Using Multicurrency Processing

Let us look at two multicurrency processing scenarios. The first scenario shows how you maintain multiple books using all multicurrency processes; the second scenario compares the single book translation to the results of maintaining a translation ledger within a multibook environment.

This section discusses:

Note: General Ledger must be installed and the Create MultiBook Accounting Entries in Subsystems check box must be selected on the Installed Products page for multibook functionality to be available in subsystems, such as PeopleSoft Accounts Payable.

The following example demonstrates multicurrency processes in a multibook environment. Suppose that your company uses the following ledger structure:

Field or Control |

Description |

|---|---|

Business Unit: |

C007 (CHF) |

Ledger Group: |

MULTI-TRAN |

Ledgers: |

|

Also assume the following currency transactions:

|

Currency Exchanges |

Exchange Rate - Transaction Date |

Exchange Rate - Reporting Date |

|---|---|---|

|

MXN to CHF |

0.295 |

0.297 |

|

MXN to EUR |

0.179 |

0.175 |

|

CHF to USD |

0.602 |

0.605 |

The results of using revaluation in a multibook environment is explained in the next section.

Using Revaluation in a Multibook Environment

The following topics discuss various aspects of revaluation processing in a multibook environment.

Beginning Ledger

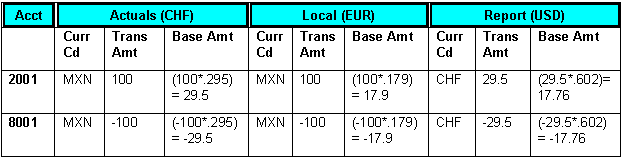

This table shows the results of revaluation in a multibook environment. Assume that the following balances exist in the ledger. Account 2001 is a balance sheet account; 8001 is a profit and loss account. The base amount calculations are shown to exhibit the derivation of the base currency balance:

Example of Assumed Beginning Ledger Balances

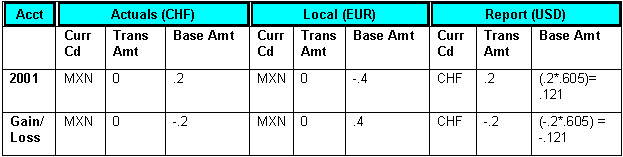

Month End Revaluation Journal (Only Revalue Balance Sheet Accounts)

This journal results from running revaluation on the entire ledger group. The revaluation process skips the report ledger because it is specified as a translation ledger. The actuals and local ledgers are revalued. Running journal edit on this ledger carries the adjustments to the base currency of the actuals ledger down to the report ledger.

Example of Month-End Revaluation

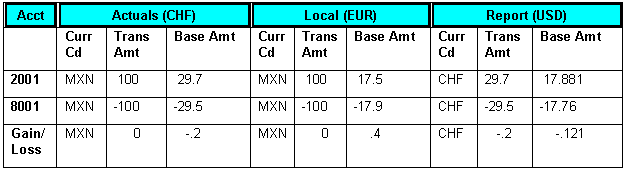

Ending Ledger

The following table contains the ending ledger amounts after the revaluation:

Example of Ending Ledger Amounts

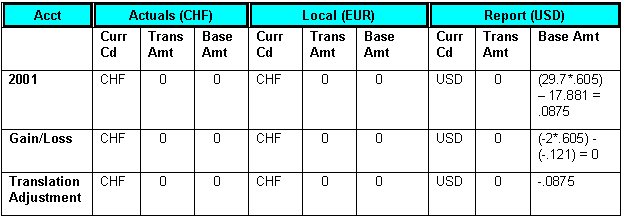

Translate Within Ledger Process

After revaluation, you run the Translate Within Ledger process, which generates the translation adjustment. Only the report translation ledger are processed. Continuing with the previous example, the report ledger balances are shown as follows.

Beginning Ledger (Report Only)

The following table contains the beginning ledger amounts to appear on the translation ledger for reports only:

|

Account |

Foreign Currency |

Foreign Currency Balance |

Report (USD) |

|---|---|---|---|

|

2001 |

CHF |

29.7 |

17.881 |

|

8001 |

CHF |

–29.5 |

–17.76 |

|

Gain/Loss |

CHF |

–0.2 |

–0.121 |

Month End Translation Journal

The output journal that results from the Translate Within Ledger process is shown in this example. This example assumes that the translate within ledger step is defined for balance sheet accounts only, but this need not be the case. You can, for example, define your translate within ledger step definition to include profit and loss, or income statement, accounts to be processed at an average rate.

Example of Month-End Translation Journal

Ending Ledger

The following table shows the ending ledger amounts after you run the translate process for reports:

|

Account |

Foreign Currency |

Foreign Currency Balance |

Report (USD) |

|---|---|---|---|

|

2001 |

CHF |

29.7 |

17.9685 |

|

8001 |

CHF |

–29.5 |

–17.76 |

|

Gain/Loss |

CHF |

–0.2 |

–0.121 |

|

Translation Adjustment |

CHF |

0 |

0.0875 |

Maintaining a translation ledger within a multibook ledger group results in the same ledger balances as performing a period-end translation on the actuals ledger. To illustrate, the following example starts with the ledger balances for actuals from the example above after revaluation is run on the ledger group with a single book translation: actuals (CHF) to ledger group (USD).

Beginning Ledger

The following table shows the ledger balances for actuals ledger after the revaluation is run on the ledger group:

|

Account |

Currency Code |

Transaction Amount |

Actuals (CHF) |

|---|---|---|---|

|

2001 |

MXN |

100 |

29.7 |

|

8001 |

MXN |

–100 |

–29.5 |

|

Gain/Loss |

MXN |

0 |

–0.2 |

Translation Journal

The following table shows the results of running the translation process on the actuals ledger. The translation is simplified for clarity in this example. The balance sheet accounts are translated at the CRRNT exchange rate and the profit and loss, or income statement, accounts are translated at an average rate.

Assume that these are the currency exchange rates:

|

Conversion and Type |

Exchange Rate on Reporting Date |

|---|---|

|

CHF to USD (CRRNT) |

0.605 |

|

CHF to USD (AVG) |

0.604 |

Ending Ledger

The following table shows the resulting balances of this single book ledger:

|

Account |

Currency Code |

SB Reports (USD) |

|---|---|---|

|

2001 |

USD |

(29.7 * 0.605) = 17.9685 |

|

8001 |

USD |

(–29.5 * 0.604) = –17.818 |

|

Gain/Loss |

USD |

(–0.2 * 0.605) = –0.121 |

|

Translation Adjustment |

USD |

–0.0295 |

Compare the resulting balances of this single book translation to the balances in the report ledger of the ledger group MULTI-TRAN. The difference of .058 between the translation adjustment and the value for account 8001 is because the profit and loss, or income statement, account 8001 was translated at the AVG rate, and its offset is included in the translation adjustment. If an additional Translate Within Ledger step were defined earlier to process this account at the AVG rate type, the balances would be identical.