Processing and Generating a FACTS II Flat File

Note: Make sure you have completed all the preceding FACTS II tasks before you start the tasks in this section.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ATTR_INQ |

Enables you to review the attributes for FACTS II processing before running the FACTS II Accumulation (GLS8302) process. |

|

|

F2_RUN_GLS8302 |

Accumulate FACTS II data and load it into staging tables. |

|

|

F2_STAGE_HDR |

Select data to set up the Staging Header information; enter the net period outlay that is to apply to the FACTS II file. |

|

|

F2_STAGE_DTL1 |

Review all of your FACTS II ACCOUNT and FUND CODE detail balances, including other ChartField details that apply. |

|

|

F2_STAGE_DTL2 |

Review the assigned attributes and attribute values for each FACTS II ACCOUNT and FUND_CODE. Displays the ChartField attributes associated with specific ChartFields based on the criteria entered on the Header Information page. |

|

|

F2_STAGE_FTNT |

Enter footnotes for each FACTS II account and fund code where applicable. |

|

|

F2_RUN_GLS8303 |

Validate the accumulated data and create a report that indicates whether the Accounting Edit processes passed or failed and describes the reason that the edit passed or failed. |

|

|

F2_CREATE_FILE |

Create the FACTS II flat file to send to the U.S. Treasury to upload to GOALS. |

|

|

RUN_GLS7017 |

Generate a FACTS II report for a specific business unit, ledger, fiscal year, period range, adjustment period information, and FACTS II Cohort and Acct Req Fund attributes tree-level data. You can also indicate that the numeric field can be 23 integers and 3 decimal places. |

Use the Review ChartField Attributes page (ATTR_INQ) to review the attributes for FACTS II processing before running the FACTS II Accumulation (GLS8302) process.

Navigation:

This example illustrates the fields and controls on the Review ChartField Attributes page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

SetID, ChartField, Attribute, Attribute Value, and As Of Date |

Select the appropriate criteria for a query that enables you to verify that your attributes are set up correctly before you run the Accumulate (GLS8302) process. |

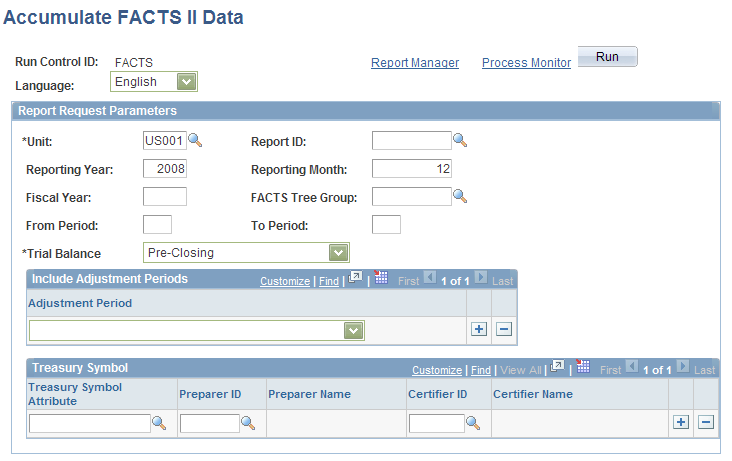

Use the Accumulate FACTS II Data page (F2_RUN_GLS8302) to accumulate FACTS II data and load it into staging tables.

Navigation:

This example illustrates the fields and controls on the Accumulate FACTS II Data page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Unit |

Select the business unit for this FACTS II data. |

Report ID |

Enter the FACTS II report identification for your agency. |

Reporting Year and Reporting Month |

Enter the reporting year and month for this FACTS II file. |

Fiscal Year |

Enter the fiscal year for this FACTS II data. |

FACTS Tree Group |

Select the FACTS tree group for FACTS II processing. |

From Period and To Period |

Enter the accounting periods for this accumulated data for the previously entered fiscal year. |

Trial Balance |

Select whether to include closing adjustments and balances in your FACTS II data:

|

Adjustment Period |

Select the adjustment periods that you want to include in the accumulation of this FACTS II data. You have one or more rows. |

Treasury Symbol Attribute |

Select the Treasury Symbol attribute that is associated with the funds that you are using in your FACTS II data. |

Preparer ID and Certifier ID |

Select the ID of the preparer of the data for this Treasury Symbol attribute and the ID of the person who certified this preparer's FACTS II data. |

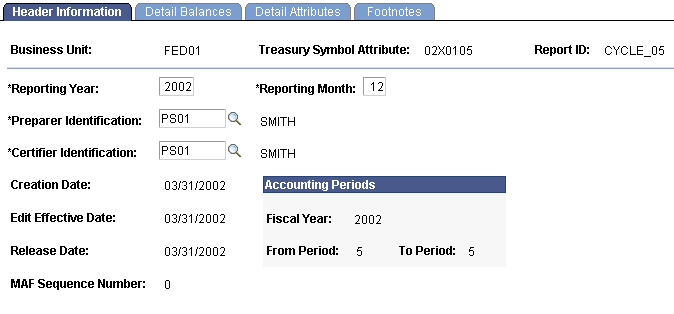

Use the Review FACTS II Data -Header Information page (F2_STAGE_HDR) to set up the Staging Header information; enter the net period outlay that is to apply to the FACTS II file.

Navigation:

This example illustrates the fields and controls on the Review FACTS II Data - Header Information page . You can find definitions for the fields and controls later on this page.

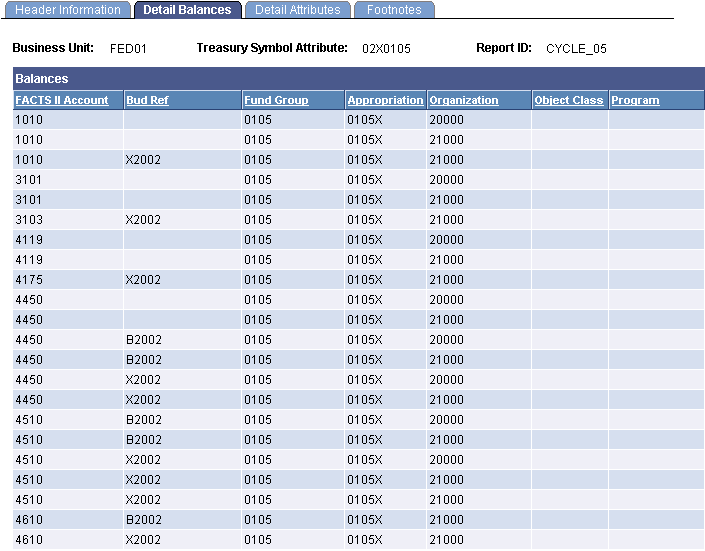

Use the Review FACTS II Data - Detail - Balances page (F2_STAGE_DTL1) to review all of your FACTS II ACCOUNT and FUND CODE detail balances, including other ChartField details that apply.

Navigation:

This example illustrates the fields and controls on the Detail - Balances page. You can find definitions for the fields and controls later on this page.

This page contains all of the detail information for a specific fund code and its associated general ledger and FACTS II accounts.

Use the Review FACTS II Data - Detail Attributes page (F2_STAGE_DTL2) to review the assigned attributes and attribute values for each FACTS II ACCOUNT and FUND_CODE.

Displays the ChartField attributes associated with specific ChartFields based on the criteria entered on the Header Information page.

Navigation:

You can review the attribute values that are assigned to each FACTS II fund code and account.

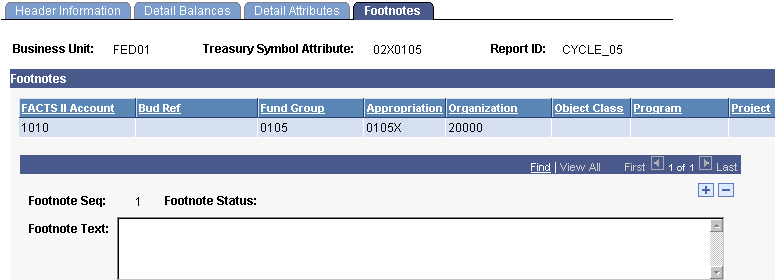

Use the Review FACTS II Data - Footnotes page (F2_STAGE_FTNT) to enter footnotes for each FACTS II account and fund code where applicable.

Navigation:

This example illustrates the fields and controls on the Footnotes page. You can find definitions for the fields and controls later on this page.

Enter necessary footnotes based on your organization's data.

Note: Review this information thoroughly before continuing with your FACTS II processing.

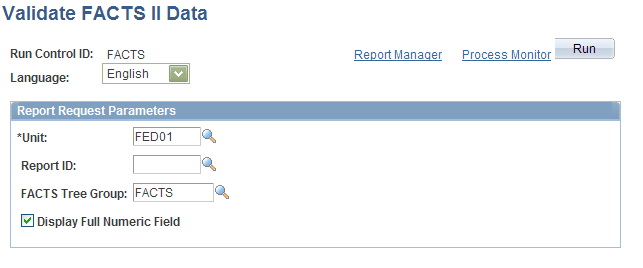

Use the Validate FACTS II Data page (F2_RUN_GLS8303) to validate the accumulated data and create a report that indicates whether the Accounting Edit processes passed or failed and describes the reason that the edit passed or failed.

Navigation:

This example illustrates the fields and controls on the Validate FACTS II Data page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Unit |

Select the business unit for this FACTS II reporting. |

Report ID |

Enter the Report ID that you entered to accumulate the FACTS II data. |

FACTS Tree Group |

Select to validate FACTS II data for a particular FACTS Tree Group. |

Display Full Numeric Field |

If you report amounts larger than 15 integers and 2 decimal places, select this option to display full numeric fields consisting of 23 integers and 3 decimal places on the Validation report. The validation process performs edits against the account balances that are generated by the accumulation process. It compares the current period net outlay amount entered with the amount that was extracted in edit 12 and generates a report that indicates a pass or fail for each edit. |

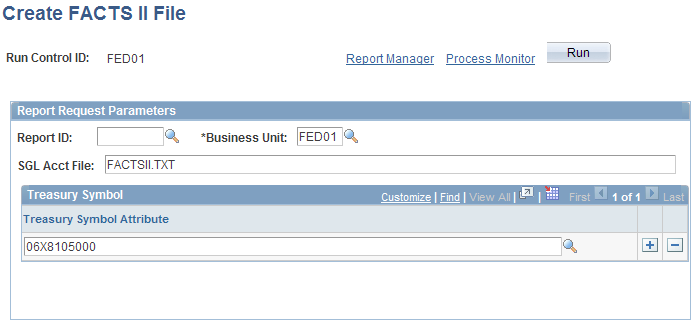

Use the Create FACTS II File page (F2_CREATE_FILE) to create the FACTS II flat file to send to the U. S. Treasury to upload to GOALS.

Navigation:

This example illustrates the fields and controls on the Create FACTS II File page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Report ID |

Enter the accumulated and validated FACTS II report ID. |

Business Unit |

Select the business unit for this FACTS II data. |

SGL Acct File (SGL account file) |

Enter the name of the FACTS II flat file. You must use a .TXT file extension. Do not enter a path. |

Treasury Symbol Attribute |

Select one or more Treasury Symbol attributes for this FACTS II data. |

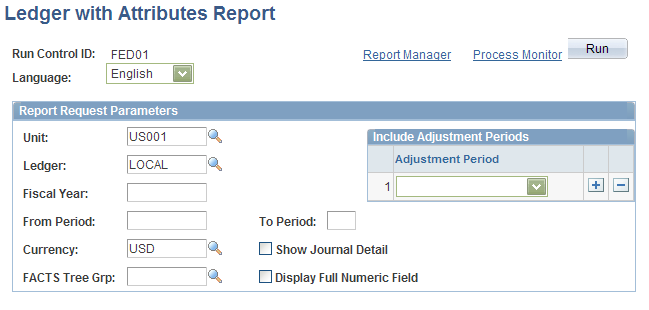

Use the Ledger with Attributes Report page (RUN_GLS7017) to generate a FACTS II report for a specific business unit, ledger, fiscal year, period range, adjustment period information, and FACTS II Cohort and Acct Req Fund attributes tree-level data.

You can also indicate that the numeric field can be 23 integers and 3 decimal places.

Navigation:

This example illustrates the fields and controls on the Ledger with Attributes Report page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Run |

Click to generate the Ledger Activity report (GLS7017) containing the specified business unit ledger's fund and account attributes for the specified fiscal year and period range. This report can include journal detail and draws its data from the Cohort Year tree and level and the Accts Req Fund attributes tree and level. |

Display Full Numeric Field |

Select if you report amounts larger than 15 integers and 2 decimal places. Full numeric fields consisting of 23 integers and 3 decimal places will appear on the report. |