Obtaining D and B Credit Reports

To enter D&B report information, use the D&B component (CUSTOMER_DB).

This section provides an overview of D&B report processing, lists prerequisites, lists common elements, and discusses how to view various related information and link customers to DUNS numbers.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DB_LOOKUP_ORDER |

Retrieve online information from the Dun & Bradstreet database, order Dun & Bradstreet reports, and update the PeopleSoft database. |

|

|

Operations Page |

DB_OPERATIONS |

Enter or review operational information such as demographics, business associations, or relationships. View a list of customers who are associated with a DUNS number. |

|

Credit Profile Page |

CUST_CREDIT_PRFL1 |

Review credit profile information for the customer. |

|

CUST_GENERAL2 |

Link new DUNS numbers to customers. |

|

|

DB_CREDITNRISK |

Enter or review credit and risk information. |

|

|

DB_FINANCIALS |

Enter or review financial statement information for the current and previous periods. |

|

|

DB_REPORT_TEXT |

View entire Dun & Bradstreet reports in text format. |

The Dun & Bradstreet interface enables you to automatically update Dun & Bradstreet information online and link it to a customer. Use the XML Data Integration Toolkit that Dun & Bradstreet provides and PeopleSoft Integration Broker to enable the interface.

When you use the interface to request a report, the system publishes the DNB_REQUEST_MESSAGE message to Dun & Bradstreet. When Dun & Bradstreet returns the report information, they publish the DNB_REPLY_MESSAGE message. The system populates the Customer Dun & Bradstreet (PS_CUST_DB) and Dun & Bradstreet Reports (PS_DB_REPORTS) tables with the report information.

Dun & Bradstreet sends a bill for each Dun & Bradstreet report that you order. Users should know which reports the organization uses because some reports cost more than others. The PeopleSoft interface enables users to download these report types:

Business Verification

Quick Check

Financial Standing

Delinquency Score

Decision Support

Enterprise Management

Commercial Credit Score (USA)

When you purchase a report for a specific DUNS number, you see the last time that you purchased a report for that DUNS number and which report you purchased.

Review each report for a specific DUNS number using the Dun & Bradstreet component (CUSTOMER_DB). Only the key fields appear in the reports on the Operations, Credit and Risk, and Financials pages. If you want to view the entire report in text format, use the Full Text Report page. Also, some reports might not populate all of the fields. Associate the report with a customer on the Dun and Bradstreet - Operations page.

Note: If you do not use the Dun & Bradstreet interface, you can manually enter information for a Dun & Bradstreet report in the Dun & Bradstreet component.

To review a Dun & Bradstreet report that is associated with a customer, access the report from the Credit Profile - General page or the Account Overview - Profile page.

If needed, create a unique logon to the Dun & Bradstreet database for each SetID so you can have separate billing accounts for different areas of the organization.

Note: When you implement the PeopleSoft Receivables system, you may have existing Dun & Bradstreet information that you want to convert to the Receivables system. Use the Dun & Bradstreet component interface (CUSTOMER_DB_CI) and the PeopleSoft Excel to Component Interface utility to populate data in the Dun & Bradstreet tables.

Perform these tasks before using the Dun & Bradstreet interface:

Establish a Dun & Bradstreet account to obtain a Dun & Bradstreet (D&B) user ID and password, and arrange to access D&B data using the D&B Data Integration Toolkit.

Enable the Dun & Bradstreet interface on the Installation Options - Overall page.

Set up a unique logon to the Dun & Bradstreet database by SetID for each Dun & Bradstreet account on the D&B Account page.

Activate the DNB_REQUEST_MESSAGE and DNB_RESPONSE_MESSAGE messages in PeopleSoft Application Designer.

You must also use Integration Broker to set up the integration point. The PeopleTools documentation provides information about setting up integration points. This section discusses the specific information that you must enter to enable the integration:

Create a gateway definition using the Gateways component (IB_GATEWAY) in PeopleSoft Integration Broker.

Create a remote node for the Dun & Bradstreet connection using the Nodes component (IB_NODE).

Set these parameters on the On the Node Definitions - Connectors page:

Enter HTTPTARGET in the Connector ID field.

If you need to set a location, enter Location in the Property Name field and enter request in the associated Value field.

Add another row, and enter URL in the Property Name field and enter http://toolkit.dnb.com/access/script/broker.asp in the associated Value field.

Note: Verify with Dun & Bradstreet that this URL is correct.

Create an outbound synchronous transaction for the node on the Node Definitions - Transactions page.

Enter DNB_REQUEST_MESSAGE, in the Request Message field on the Transactions page.

Enter DNB_RESPONSE_MESSAGE for the response message in the Message Name field on the Messages page.

Create a relationship between the local node and the remote node that you have just created using the Relationships component (IB_RELATIONSHIP).

Enter DNB_CONVERT in the Relationship ID field when you add the relationship on the Relationship Transactions page.

Enter DNB_TRANSFM in the Request field in the Transformations group box on the Transaction Modifiers page.

See the product documentation for PeopleTools: Integration Broker, PeopleTools: Component Interfaces

Field or Control |

Description |

|---|---|

Product |

Select the Dun & Bradstreet report type. Values are: Business Verification: Verifies that the business is a valid entity. Credit Score (USA): Checks the score that corresponds to a delinquency performance. Decision Support: Checks for summary updates, but no credit investigation is available. Delinquency Score: Contains values that cannot be calculated. Enterprise Management: Checks who owns and manages the business, such as a social, state owned, free trade zone, or collectivity owned. Financial Standing: Checks business financial strength. Quick Check: Checks customer credit ratings. |

Purchase Dun and Bradstreet Information |

Click to access the DB Lookup and Order page and purchase a Dun & Bradstreet report. |

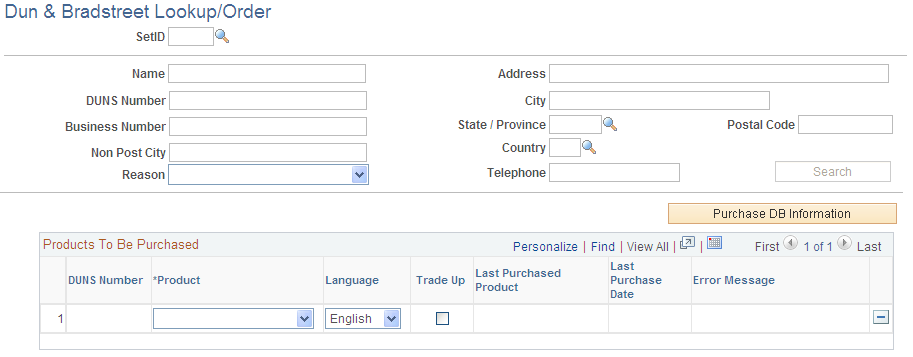

Use the Dun & Bradstreet Lookup/Order page (DB_LOOKUP_ORDER) to retrieve online information from the Dun & Bradstreet database, order Dun & Bradstreet reports, and update the PeopleSoft database.

Navigation:

Click the Purchase Dun and Bradstreet Information link on the Dun and Bradstreet - Operations page or the other pages in the Dun and Bradstreet component.

This link is available only if you enable the Dun & Bradstreet interface on the Installation Options - Overall page.

Click the Search or Purchase D & B Info link on the Additional General Info page or the Credit Profile page for a customer.

This example illustrates the fields and controls on the Dun & Bradstreet Lookup/Order page. You can find definitions for the fields and controls later on this page.

Searching the Dun and Bradstreet Database

Enter search criteria for DUNS numbers. You must enter at least the DUNS number or address information.

Field or Control |

Description |

|---|---|

Name |

Enter the legal name for the business. |

DUNS Number |

Enter the identification number assigned by Dun & Bradstreet to identify a business. |

Business Number |

Enter the business identification number assigned to the business by a government agency. |

Non Post City |

Enter the name of the town in which the business is located if it differs from the town that the postal service lists. This field does not apply to all countries. |

(DEU) Reason |

Enter the reason the report is being purchased: Commercial Credit: Select to check a commercial customer's credit. Credit Check - Ongoing Business: Select to check an existing commercial customer's credit. Credit Decision: Select to view a summary of decisions that were made on credit history. Debt Collection: Select to check credit because of past or current debt collection. Insurance Contract: Select to check credit because of a signed insurance contract. Leasing Agreement: Select to check credit because of a signed lease agreement. Rental Agreement: Select to check credit because of a signed rental agreement. Note: This field is required only for Germany. |

Search |

Click to obtain a list of DUNS numbers from the Dun & Bradstreet database that match the search criteria. |

Purchasing Dun & Bradstreet Reports

To purchase a report:

In the Search Results grid, select the DUNS numbers for which you want to purchase a report.

The system automatically moves the DUNS number to the Products to be Purchased grid.

In the Product field, select the report type that you want to purchase.

Only report types that are available for the DUNS number appear. Select Trade Up to purchase the report for the ultimate parent company.

Note: If you have previously purchased a report for the DUNS number, the last report type purchased and the date appear.

Click the Purchase DB Information button.

A confirmation message appears.

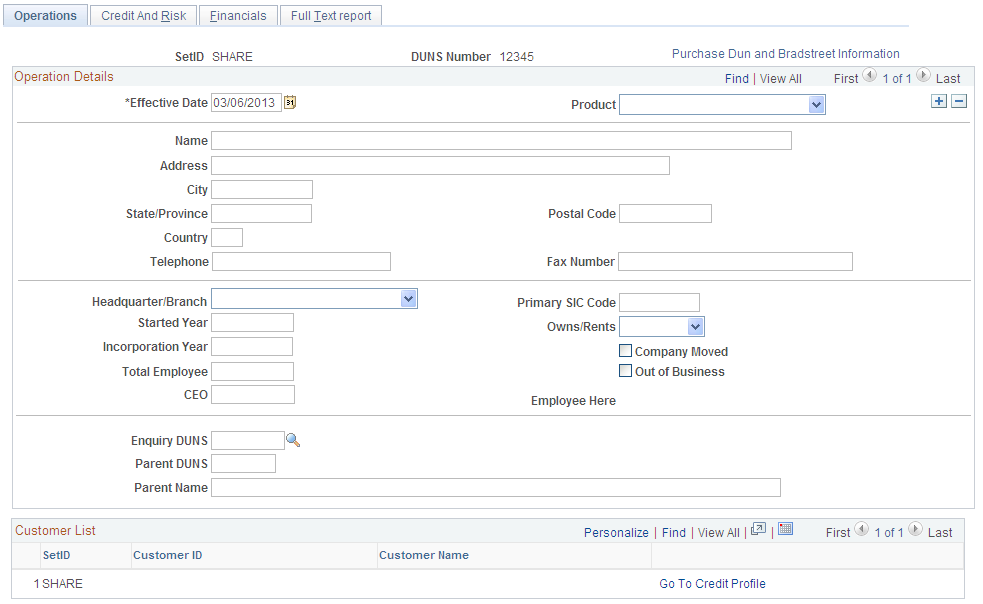

Use the Dun & Bradstreet Operations page (DB_OPERATIONS) to enter or review operational information such as demographics, business associations, or relationships.

View a list of customers who are associated with a DUNS number.

Navigation:

This example illustrates the fields and controls on the Operations page. You can find definitions for the fields and controls later on this page.

The Dun & Bradstreet interface populates the values on this page. If you do not use the interface, you can enter information manually.

Field or Control |

Description |

|---|---|

Headquarter/Branch |

Select the value that indicates whether the organization is a parent or a subsidiary location. Values are: Headquartr (headquarters), Branch, or Single Loc (single location). |

Primary SIC Code (primary standard industrial classification code) |

Enter a SIC code, which is an index that describes the function (manufacturer, wholesaler, retailer, or service) and the line of business in which the company is engaged. |

Started Year |

Enter the year in which the entity commenced present operations. If the entity was formed to acquire or continue a preexisting entity's operations, then the start date may reflect this original start date. |

Owns/Rents |

Select a value that indicates whether the premises at the physical address are owned or rented. Values are Co-Owns, Leases, Other, Owns, Rents, Shares, or Utilizes. |

Incorporation Year |

Enter the year in which the business incorporated. The incorporation year may not be the same as the year in which the business started. |

Total Employee |

Enter the total number of employees, including staff at branches, divisions, and subsidiaries located elsewhere. |

Company Moved |

Select if the business has moved. |

Out of Business |

Select if the business is no longer active at this location. |

Employee Here |

Enter the total number of employees at the headquarters location. |

Enquiry DUNS |

Enter the number assigned by Dun & Bradstreet to identify a business. |

Parent DUNS |

Enter the number assigned by Dun & Bradstreet to identify the parent company. |

Parent Name |

Enter the name of the company that has a majority interest in the business. The subject business is known as a subsidiary. |

Customer List

A list of customers who are associated with the DUNS number appears in the Customer List grid.

Field or Control |

Description |

|---|---|

Go To Credit Page |

Click to access the Credit Profile - General page and view credit information for a customer who is linked to the DUNS number, or link another customer to a DUNS number. |

Use the Credit And Risk page (DB_CREDITNRISK) to enter or review credit and risk information.

Navigation:

This example illustrates the fields and controls on the Credit and Risk page. You can find definitions for the fields and controls later on this page.

The Dun & Bradstreet interface populates the values on this page. If you do not use the interface, you can enter information manually.

Field or Control |

Description |

|---|---|

Bankruptcy |

Select if the organization is in bankruptcy. |

Suits |

Select if the organization has lawsuits in the Dun & Bradstreet database. |

Liens Present |

Select if the organization has open liens in the Dun & Bradstreet database. |

Judgement Indicator |

Select if the organization has open suits, judgments, petitions, or payment remarks in the Dun & Bradstreet database. |

3 mons Paydex (three months Paydex) |

Enter the Dun & Bradstreet payment score (Paydex) from three months ago. |

Comment |

Enter additional text about the three-month Paydex score. |

Paydex Norm |

Enter the industry median or average Dun & Bradstreet Paydex score. |

Prior Year Paydex Rating |

Enter a dollar-weighted score that indicates how the organization has paid its bills over the last 12 months. The prior year Paydex rating represents how the organization paid its bills in the previous year or previous 12 to 24 months. |

Credit Risk Score |

Enter the credit risk numeric score that is a translation of the risk of delinquent payment over the next 12 months. |

Credit Score Percent |

Enter the percentile rank that indicates where the organization falls among organizations in the Dun & Bradstreet U.S. database. The percent is based on a 1 to 100 scale, where 1 represents organizations with the highest probability of delinquency and 100 represents organizations with the lowest probability of delinquency. |

Explanation |

Enter the literal explanation of the credit risk numeric score, which explains the risk of delinquent payment over the next 12 months. |

Rating |

Enter the code that Dun & Bradstreet assigns to a company that consists of a composite capital and credit rating. |

Score Date |

Enter the date on which the credit risk score was calculated. |

Score Class |

View the risk of delinquent payments over the next 12 months, as indicated by a number from 0 to 5. |

Commercial Score |

Enter the numeric score that corresponds to the delinquency performance. |

High Score |

Enter the high range of the commercial credit score for which an incidence of delinquency percentage could be linked. If the range is 240 to 280, the high range score is 280. |

Highest Credit |

Enter the highest account balance during the past 12 months. |

Low Score |

Enter the low range of the commercial credit score for which an incidence of delinquency percentage could be linked. If the range is 240 to 280, the low range score is 240. |

Average High Credit |

Enter the median of the highest credit extended over the past 12 months. To calculate this value, divide the sum of all of the high credit dollar amounts by the total number of account experiences. |

All Firms PCTG (all firms percentage) |

Enter the delinquency percentage for the company as it relates to all firms in the Dun & Bradstreet U.S. database. |

Range PCTG (range percentage) |

Enter a delinquency percentage as it relates to a specific commercial credit score range. |

Commentary |

Enter an explanation about the conditions affecting the score. |

Total Payment Experience |

Enter the total number of payment experiences in the Dun & Bradstreet database for the organization. |

Past Due Amount and Past Due Payments |

Enter the sum of past due dollar amounts. |

Negative Comments |

Enter the total number of payment experiences with negative comments in the payment notes. |

Slow Payments |

Enter the conditional comment that is generated when the Paydex score is used or slow payment experiences are present. |

Failure Risk Score |

Enter the score that predicts the likelihood of a firm going out of business without paying all creditors in full over the next 12 months. |

Failure Risk Score Nat Percent (failure risk score national percent) |

Enter a percent that places the organization in a 1 through 100 rank order; 1 is the highest risk and 100 is the lowest risk. The percent means that the organization scores better than a percent of organizations available in the Dun & Bradstreet U.S. database. |

(USA) Failure Risk Score Commentary |

Enter text that explains the conditions that drive the score that is assigned to the organization. This field is available only in the U.S. |

(AUS) Failure Risk Score Ovrd Code (failure risk score override code) |

Enter a score for Australian organizations when the delinquency score is a special value (0, 893–895) or cannot be calculated. |

Small Business |

Select if the Small Business Administration (SBA) classified the organization as a small business. |

8(A) Firms |

Select if the SBA classified the organization as a socially or economically disadvantaged small business. |

Debarments Date and Debarments Count |

Enter the number of the U.S. government debarments that are present in the Dun & Bradstreet database and the date of the most current debarments filing. |

Minority Owned |

Select if the organization is classified as minority owned. |

Woman Owned |

Select if the majority of the organization is owned by a woman. |

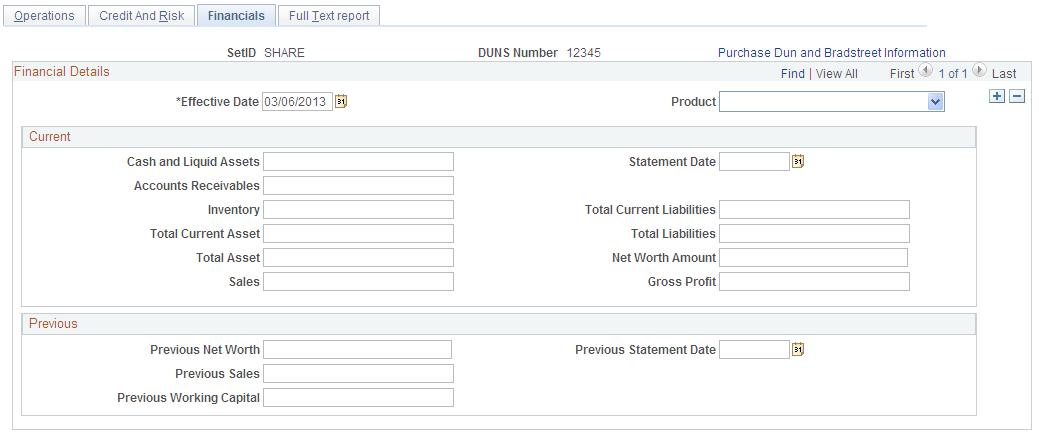

Use the Financials page (DB_FINANCIALS) to enter or review financial statement information for the current and previous periods.

Navigation:

This example illustrates the fields and controls on the Financials page. You can find definitions for the fields and controls later on this page.

The Dun & Bradstreet interface populates the values on this page. If you do not use the interface, you can enter information manually.

Field or Control |

Description |

|---|---|

Cash and Liquid Assets |

Enter the amount of cash on hand and in banks. |

Statement Date |

Enter the date of the current financial statement. |

Accounts Receivables |

Enter the total amount of accounts receivable. |

Inventory |

Enter the amount of merchandise on hand. The amount may also include work in progress and raw materials minus depreciation. |

Total Current Liabilities |

Enter the total amount of all current liabilities that are less than one year old. |

Total Current Asset |

Enter the total amount of all current assets that are less than one year old. |

Total Liabilities |

Enter the total amount of liabilities. |

Total Asset |

Enter the total amount of current and long term assets. |

Net Worth Amount |

Enter the total amount of equity, which can include stock. |

Sales |

Enter the amount of net sales for the period after returns, allowances, and discounts are deducted. In Europe, this amount is the sales for the period less taxes. |

Gross Profit |

Enter the amount that remains after deducting the cost of goods sold from net sales. |

Previous Net Worth |

Enter the amount of net worth minus intangibles in the last financial statement. The amount may be negative to reflect a deficit net worth position. |

Previous Statement Date |

Enter the date of the previous financial statement. |

Previous Sales |

Enter the amount of net sales for the previous statement. |

Previous Working Capital |

Enter the amount of current assets minus current liabilities for the previous statement. |

Use the Full Text Report page (DB_REPORT_TEXT) to view entire Dun & Bradstreet reports in text format.

Navigation:

Field or Control |

Description |

|---|---|

Report Text |

View the full text of the Dun & Bradstreet report. This text is not available if you did not obtain the report using the Dun & Bradstreet interface. |

Use the Additional General Info page (CUST_GENERAL2) to link new DUNS numbers to customers.

Navigation:

Click the Additional General Info link on the Credit Profile page.

Field or Control |

Description |

|---|---|

Standard ID Qualifier and DUNS Number elements, descriptionstype (additional customer information) elements, descriptionsDUNS number (additional customer information) |

Select DUNS Number With Edit to associate the customer with a DUNS number in the system and enter the DUNS number. |