total amount of the payment in the body section of the banking file in 12 digits, plus "=" repeated 19 times. |

000000014373=================== |

|

4 |

Separator Line |

Fixed value. |

================*************** |

The following table illustrates the body section of the banking file. The body section comprises three items.

|

Item |

Description |

Data Source |

Digit |

Example |

|

1 |

Account Number |

Account ID on Payee Net Distribution page. |

19 |

1218419980110047698 |

|

2 |

Payment Amount |

Sum of Net Result Values stored in the Global Payroll Core result table by each payee. |

9 |

000006545 (meaning 65.45 CNY) |

|

3 |

Transaction Type Code |

Fixed value. |

10 |

0000000003 |

The following is an example of the EFT file:

ABCD (China) COMPANY LIMITED=== 000004========================= 000000014373=================== ================*************** 12184199801100476980000065450000000003 12184199801100512780000000080000000003 12184199801100766220000009350000000003 12184199801100874700000068850000000003

The Global Payroll for China Banking Process

The Global Payroll for China Banking Process

These steps summarize the Global Payroll for China banking process:

Calculate absence and payroll.

Run and finalize the Global Payroll core Calculate Absence and Payroll process using the Payroll/Absence Run Control page.

Run the payment preparation process.

Run and finalize the Global Payroll core Run Payment Prep Process.

Run the Global Payroll for China Banking process using the Create Payment EFT page.

See Also

PeopleSoft Enterprise Global Payroll 9.1 PeopleBook, "Processing Payroll"

PeopleSoft Enterprise Global Payroll 9.1 PeopleBook, "Viewing and Finalizing Payroll Results"

PeopleSoft Enterprise Global Payroll 9.1 PeopleBook, "Entering and Processing Absences"

PeopleSoft Enterprise Global Payroll 9.1 PeopleBook, "Defining Banking Instructions," Reviewing Banking Results by Calendar Group

Generating the EFT Payment File

Generating the EFT Payment File

This section provides an overview of the Payment EFT File Creation process and discusses how to create the Payment EFT File.

Understanding the Payment EFT File Creation Process

Understanding the Payment EFT File Creation Process

You use the Create Payment EFT page to define the parameters for the EFT file and to run the Create Payment EFT File process.

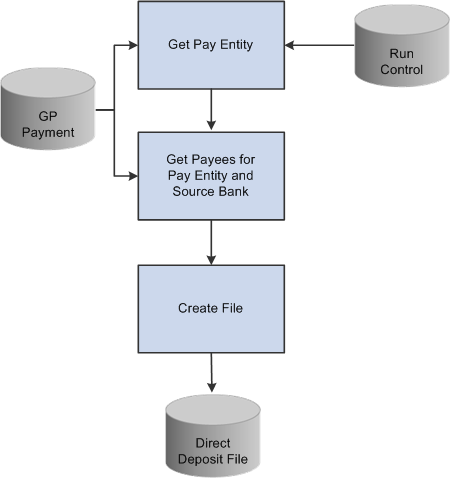

This diagram shows the Create Payment EFT File process:

Create Payment EFT File process

Page Used to Generate the EFT Payment File

Page Used to Generate the EFT Payment File

Creating the Payment EFT File

Creating the Payment EFT File

Access the Create Payment EFT page (Global Payroll & Absence Mgmt, Payment Processing, Create EFT Payment File CHN).

|

Calendar Group ID |

Select the calendar group ID to be used with this Payment EFT file. Only those calendars that are ready for banking are available for selection. |

|

Source Bank ID |

Select a source bank ID. |

|

Debit Date |

Net Pay Distribution data for each payee as of this date is used when the Payment EFT file is created. |

See Also

PeopleSoft Enterprise Global Payroll 9.1 PeopleBook, "Processing Payroll"