Establishing Accounting Rules for Lease Administration

This topic discusses how to define lease administration accounting rules for lease administration.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CA_ACCT_RULES |

Define accounting rules for transaction destinations and transaction groups for lease transactions. |

Use the Accounting Rules for Lease Administration page (CA_ACCT_RULES) to define accounting rules for transaction destinations and transaction groups for lease transactions.

Navigation:

Set Up Financials/Supply Chain, Product Related, Lease Administration, LA Accounting Rules

Note: When you add a new accounting rule for a lease administration business unit, you should use the same general ledger business unit that you selected on the Lease Administration Business Unit Definition - General page in the General Ledger field for that lease administration business unit.

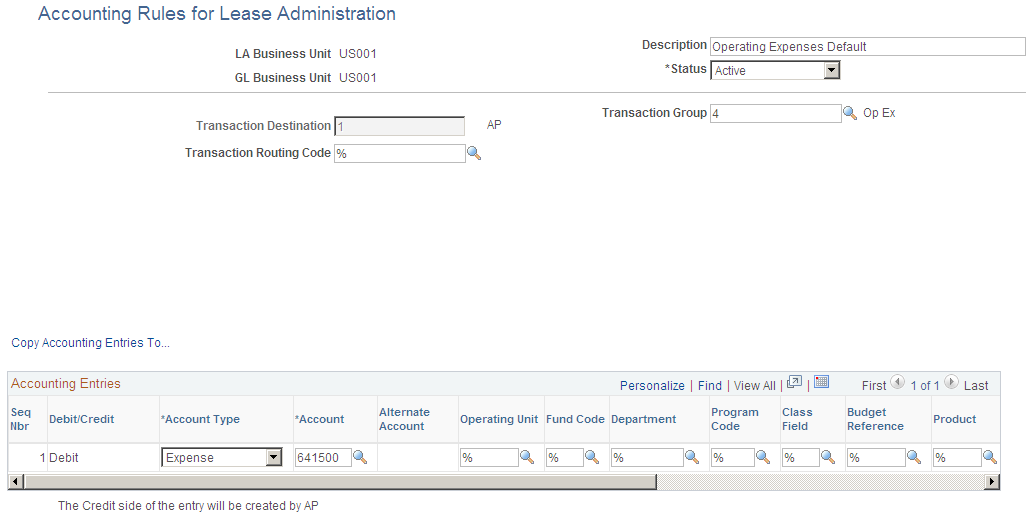

This example illustrates the fields and controls on the Accounting Rules for Lease Administration page (partial). You can find definitions for the fields and controls later on this page.

When you define the lease administration accounting rules, you must keep in mind that the lease administration business unit can only be mapped to a single general ledger business unit. PeopleSoft Lease Administration does not support interunit accounting, therefore, only the accounting rules defined for the lease administration business unit and general ledger business unit combination can be used to generate accounting entries. For example, the lease administration business unit of US001 mapped to general ledger business unit US001 uses only those accounting rules that are defined by this business unit combination. Accounting rules defined for any other business unit combination cannot be used for processing.

Field or Control |

Description |

|---|---|

Transaction Destination |

Enter the destination where the transaction is sent. The value that you enter determines the accounting rules for an expense or revenue transaction. Values are: AP (PeopleSoft Payables): If the transaction destination is AP, then PeopleSoft Payables uses the accounting rule that you define. When the transaction goes to PeopleSoft Payables, the accounting rule specifies the expense debit side of the accounting entry. BI (PeopleSoft Billing): If the transaction destination is BI, then PeopleSoft Billing uses the accounting rule that you define. When the transaction goes to PeopleSoft Billing, the accounting rule specifies the revenue credit side of the accounting entry that the transaction needs to offset the PeopleSoft Receivables side of the entry that they create. GL (PeopleSoft General Ledger): If the transaction destination is GL, then PeopleSoft General Ledger uses the accounting rule that you define. When the transaction goes to PeopleSoft General Ledger, the accounting rule specifies the expense debit side of the accounting entry. |

Transaction Group |

Select the transaction group to define the type of transactions being sent to create the proper journal entries. Possible values for this field are Base Rent, Security Deposit, Straightline Accounting, Operating Expense, Miscellaneous Expense, Manual Fee and Percent Rent. |

Transaction Routing Code |

Select the transaction routing code. You can define unique accounting rules by specifying the transaction routing code for a specific transaction group. |

Copy Account Entries To |

Click to copy accounting rules to create a new accounting rule. |

Accounting Entries

Use the fields in this group box to define your accounting entries for your lease transactions. By using the % (wildcard), the system accepts the default entries for that field.

Field or Control |

Description |

|---|---|

Debit/Credit |

Displays whether the accounting entry is a debit or credit. This field corresponds with the value that you selected in the Account Type field. |

Account Type |

Select the account type for this accounting entry. |

Account |

Enter the account number for the account type. |