Administering Statement Information

This topic discusses how to update bank balances and bank transaction entries, enter funds availability, and review addenda information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BANK_BALANCE_ENTRY |

Enter bank account balance information. |

|

|

BNK_STMT_ENTRY |

Enter bank transaction and addenda information for a specific bank statement ID. View parsed addenda information. |

|

|

BANK_FLOAT_BAL_SEC |

Enter one-day and two-day float for a bank statement deposit entry item. The Funds Availability page is available for deposit transactions only. |

|

|

BANK_ADDENDA_SEC |

View and edit addenda detail information that is associated with a statement transaction. View parsed addenda information. |

Once you transfer bank statement information to the production tables, you can update the data by using the Bank Balance Entry and Bank Transaction Entry pages.

If you do not receive bank statements electronically from the bank, you also use the same pages to manually enter bank statement information online.

Use the Bank Balance Entry page (BANK_BALANCE_ENTRY) to enter bank account balance information.

Navigation:

Click the View Bank Statement icon on the Book to Bank Reconciliation Details page.

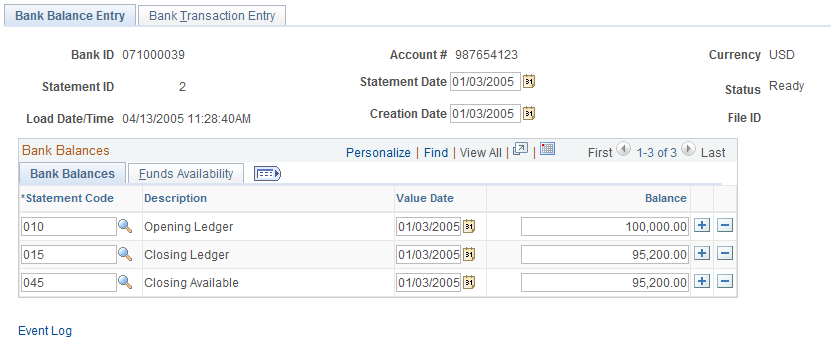

This example illustrates the fields and controls on the Bank Balance Entry page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

File ID |

Displays the bank statement number provided by the bank. This field is populated during import of MT940, BAI2, and FINSTA statements and is display-only. The user cannot change the File ID for a bank statement that has been loaded into the system. When you manually create a new bank statement, you can enter the File ID value. The File ID value appears as display-only during update mode. |

Bank Balances

Enter the statement code, value date, and balance amount for each item. If you receive bank statements electronically, the system populates these fields.

Note: The system balances the opening and closing ledger amounts with the sum of the daily transactions and displays a warning message if the amounts are unbalanced. It uses the default balance codes 010 - OPENING BALANCE and 015 - CLOSING BALANCE. If your organization uses different balance codes, you must edit the following with your preferred default code values: the component BANK_BALSTMT_ENTRY, the record BNK_RCN_CYC, and Saveedit PeopleCode.

Field or Control |

Description |

|---|---|

Statement Code |

Determines the type of balance that is being entered. The system uses these balances for various bank features and processes, such as the cash position worksheet. |

Balance |

Enter the total amount of funds that are available on the specified value date. |

Funds Availability

Field or Control |

Description |

|---|---|

Available Balance |

Displays the portion of the balance amount that is immediately available for use. Differences between the balance and available balance amounts are generally due to deposits (credits) that have not yet cleared the bank. |

One Day Float |

Stores the one-day float information that is provided by you or the bank. |

Two+ Day Float (two or more day float) |

Stores the two (or more) day float information that is provided by you or the bank. |

Use the Bank Transaction Entry page (BNK_STMT_ENTRY) to enter bank transaction and addenda information for a specific bank statement ID. View parsed addenda information.

Navigation:

Select Enter Bank Statements in the Go To list on the Bank Statement Manager page.

Click theView Bank Statement icon on the Book to Bank Reconciliation Details page and select the Bank Transaction Entry tab.

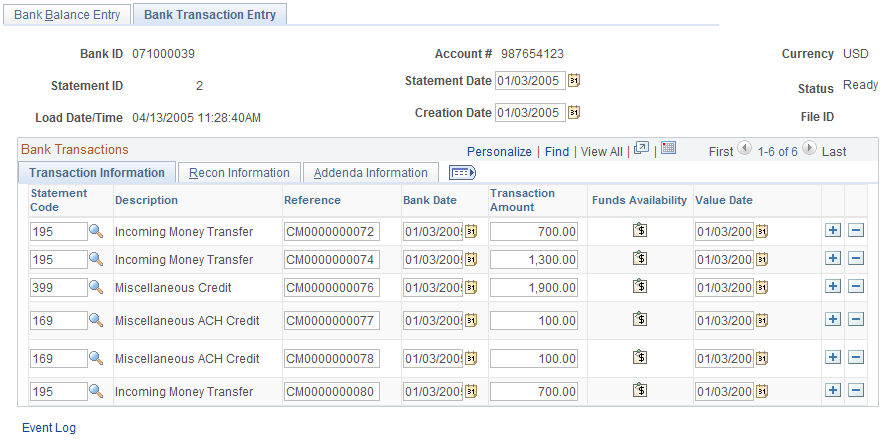

This example illustrates the fields and controls on the Bank Transaction Entry page. You can find definitions for the fields and controls later on this page.

The system populates the transaction information on this page when you load statements electronically; you can edit them if needed.

Field or Control |

Description |

|---|---|

File ID |

Displays the bank statement number provided by the bank. This field is populated during import of MT940, BAI2, and FINSTA statements. This field is display-only; you cannot change the File ID for a bank statement that has been loaded into the system. When you manually create a new bank statement, you can enter the File ID value. The File ID value appears as display-only during update mode. |

Transaction Information

Field or Control |

Description |

|---|---|

Statement Code |

Select a statement code to indicate if the transaction is a debit or a credit. This value determines the default transaction code and statement activity type that is on the Recon Information grid. |

Reference |

Enter a transaction reference number. |

Bank Date |

Select the entry date of the transaction. The default is the statement date. |

|

Click this icon to enter available funds information for bank deposit transactions. |

Value Date |

Enter the date that the bank recorded the transaction. The default is the statement date. |

Recon Information

Field or Control |

Description |

|---|---|

Trans Code (transaction code) |

Identifies the type of transaction in a bank statement, such as bill orders, deposits, direct debits, drafts, fees, payments, receipts, and voided transactions. Other transaction values are: Automated Clearing House Bank Adjustments Bill of Exchange - Disburse Bill of Order - Disburse Check Deposits Direct Debit Direct Debit - Disburse Drafts Electronic Funds Transfer Fee Expense Funding Receipt General Transaction Interest Expense Manual Check Miscellaneous Transaction Payment Stop Pay Trade Receipt Voided Payment Wire - Disbursement Wire - Incoming |

Recon Status (reconciliation status) |

Select a status for the transactions. If you import this statement data, the system initially sets the row to Unreconciled. If you then run Cash Management Bank Statement Accounting functionality, the functionality reconciles those specific transactions that match predefined rules and changes their status to Reconciled. |

Activity Type |

Select a statement activity type. This identifies a transaction to be processed by a specific accounting template. |

Addenda Information

Field or Control |

Description |

|---|---|

Expanded Addenda |

Click this link to access the Bank Addenda Detail page and view addenda detail information that is transmitted from the bank for this item, including parsed addenda information. You can also view this information in the Addenda field, by using the scroll arrows. For more information about parsed addenda information, see Understanding How to Parse Bank Statement Addenda. |

Use the Funds Availability page (BANK_FLOAT_BAL_SEC) to enter one-day and two-day floats for a bank statement deposit entry item.

Navigation:

Click the Funds Availability icon on the Bank Transaction Entry page.

For a bank statement deposit item, enter amounts in the Available Balance, One Day Float, and Two Day Float fields.

Use the Bank Addenda Details page (BANK_ADDENDA_SEC) to view and edit addenda detail information that is associated with a statement transaction. View parsed addenda information.

Navigation:

Click the Expanded Addenda link on the Addenda Information tab of the Bank Transaction Entry page.

Click the Expanded Addenda link on the Bank Statement Manager page.

The Addenda field can store up to 254 characters, and each value in the Seq No (sequence number) field corresponds to a Text field. If the addenda information is more than 254 characters long and contained in multiple text fields, the sequential numbering keeps the addenda message in the correct processing order.

Funds Availability

Funds Availability