Processing Journal Expense Reports

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EX_SHEET_HDR_JRNL |

Create journal expense reports to correct errors and make adjustments to expense report payments to synchronize the expense system and general ledger. |

|

|

TE_SHEET_DIST_J |

Correct errors and make adjustments to expense report payments to synchronize the expense system and general ledger. |

If an auditor discovers an error during a prepayment audit, the auditor can correct the original expense report before processing it for payment. If an auditor discovers errors after the system issues a payment, make adjustments using journal expense reports.

Journal expense reports are not associated with changes to monetary amounts, nor do they create any payments. You process journal expense reports to correct accounting entries that have already been recorded in the general ledger. Performing the adjustment through PeopleSoft Expenses keeps the detail transactions synchronized with the balances in the general ledger. If you use PeopleSoft Commitment Control, you must also budget-check the journal expense report to reflect the same changes in the PeopleSoft Commitment Control ledgers.

Note: You can create only one journal expense report for an expense report.

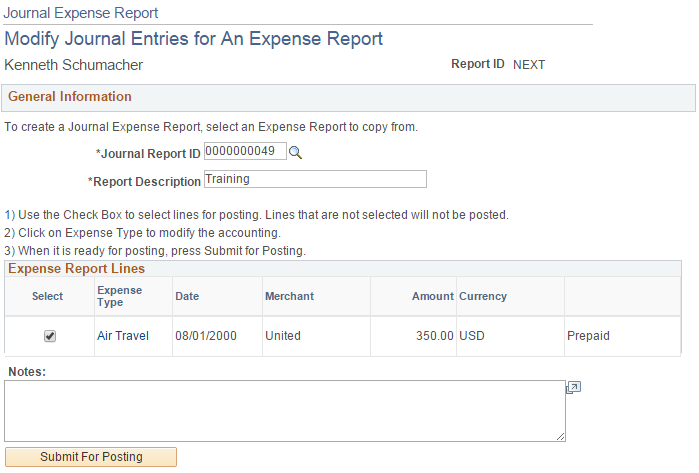

Use the Modify Journal Entries for An Expense Report page (EX_SHEET_HDR_JRNL) to create journal expense reports to correct errors and make adjustments to expense report payments to synchronize the expense system and general ledger.

Navigation:

This example illustrates the fields and controls on the Modify Journal Entries for An Expense Report page.

Processing Journal Expense Reports

When you save a journal expense report, it is ready to post to the general ledger. The system saves only modified expense lines. It does not pass journal expense reports to the accounts payable system because they do not have monetary amounts. Instead, you can select the Post Liabilities function on the Expense Processes page to process the journal expense reports.

When you process the journal expense reports, the system rolls back the original accounting entries and posts the new entries. This corrects the general ledger to reflect the same entries that exist in the expense system. If you use PeopleSoft Commitment Control, you must run budget checking to reverse out the entries in the Commitment Control ledgers.

General Information

Field or Control |

Description |

|---|---|

Journal Report ID |

Enter the original expense report ID that requires an adjustment. Available report IDs are those that are associated with employee IDs for whom the auditor has entry authority. |

Report Description |

Enter a description for the journal expense report. |

Expense Report Lines

Field or Control |

Description |

|---|---|

Select |

Select lines to post. Lines not selected will not post. |

Expense Type |

When you select an expense report ID, the system displays all line items in that report. To view or correct accounting information for a line item, click the link to access the Journal Expense Report - Accounting Detail page and modify the accounting for the expense. |

Date |

Displays the date of the original transaction. |

Comments |

Enter comments about this journal expense report. |

Budget Status |

If you use PeopleSoft Commitment Control and budget checking for expense reports is active, PeopleSoft Expenses displays the budget status for the expense report. |

Budget Options |

Click the Budget Check Options link to access the Commitment Control page to budget check the travel expense or view comments about the budget check. This link is available only if you use PeopleSoft Commitment Control and budget checking for expense reports is active. Note: If you make any changes to distributions or amounts, you must budget check the expense report again to reflect the changes in the commitment control ledgers. |

Submit For Posting |

Submit the journal expense report for processing. |

Use the Journal Expense Report - Accounting Detail page (TE_SHEET_DIST_J) to correct errors, make adjustments to expense report payments, create reversal accounting entries, and to synchronize the expense system and general ledger.

Navigation:

Click a link in the Expense Type column on the Journal Expense Report - Modify Journal Entries for An Expense Report page.

This page displays the selected journal expense report line item and its associated ChartFields. A row displays a reversing entry that the system automatically created. You can modify the entry and create additional entries if necessary.

Important! All of the distribution amounts added together must equal zero for the expense line.

Field or Control |

Description |

|---|---|

Add |

Click to insert a new row and create a reversing entry to offset the expense item. Your reversing entry must be a positive number. |

Accounting Detail

Modify the ChartFields to which you want to charge the expense. If you charge the line to more than one set of ChartFields, adjust the amount to reflect the appropriate portion for these accounts.