Defining MICR IDs

To define customer MICR IDs, use the Customer MICR Information component (CUSTOMER_MICR).

This section provides an overview of MICR IDs.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CUSTOMER_MICR |

Enter MICR IDs and associate them with remit from customers. |

|

|

CUSTOMER_MICR2 |

Enter additional bank information for specific customers. |

Every bank account has an associated MICR ID. Because customers may use multiple bank accounts, you can associate a customer with more than one MICR ID. A MICR ID is one way in which Payment Predictor identifies customers and can be used as the basis for building payment and maintenance worksheets.

The MICR pages are optional: use them if the lockbox interface provides a MICR ID for customer identification or if you regularly use MICR IDs for identification. If you perform direct debit or electronic draft processing, you can use these pages to define customer bank account information used for remittance processing.

Use the MICR Information - Address page (CUSTOMER_MICR) to enter MICR IDs and associate them with remit from customers.

Navigation:

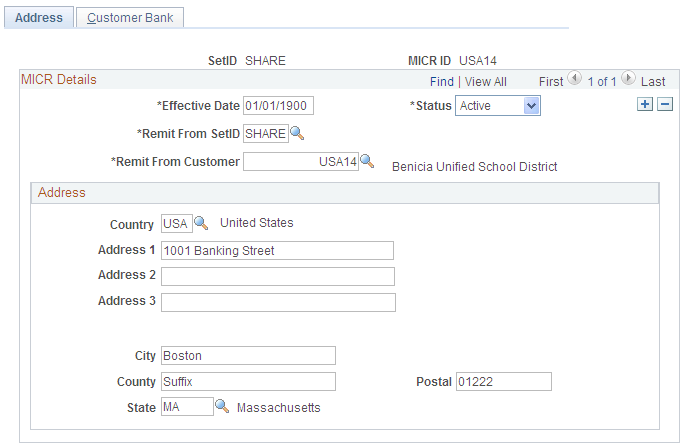

This example illustrates the fields and controls on the MICR Information - Address page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Effective Date |

MICR ID information is keyed by effective date to enable you to keep a history of changes that you make and enter changes that will go into effect on some future date. |

Remit From Customer |

Select the SetID and the customer ID of the remit from customer to enable Payment Predictor to select items from more than one customer based on the MICR ID. Because a remit from customer is the paying entity, you link MICR IDs to remit from groups rather than to individual customers. Every customer is its own remit from customer if it does not belong to a larger remit from group. |

Address |

If a customer that is enabled for draft processing will use this MICR ID and the bank interface requires the draft bank address, then enter that address in the fields in this group box. Otherwise, this information is optional and not used in any Receivables processing. |

Note: During processing, you may discover a payment with a MICR ID that does not match any customer in the system. If you have additional information that is associated with the payment that positively identifies the remit from customer, then link the MICR ID to the customer by clicking the Link MICR link on the Regular Deposit Entry - Payments page or the Worksheet Selection page.

Use the MICR Information - Customer Bank page (CUSTOMER_MICR2) to enter additional bank information for specific customers.

Navigation:

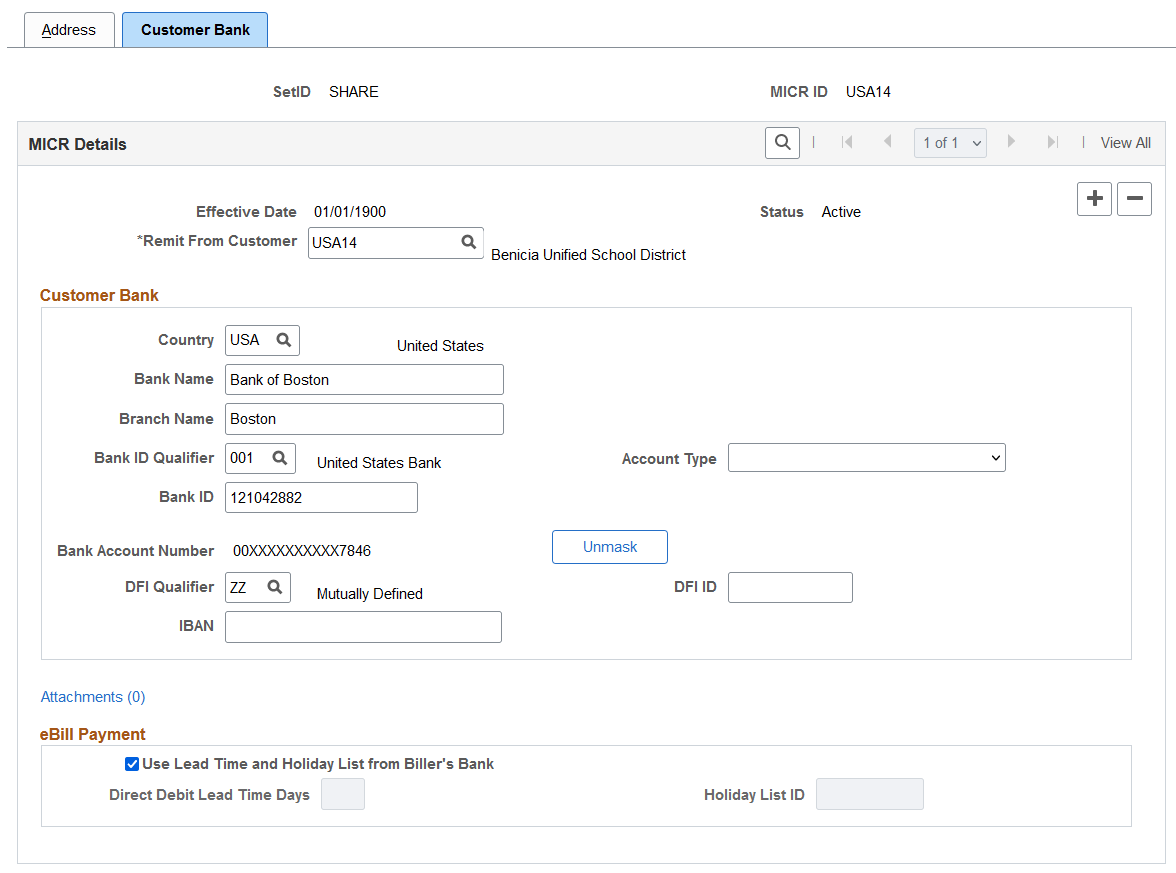

This example illustrates the fields and controls on the MICR Information - Customer Bank page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Effective Date, Status, and Remit From Customer |

View data from the MICR Information - Address page. |

Remit From Customer |

For each MICR ID that you set up for the customer, enter the bank account information to process direct debits and drafts electronically. This action associates the bank account details with the remit from customer and the MICR ID that you enter on the MICR Information - Address page. |

Country |

View data from the MICR Information - Address page and define where the bank is located. Depending on the country, you may be required to enter different information to identify the customer's bank account. |

Bank Name Alt Characters (bank name alternate characters) |

If you have enabled alternate character sets for the user, the Bank Name Alt Characters button appears next to Bank Name. Click to enter each name in alternate characters. Note: To activate alternate characters, set the User Preferences to use alternate characters on the User Preferences - Overall Preferences page. |

Bank ID Qualifier |

Defines which fields are required for the customer's bank and the editing rules for each field. For example, you may be required to enter a bank ID with five characters for the French Bank (009). System-defined qualifiers are provided for each country; review them on the Bank ID Qualifiers page. See the product documentation for PeopleSoft Banks Setup and Processing. |

Bank Identifier Code |

Enter a bank identifier code (BIC) for this bank branch. This code is based on the ISO standard (9362), which is the universal method used to identify the financial institutions that enable automated processing of payments. A BIC code is used to route cross-border and some domestic payments to a bank branch or payments center. SEPA requires the use of BIC and IBAN codes to uniquely identify the creditor's and debtor's banks and bank accounts in all Euro cross-border payments. The IBAN and BIC codes must be correct to avoid repair fees that the bank charges due to processing errors and to avoid delays in processing payments and collections due to the correction of these errors. Once you enter a BIC code, the system validates the length and layout of the characters, and it validates the BIC country code against the country code set up for the bank branch. |

Bank ID |

Identifies the bank. |

Branch ID |

Depending on the bank ID qualifier, you may need to enter a check digit for the account number and a corresponding branch ID. |

Account Type |

Select a value:

|

|

Bank Account Number |

Enter bank account number. If you set up bank account encryption, account numbers are masked when you save the page. You can edit the bank account numbers using the Unmask button. For more information about bank account number encryption and the National Automated Clearing House Association (NACHA) data security requirements, see Understanding Bank Account Encryption and Setting Up Bank Account Encryption. |

|

Unmask |

Select to unmask the bank account number. |

To conduct EFT transfers using this account, you may need to provide the appropriate routing information for the depository financial institution (DFI).

Field or Control |

Description |

|---|---|

DFI Qualifier |

Select to identify the bank using its DFI ID and enter the associated DFI ID. The DFI qualifier specifies the format and how many characters and numerals are used in the bank's DFI ID. |

Attachments |

Click this link to access the Customer MICR Attachments page, where MICR attachments can be uploaded, viewed, and deleted. |

Use Lead Time and Holiday List from Biller's Bank |

Select this option to use the lead time days and holiday list based on the Biller's bank account. The Lead Time and the Holiday List should come from the same source, either both from MICR ID or both from Biller's Bank account because the customer and biller's bank may be in different countries with different holiday schedules. Lead Time and Holiday List entered in MICR ID will be used when Use Lead Time and Holiday List from Biller's Bank is not selected. When Use Lead Time and Holiday List from Biller's Bank is selected, Lead Time and Holiday List fields in MICR ID will be disabled and it will be ignored by the process. |

Direct Debit Lead Time Days |

Enter the number of lead time days. Default value for Lead Time Days is zero. |

Holiday List ID |

Enter the Holiday List ID for the customer's bank account. |

Each DFI ID type has a specific number of digits that you can enter, as listed in this table:

|

DFI Qualifier |

DFI ID |

|---|---|

|

Transit Number |

Exactly nine numerals, plus check digit calculation. |

|

Swift ID |

Eight or 11 characters; positions five and six must comprise a valid two-character country code. |

|

CHIPS ID |

Three or four numerals. |

|

Canadian Bank Branch/Institute |

No validation. |

|

Mutually Defined |

No validation. |