Setting Up the GST Common Tax Structure

This section discusses how to set up the common tax structure.

Note: Common tax structure setup for GST and customs duty is shared unless otherwise specified.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EXS_TAX_CMPNT_GST |

Define a tax component code for each tax required. |

|

|

EXS_TAX_DPNDNC_GST |

Define tax dependency codes that indicate the basis for calculating tax, as well as the precedence of taxes for the same tax type to be included in the calculation. |

|

|

EXS_TAX_RATE_GST |

Define tax calculation codes that group tax component codes of the same tax type along with tax rates and other attributes. |

|

|

EXS_TAX_DETERM_GST |

Assign a tax calculation code to one or more tax determination parameters. |

|

|

STX_TAX_AUTH_GST |

Define tax authorities for each type of such tax, such as CGST, IGST or SGST. |

|

|

EXS_TAX_CATG_GST |

Define tax categories for assignment to suppliers, customers, products, and items for GST. |

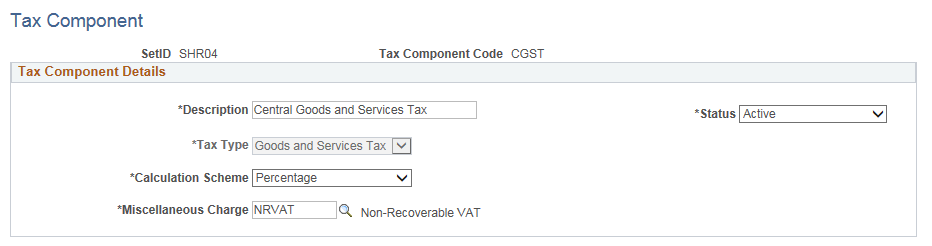

Use the Tax Component page (EXS_TAX_CMPNT_GST) to define a tax component code for each tax required.

Navigation:

This example illustrates the fields and controls on the Tax Components Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Component Code |

The tax component code that you enter on the prompt page appears. You create tax component codes for each required tax. The available codes are:

Note: No other Tax Component Codes may be added to or used in respect of Goods and Services Tax in the system as these specific codes are linked to translate values for handling GL Accounts. And it is to these GL accounts that tax components are posted via a tax calculation code. Use the Tax Calculation Code page to combine tax component codes of the same tax type. |

Tax Type |

Select a tax type with which to associate the tax component code. Defining this information filters tax component codes in the Tax Calculation Code table (EXS_TAX_CMPNT_GST) to ensure that tax calculation code definitions contain only tax component code lines of the same tax type. The available values are Goods and Services Tax or Custom Duty. |

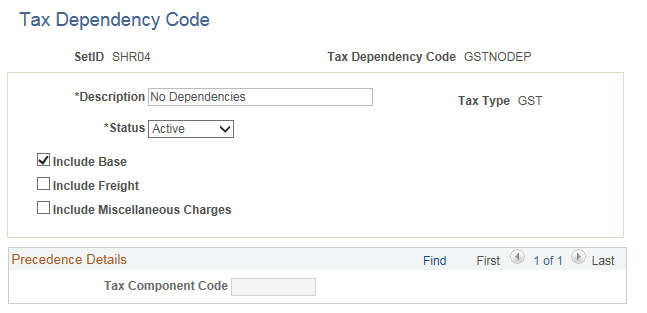

Use the Tax Dependency Code page (EXS_TAX_DPNDNC_GST) to define tax dependency codes that indicate the basis for calculating tax, as well as the precedence of taxes for the same tax type to be included in the calculation.

Navigation:

This example illustrates the fields and controls on the Tax Dependency Code Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Dependency Code |

The tax dependency code that you enter on the prompt page appears. Tax dependency codes indicate the basis for calculating tax, as well as the precedence of taxes of the same tax type that must be included. You assign tax dependency codes to tax calculation codes, enabling tax calculation codes to be calculated accordingly |

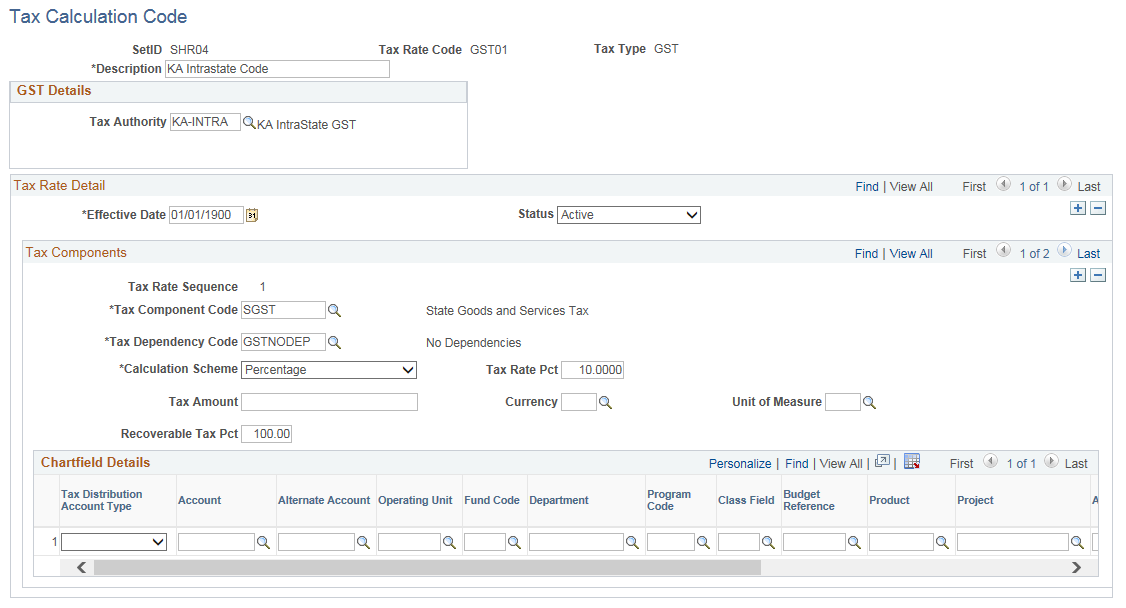

Use the Tax Calculation Code page (EXS_TAX_RATE_GST) to define tax calculation codes that group tax component codes of the same tax type along with tax rates and other attributes.

Navigation:

This example illustrates the fields and controls on the Tax Calculation Code Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Authority |

Select the GST Authority Type. |

Tax Component Code |

Select a tax component code for the tax required. |

Tax Dependency Code |

Select the tax dependency code to indicate the basis of calculating tax as well as the precedence of taxes for the same tax type. |

This table contains information about Tax Accounting Types and the usage associated with each.

|

Tax Accounting Types |

Usage |

|---|---|

|

Inter- Setoff account types are:

|

Use to store provisional input credits on advances paid to suppliers on reverse charge applicable purchases. Note: Amounts debited to these intermediate input credit accounts are reversed when vouchers are created upon receipt of the goods or services and invoices generated by suppliers. |

|

Set Off account types are:

|

Use these accounts to represent final input GST credits in the Procure to Pay cycle. Note: GST on invoices from suppliers is debited to these accounts. Note: Debits to intermediate (provisional) accounts for advances paid on reverse charge applicable purchases are reversed to these accounts, when regular invoices are received and posted. |

|

Inter-Tax account types are:

|

Use these accounts to store contra GST amounts payable on advances received from customers against sales orders. Note: When bills or invoices are raised, accounting entries are created which include GST payable on bills or invoices. Subsequently, amounts stored in contra GST Accounts are reversed to the debit of the respective GST payable accounts. |

|

Tax account types are:

|

Use these accounts to represent GST payable in the Order to Cash cycle. Any GST on bills is credited to these accounts. Note: These accounts carry the GST Amounts payable in respect of sales to various GST Authorities for each GST Component. Note: These liabilities can either be settled as payments via Third Party vouchers or set off against any input tax credits available in respective set off accounts in that state. |

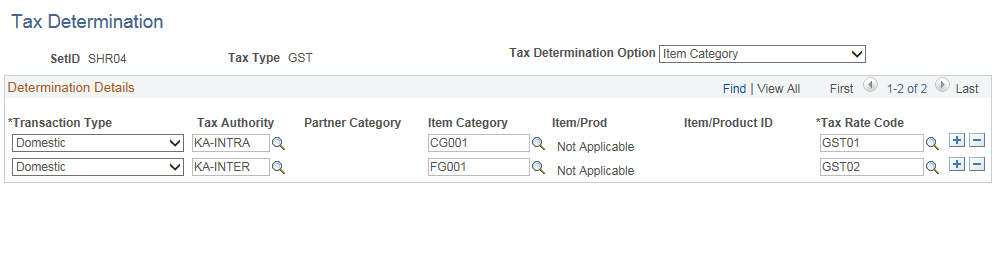

Use the Tax Determination page (EXS_TAX_DETERM_GST) to assign a tax calculation code to one or more tax determination parameters.

Available field values on the page are based on Tax Determination hierarchy.

Navigation:

This example illustrates the fields and controls on the Tax Determination Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Authority |

Select the GST Authority Type. Note: This is a mandatory field for both Item and Partner categories. |

Tax Rate Code |

Enter the GST rate code. |

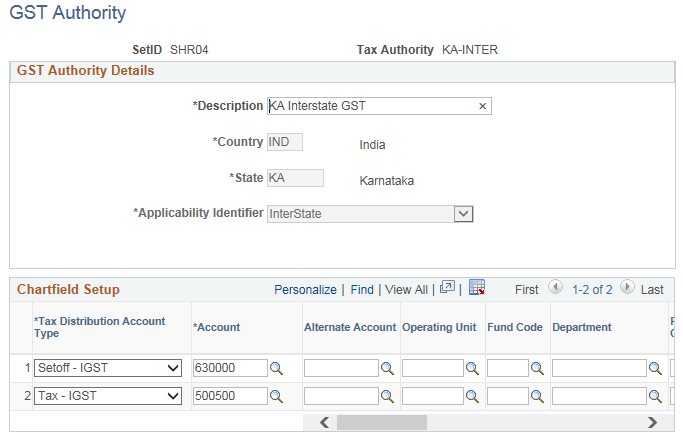

Use the GST Authority page (STX_TAX_AUTH_GST) to define tax authorities for each type of such tax, such as CGST, IGST or SGST.

Navigation:

This example illustrates the fields and controls on the GST Authority Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Application Identifier |

Select the GST Type. |

Tax Distribution Account Type |

Select the tax distribution type for a given account. |

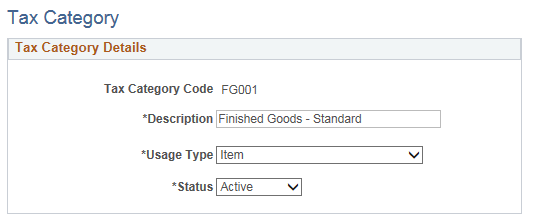

Use the Tax Category page (EXS_TAX_CATG_GST) to define tax categories for assignment to suppliers, customers, products, and items for GST.

Navigation:

This example illustrates the fields and controls on the Tax Category Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Usage Type |

Select the tax category usage type. The available values are:

|