Creating EFT Requests

You can use the pages in this topic to create an EFT request, whether your request is for a regular EFT request, or an EFT request involving repetitive transfer or drawdown transfer information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TR_WIRE_PNL |

Enter transfer origin information. Capture data on the account from which funds will be furnished for the transfer |

|

|

Category Purpose Page |

CAT_PURP_EFT |

Identify the high-level purpose of the payment instruction based on a set of predefined categories as per ISO 20022 external code list or a proprietary scheme name. See the EFT Request - Origin Page for more information. |

|

TR_WIRE_TO_PNL |

Specify destination information by entering recipient information for a funds transfer. |

|

|

Identification Information Page |

TR_WR_OTHID_SP |

Provide other identification for Name1, Bank, and/or Bank Account values, respectively. See the EFT Request - Destination Page for more information. |

|

EFT Options Page |

TR_EFT_OPT_SEC |

Configure EFT handling options. |

|

Routings Page |

TR_INTR_TBL_SEC |

Set up multiple routing information for a funds transfer. |

|

EFT Request - Detailed Description Page |

TR_WR_DESC_SEC |

Enter any of your in-house notes for the funds transfer. This information is not transmitted to the recipient. |

|

EFT Request - Addenda Page |

STL_ADDENDA2_SP |

Enter addenda information. The system transmits this information to the recipient. For funds transfers, direct debits, and treasury wires, this page consists of four 35-character lines. For ACH transactions, this page is a free form, 80-character field. |

|

TR_WIRE_ADDRESS |

Capture the address and telephone information for the recipient of your funds transfers. |

Use the EFT Request - Origin page (TR_WIRE_PNL) to enter transfer origin information.

Capture data on the account from which funds will be furnished for the transfer

Navigation:

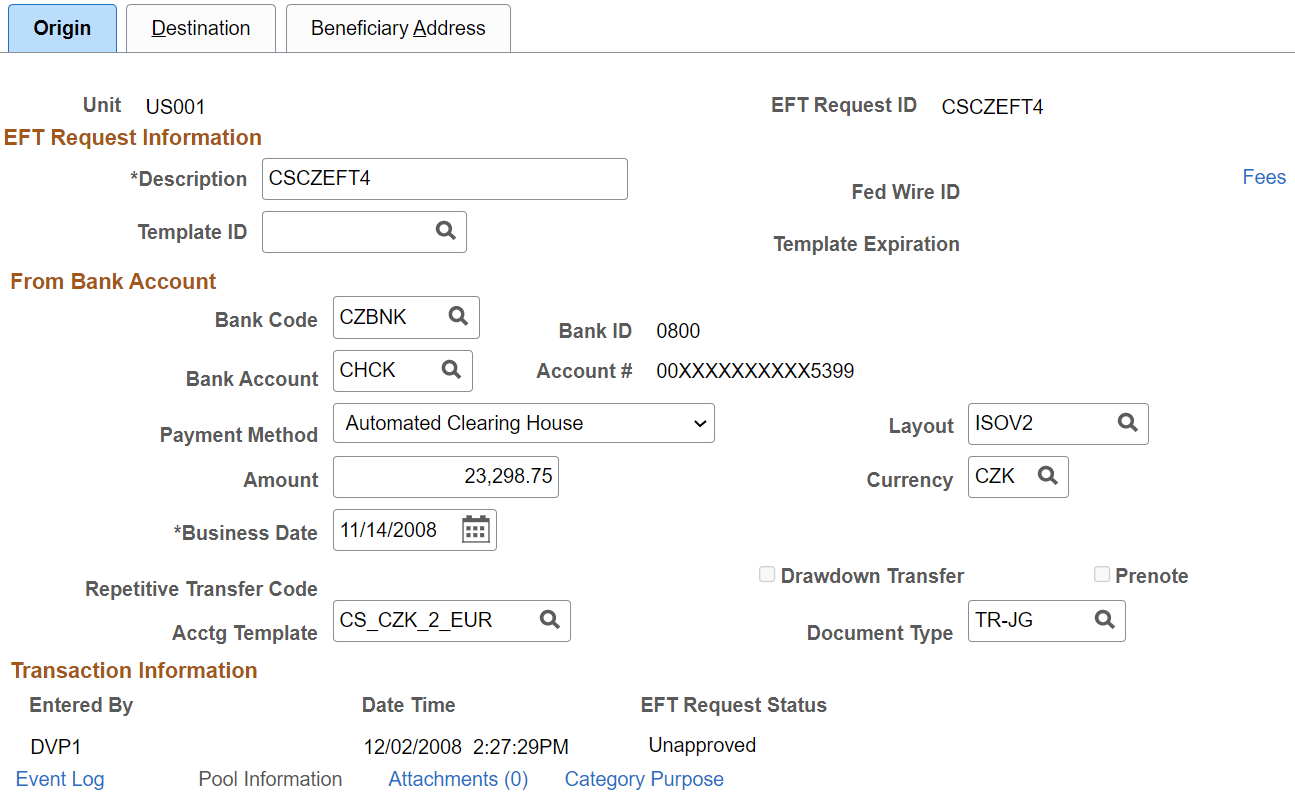

This example illustrates the fields and controls on the EFT Request - Origin page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Description |

Enter a description. When you do not enter a description, the system populates the field with the description from the template assigned to the request. The system will not override a description that has been entered manually. |

Template ID |

Select the template, if you are executing the EFT requests from a template. Note: Expired templates are not available for selection. |

Prenotification |

This field is display-only and will appear selected for ACH prenotes. |

Fed Wire ID (federal wire ID) |

For EFT requests associated with federal fund transfers, the Federal Reserve agency assigns a Federal Wire ID code after receiving the request. Enter the code in this field for your reference. This field is automatically populated if the bank returns acknowledgements containing the Fed Wire ID. This field is used only as reference in Cash Management; it is not necessary for the accounting process. Note: The Federal Wire ID code is the only reference number that the Federal Reserve recognizes when handling issues or questions about the transfer. |

Fees |

Click to create fees for this EFT request. |

Payment Method |

Select an available payment method (methods are determined by the values that you defined in the Bank Code and Bank Accountfields). Values are Automated Clearing House, Direct Debit, Electronic Funds Transfer, or Wire Transfer. You cannot select a payment method for any type of repetitive transfer. |

Business Date |

Enter the business date on which the funds transfer is to occur. The date that you select carries over to the next business day, depending on:

|

Acct Template (accounting template) |

Select an accounting template if accounting is to be run for the transfer. Leave this field blank if the transfer is already accounted for in another PeopleSoft application (for example, Payables). Note: The Acct Template field is unavailable when the selected account in the Account # field is not enabled for cash clearing. |

IBAN |

Displays the international bank account number (IBAN) in addition to the local, domestic bank account number when the country has been set up to display the IBAN on the IBAN Formats Page. If you set up bank account encryption, IBAN is masked when you save the page. For more information about bank account number encryption and the National Automated Clearing House Association (NACHA) data security requirements, see Understanding Bank Account Encryption and Setting Up Bank Account Encryption. |

Transaction Information

Field or Control |

Description |

|---|---|

EFT Request Status |

Displays a value of Unapproved. This value changes as activity occurs later in the workflow—for example, when a supervisor approves the entered funds. |

Pool Information |

Click to access the Pool Information page. If this bank account is used for holding investment pool funds, enter the business unit and identifier of the pool. |

Category Purpose |

Click to access the Category Purpose page (CAT_PURP_EFT), where you can identify the high-level purpose of the payment instruction based on a set of predefined categories as per ISO 20022 external code list or a proprietary scheme name. Available only for SEPA transactions. |

|

Attachments |

Click to view/ add attachments. See Installation Options - Multiple Attachments Page to define the maximum attachment upload limit for various products. |

Use the EFT Request - Destination page (TR_WIRE_TO_PNL) to specify destination information by entering recipient information for a funds transfer.

Navigation:

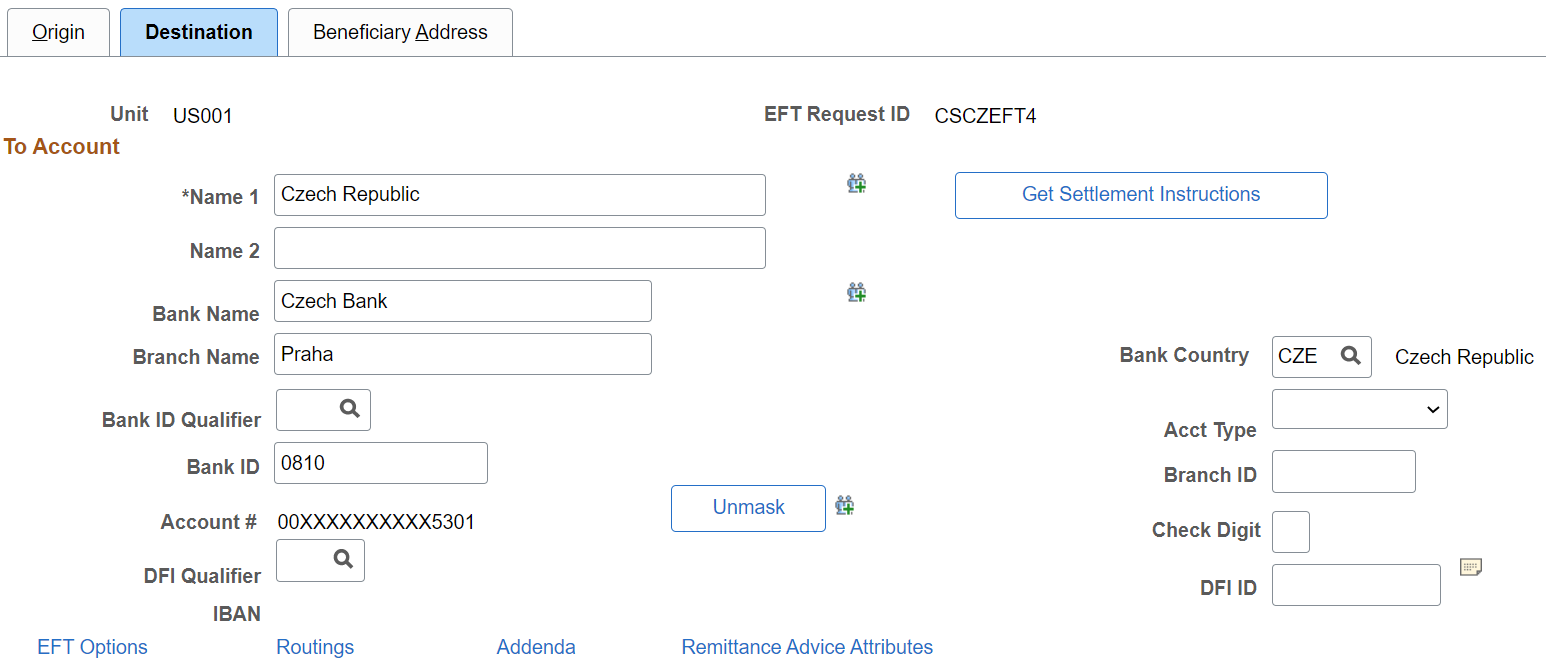

This example illustrates the fields and controls on the EFT Request - Destination page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Get Settlement Instructions |

Click to select settlement instructions and automatically populate fields. All fields are overwritten with the settlement instruction information, including fields on the Beneficiary Address, EFT Options, Routings, and Detailed Description pages, which you can access through links at the bottom of the EFT Request - Destination page. Also, if a field is blank in the settlement instruction, the corresponding field on this page is also blank. |

Name 1 and Name 2 |

Enter the recipient's name and other significant identifying information (for example, a company name, a DBA, or joint payees). |

|

Click this icon to access the Identification Information page (TR_WR_TPL_OID_SP), where you can where you can provide other identification for Name1, Bank, and/or Bank Account values, respectively. Available only for a Partner Instructions/Pay Into settlement type. |

Country |

Select the destination country code, which also determines the selection of available values in the Bank ID Qual (bank ID qualifier) values. Then specify a qualifier that determines which edit algorithm the system should use to check the bank ID number sequence. |

Bank ID |

Enter the routing number of your recipient's financial institution. |

Branch ID |

Enter the recipient's branch number. |

Acct Type (account type) |

Select the destination account type:

|

Account # (account number) |

Enter the account number that you are funding with this transaction. If you set up bank account encryption, account numbers are masked when you save the page. For more information about bank account number encryption and the National Automated Clearing House Association (NACHA) data security requirements, see Understanding Bank Account Encryption and Setting Up Bank Account Encryption. |

|

Unmask |

Select to unmask the bank account number and IBAN. |

Check Digit |

This field is conditional and dependent on the selected country. |

|

Click the View Description button to add internal notes about the funds transfer. These notes are not transmitted to the recipient. |

DFI Qualifier (depository financial institution qualifier) |

Select to identify the bank and enter the associated DFI ID (depository financial institution ID), if required. If you use intermediary routings, this bank represents the final bank into which funds are transferred. The DFI qualifier indicates what format—how many characters and numerics—are in the bank's DFI ID. Note that each type has a specific number of digits that you can enter. Values are: Transit Number: Exactly 9 numeric characters, plus check digit calculation. Swift ID: 8 or 11 characters; positions 5 and 6 must be a valid 2-character country code. CHIPS Participant ID (Clearing House Interbank Payments System participant ID): 3 or 4 numeric characters. CHIPS Universal ID (Clearing House Interbank Payments System universal ID): 6 numeric characters. Canadian Bank Branch/Institute: No validation. Mutually Defined: No validation. |

IBAN (international bank account number) |

Enter the IBAN. This field appears only if the IBAN Enterable field is selected on the IBAN Formats page. |

IBAN Digit (international bank account number digit) |

Define the account's IBAN for transmittal with other transfer information. Enter the check digit and click View IBAN. If the DFI qualifier for the specified country is IBAN enabled, and the system successfully validates check digit, the IBAN for this account appears. This field and the View IBAN button appears only if the IBAN Enterable field is not selected on the IBAN Formats page. |

BIC (bank identifier code) |

Enter the BIC code for the selected bank. This code is based on the ISO standard (9362), which is the universal method used to identify the financial institutions that enable automated processing of payments. A BIC code is used to route cross-border and some domestic payments to a bank branch or payments center. SEPA requires the use of BIC and IBAN codes to uniquely identify the creditor's and debtor's banks and bank accounts in all euro cross-border payments. It is imperative that the IBAN and BIC codes are correct to avoid repair fees that the bank charges due to processing errors, and to avoid delays in processing payments and collections due to the time-consuming correction of these errors. Once you enter a BIC code, the system validates the length and layout of the characters, and validates the BIC country code against the country code set up for the bank branch . |

Validating DFI Field Requirements for EFT Requests

The DFI Qualifier and DFI ID fields on the EFT Request - Destination page are by default not required fields, however, you can configure the system to return an error or warning in case these fields are not populated. PeopleSoft Cash Management provides two message numbers (9450, 3007 and 9450, 3008) for this purpose, where you can change the message severity to error or warning to get the following behavior:

Error - An error message is displayed, processing terminates, and data cannot be saved until the DFI Qualifier and DFI ID values have been entered.

Warning - A warning message is displayed. You can decide to either stop processing or continue processing without the DFI Qualifier and DFI ID values.

Use the EFT Request - Beneficiary Address page (TR_WIRE_ADDRESS) to capture the address and telephone information for the recipient of your funds transfers.

Navigation: