Establishing Period Calculation Factors

To establish period calculation factors, use the Period Calculation Factors component (PROJ_INT_DETP).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PROJ_INT_CAL_DETP |

Define period calculation factors for specified time periods. |

Use the Period Calculation Factor page (PROJ_INT_CAL_DETP) to define period calculation factors for specified time periods.

Navigation:

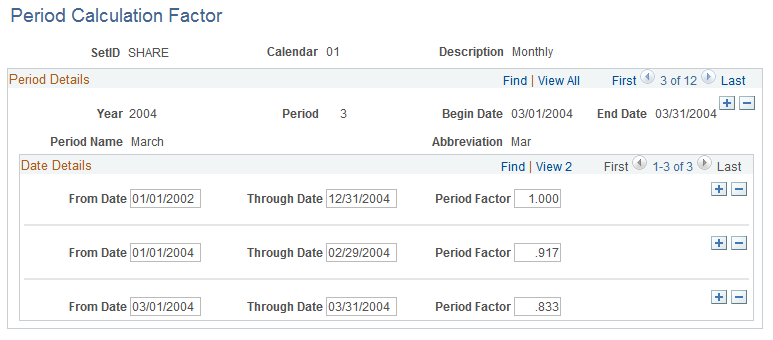

This example illustrates the fields and controls on the Period Calculation Factor page. You can find definitions for the fields and controls later on this page.

Period calculation factors are based on general ledger calendars. Select a period in the general ledger calendar and specify the dates for which you want to accumulate costs, and the factor by which you want those costs to be multiplied.

Field or Control |

Description |

|---|---|

From Date and Through Date |

Enter the period of time that the system uses to calculate interest. Interest is calculated on costs that are incurred during the period that you specify. Add rows to enter additional date ranges. |

Period Factor |

Enter the percentage of costs that the system uses to calculate interest. Interest is calculated on the specified percentage of the costs incurred—usually 100 percent—during the specified date range. Use a decimal fraction to enter a percentage that is less than 100 percent. For example, enter .5 for 50 percent. |

The next two sections provide examples of period calculation factors that are set up by using the straight average method and FASB 34 method of accumulating costs.

Example of Period Calculation Factor Straight Average Method

The Straight Average method uses this formula:

Costs = (Beginning Costs* + Ending Costs**) ÷ 2

*Total costs for the project up to the beginning of a period.

**Total costs for the project through the end of the same period.

For example:

|

Variable |

Value |

|---|---|

|

Project Length |

4 years (2002–2005) |

|

Current Date Range |

1/1/2004 – 12/31/2004 |

|

Calendar Type |

Months |

|

Current Date |

4/6/2004 |

|

Spending Prior to Current Fiscal Year |

1,000,000 USD |

|

Spending for Current Year |

|

Using the Straight Average method, the project cost accumulation calculations for March, 2004 are:

(1,027,500 + 1,040,900) ÷ 2 = 1,034,200

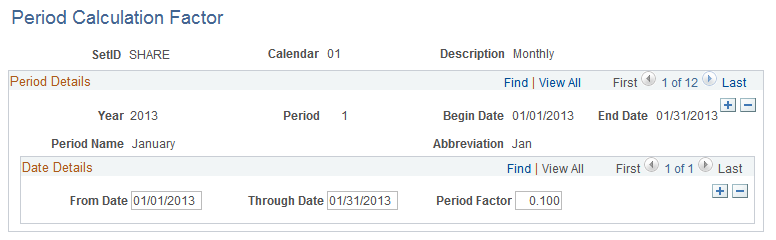

The following page illustrates period calculation factors that are set up for the Straight Average example just discussed. The last period, March, is assigned a value of 0.5 (50 percent) to reflect the assumption that half of the costs were incurred in the first half of the month, and the other half were incurred in the last half of the month.

This example illustrates the fields and controls on the Example of the Period Calculation Factor page with Straight Average method. You can find definitions for the fields and controls later on this page.

FASB 34 Method

The FASB 34 method calculates a weighted average of costs using the following formula:

Cost Accumulation = (Prior Costs*) × (Weighted Current Year Costs**)

*Project-to-date costs prior to the current date range.

**Sum of the weighted average costs for each completed period in the current date range.

Using the FASB 34 method, the project cost accumulation calculations for March 2005 (using the example above) are:

((1,000,000 + 12,000 × 12 ÷ 12) + (15,500 × 11 ÷ 12) + (13,400 × 10 ÷ 12)) = 1,037,375

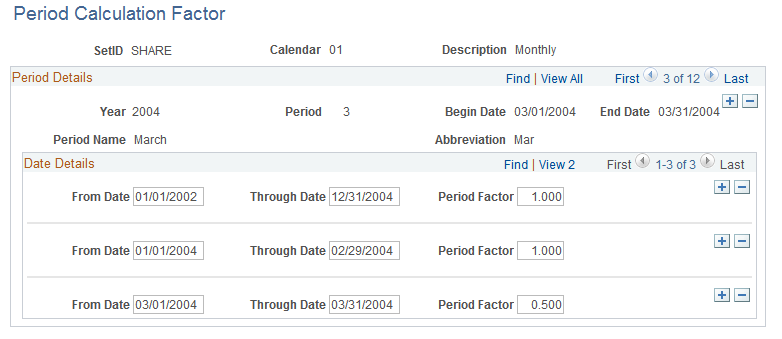

The following page illustrates period calculation factors that are set up for the FASB 34 example just discussed:

This example illustrates the fields and controls on the Example of the Period Calculation Factor page with FASB 34 method. You can find definitions for the fields and controls later on this page.