Entering Interest Rate Physical Deals Examples

This topic discusses how to:

Enter bonds.

Enter bank loans.

Enter constant method amortizing loans.

Enter sell/buybacks.

Enter repurchase agreements ("repos").

On May 11, 2000, you receive an order for a floating rate bond with a par amount of one million USD, an initial rate of 10 percent, and a term of 367 days. The settlement date is May 12, 2000 and the maturity date is May 14, 2001.

|

Section Heading |

Field |

Field Value |

|---|---|---|

|

Deal Detail |

|

|

|

|

Unit |

US001 |

|

|

Deal ID |

TCORPBOND3 |

|

|

Instrument Type |

CORPBOND |

|

|

Transaction Date |

05/11/2000 |

|

|

Interest Base Type |

Interest Rate Physical |

|

Interest Rate Physical Details |

|

|

|

|

Settlement Date |

05/12/2000 |

|

|

Term |

367 |

|

|

Maturity Date |

05/14/2001 |

|

|

Issue Date |

05/12/2000 |

|

|

Interest Period Start Date |

05/12/2000 |

|

|

Classification |

Debt |

|

|

Rate Type |

Floating |

|

|

Rate |

10.0 |

|

|

Reset Index |

LIBOR |

|

|

Day/Count Basis |

30/360 |

|

|

Interest Calculation |

Interest Bearing |

|

|

Par Amount |

1,000,000.00 |

|

|

Currency |

USD |

|

|

Settlement Amount |

1,000,000.00. |

|

|

Price % of Par |

100.0. (Automatically populated with the default value.) |

|

|

Discount/Premium |

Straightline Method |

|

Interest Dates and Calculations |

|

|

|

|

Repeat Interest Dates |

Selected |

|

|

Interest Frequency |

Semi-Annual |

|

|

Reset Frequency |

Semi-Annual |

|

|

Reset Rate Index Tenor |

6 Month |

|

|

Business Day Convention |

Modified Following |

|

|

Next Interest Payment |

Traded Cum-Interest |

|

|

Interest Calculation |

Day Counted Interest Use Actual Interest Dates |

|

Interest Date Rule |

||

|

|

Interest Date Rule |

Backwards from Maturity Date |

|

|

Payment Date |

Business Days - Paid in Arrears |

|

|

+/- Payment Days |

0 |

|

|

Reset Date |

Set in Advance |

|

|

+/- Reset Days |

0 |

|

|

Accounting Treatment |

Held to Maturity |

|

|

Counterparty |

USBNK |

|

|

Description |

1 Year to 2001-05-14 Debt USD 1.1m. @ LIBOR |

|

|

Deal Status |

Matured |

|

Cash Flows Page |

|

|

|

|

Settlement Date Description Amount Currency |

05/12/2000 Principal 1,000,000.00 USD |

|

|

Settlement Date Description Amount Currency Nominal Date Interest Date |

05/15/2000 Interest -833.33 USD 05/14/2000 11/14/2000 |

|

|

Settlement Date Description Amount Currency Nominal Date Interest Date |

11/14/2000 Interest 0.00 USD 11/14/2000 11/14/2000 |

|

|

Settlement Date Description Amount Currency |

05/14/2001 Principal -1,000,000.00 USD |

|

Settlement Instructions page |

||

|

Payment Information |

||

|

Our Settle Thru SetID |

SHARE |

|

|

Our Settle Thru Bank |

USBNK |

|

|

Our Settle Thru Account |

CHCK |

|

|

Counterparty's Instructions |

USBKS |

|

|

Payment Method |

Wire Transfer |

|

|

Layout |

820 |

|

|

Receipt Information |

||

|

Our Settle Into SetID |

SHARE |

|

|

Our Settle Into Bank |

USBNK |

|

|

Our Settle Into Account |

CHCK |

|

|

Our Settlement Instructions |

TUS01 |

On October 16, 2000, you receive an order for bank loan of $100,000 USD, with a floating rate tied to the LIBOR (London Inter-bank Offer Rate). The settlement date is October 25, 2000 with a term of 365 days. The Straightline Method is used for the Discount/Premium. Any initial rate value you may have is entered in the Rate field.

|

Section Heading |

Field |

Field Value |

|---|---|---|

|

Deal Detail |

|

|

|

|

Unit |

US001 |

|

|

Deal ID |

STL2 |

|

|

Instrument Type |

BANKLOAN |

|

|

Transaction Date |

10/16/2000 |

|

|

Instrument Base Type |

Interest Rate Physical |

|

Interest Rate Physical Details |

|

|

|

|

Settlement Date |

10/25/2000 |

|

|

Term |

365 |

|

|

Maturity Date |

10/25/2001 |

|

|

Issue Date |

10/25/2000 |

|

|

Interest Period Start Date |

10/25/2000 |

|

|

Classification |

Debt |

|

|

Rate Type |

Floating |

|

|

Rate |

6.7 |

|

|

Reset Index |

LIBOR |

|

|

Day/Count Basis |

Actual/360 |

|

|

Interest Calculation |

Interest Bearing |

|

|

Par Amount |

1,000,000.00 |

|

|

Currency |

USD |

|

|

Settlement Amount |

1,000,000.00. |

|

|

Price % of Par |

100.0 (Automatically populated with the default value.) |

|

|

Discount/Premium |

Straightline Method |

|

|

Initial Reset Rate |

6.7 |

|

Interest Dates and Calculation |

|

|

|

|

Repeat Interest Dates |

Selected |

|

|

Interest Frequency |

Quarterly |

|

|

Reset Frequency |

Quarterly |

|

|

Reset Rate Index Tenor |

3 Month |

|

|

Business Day Convention |

Modified Following |

|

|

Next Interest Payment |

Traded Cum-Interest |

|

|

Interest Calculation |

Day Counted Interest Use NominalDates |

|

Interest Date Rule |

|

|

|

|

Interest Date Rule |

Backwards from Maturity Date |

|

|

Payment Date |

Business Days - Paid in Arrears |

|

|

+/- Payment Days |

0 |

|

|

Reset Date |

Set in Advance |

|

|

+/- Reset Days |

-2 |

|

|

Accounting Treatment |

Available for Sale |

|

|

Counterparty |

USBNK |

|

|

Issuer |

USBNK |

|

|

Guarantor |

USBNK |

|

|

Description |

1 Year to 2001-10-25 Debt USD 1.0m. @ LIBOR |

|

|

Deal Status |

Matured |

|

Cash Flows Page |

|

|

|

|

Settlement Date Description Amount Currency |

10/25/2000 Principal 1,000,000.00 USD |

|

|

Settlement Date Description Amount Currency Nominal Date Interest Date |

01/25/2001 Interest -17,122.22 USD 01/25/2001 01/25/2001 |

|

|

Settlement Date Description Amount Currency Nominal Date Interest Date |

04/25/2001 Interest -19,500.00 USD 04/25/2001 04/25/2001 |

|

|

Settlement Date Description Amount Currency Nominal Date Interest Date |

07/25/2001 Interest 0.00 USD 07/25/2001 07/25/2001 |

|

|

Settlement Date Description Amount Currency |

10/25/2001 Principal -1,000,000.00 USD |

|

Settlement Instructions page |

||

|

Payment Information |

||

|

Our Settle Thru SetID |

SHARE |

|

|

Our Settle Thru Bank |

USBNK |

|

|

Our Settle Thru Account |

CHCK |

|

|

Counterparty's Instructions |

USBKS |

|

|

Payment Method |

Wire Transfer |

|

|

Layout |

820 |

|

|

Receipt Information |

||

|

Our Settle Into SetID |

SHARE |

|

|

Our Settle Into Bank |

USBNK |

|

|

Our Settle Into Account |

CHCK |

|

|

Our Settlement Instructions |

TUS01 |

On April 30, 2003, you initiate a bank loan of $450,000 USD, with a fixed rate of 5%. The settlement date is May 2, 2003 with a term of three years (1096 days). The Straightline Method is used for the Discount/Premium and the loan is to be amortized using the Constant method.

|

Page |

Field |

Field Value |

|---|---|---|

|

Deal Detail |

|

|

|

|

Unit |

US001 |

|

|

Deal ID |

358 |

|

|

Instrument Type |

BANKLOAN |

|

|

Transaction Date |

04/30/2003 |

|

|

Instrument Base Type |

Interest Rate Physical |

|

Interest Rate Physical Details |

|

|

|

|

Settlement Date |

05/02/2003 |

|

|

Term |

1096 |

|

|

Maturity Date |

05/02/2006 |

|

|

Issue Date |

05/02/2003 |

|

|

Interest Period Start Date |

05/02/2003 |

|

|

Classification |

Debt |

|

|

Rate Type |

Fixed |

|

|

Rate |

5.0 |

|

|

Day Count Basis |

Actual/360 |

|

|

Interest Calculation |

Interest Bearing |

|

|

Par Amount |

450,000.00 |

|

|

Currency |

USD |

|

|

Settlement Amount |

450,000.00. |

|

|

Price % of Par |

100.0 (Automatically populated with the default value.) |

|

|

Discount/Premium |

Straightline Method |

|

|

Amortization Method |

Constant Payment |

|

|

End Principal |

0.00 |

|

Interest Dates and Calculation |

|

|

|

|

Repeat Interest Dates |

Selected |

|

|

Interest Frequency |

Semi-Annual |

|

|

Business Day Convention |

Modified Following |

|

|

Next Interest Payment |

Traded Cum-Interest |

|

|

Interest Calculation |

Same Interest each Period Normal First Coupon Period Normal Last Coupon Period |

|

|

Interest Date Rule |

Forwards from Issue Date |

|

|

Payment Date |

Business Days - Paid in Arrears |

|

|

+/- Payment Days |

0 |

|

|

+/- Reset Days |

0 |

|

|

Accounting Treatment |

Held to Maturity |

|

|

Counterparty |

USBNK |

|

|

Issuer |

USBNK |

|

|

Guarantor |

USBNK |

|

|

Description |

3 Years to 2006–05–02 Debt USD 450K @5% |

|

|

Deal Status |

Open |

When you process a deal, the system (using the TR_POSN process) automatically populates the interest date, amortization and cashflow details with the calculated values.

|

Page |

Field |

Field Value |

|---|---|---|

|

Interest and Payment Dates page |

|

|

|

|

Type Period End Date Payment Date Amount Principal Balance Interest Payment Principal Payment |

Interest 11/02/2003 11/03/2003 -81,697.49 -450,000.00 -11,250.00 -70,477.49 |

|

|

Type Period End Date Payment Date Amount Principal Balance Interest Payment Principal Payment |

Interest 05/02/2004 05/03/2004 -81,697.49 -379,552.51 -9,488.81 -72,208.68 |

|

|

Type Period End Date Payment Date Amount Principal Balance Interest Payment Principal Payment |

Interest 11/02/2004 11/03/2004 -81,697.49 -307,343.83 -7,683.60 -74,013.89 |

|

|

Type Period End Date Payment Date Amount Principal Balance Interest Payment Principal Payment |

Interest 05/02/2005 05/02/2005 -81,697.49 -233,329.94 -5,833.25 -75,864.24 |

|

|

Type Period End Date Payment Date Amount Principal Balance Interest Payment Principal Payment |

Interest 11/02/2005 11/03/2005 -81,697.49 -157,465.70 -3,936.64 -77,760.85 |

|

|

Type Period End Date Payment Date Amount Principal Balance Interest Payment Principal Payment |

Interest 05/02/2006 05/02/2006 -81,697.47 -79,704.85 -1,992.62 -79,704.85 |

|

Cashflows |

|

|

|

|

Settlement Date Description Amount Currency |

05/02/2003 Principal 450,000.00 USD |

|

|

Settlement Date Description Amount Currency Nominal Date Interest Date |

11/03/2003 Interest -81,697.49 USD 11/02/2003 11/03/2003 |

|

|

Settlement Date Description Amount Currency Nominal Date Interest Date |

05/03/2004 Interest -81,697.49 USD 05/02/2004 05/03/2004 |

|

|

Settlement Date Description Amount Currency Nominal Date Interest Date |

11/02/2004 Interest -81,697.49 USD 11/02/2004 11/02/2004 |

|

|

Settlement Date Description Amount Currency Nominal Date Interest Date |

05/02/2005 Interest -81,697.49 USD 05/02/2005 05/02/2005 |

|

|

Settlement Date Description Amount Currency Nominal Date Interest Date |

11/02/2005 Interest -81,697.49 USD 11/02/2005 11/02/2005 |

|

|

Settlement Date Description Amount Currency |

05/02/2006 Principal & Interest -81,697.47 USD |

You may enter deals with sell/buyback options. You may exercise a sell/buyback as a full sale transaction or as partial sale transactions. The following two examples describe a Sell/Buyback deal with Partial Sale transactions followed by a Sell/Buyback deal with a Full Sale transaction.

Sell/Buyback with Partial Sale

A corporate bond investment was entered on April 30, 2003. The bond was issued in the amount of $1,000,000.00 USD for 2 years to mature May 1, 2005 at 6.125% interest. On September 30, 2003, the investor partially sells 30% of the investment to another investor.

Access the Deal Detail page for this deal.

|

Page |

Field |

Field Value |

|---|---|---|

|

Deal Detail page |

|

|

|

|

Instrument Type |

CORPBOND |

|

|

Transaction Date |

04/30/2003 |

|

|

Instrument Base Type |

Interest Rate Physical |

|

Interest Rate Physical Details |

|

|

|

|

Settlement Date |

05/01/2003 |

|

|

Term |

732 |

|

|

Maturity Date |

05/02/2005 |

|

|

Issue Date |

05/01/2003 |

|

|

Interest Period Start Date |

05/01/2003 |

|

|

Classification |

Investment |

|

|

Rate Type |

Fixed |

|

|

Rate |

6.125 |

|

|

Day/Count Basis |

30/360 |

|

|

Interest Calculation |

Interest Bearing |

|

|

Par Amount |

2,000,000.00 |

|

|

Currency |

USD |

|

|

Settlement Amount |

2,000,000.00. |

|

|

Price % of Par |

100.0 |

|

|

Discount/Premium |

Constant Yield Method |

|

Interest Dates and Calculation |

|

|

|

|

Repeat Interest Dates |

Selected |

|

|

Interest Frequency |

Semi-Annual |

|

|

Business Day Convention |

Following |

|

|

Next Interest Payment |

Traded Cum-Interest |

|

|

Interest Calculation |

Day Counted Interest Use Actual Interest Dates |

|

|

Interest Date Rule |

Forwards from Issue Date |

|

|

Payment Date |

Business Days - Paid in Arrears |

|

|

+/- Payment Days |

0 |

|

|

+/- Reset Days |

0 |

|

Portfolio |

DEMO |

|

|

|

Accounting Treatment |

Held to Maturity |

|

|

Counterparty |

USBNK |

|

|

Issuer |

USBNK |

|

|

Guarantor |

USBNK |

|

|

Description |

2 Years to 2005–05–02 Investment USD 2.0 m. @ 6.125% |

|

|

Deal Status |

Open (Before Sell) Partially Sold/Bought Back (After Partial Sell) |

|

Page |

Field |

Field Value |

|---|---|---|

|

Settlement Instructions page |

||

|

Payment Information |

||

|

Our Settle Thru SetID |

SHARE |

|

|

Our Settle Thru Bank |

USBNK |

|

|

Our Settle Thru Account |

CHCK |

|

|

Counterparty's Instructions |

USBKS |

|

|

Payment Method |

Wire Transfer |

|

|

Layout |

820 |

|

|

Receipt Information |

||

|

Our Settle Into SetID |

SHARE |

|

|

Our Settle Into Bank |

USBNK |

|

|

Our Settle Into Account |

CHCK |

|

|

Our Settlement Instructions |

TUS01 |

|

Page |

Field |

Field Value |

|---|---|---|

|

Update/Display Sell/Buyback Details page |

|

|

|

|

Unwind Date |

09/30/2003 |

|

|

Settlement Date |

09/30/2003 |

|

Unwind Settlement |

|

|

|

|

Unwind Principal Balance |

2,000,000.00 |

|

|

Unwind Par |

600,000.00 |

|

|

Unwind Pro Rata % |

30.0 |

|

|

Sale Currency |

USD |

|

|

Amortized Disc/Premium |

0.00 |

|

|

Price % of Par |

100.00000000 |

|

|

Unamortized Disc/Premium |

0.00 |

|

|

Unwind Principal Amount |

600,000.00 |

|

|

Write-Off Unam Disc/Prem |

0.00 |

|

|

Unwind Accrual Amt |

15,210.42 |

|

|

Fee Balance |

0.00 |

|

|

Unwind Settlement Amount |

615,210.42 |

|

|

Amortized Fee |

0.00 |

|

|

Unwind Book Value |

600,000.00 |

|

|

Unamortized Fee |

0.00 |

|

|

Gain/Loss |

0.00 |

|

|

Write-Off Fee |

0.00 |

|

Counterparty |

|

|

|

|

SetID |

SHARE |

|

|

Counterparty |

USBNK |

|

Settlement Instructions |

|

|

|

|

Sale Bank SetID |

SHARE |

|

|

Our Settlement Bank |

USBNK |

|

|

Our Settlement Account |

CHCK |

|

|

Settlement Instructions |

TUS01, TUS01 Corporate Tr Settle Inst |

A new deal representing the balance remaining of the original deal after the original deal has been entered as Partially Sold/Bought Back.

Note the new Deal ID, the added field Deal Start Date and the Deal Status.

|

Page |

Field |

Field Value |

|---|---|---|

|

Deal Detail page |

|

|

|

|

Settlement Date |

05/01/2003 |

|

|

Term |

732 |

|

|

Maturity Date |

05/02/2005 |

|

|

Issue Date |

05/01/2003 |

|

|

Interest Period Start Date |

05/01/2003 |

|

|

Classification |

Investment |

|

|

Rate Type |

Fixed |

|

|

Rate |

6.125 |

|

|

Day/Count Basis |

30/360 |

|

|

Interest Calculation |

Interest Bearing |

|

|

Par Amount |

1,400,000.00 |

|

|

Currency |

USD |

|

|

Settlement Amount |

1,400,000.00. |

|

|

Price % of Par |

100.0 |

|

|

Purchased Interest |

0.00 |

|

|

Discount/Premium |

Constant Yield Method |

|

|

Yield |

4.25000008 |

|

|

Amort Method |

Non Amortizing |

|

Interest Dates and Calculation |

|

|

|

|

Repeat Interest Dates |

Selected |

|

|

Interest Frequency |

Semi-Annual |

|

|

Business Day Convention |

Following |

|

|

Next Interest Payment |

Traded Cum-Interest |

|

|

Interest Calculation |

Day Counted Interest Use Actual Interest Dates |

|

|

Interest Date Rule |

Forwards from Issue Date |

|

|

Payment Date |

Business Days - Paid in Arrears |

|

|

+/- Payment Days |

0 |

|

|

+/- Reset Days |

0 |

|

Portfolio |

DEMO |

|

|

|

Accounting Treatment |

Held to Maturity |

|

|

Counterparty |

USBNK |

|

|

Issuer |

USBNK |

|

|

Guarantor |

USBNK |

|

|

Description |

2 Years to 2005–05–02 Investment USD 2.0 m. @ 6.125% |

|

|

Deal Status |

Open |

|

|

Deal Status |

Open |

|

|

Deal Start Date |

09/30/2003 |

Save the new deal. When you generate cash flows for the original deal and the new deal, the principal and interest values will be updated to reflect the partial sell/buyback transaction.

|

Page |

Field |

Field Value |

|---|---|---|

|

Cashflows page |

|

|

|

|

Date Description Amount Currency Nominal Date Interest Date |

11/03/2003 Interest 43,351.39 USD 11/01/2003 11/03/2003 |

|

|

Date Description Amount Currency Nominal Date Interest Date |

05/03/2004 Interest 42,875.00 USD 05/01/2004 05/03/2004 |

|

|

Date Description Amount Currency Nominal Date Interest Date |

11/01/2004 Interest 42,398.61 USD 11/01/2004 11/01/2004 |

|

|

Date Description Amount Currency |

05/02/2005 Principal & Interest 1,443.113.09 USD |

|

Page |

Field |

Field Value |

|---|---|---|

|

Interest and Payment Dates page |

|

|

|

|

Type Period End Date Payment Date Amount Principal Balance Rate Set Rate Interest Payment Principal Payment Currency |

Interest 11/03/2003 11/03/2003 43,351.39 1,400,000.00 Selected 6.125 43,351.39 0.00 USD |

|

|

Type Period End Date Payment Date Amount Principal Balance Rate Set Rate Interest Payment Principal Payment Currency |

Interest 05/03/2004 05/03/2004 42,875.00 1,400,000.00 Selected 6.125 42,875.00 0.00 USD |

|

|

Type Period End Date Payment Date Amount Principal Balance Rate Set Rate Interest Payment Principal Payment Currency |

Interest 11/01/2004 11/01/2004 42,398.61 1,400,000.00 Selected 6.125 42,398.61 0.00 USD |

|

|

Type Period End Date Payment Date Amount Principal Balance Rate Set Rate Interest Payment Principal Payment Currency |

Interest 05/02/2005 05/02/2005 43,113.19 1,400,000.00 Selected 6.125 43,113.19 0.00 USD |

|

Page |

Field |

Field Value |

|---|---|---|

|

Cashflows page |

|

|

|

|

Date Description Amount Currency |

05/01/2003 Principal -2,000,000.00 USD |

|

|

Date Description Amount Currency |

09/30/2003 Sale Settlement 615,210.42 USD |

Sell/Buyback with Full Sale

A corporate bond investment was entered on April 30, 2003. The bond was issued in the amount of $1,000,000.00 USD for 2 years to mature May 1, 2005 at 4.25% interest. On September 25, 2003, the investor sells 100% of the investment.

|

Page |

Field |

Field Value |

|---|---|---|

|

Deal Detail page |

|

|

|

|

Instrument Type |

CORPBOND |

|

|

Transaction Date |

04/30/2003 |

|

|

Instrument Base Type |

Interest Rate Physical |

|

|

Settlement Date |

05/01/2003 |

|

|

Term |

731 |

|

|

Maturity Date |

05/01/2005 |

|

|

Issue Date |

05/01/2003 |

|

|

Interest Period Start Date |

05/01/2003 |

|

|

Classification |

Investment |

|

|

Rate Type |

Fixed |

|

|

Rate |

4.25 |

|

|

Day/Count Basis |

30/360 |

|

|

Interest Calculation |

Interest Bearing |

|

|

Par Amount |

1,000,000.00 |

|

|

Currency |

USD |

|

|

Settlement Amount |

1,000,000.00. |

|

|

Price % of Par |

100.00000000 |

|

|

Purchased Interest |

0.00 |

|

|

Discount/Premium |

Constant Yield Method |

|

|

Yield |

4.25000000 |

|

Interest Dates and Calculation |

|

|

|

|

Repeat Interest Dates |

Selected |

|

|

Interest Frequency |

Semi-Annual |

|

|

Business Day Convention |

Modified Following |

|

|

Next Interest Payment |

Traded Cum-Interest |

|

|

Interest Calculation |

Same Interest each Period Normal First coupon Period Normal Last Coupon Period |

|

|

Interest Date Rule |

Forwards from Issue Date |

|

|

Payment Date |

Business Days — Paid in Arrears |

|

|

Accounting Treatment |

Held to Maturity |

|

|

Counterparty |

USBNK |

|

|

Issuer |

USBNK |

|

|

Guarantor |

USBNK |

|

|

Description |

2 Years to 2005–05–01 Investment USD 1.0 m. @ 4.25% |

|

|

Deal Status |

Open (Before Sale) Sold/Bought Back (After Sale) |

|

Page |

Field |

Field Value |

|---|---|---|

|

Settlement Instructions page |

||

|

Payment Information |

||

|

|

Our Settle Thru SetID |

SHARE |

|

|

Our Settle Thru Bank |

USBNK |

|

|

Our Settle Thru Account |

CHCK |

|

|

Counterparty's Instructions |

USBKS |

|

|

Payment Method |

System Check |

|

Receipt Information |

||

|

|

Our Settle Into SetID |

SHARE |

|

|

Our Settle Into Bank |

USBNK |

|

|

Our Settle Into Account |

CHCK |

|

|

Our Settlement Instructions |

TUS01 |

Select the Sell/Buyback hyperlink and access the Update/Display Sell/Buyback Details page.

|

Page |

Field |

Field Value |

|---|---|---|

|

Update/Display Sell/Buyback Details page |

|

|

|

|

Unwind Date Settlement Date |

08/25/2003 08/25/2003 |

|

|

Receive |

Yes |

|

|

Unwind Principal Balance |

1,000,000.00 |

|

|

Unwind Par |

1,000,000.00 |

|

|

Unwind Pro Rata % |

100.0 |

|

|

Sale Currency |

USD |

|

|

Amortized Disc/Premium |

0.00 |

|

|

Price % of Par |

100.00000000 |

|

|

Unamortized Disc/Premium |

0.00 |

|

|

Unwind Principal Amt |

1,000,000.00 |

|

|

Write-Off Unam Disc/Prem |

0.00 |

|

|

Unwind Accrual Amt |

13,458.33 |

|

|

Fee Balance |

0.00 |

|

|

Unwind Settlement Amount |

1,013,458.33 |

|

|

Amortized Fee |

0.00 |

|

|

Unwind Book Value |

1,000,000.00 |

|

|

Unamortized Fee |

0.00 |

|

|

Gain/Loss |

0.00 |

|

|

Write-Off Fee |

0.00 |

|

|

Counterparty |

USBNK |

|

|

Our Settlement Bank |

USBNK, USA BANK |

|

|

Our Settlement Account |

CHCK, USBNK CHECKING ACCT |

|

|

Settlement Instructions |

TUS01, TUS01 Corporate Tr Settle Inst |

Process the deal to generate cash flows.

|

Page |

Field |

Field Value |

|---|---|---|

|

Cashflows page |

|

|

|

|

Settlement Date Description Amount Currency |

05/01/2003 Principal -1,000,000.00 USD |

|

|

Settlement Date Description Amount Currency |

08/25/2003 Sale Settlement 1,013,458.33 USD |

On August 8, 2000, you settle an overnight repurchase agreement for 452,000,000 USD at 5.375%, with a haircut of .442%. The Deal Detail page has two lines for this repo:

One debt line for the Par Amount of 452,000,000.00 USD calculated at a rate of 5.37500000%.

One investment line for the Par Amount of 2,000,000.00 USD calculated at a rate of 0.00000001% (the haircut).

|

Page |

Field |

Field Value |

|---|---|---|

|

Deal Detail page |

|

|

|

Instrument Type |

REPO |

|

|

Transaction Date |

08/08/2000 |

|

|

Line |

1 of 2 |

|

|

Instrument Base Type |

Interest Rate Physical |

|

|

Settlement Date |

08/08/2000 |

|

|

Term |

1 |

|

|

Maturity Date |

08/09/2000 |

|

|

Issue Date |

08/08/2000 |

|

|

Interest Period Start Date |

08/08/2000 |

|

|

Classification |

Debt |

|

|

Rate Type |

Fixed |

|

|

Rate |

5.375 |

|

|

Day/Count Basis |

Actual/360 |

|

|

Interest Calculation |

Interest Bearing |

|

|

Par Amount |

452,000,000.00 |

|

|

Currency |

USD |

|

|

Settlement Amount |

452,000,000.00. |

|

|

Price % of Par |

100.00000000 |

|

|

Purchased Interest |

0.00 |

|

|

Yield |

5.37499948 Note: This is a system-generated value. You do not need to enter this value. |

|

|

Discount/Premium |

(blank) |

|

|

Interest Dates and Calculation |

|

|

|

Repeat Interest Dates |

Cleared |

|

|

Business Day Convention |

Following |

|

|

Interest Calculation |

Day Counted Interest Use Actual Interest Dates |

|

|

Interest Date Rule |

(blank) |

|

|

Payment Date |

Business Days — Paid in Arrears |

|

|

Deal Detail |

|

|

|

Line |

2 of 2 |

|

|

Instrument Base Type |

Interest Rate Physical |

|

|

Settlement Date |

08/08/2000 |

|

|

Term |

1 |

|

|

Maturity Date |

08/09/2000 |

|

|

Issue Date |

08/08/2000 |

|

|

Interest Period Start Date |

08/08/2000 |

|

|

Classification |

Investment |

|

|

Rate Type |

Fixed |

|

|

Rate |

0.00000001 |

|

|

Day/Count Basis |

Actual/360 |

|

|

Interest Calculation |

Interest Bearing |

|

|

Par Amount |

2,000,000.00 |

|

|

Currency |

USD |

|

|

Settlement Amount |

2,000,000.00. |

|

|

Price % of Par |

100.00000000 |

|

|

Purchased Interest |

0.00 |

|

|

Discount/Premium |

(blank) |

|

|

Yield |

(blank) |

|

|

Interest Dates and Calculation |

|

|

|

Repeat Interest Dates |

Cleared |

|

|

Business Day Convention |

Following |

|

|

Interest Calculation |

Day Counted Interest Use Actual Interest Dates |

|

|

Interest Date Rule |

(blank) |

|

|

Payment Date |

Business Days — Paid in Arrears |

|

|

Portfolio |

DEMO |

|

|

Accounting Treatment |

Held to Maturity |

|

|

Counterparty |

USBNK |

|

|

Issuer |

USBNK |

|

|

Guarantor |

USBNK |

|

|

Description |

Overnight Repurchase Agreement with a 0.44 % "Haircut." 1 day debt to 08/09/00. USD 452,000,000 @ 5.375 |

|

|

Deal Status |

Matured |

|

|

Interest Dates |

|

|

|

Payment Type |

Interest |

|

|

Period End Date |

08/09/2000 |

|

|

Payment Date |

08/09/2000 |

|

|

Override |

(not selected) |

|

|

Amount |

-67,486.11 |

|

Page |

Field |

Field Value |

|---|---|---|

|

Settlement Instructions page |

||

|

Line |

1 |

|

|

Payment Information |

||

|

Our Settle Thru SetID |

SHARE |

|

|

Our Settle Thru Bank |

USBNK |

|

|

Our Settle Thru Account |

CHCK |

|

|

Counterparty's Instructions |

USBKS |

|

|

Payment Method |

Wire Transfer |

|

|

Layout |

820 |

|

|

Receipt Information |

||

|

Our Settle Into SetID |

SHARE |

|

|

Our Settle Into Bank |

USBNK |

|

|

Our Settle Into Account |

CHCK |

|

|

Our Settlement Instructions |

TUS01 |

|

|

Settlement Instructions |

||

|

|

Line |

2 |

|

Payment Information |

||

|

Our Settle Thru SetID |

SHARE |

|

|

Our Settle Thru Bank |

USBNK |

|

|

Our Settle Thru Account |

CHCK |

|

|

Counterparty's Instructions |

USBKS |

|

|

Receipt Information |

||

|

Our Settle Into SetID |

SHARE |

|

|

Our Settle Into Bank |

USBNK |

|

|

Our Settle Into Account |

CHCK |

|

|

Our Settlement Instructions |

TUS01 |

|

Page |

Field |

Field Value |

|---|---|---|

|

Cashflows page |

||

|

Settlement Date Description Amount Currency |

08/08/2000 Principal 452,000,000.00 USD |

|

|

Settlement Date Description Amount Currency |

08/08/2000 Principal -2,000,000.00 USD |

|

|

Settlement Date Description Amount Currency |

08/09/2000 Principal & Interest -452,067,486.11 USD |

|

|

Settlement Date Description Amount Currency |

08/09/2000 Principal 2,000,000.00 USD |

When you select a periodic compounding frequency for a deal, the amount accrued is compounded into the principal to calculate the new interest. However, there are deal situations when you want the amount to accrue on a periodic basis, but not be compounded into the principal until the maturity date. These deals situations encompass IRP deals with a term over 1 year and the accrued interest to be paid at maturity—instead of the accrued interest being periodically applied to the principal. (In this discussion we use the convention IRP/1+YR/Interest at Maturity to refer to these types of deals.) To accomplish this, you need to create a new instrument and configure certain fields the Deal Detail page. This ensures that the system withholds paying the accrued amount to the principal until the specified Maturity Date.

To create IRP/1+YR/Interest at Maturity deals:

Define a simple interest rate physical instrument, completing the Instrument Detail page as shown here.

Important! Whenever you configure a new instrument for use in Deal Management, you must also define accounting templates to process the associated accounting events.

See Selecting Accounting Templates.

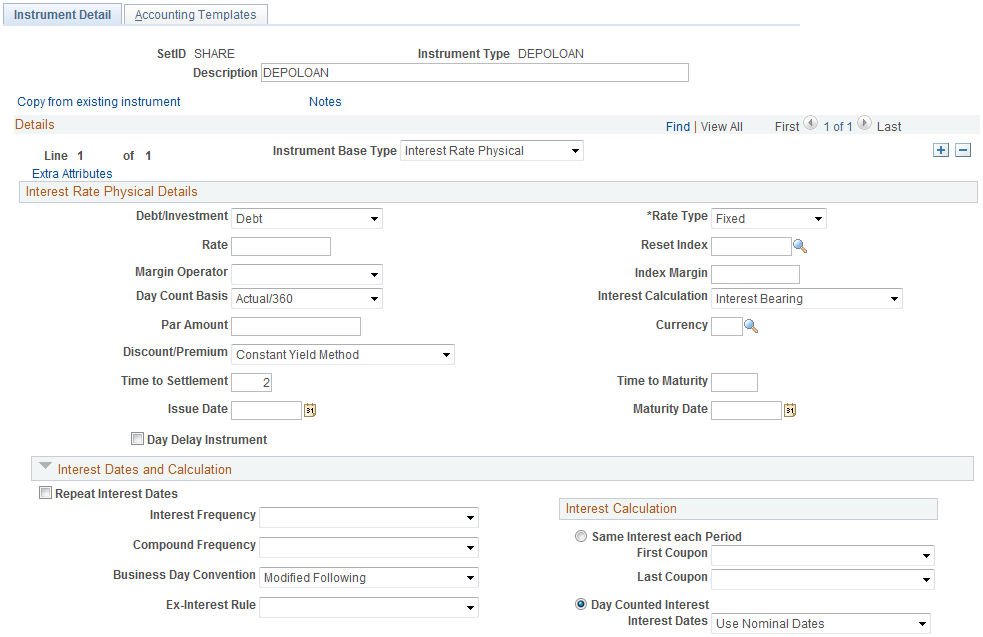

This example illustrates the fields and controls on the Instrument Detail page – for an interest rate physical instrument (1 of 2). You can find definitions for the fields and controls later on this page.

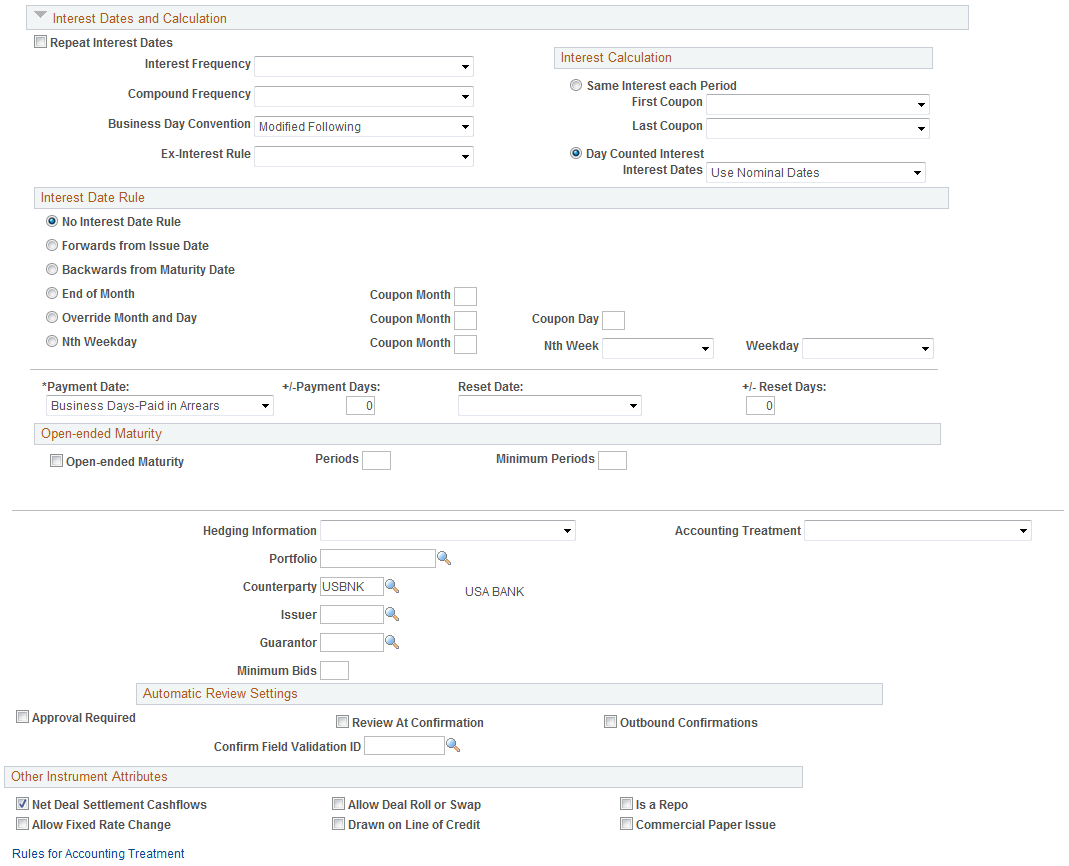

This example illustrates the fields and controls on the Instrument Detail page – for an interest rate physical instrument (2 of 2). You can find definitions for the fields and controls later on this page.

Note that the Repeat Interest Dates check box is deselected, and the Interest Frequency, Ex-Interest Rule, and Interest Date Rule fields are left blank.

Important! This setting is what enables the system to calculate and pay accrued interest at maturity (for deals created from this instrument).

Once you have defined and saved the IRP/1+YR/Interest at Maturity instrument, you can create IRP/1+YR/Interest at Maturity deals. The following two screenshots illustrate defining a IRP/1+YR/Interest at Maturity deal.

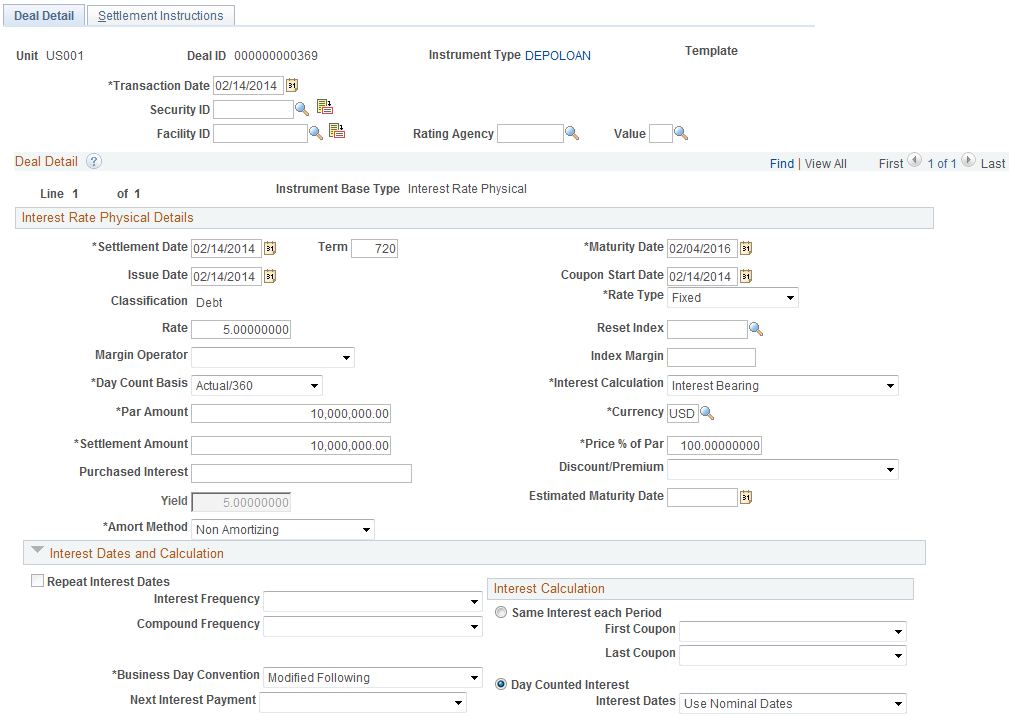

On the Deal Detail page, the option you select for Day Count Basis affects the total accrued interest. In this example, specifying Actual/360 for the Day Count Basis returns a total accrued interest amount of 1 million USD. However, if 30/360 is specified, the total accrued interest amount is slightly lower due to the decreased number of days for interest calculation.

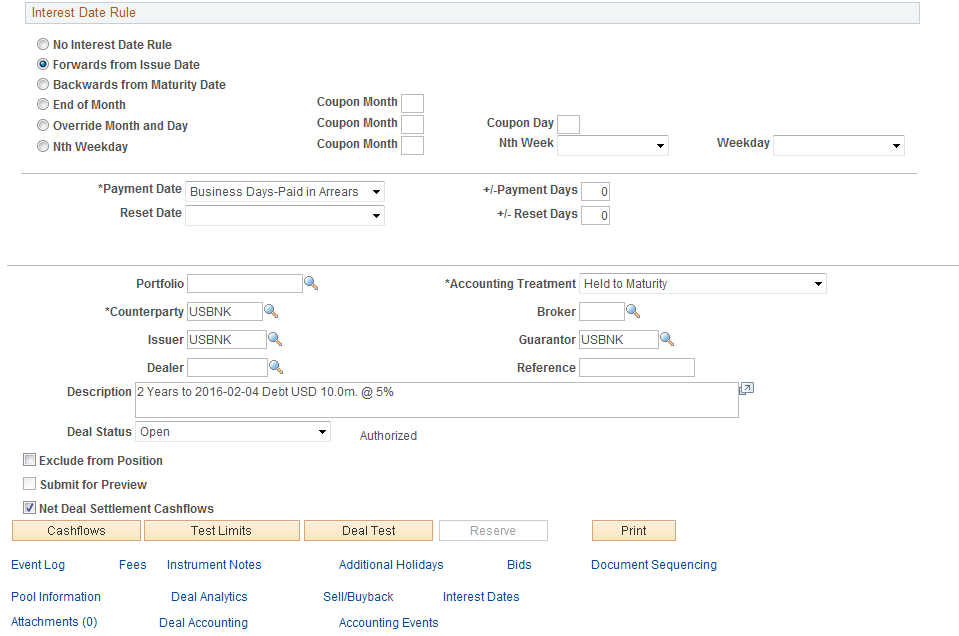

As the Deal Detail page for the IRP/1+YR/Interest at Maturity deal derives information from the Instrument Detail page for the IRP/1+YR/Interest at Maturity instrument, the check box and fields left blank on the instrument are unavailable for entry on the deal.

This example illustrates the fields and controls on the Deal Detail page – entering deal detail information (1 of 2).

This example illustrates the fields and controls on the Deal Detail page – entering deal detail information (2 of 2).

When you complete entering information and save the deal, the Cashflows page and the Interest and Payment Dates page are populated as shown in the following two page views.

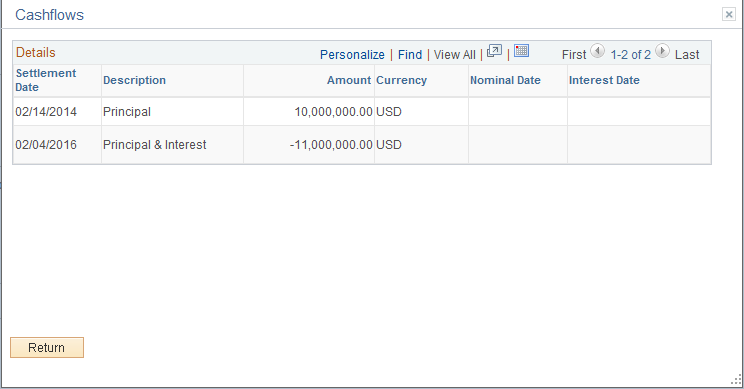

This example illustrates the fields and controls on the Cashflows page – with interest added to principal at maturity. You can find definitions for the fields and controls later on this page.

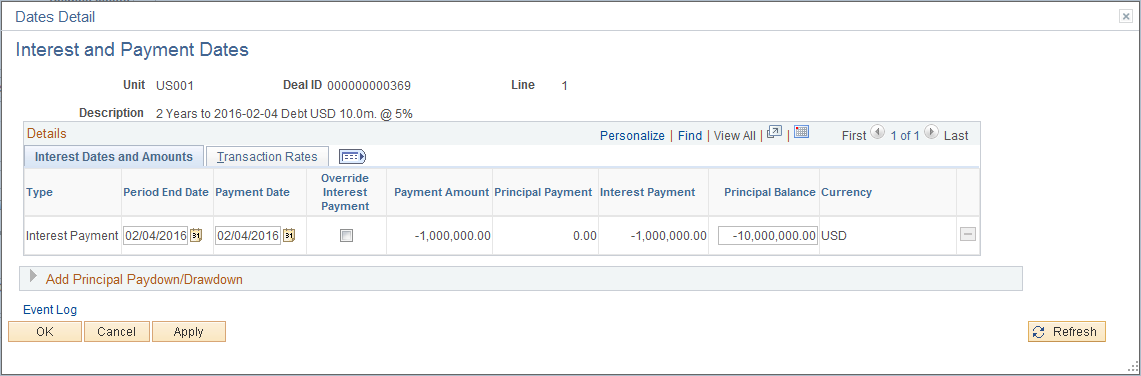

This example illustrates the fields and controls on the Interest and Payment Dates page - with interest added to principal at maturity.

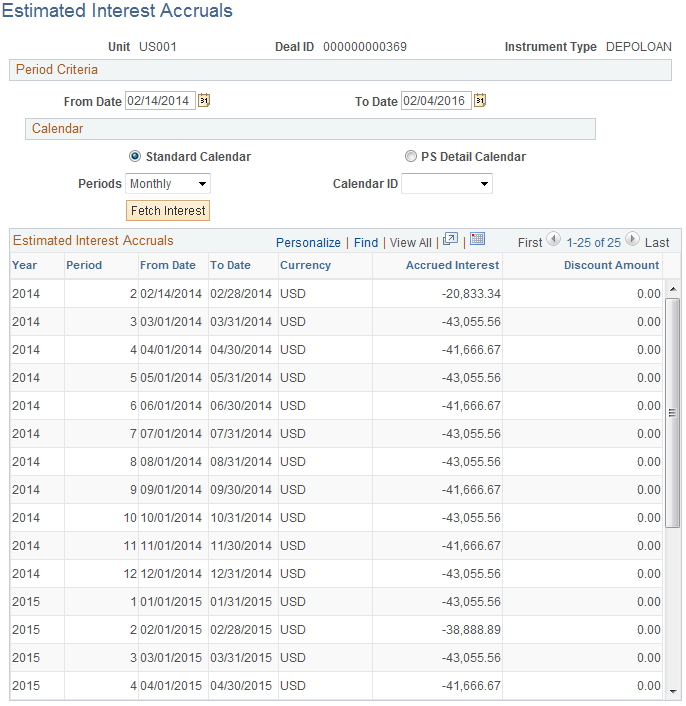

You can view periodic accrual amounts using the Estimated Interest Accruals page (TRX_ACCR_INT_PNL). The monthly interest accrual for this IRP/1+YR/Interest at Maturity deal example is shown in the following application page.

This example illustrates the fields and controls on the Estimated Interest Accruals page.

Also, if you set up Treasury Accounting to automatically run (on a periodic basis), the system books the accrual amount each time you run the accounting process. However, the system does not book the interest payment until the defined payment date (which may or may not be the deal maturity date, depending on the deal capture details).