Setting Up Trading Partners for GST Processing

Setting up Trading Partners is required for every new and existing customer for India business units.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TRP_TYPE_GST |

Define trading partner types that are used to categorize and process E-invoices and report transactions to the GST network. |

|

|

TPR_TXNCAT_GST |

Define categories that are used to categorize and process E-invoices and report transactions to the GST network. |

|

|

TPR_SETUP_GST |

Identify the trading partner as a customer or supplier. |

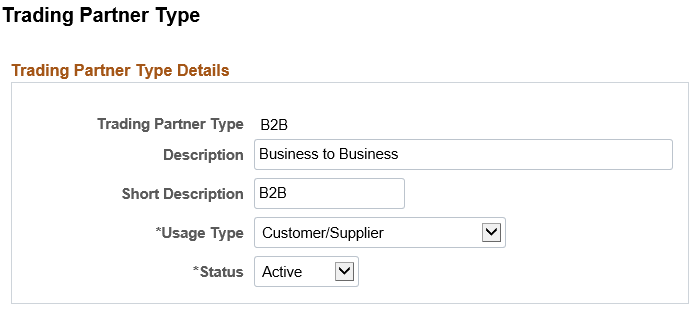

Use the Trading Partner Type page (TRP_TYPE_GST) to define trading partner types that are used to categorize and process E-invoices and report transactions to the GST network.

Navigation:

This example illustrates the fields and controls on the Trading Partner Type Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Usage Type |

Select one of these options:

|

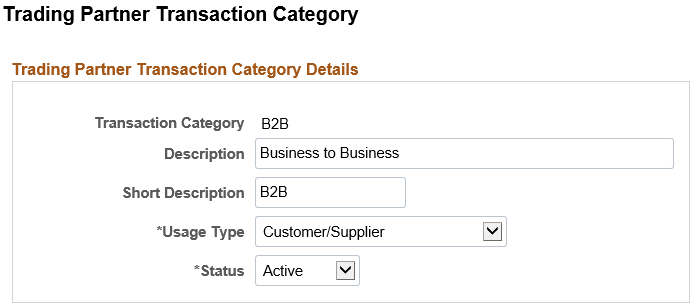

Use the Trading Partner Transaction Category page (TPR_TXNCAT_GST) to define categories that are used to categorize and process E-invoices and report transactions to the GST network.

Navigation:

This example illustrates the fields and controls on the Trading Partner Transaction Category Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Usage Type |

Select one of these options:

|

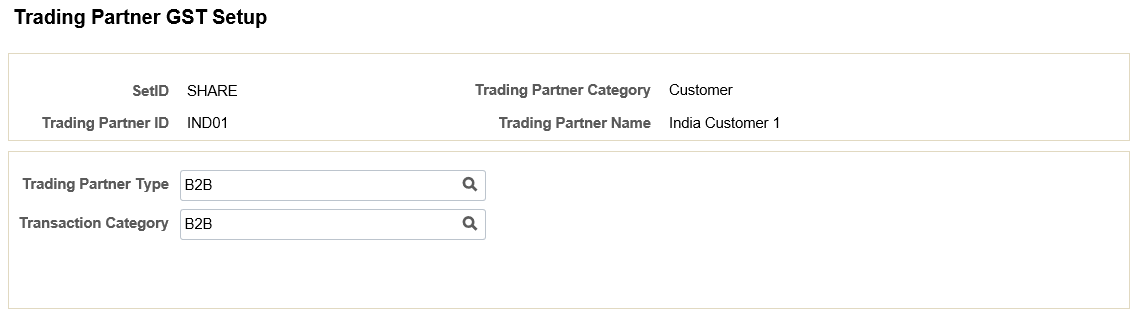

Use the Trading Partner GST Setup page (TPR_SETUP_GST) to identify the trading partner as a customer or supplier.

A trading partner can be a customer or a supplier.

Navigation:

This example illustrates the fields and controls on the Trading Partner GST Setup Page. You can find definitions for the fields and controls later on this page.

This page also allows you to select a Trading Partner Type and Trading Partner Transaction Category for GST transactions and reporting.

If the Trading Partner Category is Supplier, you can indicate whether the Supplier has to provide IRN registered invoices, and if so, whether the IRN is required before an invoice from the supplier can be processed in Payables.

Field or Control |

Description |

|---|---|

Trading Partner Type |

Select the value that is displayed in the Trading Partner Type field if the Trading Partner Category is Customer or Supplier. |

Transaction Category |

Select the value that is displayed in the Trading Partner Transaction Category field, if the Trading Partner Category is Customer or Supplier. Note: This field is only available when the Trading Partner Type is B2B, Export, or IMPG. |

IRN Applicable (invoice reference number applicable) |

Select to indicate that the supplier has to submit IRN registered invoices. Payables vouchers also display this value to show the requirement when creating the voucher. Note: This check box is only available if the Trading Partner Category is Supplier. |

IRN Mandatory (invoice reference number mandatory) |

Select to indicate that Payables does not save supplier vouchers if the IRN is required, but not available on the supplier invoice. Note: This check box is only available if the Trading Partner Category is Supplier and if the IRN Applicable check box is selected. |