Defining Revaluation Steps

To define revaluation steps, use the Revaluation Step component (REVAL_STEP).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

REVAL_STEP_LED_TM |

Define a ledger, TimeSpan, and rate type for revaluation. |

|

|

REVAL_STEP_CF |

Identify accounts to revalue. |

|

|

CURR_STEP_OUT_JR |

Specify output options, journal information, and revaluation reversal options. Also, use the Translation Step - Output and Journal Options version of this page to determine whether General Ledger automatically posts translated amounts to the ledger or generates journal entries for subsequent posting. |

|

|

CURR_STEP_GN_LS |

Identify the revaluation gain and loss accounts or specify the specific accounts where you record translation gain or loss. |

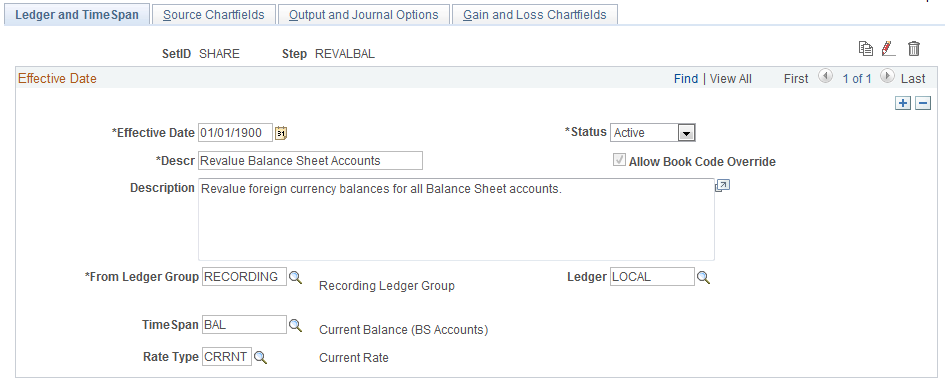

Use the Revaluation Step - Ledger and TimeSpan page (REVAL_STEP_LED_TM) to define a ledger, TimeSpan, and rate type for revaluation.

Navigation:

This example illustrates the fields and controls on the Revaluation Step - Ledger and TimeSpan page.

Field or Control |

Description |

|---|---|

|

Click the Copy icon to copy the current version to a new process step. The system displays a Copy Step window where you enter a new name for the process step. When you change the name and click the OK button, the system displays a message that the current process step is copied to a new process step. |

|

Click the Rename icon to rename this version of the the revaluation step. |

|

Click the Delete icon to delete this version of the revaluation step. |

Allow Book Code Override |

Select this check box to enable you to choose different book code and account combinations at the time of revaluation journal entry. You can then associate any of your book codes with the account value to record related amounts in the same ledger. For example, book codes C, L or B can be associated with account 500001. The chief advantage of this method is that fewer account values are required. The book codes that you can associate with an account are available from a drop down list at the time of journal entry. See PeopleSoft Application Fundamentals, Defining and Using ChartFields: Adding Book Code Values See PeopleSoft Application Fundamentals, Defining and Using ChartFields: Adding Account Values See PeopleSoft Global Options and Reports, Managing Multiple GAAPs and Prior Period Adjustments: Book Code See PeopleSoft Application Fundamentals, Setting Installation Options for PeopleSoft Applications, Setting Overall Installation Options |

From Ledger Group and Ledger |

Specify the from ledger group and specific ledger in which you want to perform the revaluation. You cannot specify a translation ledger for revaluation. If you do not specify a ledger, revaluation revalues the amounts of all the ledgers in the ledger group. To revalue a ledger group with KLS (keep ledgers in sync) selected, you must leave the Ledger field blank. Note: The effect of a base amount adjustment resulting form a revaluation of a primary ledger within a ledger group that has keep ledgers in sync (KLS) selected, is carried down to a translate ledger if it is a secondary ledger in that KLS ledger group by either a journal edit or by a revaluation if the edit option is not selected. To avoid this impact to a translation secondary ledger, do not use a translation secondary ledger in a KLS ledger group and use a separate ledger group for translation ledgers where you can use separate translation processes rather than the translate within ledgers process. |

TimeSpan |

General Ledger generates journal entries whose amounts represent the period of time indicated by the TimeSpan for the revaluation being processed. The TimeSpan normally used for balance sheet accounts is BAL (year to date). With this TimeSpan, the system totals the account balances in periods 0 through n for balance sheet accounts. |

Rate Type |

Enter the exchange rate type for the process. |

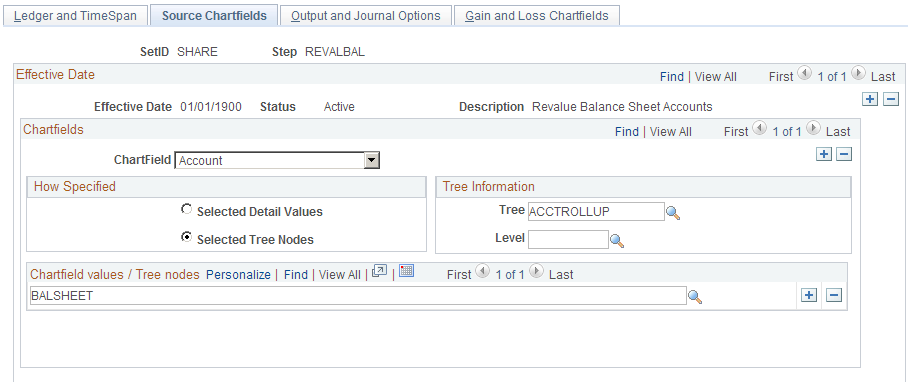

Use the Revaluation Step - Source Chartfields page (REVAL_STEP_CF) to identify accounts to revalue.

Navigation:

This example illustrates the fields and controls on the Revaluation Step - Source Chartfields page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

ChartField |

Select the ChartField (for example, Account or Alternate Account) for which values are to be revalued using the TimeSpan and rate type specified. |

How Specified |

List your accounts individually by selecting the Selected Detail Values check box or, more likely, select the Selected Tree Nodes check box. The latter option activates the Tree Information fields for you to specify a tree from which to select nodes. Using trees establishes rollups for the account values so that you can select particular types of accounts according to the structure of your business unit. |

Tree |

Use trees to establish rollups for account values. |

Level |

(Optional) If the tree has levels, you can limit prompting in this field to selected levels. |

ChartField Values/Tree Nodes |

Select particular types of accounts according to the structure of your business unit. It is best practice to use trees whenever possible to reduce future maintenance when your ChartField values change. |

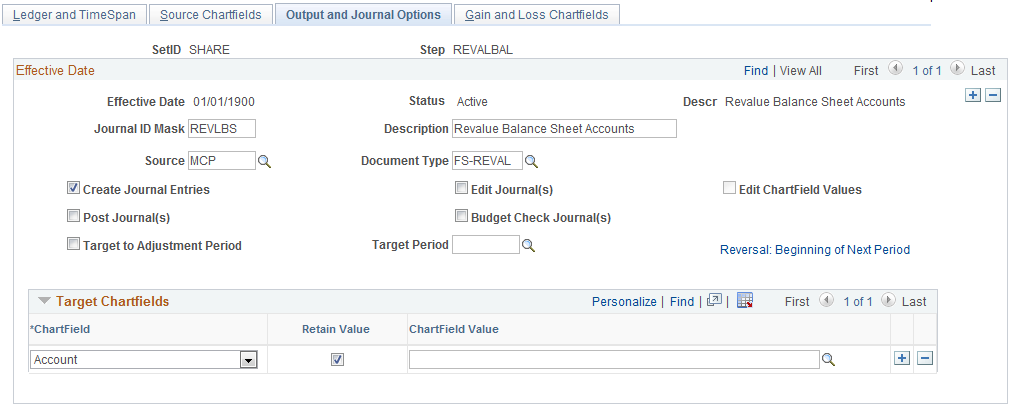

Use the Output and Journal Options page (CURR_STEP_OUT_JR) to specify output options, journal information, and revaluation reversal options.

Also, use the Translation Step - Output and Journal Options version of this page to determine whether General Ledger automatically posts translated amounts to the ledger or generates journal entries for subsequent posting.

Navigation:

This example illustrates the fields and controls on the Revaluation Step - Output and Journal Options page.

Field or Control |

Description |

|---|---|

Journal ID Mask |

Identifies the revaluation journal naming convention that you specify. General Ledger identifies journals by a 10-character alphanumeric identifier. The system automatically names journals starting with the mask value that you specify here. For example, if you entered a mask of RVAL1, the system supplies the remaining characters based on the next available journal ID number. If the next available journal ID number is 19, the generated journal ID would be RVAL100019. Alternatively, if you do not use the journal ID mask, the system automatically assigns the next 10-character available journal ID number. If you use a journal ID mask, reserve a unique mask value to ensure that no other process creates the same journal ID. |

Description |

Describes this revaluation step. |

Source |

Identifies the source of the journals. You can select any valid source on the Source table. |

Document Type |

If you enabled PeopleSoft Document Sequencing in your system, select a predefined document type for your revaluation journals. Document sequencing requires that you have a document type for all of the journal entries that you create. |

Create Journal Entries |

Creates journal entries with a header status of V = Valid that can be posted automatically as part of revaluation processing or through the normal posting methods. Select the Post Journal(s) check box along with this option to automatically post the journals created. |

Edit Journal(s) |

Journals will always be edited with a conditional edit for the ChartFields. Journal edit will create any missing multibook lines. Note: With the Edit ChartField Values option, the Edit Journal(s) check box will not be used. |

Edit ChartField Values |

Initiates the journal ChatField Edit process (GL_JEDIT_CF0) to verify whether the journal has any ChatField-related errors, including ChatField edit, combo ChatField edit, and Alternate Account edit. |

Budget Check Journal(s) |

Submits journal entries to the budget processor for the control budget. |

Post Journal(s) |

Posts the journals to the target ledger as part of revaluation processing. When you process multiple revaluation steps together, where each step depends on the results of the previous step, you must select this check box for all but the last step to provide updated ledger balances for each subsequent step. In the last step, posting the journals is optional. The journals created by multicurrency processing are not intended or designed to be viewed using the journal entry pages before running journal edit or journal post. |

Note: When you run revaluation on secondary ledgers in a multibook ledger group, the revaluation version of this page produces a journal with a journal header and journal lines for the secondary ledgers only. This action optimizes performance. If you attempt to view these journals using the Journal Entry pages, this type of journal may appear corrupt because no primary ledger lines exist for the ledger group. If you want to view the primary ledger lines from the Journal Entry pages, the recommended procedure is to run the Journal Edit process on all multicurrency journals. The journal editing process creates the missing primary ledger lines needed to view the complete journal.

See Multi-Currency Processing - Request Page.

Adjustment Period

Field or Control |

Description |

|---|---|

Target to Adjustment Period |

Click to specify an adjustment period as the accounting period for the revaluation journals and to enter a period in the Target Adjusting Period field. An adjustment period revaluation journal can only be reversed to an adjustment period. If you want to reverse the journal, click the Reversal link and select the Adjustment Period check box to enter an adjustment period in the Specify field on the MultiCurrency Process Journal Reversal page. |

Reversal Link

Field or Control |

Description |

|---|---|

Reversal, Reversal: Beginning of Next Period, or Reversal: Adjustment Period <YYYY-MM-DD> |

Click this link to access the MultiCurrency Process Journal Reversal page. Use the MultiCurrency Process Journal Reversal page to select a reversal option. To facilitate period based reporting, the system generates a reversal for the period that follows the revaluation process period. The net amount that results on the target ledger represents the current period year-to-date (YTD) amount, less the reversal amount generated by the prior period process run. (The reversal journal date is calculated using the as-of date of the process request, the reversal option, and business unit calendar.) Select a reversal code:

|

Target ChartFields

Field or Control |

Description |

|---|---|

ChartField |

Select the ChartFields to be included in the revaluation journal entries. The ChartFields defined here relate to the ChartFields that you specified on the Specifying Gain and Loss ChartFields for the Revaluation page. If you are balancing by ChartFields, include all balancing ChartFields as your target ChartFields. |

Retain Value (retain ChartField value) |

You can either select this check box or enter a ChartField value in the Chartfield Value column. If you select this check box, the ChartField values are carried over from the source transaction entries to the system-generated position accounts. For the ledger defined on the Ledger and TimeSpan page and for a balancing ChartField as defined in the ledger group, if Retain Value is selected for the gain and loss ChartFields, it must also be selected here for the Target ChartField. If Retain Value is not selected for gain and loss ChartFields, then it is clear for the Target ChartField. All three fields must have the same ChartField value if retain value is not selected. |

ChartField Value |

If you did not select the Retain Value check box, use this field to specify the ChartField value to be used for the system-generated target account. If you enter a ChartField value here, the system ignores the ChartField value on the source transaction entry. When a ChartField value is not included in target ChartFields, it is blank for the target journals. Extra gain or loss entries can be created from multiple runs of revaluation, if the gain ChartField value is different from the corresponding loss ChartField value. |

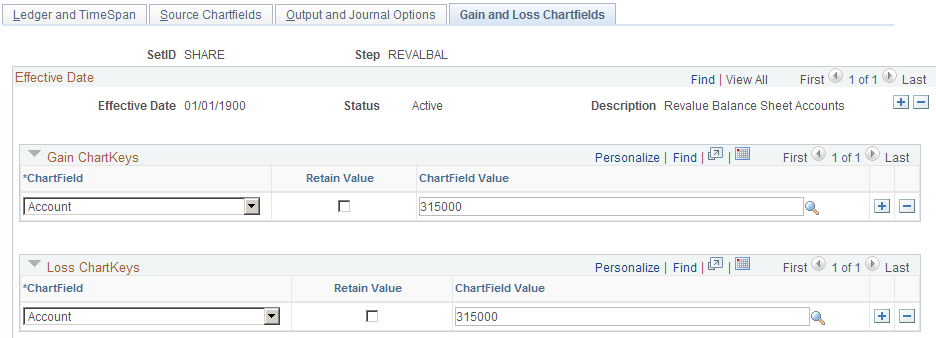

Use the Gain and Loss Chartfields page (CURR_STEP_GN_LS) to identify the revaluation gain and loss accounts or specify the accounts where you record translation gain or loss.

Navigation:

This example illustrates the fields and controls on the Revaluation Step - Gain and Loss Chartfields page. You can find definitions for the fields and controls later on this page.

General ledger posts the offsetting entries that correspond to the adjusting entries created during revaluation to the accounts specified as follows—credits to the gain ChartFields, debits to the loss ChartFields.

Field or Control |

Description |

|---|---|

Gain ChartKeys |

Enter the ChartField and either select the Retain Value check box or enter a value in the ChartField Value field. |

ChartField |

Indicate the ChartFields to be included in the revaluation gain and loss journal entries. If you are balancing by ChartFields, include all balancing ChartFields (do not include business unit and currency) as your target ChartFields. |

Retain Value (retain ChartField value) |

You can either select this check box or enter a ChartField value in the Chartfield Value field. If you select this check box, the ChartField values are carried over from the source transaction entries to the system-generated position accounts. Select Retain Value for a ChartField for both gain and loss, or for neither. So, for the same ChartField, either select both check boxes, or deselect both. For the ledger defined on the Ledger and TimeSpan page, for a balancing ChartField as defined in the ledger group, if Retain Value is selected for the gain and loss ChartFields, it must also be selected for the Target ChartField. If the Retain Value check box is deselected for gain and loss ChartFields, then it is clear for the Target ChartField. All three fields must have the same ChartField value if Retain Value is clear (not selected). Extra gain or loss entries may be created from multiple runs of revaluation if a ChartField is set to retain value in gain or loss but not in target. If some ChartFields are not included as target ChartFields, they will be blank. |

ChartField Value |

If you did not select the Retain Value check box, use this field to specify the ChartField values that are to be used for the system-generated target account. If you enter a ChartField value here, the system ignores the ChartField value on the source transaction entry. When a ChartField value is not included in target ChartFields, it will be blank for the target journals. |

Loss ChartKeys |

Enter the loss ChartField and either select the Retain Value check box or enter a ChartField value. The field definitions for the loss ChartFields are the same as for gain ChartFields. If a ChartField retains value for gains, it must retain value for loss, and conversely. |

Note: When you balance by ChartFields, if a balancing ChartField is designated as a gain or loss ChartField, then the balancing ChartField overrides the value specified on this page.

(copy)

(copy) (rename)

(rename) (delete)

(delete)