Generating French FEC Audit Files

Statutory rules in France require all companies subject to tax in that country and under audit by French tax authorities to produce audit documentation in the prescribed electronic format. This FEC (Fichier d'Ecritures Comptables) audit file is to contain data of all accounting transactions for a given fiscal year for certain products. Even if you have not been notified of a tax audit, you should create and archive such files and make them available to auditors when asked for them. Some large companies are permitted to report balances on a summarized level, without providing transaction details.

Note: Document sequencing activation is mandatory and must be used in your PeopleSoft system.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

FEC_PRODUCT_TBL |

Add or remove products to extract transaction data from and to include in the FEC Audit file. |

|

|

FEC_SETUP |

Add or remove accounts used to select data extracted into the FEC audit file. |

|

|

RUN_FEC_EXPORT |

Run the FEC export process to extract data into the FEC Audit file in the prescribed format. |

Use the Set Up FEC Products for Reporting page (FEC_PRODUCT_TBL) to add or remove products to extract transaction data from and to include in the FEC Audit file.

Navigation:

This example illustrates the fields and controls on the Set Up FEC Products for Reporting page. You can find definitions for the fields and controls later on this page.

The system delivers a list of products by default from which you can extract data for the audit file.

Click the Add a Product icon to add products not delivered by PeopleSoft. If you have a non-PeopleSoft product that creates accounting transactions in PeopleSoft General Ledger, through the PeopleSoft Journal Generator process, you can add this product here. However, you must use the same system source value that you have defined for this product in the General Ledger Journal Generator Accounting Entry Definition table. All products entered here will be available for filtering purposes in the Limit to Products grid on the Export FEC Data Request page.

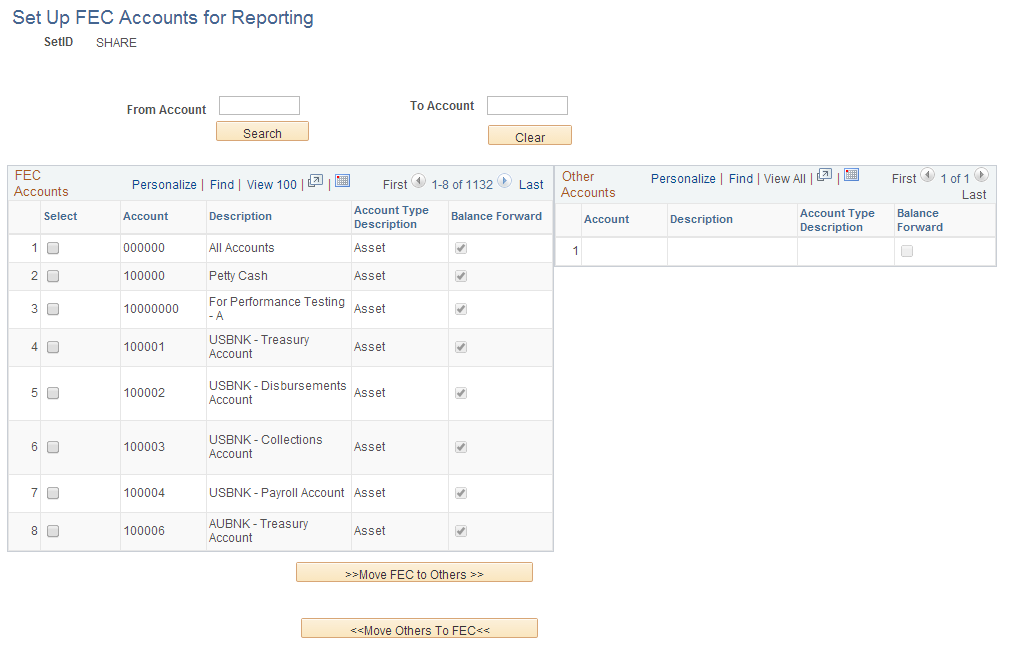

Use the Set Up FEC Accounts for Reporting page (FEC_SETUP) to add or remove accounts used to select data extracted into the FEC audit file.

Navigation:

This example illustrates the fields and controls on the Set Up FEC Accounts for Reporting page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

SetID |

Select the Set ID to set up the group of accounts. |

Exclude Type 8 and 9 Accounts |

Select this check box to exclude accounts starting with numbers 8 and 9 from the data load process being entered into the FEC Account table. |

Populate from Account |

Click the Populate from Account button to load associated data into the FEC Account table. Select this option if the accounts you are reporting are stored in the ACCOUNT ChartField. Note: This button is only displayed when loading data for the first time, for the selected SetID. |

Populate from Alternate Account |

Click the Populate from Alternate Account button to load associated data into the FEC Account table if a statutory chart of accounts exists. Select this option if the accounts you are reporting are stored in the ALTACCT ChartField. Note: This button is only displayed when loading data for the first time, for the selected SetID. |

From Account |

Enter the beginning account number to search and display for a range of accounts. |

To Account |

Select the ending account number to search and display for a range of accounts. |

Clear |

Click to remove all FEC accounts from the FEC Accounts grid and tables. |

Account Type Description |

Displays the account type. |

Balance Forward |

Indicates if the account has carry forward balances. |

Move FEC to Others |

Select an account from the FEC Accounts grid and click the Move FEC to Others button to move it to the Other Accounts grid. This will exclude the selected accounts from reporting in the FEC File. |

Move Others To FEC |

Select an account from the Other Accounts grid and click the Move Others To FEC button to move it to the FEC Accounts grid. This will enable the selected accounts for reporting in the FEC File. |

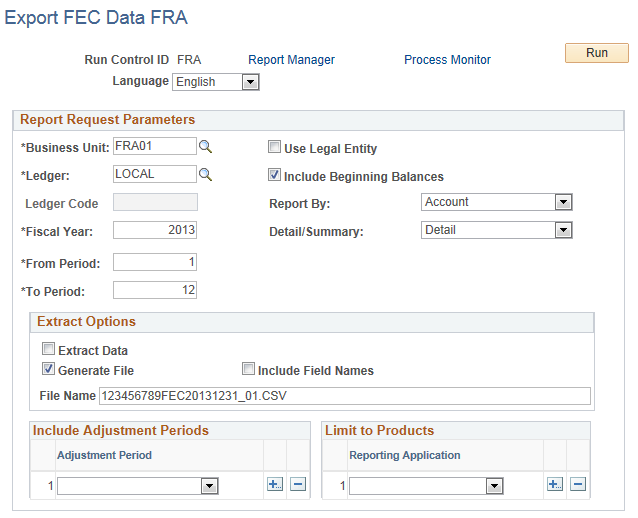

Use the Export FEC Data FRA (RUN_FEC_EXPORT) page to Run the FEC export process and extract data into the FEC Audit file in the prescribed format.

Navigation:

This example illustrates the fields and controls on the Export FEC Data FRA page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Language |

Select the language used to extract description information. |

Business Unit |

Select the general ledger Business Unit from which to export data. |

Use Legal Entity |

Select this check box to allow multiple GL Business Unit to be grouped into a single legal entity and to extract data from all such business units. This selection will also override any applicable row-level security for a particular GL Business Unit and will allow access to all GL Business Units in the legal entity. In this case, data will be exported for all GL Business Units that belong to the entered GL Business Unit. For more information about legal entities, please refer toOrganizational and Legal Categorization of Transactions . |

Ledger |

Select the ledger from which to export data. |

Include Beginning Balances |

Select this check box to extract beginning balances from the Beginning Balance Journals. Beginning balances are assumed to have been established through a Beginning Balance Journal. Beginning balances will always refer to the beginning balance of the first period of the entered Fiscal Year. For more information about Beginning Balance Journals, please refer to Closing Rules - Journal Options Page. |

Ledger Code |

Enter the ledger code, if applicable. Note: This field is only available for entry if the Book Code Feature is enabled on the Installation Options - Overall page. For more information about Book Codes and Ledger Codes, please refer to Understanding PeopleSoft ChartFieldsEntering and Maintaining ChartField Values |

Report By |

Select Account or Alternate Account as shown on the FEC Setup Accounts page. When you report by account, you must have Accounts populated in the FEC Accounts table. Likewise, you must have Alternate Accounts populated in the FEC Accounts table when you report by alternate account. |

Fiscal Year |

Enter a fiscal year from which to select data. |

Detail/Summary |

Select Summary only if your company is exempted from reporting transaction details. Otherwise, select Detail. If you select the Detail option, accounting transactions will be reported from the product accounting transaction tables (and from the Journal tables for transactions entered manually within General Ledger). If the Summary option is chosen, summarized accounting information from the General Ledger Journal tables will be reported for all products. |

From Period |

Enter a starting accounting period from which to export data. |

To Period |

Enter an ending accounting period from which to export data. |

Extract Data |

Select this check box to extract data into staging tables. You must first extract the data into staging tables, from where it can be exported into the FEC audit file. Selecting this option separately from the Generate File option allows you to distribute the workload over several processes. For example, you can extract the data first for specific products and for specific periods before exporting the data into the FEC audit file, in a different process. |

Generate File |

Select this check box to extract data from staging tables into an output file. You must first extract the data into staging tables, from where it can be exported into the FEC audit file. Selecting this option separately from the Extract Data option allows you to distribute the workload over several processes. For example, you can run an individual process that will only export the data from the staging tables after you have previously loaded the data into the staging tables through one or several separate processes. |

Include Field Names |

Select this check box to include field names in the first line of the final output file. |

File Name |

Enter a name for the final output file, along with the .CSV suffix, as part of the file name; this action is mandatory. The Process Scheduler determines the path for this file. The file produced by the export process is a delimited file, using the | character as the delimiter. For more information, please refer to “PeopleCode Built-in Functions and Language” in PeopleTools: PeopleCode Language Reference. |

You must enter the correct file name in the prescribed format, SirenFECYYYYMMDD_AB, where Siren corresponds to the Legal Company Number of the organization. Following are examples for FEC audit file names (123456789 to be replaced by your SIREN number):

123456789FEC20131231_01 : Accounting entries for the January accounting period of the fiscal year that ended on December 31, 2013.

123456789FEC20131231_02: Accounting entries for the February accounting period of the fiscal year that ended on December 31, 2013.

123456789FEC20131231_Q1: Accounting entries for the first quarter of the fiscal year that ended on December 31, 2013.

Note: French Tax authorities require amount fields in the FEC French Audit File to include a comma as a decimal separator and no thousands separator. You must make this change on the Personalize Regional Settings page.