Updating and Viewing Sales Order VAT Information

This topic provides an overview of sales order VAT information and discusses how to modify sales order VAT information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ORDENT_HDR_VAT |

Modify header VAT data. Override VAT header default values. |

|

|

ORDENT_LINE_VAT |

Override VAT line default values. |

|

|

ORDENT_SCH_VAT |

Override VAT schedule default values. |

|

|

Freight VAT Information |

ORDENT_FRT_VAT |

Override VAT freight default values. |

This section discusses:

VAT sales order processing

Header defaults

Line defaults

Schedule defaults

VAT Sales Order Processing

Avoid changing these values manually because complex algorithms are used to obtain the VAT defaults. However, if the algorithms have problems finding defaults, then manual intervention is necessary. For this reason, PeopleSoft Order Management does not protect most of the fields on the VAT Information pages.

Be careful when manually changing defaults, especially the value in the VAT Treatment field, because this value is used as a VAT default value for sales order lines.

You can change the customer exception type only if a valid country is in the bill from the VAT country field and the treatment is domestic or domestic distance sale. You can change the exception type to Suspended only if suspension is allowed for the seller's VAT registration country.

The fields should be populated before the VAT default function is called to avoid errors or incorrect calculations. This table displays the source for the fields:

|

Field |

Header Source |

Line/Schedule Source |

|---|---|---|

|

Customer Location Country (COUNTRY_LOC_BUYER). |

Customer bill to location. |

Default value from header. |

|

Customer Location State (STATE_LOC_BUYER). |

Customer bill to location. |

Default value from header. |

|

Location Country (COUNTRY_LOC_SELLER). |

Order Management Business Unit location. |

Default value from header. |

|

Location State (STATE_LOC_SELLER). |

Order Management Business Unit location. |

Default value from header. |

|

Ship from Country (COUNTRY_SHIP_FROM). |

Default Inventory Business Unit location country. |

If line ship-from Inventory business unit is the same as the header Inventory business unit, the header default value is used. Otherwise, the location country of the Inventory business unit where the product is shipping from is used. |

|

Ship from State (STATE_SHIP_FROM). |

Default Inventory Business Unit location state. |

If line ship-from Inventory business unit is the same as the header Inventory business unit, the header default value is used. Otherwise, the location state of the Inventory business unit where the product is shipping from is used. |

|

Ship to Country (COUNTRY_SHIP_TO). |

Ship to customer location country or override value. |

Header default value if the ship-to locations are the same; otherwise, use the ship-to location or override on the line. |

|

Ship to State (STATE_SHIP_TO). |

Ship to customer location state or override value. |

Header default value if the ship-to locations are the same; otherwise, use the ship-to location or override on the line. |

|

Service Performed Country (COUNTRY_VAT_PERFRM). |

Depends on the value in the Where Services Performed flag at the header.

|

Depends on the value in the Where Services Performed field at the line.

|

|

STATE_VAT_PERFRM |

Depends on the value that is in the Where Services Performed field at the header.

|

Depends on the value in the Where Services Performed field at the line.

|

The following fields are always unavailable for entry; they automatically change in response to a change in the ship-from Inventory business unit or the ship-to address. If the ship-from or ship-to country that is involved does not require tracking VAT at the state level, the state field is blank.

State ship from

Country ship from

State ship to

Country ship to

Header Defaults

Initial header-level defaults are determined:

At save time or edit for the entire order.

Header-level defaults are determined prior to line defaults.

When you access the Header VAT Information page.

When you click the Calculate Price button.

If a line default is triggered, the system checks to ensure that the header-level defaults are applied. If the defaults are needed, they are determined.

The Where Services Performed flag is retrieved from either the bill-to customer location or the Order Management business unit.

Defaults are automatically reapplied if VAT defaults are already determined at the header level and the fields are changed at the line level:

Address Ship To Sequence change or Ship To Address Override.

If the resulting change causes the ship-to country or state to change, the system automatically reapplies the VAT defaults to the header, line, and any schedules that have their addresses updated as a result of this change.

Sold-to or bill-to customer changes cause the entire order to be moved again by default; however, this type of change can occur only before the sales order is saved.

Note: If the bill-to location is changed and this results in changes to the customer location and state, VAT defaults are not automatically reapplied. Any lines or schedules to which defaults have been applied prior to the change being made must be reapplied manually, as needed.

Line Defaults

Initial line-level defaults are determined:

At save time or edit for the entire order.

When you access the Line VAT Information page.

When you access the Shipment Schedule page for the line.

When you click the Calculate button.

The default Physical Nature and Where Services Performed flags are automatically applied when you enter the product ID. The fields are applied based on this hierarchy: product definition, bill-to customer location, Order Management business unit.

The header-level VAT defaults are copied to the line if the fields on the header and line match:

Physical nature.

Ship-from and ship-to country/state.

Buyer and seller location/state.

Country and state where the service is physically performed.

VAT entity.

VAT service type.

VAT service place of supply driver.

VAT defaults are automatically reapplied if the VAT defaults are already determined and the fields are changed at the line level:

Product ID.

The VAT defaults are reapplied to the line and all schedules.

Address ship-to sequence change or ship-to address override.

If the resulting change causes the ship-to country or state to change, the system automatically reapplies the VAT defaults to the line and any schedules that have their addresses updated as a result of this change.

Ship from Inventory business unit.

If the resulting change causes the ship-from country or state or the VAT entity to change, the system automatically reapplies the VAT defaults to the line. If a single schedule exists, the schedule defaults are also be reapplied.

Schedule Defaults

Initial schedule-level defaults are determined:

At save time or edit for the entire order.

When you click the Calculate button.

When you access the Shipment Schedule page for the first time.

When you copy or split a shipment into additional schedules.

The line-level VAT defaults are copied to the schedule if the fields on the line and schedule match:

VAT entity.

Ship-from and ship-to country/state.

Buyer and seller location/state.

Country and state where the service is physically performed.

VAT service type.

VAT service place of supply driver.

VAT defaults are automatically reapplied if the VAT defaults are already determined and these fields are changed at the schedule level:

Address ship to sequence

If the resulting change causes the ship-to country or state to change, the system automatically reapplies the VAT defaults to the schedule. If a single schedule exists, the line defaults are also reapplied.

Address override.

If the resulting change causes the ship-to country or state to change, the system automatically reapplies defaults to the schedule.

Ship-from Inventory business unit.

If the resulting change causes the ship-from country or state, or the VAT entity to change, the system automatically reapplies the VAT defaults to the schedule. If a single schedule exists, the line defaults are also reapplied.

Use the Header VAT Information page (ORDENT_HDR_VAT) to modify header VAT data.

Override VAT header default values.

Navigation:

Select VAT Information in the Header Menu field on the Order Entry Form page.

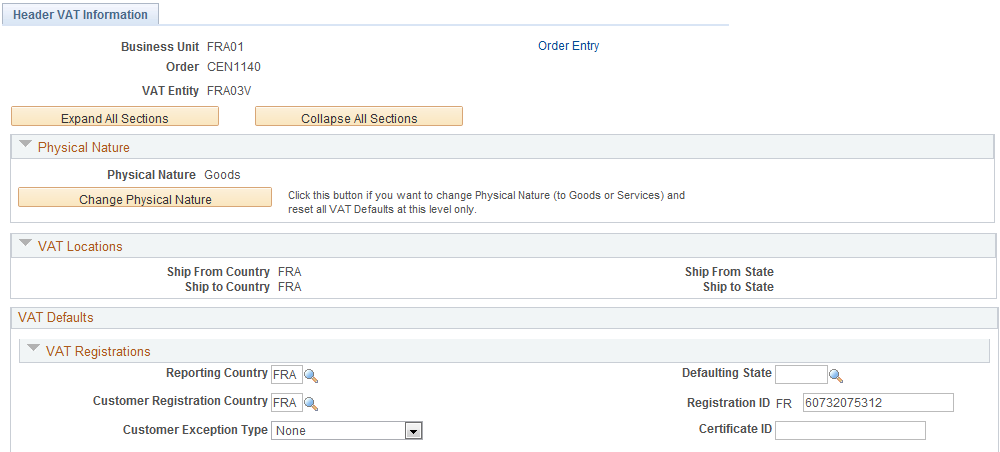

This example illustrates the fields and controls on the Header VAT Information page (1 of 2). You can find definitions for the fields and controls later on this page.

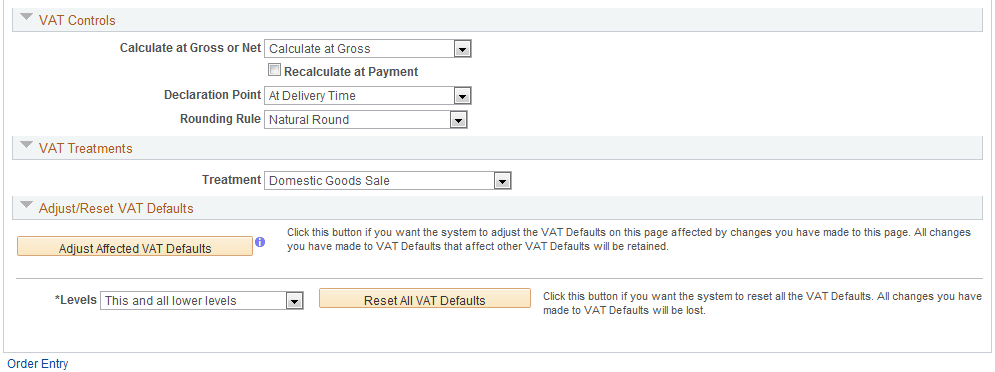

This example illustrates the fields and controls on the Header VAT Information page (2 of 2). You can find definitions for the fields and controls later on this page.

Expanding and Collapsing Sections

To manage the VAT data more efficiently, you can expand and collapse sections that are on this page.

Field or Control |

Description |

|---|---|

Expand All Sections |

Click the expand button to scroll to and access every section on the page. You can also expand one or more sections by clicking the arrow that is next to the section's name. |

Collapse All Sections |

Click to collapse all sections displaying only the header information. If you expand one or more sections, you can click the arrow that is next to the section's name to collapse the section. |

Physical Nature

Field or Control |

Description |

|---|---|

Change Physical Nature |

Click the button to change to Goods or Services. When you click the button, the VAT defaults are reset for the new value. |

VAT Locations

Field or Control |

Description |

|---|---|

Location Country |

For services only, displays the country of the Order Management business unit. |

Location State |

For services only, displays the state of the Order Management business unit. |

Customer Location Country |

For services only, displays the customer's bill-to location country. |

Customer Location State |

For services only, displays the customer's bill-to location state. |

Service Performed Country |

Depending on the setting of the Services Performed flag that is in the VAT default hierarchy (for example, at customer or business-unit level), the system sets the value for this field in the following ways:

|

Service Performed State |

If the service performed country requires that VAT be tracked by state, this field is populated depending on the setting of the Services Performed flag that is in the VAT default hierarchy (for example, customer or business-unit level). The system sets the value for this field in the following way:

|

Ship From Country |

Displays the ship-from location country. In the case of transactions involving goods or freight service transactions, this is used to determine the VAT treatment. |

Ship From State |

If the ship-from country requires that VAT be tracked by state, displays the ship-from location state. In the case of transactions involving goods or freight service transactions, this is used to determine the VAT treatment. |

Ship To Country |

Displays the ship-to customer location country. In the case of transactions involving goods or freight service transactions, this is used to determine the VAT treatment. |

Ship To State |

If the ship to country requires that VAT be tracked by state, displays the ship-to customer location state. In the case of transactions involving goods or freight service transactions, this is used to determine the VAT treatment. |

VAT Defaults

This group box contains the:

VAT service-specific defaults.

VAT registrations defaults.

VAT controls defaults.

VAT treatments.

Adjust/reset VAT defaults.

Field or Control |

Description |

|---|---|

Service Type |

If the transaction is for a service, it displays the VAT service type of Freight or Other. The value that is in this field determines whether the special rules for freight transport within the European Union (EU) apply. |

Place of Supply Driver |

If the transaction is for a service, displays the usual place of supply (the place where VAT is usually liable) for the service. This value is used to help determine the place of supply country and the VAT treatment. Values are Buyer's Countries, Supplier's Countries, and Where Physically Performed. |

Reporting Country |

Displays the country for which VAT is reported. This is the VAT Entity VAT registration country and determines many of the VAT defaults. |

Defaulting State |

If the reporting country requires that VAT be tracked by state or province, this field displays the state that is within the reporting country that is used to retrieve values from the VAT Defaults table. |

Customer Registration Country and Customer Registration ID |

Displays the registration country and ID of the bill-to customer. |

Customer Exception Type |

Displays the exception that is granted to the customer. Values are None, Exonerated, and Suspended. This value is specified on the bill-to customer. |

Certificate ID |

If applicable, displays the ID of the VAT exception certificate that may have been issued to the customer. |

Calculate at Gross or Net |

Indicates how VAT is calculated. Values are: Gross: The system calculates VAT before it applies any early-payment discounts. Net: The system calculates VAT after it deducts early-payment discounts. If two percentage discounts exist, the system uses the larger of the two when it calculates VAT. The system does not use discount amounts, only discount percentages. The default value comes from the VAT entity driver. |

Recalculate at Payment |

Select to enable the recalculation of VAT at payment time to allow for any early payment discounts if you are calculating VAT at gross. This causes the system to adjust the VAT amount at the time of payment if the discount is taken. This is set on the VAT entity driver. |

Declaration Point |

Determines when the VAT transaction information will be recognized for reporting purposes. Values are: Invoice: VAT is recognized at the time of invoice. Payment: VAT is recognized at the time of payment. Delivery: VAT is recognized on delivery. Accounting: VAT is recognized on the date of accounting. This value can be set at any level in the VAT hierarchy: VAT entity registration, business unit options, customer, or customer location. |

Rounding Rule |

Displays the VAT rounding rule. The value comes from the VAT country driver or VAT entity driver definition. Values are: Nat Rnd (natural round): Amounts are rounded normally (up or down) to the precision that is specified for the currency code. For example, for a currency that is defined with two decimal places, 157.4659 is rounded up to 157.47, but 157.4649 is rounded down to 157.46. Down: Amounts are rounded down. For example, for a currency that is defined with two decimal places, 157.4699 is rounded down to 157.46. Up: Amounts are rounded up with a rounding precision to one additional decimal place. For example, for a currency that is defined with two decimal places, 157.4659 is rounded up to 157.47, but 157.4609 is rounded to 157.46. |

Place of Supply Country |

For services, displays the country in which the VAT is liable. |

Treatment |

Displays the VAT treatment. Values are: Deemed Service Export: Services that are provided in the supplier's country to a foreign buyer, where the supply of these services must be zero-rated (that is, the place of supply is the country in which the supplier is located and registered for VAT, but the customer is located in another country). Domestic Goods Sale: Sale of goods where the supplier and customer are located in the same country. EU Goods Distance Sale: Sale of goods between EU countries in which the supplier is registered in an EU country and the purchaser is not registered in an EU country. The VAT rate that is charged is the rate that is applicable in the supplier's country. EU Goods Sale: Sale of goods between VAT-registered traders in different EU countries. EU Sale (Simplification): Used for a transaction between an intermediary and the purchaser in cases in which a sale of goods between EU countries involves three parties: the purchaser, an intermediary (bill-from) supplier, and the actual goods supplier. Each party is located in a different EU country and registered in their own country, and not in either of the other two countries. The only difference between this VAT treatment and that which is applied to normal EU sales is that the supplier is required to print a different message on the invoice referencing the statute that applies to triangulation, rather than the one that references the statute for normal EU sales. No VAT Processing: No VAT processing is required. Out of Scope EU Service Sale: EU services are outside of the scope of VAT. Outside of Scope Service Export: Export services are outside of the scope of VAT. Outside of Scope: Outside of the scope of VAT. Zero-rated EU Service Sale: Sale of services that are within the EU are subject to zero-rated VAT. Zero-rated Goods Export: Export of goods are subject to zero-rated VAT. Zero-rated Services Export: Export of services are subject to zero-rated VAT. Within PeopleSoft detail VAT treatment values that are on the transaction lines are used for applying the precise defaults that are applicable to the transaction lines. The treatment is determined based on the rules that apply to the transaction. |

Adjust/Reset VAT Defaults |

Any changes that you make to fields on this page may affect VAT defaults on this page. Adjusting or resetting VAT defaults will affect only fields that are within the VAT Defaults group box. |

Adjust Affected VAT Defaults |

Click to have the system adjust the VAT defaults that are affected by your changes. All changes that you have made to VAT defaults on this page that affect other VAT defaults on this page will be retained. Oracle recommends that you always click the Adjust Affected VAT Defaults button after changing any defaults on the VAT page. Because values that appear lower down on the page might depend on values that appear higher up on the page, you should work from top to bottom and click the Adjust Affected VAT Defaults button in the Adjust/Reset VAT Defaults collapsible region as needed. This prevents updating values that you have already overridden. Click the i button to list the fields that are to be adjusted. |

Levels |

Before you click the Reset All VAT Defaults button, select the levels to which you want the action to apply:

|

Reset All VAT Defaults |

Click to reset any fields that you may have overridden on this page (including those that you changed by clicking the Adjust Affected VAT Defaults button) back to the original defaults before you save the page. Depending on your selection in the Levels field, the VAT default values will be reset for the sales order header, the sales order line, the sales order schedule line, or all three. Note: Resetting completely redetermines the VAT defaults. If you have changed a VAT driver field, resetting VAT defaults does not necessarily return the original default values. Rather, it resets all of the default values based on the new driver value. |

Use the Line VAT Information page (ORDENT_LINE_VAT) to override VAT line default values.

Navigation:

Select VAT Information in the Lines Menu field on the Order Entry Form page.

Many of the fields that are on this page are the same as those that appear on the Header VAT Information page.

See Header VAT Information Page.

|

If Applicability Equals |

You Must |

|---|---|

|

Taxable, Suspended or Exonerated. |

Have a VAT Code and Transaction type. For Suspended or Exonerated lines, the VAT Code should be a zero-rate VAT Code. |

|

Exempt or Out of Scope. |

Leave VAT Code blank but have a Transaction type. |

|

N/A (VAT Applicability can equal N/A only on non-VAT lines). |

Leave VAT Code and Transaction type blank. |

VAT Details

Field or Control |

Description |

|---|---|

Applicability |

Displays the VAT status. Valid options are: Taxable, Exempt (not subject to VAT) Exonerated, NA, (not applicable) Outside, Suspend, Taxable. (VAT Only is not valid in Order Management). |

VAT Code |

Displays the VAT code that defines the rate at which VAT is calculated. |

VAT Transaction Type |

Displays the code that categorizes and classifies this transaction for VAT reporting and accounting. |

Use the Schedule VAT Information page (ORDENT_SCH_VAT) to override VAT schedule default values.

Navigation:

Select VAT Information in the Schedule Menu field on the Shipment Schedules page.

Many of the fields on this page are the same as those that appear on the Header VAT Information and Line VAT Information page.

See Header VAT Information Page.

See Line VAT Information Page.

Physical Nature

Field or Control |

Description |

|---|---|

Physical Nature |

This field is unavailable for entry on the schedule. |

Reviewing and Updating VAT Calculations

Use this group box to review the VAT calculations for the line.

Note: At sales order entry, VAT amounts are estimates and are recalculated at the time of invoicing.

Field or Control |

Description |

|---|---|

Transaction Amount |

Displays the amount of the transaction in the transaction currency for the sales order line amount. |

Transaction Amount Base |

Displays the amount of the transaction in the base currency. |

Basis Amount |

Displays the amount on which the VAT is calculated. If you are calculating VAT at Net, this is the transaction amount net of any discounts in the transaction currency. |

Basis Amount Base |

Displays the amount on which the VAT is calculated in base currency. If you are calculating VAT at Net, this is the transaction amount net of any discounts in the base currency. |

Tax Rate |

Displays the applicable VAT percentage. |

Recorded Amount |

Displays the calculated VAT amount in the transaction currency. |

Recorded Amount Base |

Displays the calculated VAT amount in the base currency. |

Recalculate |

Click to recalculate VAT for the schedule. |

Customer Amount |

Displays the customer's amount. |

Customer Amount Base |

Displays the customer's amount in the base currency. |