Setting Up FACTS II Data

To set up FACTS II data, use the following components:

Contact Information (F2_CONTACT)

ChartField Attributes (CF_ATTRIBUTES)

Fund Code (FUND_DEFINITION)

Account (GL_ACCOUNT)

Miscellaneous ChartFields (F2_ELEMENT_CF)

FACTS II Attribute Cross Reference (F2_ATTRIB_XREF)

Treasury Symbol Cross Ref (F2_TSYM_XREF)

Use the FUND_CF component interface to load data into the tables for the Fund Code component. Use the ACCOUNT_CF component interface to load data into the tables for the Account component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

F2_CONTACT_INFO |

Contains contact information about the person or persons who are responsible for preparing and certifying FACTS II data for each of the appropriations and sending it to the U.S. Treasury in the Preparer file. Only preparers may change an appropriation symbol's SGL accounts or other related information. |

|

|

F2_RUN_CONTACT |

Runs the Application Engine GL_F2 CONTACT, which creates the Contact Information Record and Contact Information Record Trailer (Input) record in the indicated input file and creates an output flat file to send to the U.S. Treasury. |

|

|

CF_ATTRIBUTES |

Enter the Fund Code and Account ChartField attributes and attribute values. |

|

|

Fund Code Page |

FUND_DEFINITION |

Access the Fund Code ChartField to associate with FUND_CODE ChartField attributes. |

|

GL_ACCOUNT |

Access the Account ChartField to associate with ACCOUNT ChartField attributes. |

|

|

CF_ATTRIB_VALUES |

Select the ChartField attributes to associate with the selected ChartField value. |

|

|

F2_ELEMENT_CF1 |

Select ChartFields to use for recording Program Reporting Category, Cohort Year, Transfer Agency, Transfer Account, and Transaction Partner information. |

|

|

F2_PROG_RPT_CAT |

Maintain PRC codes by MAF Treasury Symbol. Identify the origin of the PRCs as either resulting from user-defined values or values downloaded from a MAF file. |

|

|

F2_ATTR_XREF |

Enables each agency to decide on the names of the fund and account attributes to be used in FACTS II processing. Each agency can either create its own names or use the names that are presented in this documentation. |

|

|

F2_ATTR_XREF_EDIT |

Specify the ChartField Attributes and Attribute values that are applicable to the accounting edits. |

|

|

F2_RUN_MAF |

Load the MAF data from a file that is sent by the U.S. Treasury to the government agency to review in PeopleSoft General Ledger. |

|

|

F2_MAF_INQUIRY |

Review the MAF data that is sent by the U.S. Treasury based on a selected MAF Treasury Symbol. Add, review, and MAF data. |

|

|

Review FACTS II Data - Header Information Page |

F2_STAGE_HDR |

Enter the criteria to display the appropriate FACTS II data on the remaining pages for review. Click the Header Information tab if the page does not appear. |

|

Review FACTS II Data - Detail Balances Page |

F2_STAGE_DTL1 |

Displays the FACTS II detail account balances based on the selected business unit and the criteria that is entered on the Header Information page. |

|

Review FACTS II Data - Detail Attributes Page |

F2_STAGE_DTL2 |

Displays the ChartField attributes associated with specific ChartFields based on the criteria that is entered on the Header Information page. |

|

Review FACTS II Data - Footnotes Page |

F2_STAGE_FTNT |

Displays the FACTS II footnote information that is associated with the selected business unit and the criteria that is specified on the Header Information page. |

|

F2_TSYM_XREF |

Select the Treasury Symbol attribute that corresponds to the Treasury Symbol that is included in the MAF. |

FACTS II is a federal government electronic reporting of budgetary account data that is used for quarterly reporting to the U.S. Treasury. It must:

Record financial transactions with the required attributes.

Import data from the U.S. Treasury MAF for use in FACTS II processing.

Accumulate fund, account, and other relevant data.

Perform accounting edits on the FACTS II input files.

Produce a FACTS II Accounting Edit Validation report.

Generate a FACTS II flat file to send to the U.S. Treasury as input to GOALS.

Note: FACTS I is a separate feature that produces proprietary accounting data in the FACTS I file format for the U.S. Treasury.

See PeopleSoft Federal Government Reporting.

Overview of FACTS II Setup

To set up FACTS II data:

Enter the FACTS II contact data.

Create the preparer file and send it to the U.S. Treasury.

Set up the Account and Fund Code ChartField attributes and attribute values.

Associate the appropriate attribute values with the Fund Code and Account ChartField values.

Specify the Miscellaneous ChartFields for PRC, Cohort Year, Federal or Non-Federal Partner, Transfer Account, and Transfer Agency.

Set up the attribute cross-reference data.

Review your ChartField attributes for accuracy.

Load the MAF data that was obtained from the U.S. Treasury with any associated PRC codes.

Review the MAF data containing Treasury Symbols.

Set up the Treasury Symbol cross-reference data.

Review and maintain the PRC codes.

Overview of FACTS II Trees

You must set up these FACTS II trees and a FACTS tree group:

FACTS II Acct Rollup tree.

This tree enables an agency's posting accounts to roll up to the SGL account structure that is required for FACTS II reporting.

FACTS II Cohort Year tree.

This tree enables any agency's cohort year ChartField values to roll up to a cohort year structure for FACTS II reporting.

FACTS II Category A tree.

This tree represents the Category Program ChartField values, the three-digit program sequence number, and the Category A program descriptions that are required by the FACTS II Treasury input file.

FACTS II Category B tree.

This tree represents the Category Program ChartField values, the three-digit program sequence number, and the Category B program descriptions that are required by the FACTS II Treasury input file.

Accounts Requiring Attributes tree.

This tree represents the U.S. Treasury attributes and their associated accounts.

Transfer Agency tree.

This tree represents the U.S. Treasury department's three-digit federal transfer agency codes and the ledger values that are translated to these codes.

Transfer Account tree.

This tree represents the Treasury department's four-digit federal transfer account codes and the ledger values that are translated to these codes.

Transaction Partner tree.

This tree represents the three types of transaction partners—Federal, Non Federal, and Non Federal Exceptions—that are translated to these codes.

Set up the FACTS tree group using the appropriate tree names and levels for the trees listed previously.

Overview of FACTS II Processing

To generate and process FACTS II data:

Run the GLS8302 process to accumulate the FACTS II data.

Review the accumulated FACTS II data for accuracy.

Run the GLS8303 process to validate the FACTS II data.

Review the validation results and, if necessary, correct configuration or other data, and repeat steps 1 through 3.

Create the FACTS II flat file to send to the U.S. Treasury.

Run GLS7017 Ledger with Attributes Report to verify the accuracy of the data.

Send FACTS II file to the U.S. Treasury.

Note: These rules are defined in the U.S. Treasury's SGL Account Attributes Required for FACTS II Reporting of Detailed Financial Information on the U.S. Treasury's website.

Before setting up FACTS II data or regulatory reporting data, complete these procedures:

Set up FACTS II business units.

Set up FACTS II SGL accounts.

Define ChartFields.

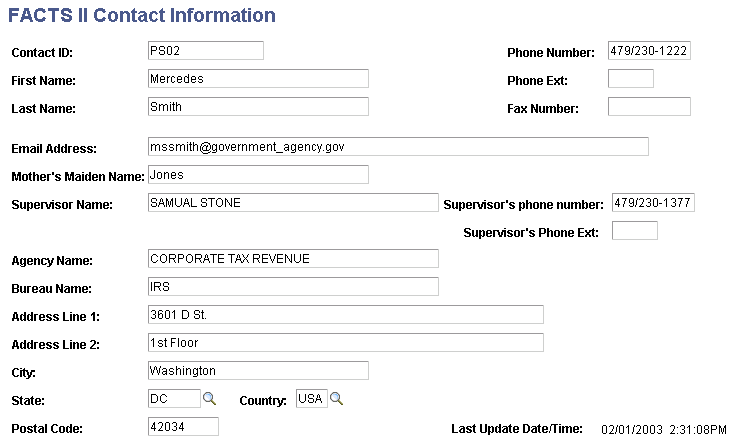

Use the FACTS II Contact Information page (F2_CONTACT_INFO) to contains contact information about the person or persons who are responsible for preparing and certifying FACTS II data for each of the appropriations and sending it to the U. S. Treasury in the Preparer file. Only preparers may change an appropriation symbol's SGL accounts or other related information.

Navigation:

General Ledger, Federal Reports, FACTS II Definition, FACTS II Contact Information, FACTS II Contact Information

This example illustrates the fields and controls on the FACTS II Contact Information page . You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Contact ID |

Enter a U.S. Treasury ID number to add or modify information about your agency's FACTS II contact personnel. |

First Name and Last Name |

Enter the first and last names of the FACTS II preparer. |

Phone Number, Phone Ext, Fax Number, and Email Address |

Enter the telephone number, phone extension, fax number, and email address of the preparer. |

Mother's Maiden Name |

For security purposes, enter the maiden name of the preparer's mother. |

Supervisor Name, Supervisor's phone number, and Supervisor's Phone Ext. |

Enter the name, phone number, and phone extension of the preparer's supervisor. |

Agency Name |

Enter the name of the agency that is responsible for submitting FACTS II data. |

Bureau Name |

If the FACTS II data represents a bureau or division of the agency, enter that name. |

Address Line 1, Address Line 2, City, State, Country, and Postal Code |

Enter the agency's street address (the second line is for information such as building or suite number), city, state, country, and postal code. |

Last Update Date/Time |

Each time you save this record, this field is updated. |

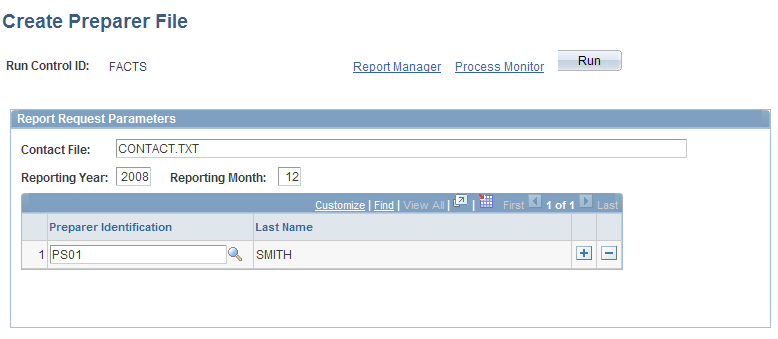

Use the Create Preparer File page (F2_RUN_CONTACT) to runs the Application Engine GL_F2 CONTACT, which creates the Contact Information Record and Contact Information Record Trailer (Input) record in the indicated input file and creates an output flat file to send to the U. S. Treasury.

Navigation:

This example illustrates the fields and controls on the FACTS II - Create Preparer File page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Contact File |

Enter a contact file name with a .TXT extension. Do not enter the entire path. |

Reporting Year and Reporting Month |

Enter the year and month for this FACT II submission. |

Preparer Identification |

Select the preparer's identification number. You can select more than one. |

Run |

Click to access the Process Scheduler Request page to run the Create FACTS Preparer File process (GL_F2CONTACT). |

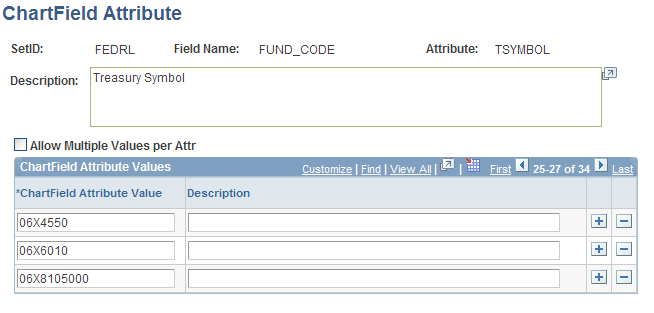

Use the Attributes - ChartField Attribute page (CF_ATTRIBUTES) to enter the Fund Code and Account ChartField attributes and attribute values.

Navigation:

Set Up Financials/Supply Chain, Common Definitions, Design ChartFields, Configure, Attributes, ChartField Attributes, ChartField Attribute

Note: You can also use ChartField Attributes for non-FACTS II purposes.

This example illustrates the fields and controls on the Attributes - ChartField Attribute page. You can find definitions for the fields and controls later on this page.

Most field values on this page are based on the ChartField Attributes table that follows the field descriptions for this page.

Important! FACTS I and FACTS II rely on only one attribute being associated with each respective ChartField. The option to allow multiple values per attribute should not be used with FACTS I and FACTS II attributes.

Field or Control |

Description |

|---|---|

SetID |

Displays the SetID that is set up for your FACTS II data. ChartField attributes are based on a SetID so that they can be associated with more than one ChartField. |

Field Name |

Enter the type of ChartField that each ChartField attribute applies to. Values are FUND_CODE and ACCOUNT and are based on the ChartField Attribute table. |

Attribute |

Enter a ChartField attribute from the ChartField table or define your own attribute names for your organization. These names and values are associated with the ChartField names and values that are required by the U.S. Treasury on the Attribute Cross Reference page. |

Description |

Enter the description of this ChartField attribute from the ChartField Attributes table or create your own description. |

Allow Multiple Values per Attr (allow multiple values per attribute) |

Warning! Do not select this check box for FACTS I or FACTS II ChartField attributes. |

ChartField Attribute Value |

Enter each attribute value from the ChartField Attributes table or define your own values. |

Description |

Enter the description of each attribute value from the ChartField Attributes table or create your own description. |

ChartField Attributes Table

The ChartField Attributes table lists the ChartField attributes that you must set up for FACTS II:

|

Field Name |

Attribute |

Description |

Allow Multiple Values |

ChartField Attribute Value (Description) |

|---|---|---|---|---|

|

FUND_CODE |

BEA |

Budget Enforcement Act |

This check box should NOT be selected. |

D (Discretionary) M (Mandatory) Note: These are Treasury values. |

|

FUND_CODE |

BORROW |

Fund borrowing source |

This check box should NOT be selected. |

P (Public) T (Treasury) F (Federal Financing Bank) Note: These are Treasury values. |

|

FUND_CODE |

CATEGORY |

Apportionment category code |

This check box should NOT be selected. |

A (Category A) B (Category B) C (Category C - Not subject to apportionment.) Note: These are Treasury values. |

|

FUND_CODE |

EX_UNEXP |

Expired or unexpired authority |

This check box should NOT be selected. |

E (Expired Authority) U (Unexpired Authority) Note: These are Treasury values. |

|

FUND_CODE |

REIMBURSE |

Funding authority indicator |

This check box should NOT be selected. |

D (Direct Authority) R (Reimbursable Authority) Note: These are Treasury values. |

|

FUND_CODE |

TSYMBOL |

Treasury Symbol |

This check box should NOT be selected. |

Each agency enters its own Treasury Symbol values and descriptions. Example: 19X0192 (No Year Revolving Fund) 19X0202 (No-Year Fund) |

|

BUDGET_REF |

YR_OF_BA |

Year of Budget Authority |

This check box should NOT be selected. |

BAL (Outlay from balances that are brought forward from previous year.) NEW (Outlays from new Budget Authority.) |

|

ACCOUNT |

ADV_FLAG |

Advance Flag |

This check box should NOT be selected. |

F (Advance in Future Year) P (Advance in Prior Year) X (Not Applicable) |

|

ACCOUNT |

AUTHORITY |

Authority type |

This check box should NOT be selected. |

B (Borrowing Authority) C (Contract Authority) P (Appropriation) S (Spending from Offsetting Collections) D (Advance Appropriation) L (Proceeds of Loan Asset Sales with Recourse) |

|

ACCOUNT |

AVAIL_TIME |

Budget resource availability |

This check box should NOT be selected. |

A (Available in the current period.) E (Available in the subsequent period.) |

|

ACCOUNT |

BEGIN_END |

Begin or end balance code |

This check box should NOT be selected. |

B (Report Beginning Balance to Treasury) E (Report Ending Balance to Treasury) Y (Report both Beginning and Ending Balances to Treasury.) |

|

ACCOUNT |

DEB_CRED |

Debit/Credit indicator |

This check box should NOT be selected. |

CR (Normal Credit Balance) DR (Normal Debit Balance) |

|

ACCOUNT |

DEF_INDEF |

Definite/Indefinite flag |

This check box should NOT be selected. |

D (Definite) I (Indefinite) |

|

ACCOUNT |

FACTSII |

FACTS II SGL account indicator |

This check box should NOT be selected. |

Y (FACTS II Account) |

|

ACCOUNT |

FUNCTION |

OMB Function Code |

This check box should NOT be selected. |

D (Defense) NND (Non-Defense) |

|

ACCOUNT |

IGN_ON_EXP |

Ignore on expiration. |

This check box should NOT be selected. |

Y (Yes, ignore on expiration.) N (No, do not ignore on expiration.) |

|

ACCOUNT |

RT7 |

Record type 7 This attribute indicates the RT7 value for a specific account. This edit is used in the processing logic for the PreEdit and Edit 6 in the FACTS II Validation process. |

This check box SHOULD BE selected. |

911 (Discount on Investments) 921 (Imprest Fund) 941 (Contract Authority) 951 (Authority to Borrow from Treasury) 961 (Exchange Stabilization Fund) 962 (Authority to Borrow from the Public) 971 (Investments in Public Debt Securities) 972 (Investments in Agency Securities) |

|

ACCOUNT |

PRE-EDIT |

Pre-edit Identifies the valid RT7 values for a specific account. Some accounts may have multiple RT7 values. |

This check box should NOT be selected. |

911 (Discount on Investments) 921 (Imprest Fund) 941 (Contract Authority) 951 (Authority to Borrow from Treasury) 961 (Exchange Stabilization Fund) 962 (Authority to Borrow from the Public) 971 (Investments in Public Debt Securities) 972 (Investments in Agency Securities) |

|

ACCOUNT |

EDIT1 |

Edit 1 Validates that the ending DR balances of budgetary accounts within a fund equal the ending CR balance of budgetary accounts within a fund. |

This check box should NOT be selected. |

EXCLUDE (Exclude form Accounting Edit 1 DR-CR Valuation.) |

|

ACCOUNT |

EDIT2 |

Status of Funds and Total Resources Balances. This edit simulates the calculation of Lines 7 and 11 from SF133. |

This check box should NOT be selected. |

ST_BEGIN (Status of Funds, Beginning Balance) ST_CURRENT (Status of Funds, Current Indicator) ST_ENDING (Status of Funds, Ending Balance) ST_CR_TO_DR (4060, 4070, 4210, and 4310, ST or TO Indicator) TO_BEGIN (Total Resources, Beginning Balance) TO_CURRENT (Total Resources, Current Balance) TO_ENDING (Total Resources, Ending Balance) |

|

ACCOUNT |

EDIT3 |

Resources ChartField less Obligation ChartField Resources ChartField less Obligation ChartField. This edit validates that the beginning balance budgetary debits equal the beginning balance credits. |

This check box should NOT be selected. |

S1 (Resources Carried Forward less Obligations Carried Forward) S2 (Equal Unobligated Status Carried Forward) |

|

ACCOUNT |

EDIT4 |

Zero balance by Quarter 4 for accounts Budgetary accounts that are related to anticipated items are not allowed to have balances at the end of the 4th quarter. This edit checks that each of the accounts with an EDIT4 account attribute have a balance that is equal to zero. |

This check box should NOT be selected. |

ZEROBYQ4 (Zero Balance by the Fourth Quarter for Anticipated Accounts) |

|

ACCOUNT |

EDIT5 |

Fund Equity and Fund Resources Balances This edit checks that the sum of the fund resources accounts must equal the sum of the equity accounts for each appropriation symbol. |

This check box should NOT be selected. |

FE_END (Fund Equity, Ending Balance) FR_BEGIN (Fund Resources, Beginning Balance) FR_END (Fund Resources, Ending Balance) FR_END_BC (Fund Resources, Ending Balance, Authority B or C) |

|

ACCOUNT |

EDIT6 |

Beginning and Ending Balances This edit will find the sum of either the beginning or ending balance for each account that has a like RT7 value and compare it with the pre-closing balance from the Treasury MAF. |

This check box should NOT be selected. |

BEGIN (Beginning Balance) END (Ending Balance) |

|

ACCOUNT |

EDIT7 |

Edit fund balance with Treasury calculation. This edit compares the ending balance of accounts 1010, 4350, and 4391 for each non-RT7 appropriation symbol with the pre-closing balance on the MAF file. |

This check box should NOT be selected. |

FBWT_CALC (Fund Balance with. Treasury) |

|

ACCOUNT |

EDIT8 |

Perform balance checks of disbursements versus collections as determined by an outlay formula and the disbursement and collections reported in the SF-133 Report on Budget Execution. |

Y An account can have multiple EDIT8 attribute values based on the formula. |

L12_1 (Line 12 Beg Bal) L12_2 (Line 12 Beg Bal, Gov Code E/F) L13_1 (Line 13 End Bal) L13_2 (Line 13 End Bal, Gov Code E) L14A_1 (Line 14A End Bal) L14A_2 (Line 14A End Bal, Gov Code E) L14A_3 (Line 14A End Bal, Gov Code E/F) L14B_1 (Line 14B End Bal, Gov Code E) L14B_2 (Line 14B End Bal, Gov Code E/F) L14C_1 (Line 14C End Bal) L14D_1 (Line 14D End Bal) L15A_1 (Line 15A End Bal) L15A_2 (Line 15A Beg/End Bal) L15B_1 (Line 15B End Bal) L15B_2 (Line 15B Beg/End Bal) L3A1_1 (Line 3A1 End Bal) L3A2_1 (Line 3A2 Beg/End Bal) L3A2_2 (Line 3A2 Beg/End Bal, Gov Code E/F) |

|

ACCOUNT, continued |

EDIT8, continued |

Perform balance checks of disbursements versus collections as determined by an outlay formula and the disbursement and collections reported in the SF-133 Report on Budget Execution. |

Y An account can have multiple EDIT8 attribute values based on the formula. |

L3B1_1 (Line 3B1 Beg/End Bal) L3B2_1 (Line 3B2 Beg/End Bal, Gov Code E/F) L3D1_1 (Line 3D1 End Bal) L3D2_1 (Line 3D2 End Bal) L3D2_2 (Line 3D2 Beg/End Bal) L4A_1 (Line 4A End Bal) L8A1_1 (Line 8A1 End Bal, Reimb D, Cat A) L8A1_2 (Line 8A1 Beg/End Bal, Reimb D, Cat A) L8A2_1 (Line 8A2 End Bal, Reimb D, Cat B) L8A2_2 (Line 8A2 Beg/End Bal, Reimb D, Cat B) L8A3_1 (Line 8A3 End Bal, Reimb D, Cat C) L8A3_2 (Line 8A3 Beg/End Bal, Reimb D, Cat C) |

|

ACCOUNT ,continued |

EDIT8, continued |

Perform balance checks of disbursements versus collections as determined by an outlay formula and the disbursement and collections reported in the SF-133 Report on Budget Execution. |

Y An account can have multiple EDIT8 attribute values based on the formula. |

L8B1_1 (Line 8B1 End Bal, Reimb R, Cat A) L8B1_2 (Line 8B1 Beg/End Bal, Reimb R, Cat A) L8B2_1 (Line 8B2 End Bal, Reimb R, Cat B) L8B2_2 (Line 8B2 Beg/End Bal, Reimb R, Cat B) L8B3_1 (Line 8B3 End Bal, Reimb R, Cat C) L8B3_2 (Line 8B3 Beg/End Bal, Reimb R, Cat C) |

|

ACCOUNT |

EDIT10 |

Cancellation Edit This edit is used for all cancelling Treasury Appropriation/Fund Symbols (TAFS). It checks for zero balances in reimbursable orders, receivables, obligations, payables, and unobligated balances. A footnote is required if any of the columns 7, 8, 9, 10, or 11 are negative. |

This check box should NOT be selected. |

GROUP1 (Group 1 [2108 Column 7] must be 0) GROUP2 (Group 2 [2108 Column 9] must be 0) GROUP3 (Group 3 [2108 Column 10] must be 0) GROUP4 (Group 4 [2108 Column 11] must be 0.) |

|

ACCOUNT |

EDIT11 |

This edit validates that the sum of certain accounts has a normal Debit or Credit balance. |

This check box should NOT be selected. |

GROUP1 (Group 1 [2108 Column 7] Normal DR Balance) GROUP2 (Group 2 [2108 Column 9] Normal DR Balance) GROUP3 (Group 3 [2108 Column 10] Normal CR Balance) GROUP4 (Group 4 [2108 Column 11] Normal CR Balance ) GROUP5 (Footnote is always required.) |

|

ACCOUNT |

EDIT12 |

Collections and Disbursements Accounts ( Outlay Edit) This edit compares the sum of the EDIT12 accounts for the from and to period that is specified on the Accumulate FACTS II Data run control panel, with the Treasury supplied Outlay Amount. |

This check box should NOT be selected. |

COLLECTIONS (Collections Account) DISBURSEMENTS (Disbursements Account) |

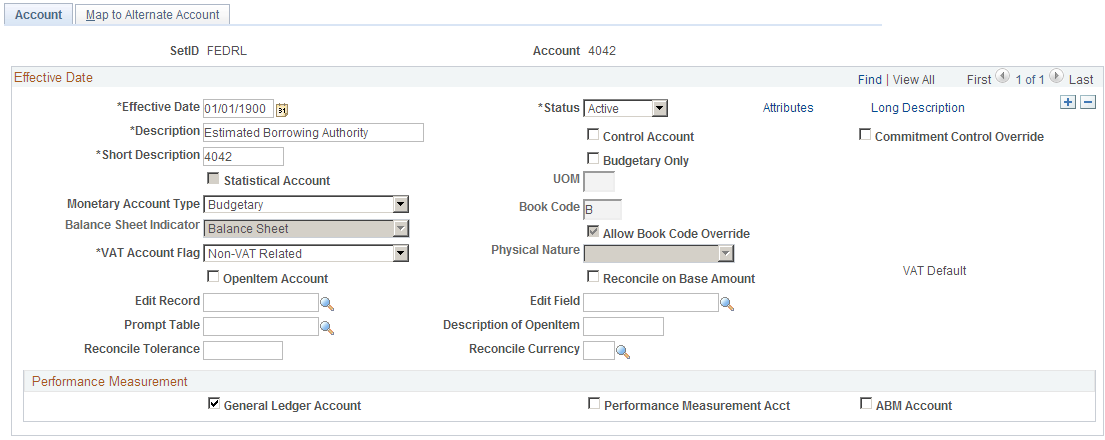

Use the ChartField Values - Account page (GL_ACCOUNT), for example, to access the Account ChartField to associate with ACCOUNT ChartField attributes.

Use a ChartField such as Account, Fund Code, or Budget Reference that requires attributes.

Navigation:

This example illustrates the fields and controls on the ChartField Values - Account page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Attributes |

Click this link to associate the ChartField attributes that you set up for FACTS II with the appropriate Account value (or Fund Code ChartField value on the Fund Code page or Budget Reference ChartField value on the Budget Reference page) that is required for FACTS II reporting. |

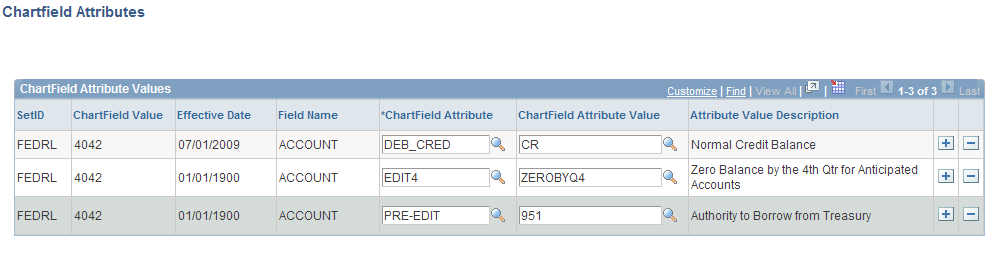

Use the ChartField Attributes page (CF_ATTRIB_VALUES) to select the ChartField attributes to associate with the selected ChartField value.

Navigation:

Click the Attributes link on an Account or Fund Code page.

This example illustrates the fields and controls on the ChartField Attributes page. You can find definitions for the fields and controls later on this page.

After selecting the Attributes link, a row that contains values for SetID, ChartField Value, Effective Date, and Field Name appears.

Field or Control |

Description |

|---|---|

ChartField Attribute |

Select the appropriate ChartField attribute for this ChartField Value. |

ChartField Attribute Value |

Select the ChartField attribute value for this ChartField attribute. You can add as many rows as needed of ChartField attributes and ChartField attribute values for the selected ChartField value (in this example, Account 4042). |

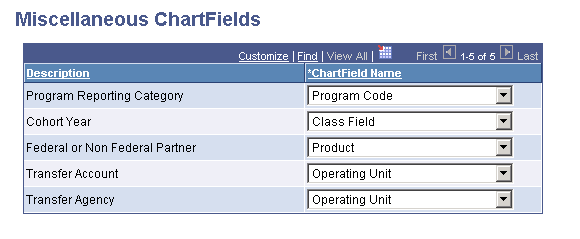

Use the Miscellaneous ChartFields page (F2_ELEMENT_CF1) to select ChartFields to use for recording Program Reporting Category, Cohort Year, Transfer Agency, Transfer Account, and Transaction Partner information.

Navigation:

This example illustrates the fields and controls on the Miscellaneous ChartFields page. You can find definitions for the fields and controls later on this page.

Note: You can change the delivered ChartField specifications to any configurable ChartField. For example, the FACTS II Data Element FED_NONFED is associated with Transaction Partner. You can change this to any other configurable ChartField. However, you must use different ChartFields for each of the FACTS II Data Elements. The exceptions to this rule are the ChartFields for Transfer Account and Transfer Agency. They can use the same configurable ChartField or two different ChartFields. In this example, Trading Partner is associated with both of these FACTS II Data Elements. Your decision to use either a single ChartField for Transfer Agency and Transfer Account or separate ChartFields has an effect on how you will enter data into your ledger. Some of these ChartField names are the result of a ChartField configuration.

Field or Control |

Description |

|---|---|

Description |

The PeopleSoft application predefines theProgram Reporting Category Cohort year, Federal or Non Federal Partner, Transfer Account, and Transfer Agency data elements and descriptions. |

ChartField Name |

Select a configurable ChartField for each FACTS II Data Element. Because Transfer Agency and Transfer Account are related, you can assign the same configurable ChartField to them, if you want, or set them up with separate configurable ChartFields. All other FACTS II data elements must be associated with different configurable ChartFields. |

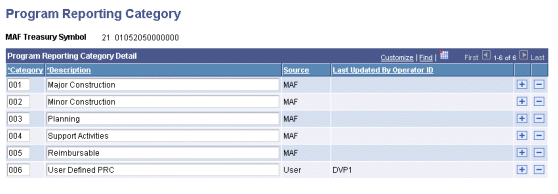

Use the Program Reporting Category page (F2_PROG_RPT_CAT) to maintain PRC codes by MAF Treasury Symbol.

Identify the origin of the PRCs as either resulting from user-defined values or values downloaded from a MAF file.

Navigation:

This example illustrates the fields and controls on the Program Reporting Category page. You can find definitions for the fields and controls later on this page.

Maintain PRC codes by MAF Treasury Symbol.

Enter a MAF Treasury Symbol and view its existing PRC codes and the descriptions that you downloaded from a MAF or that you manually entered using this page.

Field or Control |

Description |

|---|---|

Category |

Valid PRC values are 001 to 999. |

Field or Control |

Description |

|---|---|

Description |

The description can vary for a Category depending on the MAF Treasury Symbol. |

Field or Control |

Description |

|---|---|

Source |

Identifies the origin of a FACTS II Program Reporting Category as user-defined values or as values downloaded from a MAF file. |

Last Updated By Operator ID |

Identifies the operator ID that last manually entered or modified a PRC code value or description. |

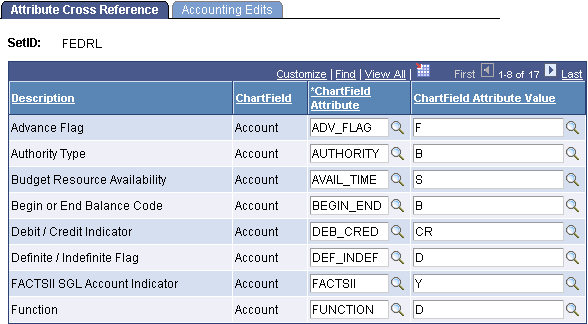

Use the Attribute Cross Reference page (F2_ATTR_XREF) to enables each agency to decide on the names of the fund and account attributes to be used in FACTS II processing.

Each agency can either create its own names or use the names that are presented in this documentation.

Navigation:

Note: Existing customers who are implementing this enhancement should reopen the Attribute Cross Reference and Accounting Edits pages and enter the ChartField Attribute names for the new data elements that are introduced by this enhancement.

This example illustrates the fields and controls on the FACTS II - Attribute Cross Reference page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Description |

These are the predefined attributes that the FACTS II processes requirements of the U.S. Treasury. |

ChartField |

The PeopleSoft application predefines the Field Name for ACCOUNT, FUND_CODE. and BUDGET_REF. |

ChartField Attribute and ChartField Attribute Value |

Select the ChartField attributes and attribute values that you defined as cross-references to each data element. Note: The values selected are only examples. |

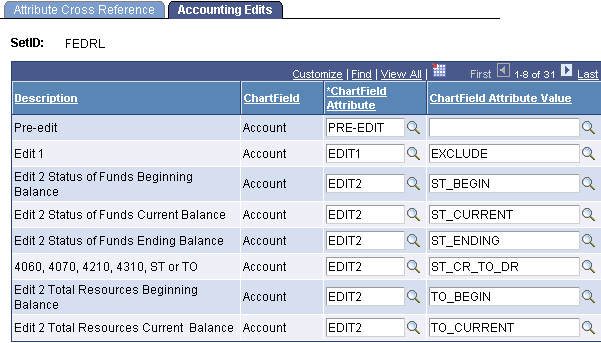

Use the Accounting Edits page (F2_ATTR_XREF_EDIT) to specify the ChartField Attributes and Attribute values that are applicable to the accounting edits.

Navigation:

Click the Accounting Edits tab on the Attributes Cross Reference page.

This example illustrates the fields and controls on the Accounting Edits page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

ChartField Attribute and ChartField Attribute Value |

Select the attributes and attribute values that you defined to cross-reference each of the predefined data elements that is listed on this page. |

Note: Refer to Review FACT II Data, Detail Attributes to review attributes for each ChartField value for a selected business unit and period.

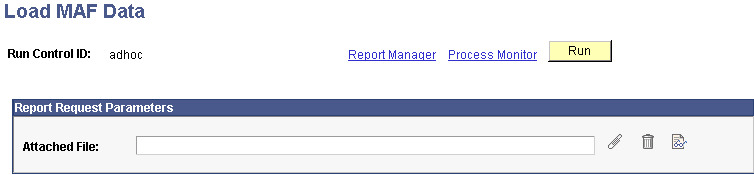

Use the Load MAF Data (load master account file data) page (F2_RUN_MAF) to load the MAF data from a file that is sent by the U. S. Treasury to the government agency to review in PeopleSoft General Ledger.

Navigation:

This example illustrates the fields and controls on the Load MAF Data page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

|

Click the Add Attachment button and type the path and file name, or click the Browse button to navigate to the MAF location. Click the Upload button to store the file as an attachment. The file name appears in the Attached File field. At the beginning of each fiscal year, the U.S. Treasury sends a MAF containing the U.S. Treasury account fund symbols (TAFS) for a specific agency along with the preparer and certifier IDs for each symbol. With this data, the U.S. Treasury sends a spreadsheet containing the attributes for each SGL account. You can use this spreadsheet to validate that your data is set up correctly. |

Run |

Click to upload the file using the PS/GL MAF Load (F2_MAF_LOAD) process. This process loads the date from the file to the appropriate database table. |

Note: The Add, Delete, and View Attachment buttons work the same way as they do for FACTS I.

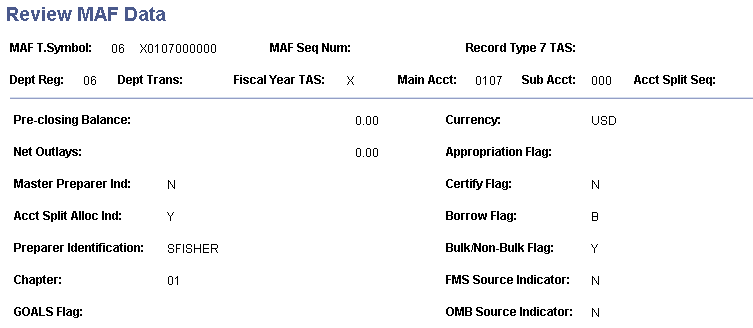

Use the Review MAF Data page (F2_MAF_INQUIRY) to review the MAF data that is sent by the U. S. Treasury based on a selected MAF Treasury Symbol. Add, review, and MAF data.

Navigation:

This example illustrates the fields and controls on the Review MAF Data page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

MAF T.Symbol (master accounting file treasury symbol) |

Stores the Treasury Symbol in the format that is defined by the U.S. Treasury for FACTS II processing. This Treasury Symbol is different from the Treasury Symbol format that is required by most other U.S. Treasury reporting. |

MAF Seq Num (master accounting file sequence number) |

The U.S. Treasury supplies this number. If the U.S. Treasury sends the agency a new MAF file, this number is increased incrementally. |

Record Type 7 TAS (record type 7 treasury appropriation fund symbol) |

The application displays a three-digit numeric code that is attached to the end of the Treasury Appropriation Fund Symbol. This code identifies the type of fund resources, such as Fund Held Outside of the Treasury, Authority to Borrow from the Treasury, and Unrealized Discounts. |

Dept Reg (department regular) |

Displays a regular (versus a transfer) department number that is associated with this MAF Treasury Symbol. |

Dept Trans (department transfer) |

Displays a transfer (versus a regular) department number that is associated with this MAF Treasury Symbol. |

Fiscal Year TAS (fiscal year treasury appropriation fund symbol) |

Displays the funding period of the appropriation that applies to this MAF Treasury Symbol. |

Main Acct (main account) |

Displays the main account that is used for this MAF Treasury Symbol. |

Sub Acct (sub account) |

Displays a sub account that is used for this MAF Treasury Symbol. |

Acct Split Seq (account split sequence) |

Displays the account split that is provided by the Office of Management and Budget interface file. Any number that is greater than 000 is an account split. |

Pre-closing Balance |

Displays the remaining appropriation balance for this department prior to the close of the fiscal year. |

Net Outlays |

Displays the net collections and disbursements that are reported to date to the U.S. Treasury by this department for the current fiscal year. |

Master Preparer Ind (master preparer indicator) |

Identifies whether a master preparer is required. This value is only necessary if an account split applies to this account. |

Acct Split Alloc Ind (account split allocation indicator) |

Indicates whether the master preparer divided the account balance among the members of an account split. |

Preparer Identification |

Displays the FACTS II preparer's name for this department. |

Chapter |

Displays the chapter number that is used in the U.S. Treasury's Annual Report. |

GOALS Flag (Government Online Accounting Link System flag) |

Indicates that the FACTS II file can be imported to the Government Online Accounting Link System (GOALS). |

Appropriation Flag |

Indicates that an appropriation is associated with this MAF Treasury Symbol. |

Certify Flag |

Indicates whether this MAF Treasury Symbol is required by the Budget Reports Branch of the Financial Management Service. |

Borrow Flag |

Indicates whether a borrowing source is required for this MAF Treasury Symbol. |

Bulk/Non-Bulk Flag |

Y indicates that you want to send the FACTS II information in a bulk transfer file. N indicates that you want to send the FACTS II information in a non-bulk transfer file. |

FMS Source Indicator (Financial Management Services source indicator) |

The FMS interface indicator. |

OMB Source Indicator (Office of Management and Budget source indicator) |

The OMB interface indicator. |

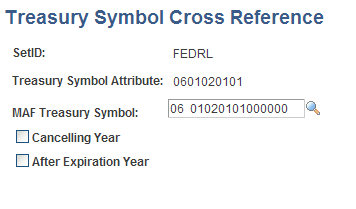

Use the Treasury Symbol Cross Reference page (F2_TSYM_XREF) to select the Treasury Symbol attribute that corresponds to the Treasury Symbol that is included in the MAF.

Navigation:

This example illustrates the fields and controls on the Treasury Symbol Cross Reference page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

SetID |

Select the SetID that applies to the FACTS II reporting data. |

Treasury Symbol Attribute |

Select the attribute that corresponds to the MAF Treasury Symbol. |

MAF Treasury Symbol (master accounting file treasury symbol) |

Select the MAF Treasury Symbol, which is imported from the U.S. Treasury MAF file. |

Cancelling Year |

Select this option if the Treasury Symbol is beyond the cancelling year. FACTS II determines the cancelling year by adding six years to the last year of availability. You must select this option to enable Edit 10 to process. |

After Expiration Year |

Select this option if this Treasury Symbol expired. If a Treasury Symbol expires, zero-balanced rows cannot be reported to the FACTS II Import file. To identify the accounts that are associated with an expired Treasury Symbol, you must select the Ignore on Expiration (IGN_ON_EXP) attribute and select Y for the attribute value on the Attribute Xref page. |