Setting Up Suppliers for GST Processing

To set up suppliers for tax processing, use the Supplier Tax Applicability component (VNDR_LOC_EXS_GST). This section discusses how to define tax details for suppliers.

Note: Setting up suppliers for tax processing is applicable to GST and customs duty.

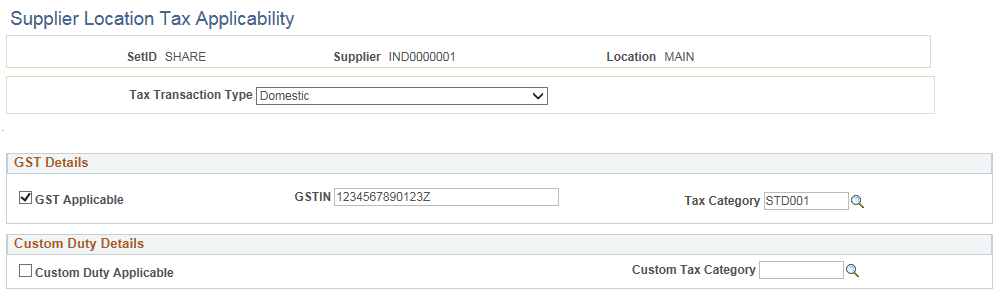

Use the Supplier Location Tax Applicability page (VNDR_LOC_EXS_GST) to define GST applicability details for suppliers.

Navigation:

This example illustrates the fields and controls on the Supplier Tax Applicability Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

GST Applicable |

Select this check box to enable GST for the transaction. |

GSTIN |

Enter the GSTIN number for this supplier. |

Note: Application pages, Tax Location, Document Number Series, Customs SION and Customs Benefit Scheme are related to customs duty in India.