Setting Up Items for GST Processing

To set up items for tax processing, use the Item Tax Applicability component (ITEM_MASTER_EXS) and the Item BU Tax Applicability component (ITEM_BU_EXS).

This section discusses how to set up items for Tax Processing.

Note: Setting up items for GST processing and customs duty is shared unless otherwise specified.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ITEM_BU_EXS_GST |

Define business unit-level GST applicability details for items. |

|

|

ITEM_MASTER_EX_GST |

Define GST applicability details for items. |

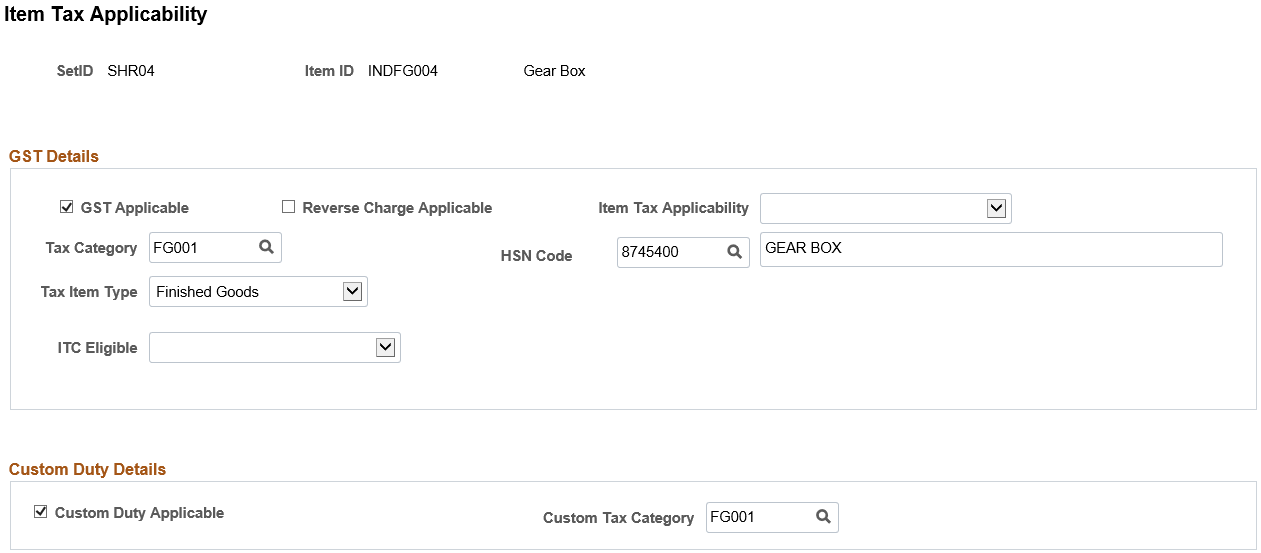

Use the Item Tax Applicability page (ITEM_MASTER_EX_GST) to define GST applicability details for items.

Navigation:

This example illustrates the fields and controls on the Item Tax Applicability page. You can find definitions for the fields and controls later on this page.

GST Details

Field or Control |

Description |

|---|---|

GST Applicable |

Select this check box to indicate that if this item is used on a transaction, then the item is subject to GST. |

Reverse Charge Applicable |

Select this check box to enable GST on a reverse charge basis for the item. |

Item Tax Applicability |

Select an option that indicates how to report zero rated GST or non-GST transactions. Options include:

|

Tax Category |

Select an option that indicates the tax rate code to use in a transaction. |

HSN Code |

Enter the HSN code specific to the item. |

Tax Item Type |

Select an option that indicates which tax determination rules to use for GST items. |

ITC Eligible |

Select an option that indicates how to group and report a transaction when the item is used. Options include:

|

Custom Duty Details

Field or Control |

Description |

|---|---|

Custom Duty Applicable |

Select to indicate that Custom Duty is applied when this item is imported to India. |

Custom Tax Category |

Select an option that indicates which custom tax category to use for the item. Tax categories are defined on the Tax Category Page. |

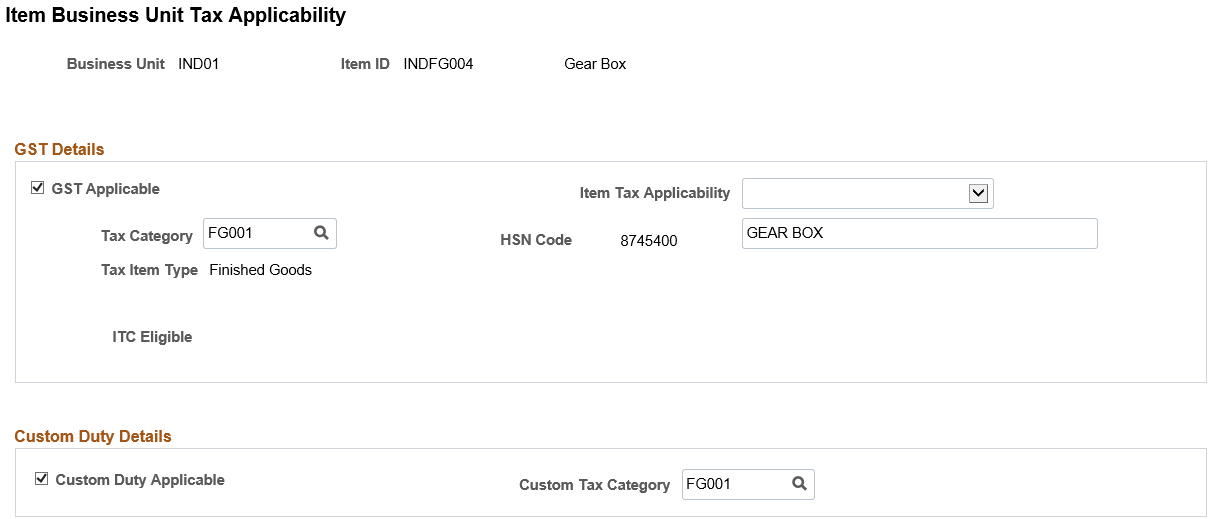

Use the Item Business Unit Tax Applicability page (ITEM_BU_EXS_GST) to define business unit-level GST applicability details for items.

Navigation:

This example illustrates the fields and controls on the Item Business Unit Tax Applicability page. You can find definitions for the fields and controls later on this page.

The Item Business Unit Tax Applicability page is similar to the Item Tax Applicability page. You define the GST applicability details for items at the business unit level.

GST Details

Field or Control |

Description |

|---|---|

GST Applicable |

Select this check box to enable GST for the transaction. If the business unit uses this item on a transaction, GST is applicable. |

Item Tax Applicability |

Select an option that indicates how to report zero rated GST or non-GST transactions. Options include:

|

Item Tax Type |

Displays the option selected on the Item Tax Applicability page. |

HSN Code |

View the HSN code specific to the item. |

ITC Eligible |

Displays the option selected on the Item Tax Applicability page. |

Custom Duty Details

The field definitions are the same as those on the Item Tax Applicability Page above.