Entering VAT Information on Expense Reports

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TE_SHEET_VAT_INFO |

Select VAT options and calculate VAT for the expense item. |

|

|

TE_SHEET_ACCTG_VAT |

View or change VAT accounting details. |

After entering an expense transaction line on the Create Expense Report page, select the VAT Information link to access the VAT Information For Expense Type page. The system defaults appear the first time you access the VAT Information For Expense Type page. You can easily change values and recalculate VAT.

Use the VAT Information For Expense [type] page (TE_SHEET_VAT_INFO) to select VAT options and calculate VAT for the expense item.

Navigation:

From the Create (or Modify) Expense Report page, click the VAT Information icon on an expense line.

This example illustrates the fields and controls on the VAT Information For Expense [type] page.

![VAT Information For [Expense Type] page](img/i2a517932n-6b25.png)

Physical Nature

Field or Control |

Description |

|---|---|

Physical Nature |

Indicates whether an expense type is a good or a service. Many countries require that the sale or purchase of goods is reported separately from that of services. PeopleSoft Expenses uses this field to retrieve values from the VAT Defaults table. |

Change Physical Nature |

Click to override the default physical nature for this expense. The system resets all the VAT defaults. |

VAT Locations

Field or Control |

Description |

|---|---|

Consumption Country |

Enter the country where you incurred the VAT. PeopleSoft Expenses uses this field to retrieve values from the VAT Defaults table. The initial default value for this field comes from the location that you enter on the expense transaction line. If you do not enter a location on the expense transaction line, PeopleSoft Expenses uses the default location from the expense report header. |

Consumption State |

If the consumption country requires that you track VAT by state or province, enter the state, province, or geographic region within the country where you incurred the VAT. PeopleSoft Expenses uses this field to retrieve values from the VAT Defaults table. The initial default value for this field comes from the location that you enter on the expense transaction line. If you do not enter a location on the expense transaction line, PeopleSoft Expenses uses the default location from the expense report header. |

VAT Defaults - VAT Controls

Field or Control |

Description |

|---|---|

Rounding Rule |

Select the VAT rounding rule that you want to use. The initial default value comes from either the VAT entity registration or VAT country VAT driver within the VAT Defaults table. Values are:

|

Use Type |

Enter a value to categorize the use of a good or service by the tax status of the activity in which it is used—the tax status of the goods or services that is ultimately produced from those procured. VAT use is one of the main determinants in the recoverability of input VAT. The initial default value comes from the expense type or Expenses business unit VAT driver within the VAT Defaults table. |

No VAT Receipt |

Select if the employee did not submit a VAT receipt for a VAT expense item that requires one. If selected, PeopleSoft Expenses sets the recovery percentage and rebate percentage fields to zero. You can set up approval and audit rules so that expenses with VAT but without VAT receipts require approval and auditing; in many countries, you cannot claim tax credits for the VAT without a VAT receipt. By default, this check box is not selected. |

Prorate Non-Recoverable |

PeopleSoft Expenses generates an accounting line for non-recoverable VAT. Deselect this check box to charge non-recoverable VAT to the non-recoverable VAT account that is designated in the VAT code. Select this check box to charge non-recoverable VAT as an expense to ChartFields that are indicated in an expense report accounting split. The initial default value comes from the Expenses Definition - VAT Options page. |

Allocate Non-Recoverable |

This check box is applicable only when non-recoverable VAT is not being prorated. When non-recoverable VAT is not being prorated, the account and alternate account for the non-recoverable VAT accounting entry will always be obtained from the VAT accounting template associated with the VAT code. Select this check box to allow the other, non-account ChartFields to be obtained based on the ChartField Inheritance Options that have been defined for non-recoverable VAT. For each ChartField, these options allow you to specify whether the ChartField value is inherited from the expense distribution line, whether the value comes from the business unit defaults, or whether the value comes from the VAT accounting template. Deselect this check box to allow the other, non-account ChartFields to all be obtained from the VAT accounting entry template. The value of this check box defaults from the Expenses Definition - VAT Options page. |

VAT Defaults - VAT Treatments

Field or Control |

Description |

|---|---|

Treatment |

Displays the appropriate VAT treatment value. Within PeopleSoft, VAT treatment values on the transactions lines—which come from complex algorithms—are used to apply the precise defaults that are applicable to the transaction lines. Options are:

|

VAT Defaults - VAT Details

Field or Control |

Description |

|---|---|

Applicability |

Displays the appropriate status for VAT applicability. Options for PeopleSoft Expenses are Taxable, Exempt (not subject to VAT) and Outside (Outside of Scope of VAT). The value comes from an algorithm that uses the VAT Applicable default from the VAT default hierarchy (expense types, Expenses business unit, and VAT country VAT drivers) within the VAT Defaults table, the treatment, and the exception type. |

VAT Code |

Displays the rate at which the system calculates VAT for the expense line. The value comes from an algorithm that uses the treatment and applicability to retrieve the applicable VAT Code default from the VAT default hierarchy (expense types, Expenses business unit, and VAT country VAT drivers) within the VAT Defaults table. |

Transaction Type |

Displays a code that categorizes and classifies this transaction for VAT reporting and accounting. The value comes from an algorithm that uses the treatment and applicability to retrieve the applicable transaction type form the VAT default hierarchy (expense types, expenses business unit, and VAT entity registration VAT drivers) within the VAT Defaults table. |

VAT Defaults - Adjust/Reset VAT Defaults

Field or Control |

Description |

|---|---|

Adjust Affected VAT Defaults |

Click this button to have the system adjust the VAT defaults that are affected by your changes. All changes you have made to VAT defaults on this page that affect other VAT defaults on this page are retained. Oracle's PeopleSoft recommends that you always click the Adjust Affected VAT Defaults button after changing any defaults on the VAT page. Since values that appear further down the page can be dependent on values that appear previously on the page, you should work from top to bottom and click the Adjust Affected VAT Defaults button in the Adjust/Reset VAT Defaults region as needed. This action avoids updating values that you have already overridden. |

|

Click the List of fields to be selected icon to view a list of the fields whose values will be adjusted when you click the Adjust Affected VAT Defaults button. |

Levels |

Before you click the Reset All VAT Defaults button, select the levels to which you want the action to apply. Options are:

|

Reset All VAT Defaults |

Click to reset VAT defaults that you overwrote to the original defaults before you saved the component. This action includes changes that you made when you clicked the Adjust Affected VAT Defaults button. The reset default values will be saved onto the expense line, the distribution line, or both levels, depending on your selection in the Level field. Note: Reset redetermines the VAT defaults. If you changed a VAT driver field, resetting VAT defaults does not return the original default values; it resets all of the default values based on the new driver value. |

VAT Calculations

Field or Control |

Description |

|---|---|

Basis Amount |

Displays the amount on which the VAT is calculated in the transaction currency. |

Tax Rate |

Displays the applicable VAT percentage. |

Calculated Amount |

Displays the system-calculated VAT amount in the transaction currency. |

Override VAT Amount |

Displays the manually entered VAT amount for the line when the calculated VAT amount is not equal to the VAT on the invoice being recorded; otherwise, this field is blank. |

Recorded Amount |

Displays the amount of VAT that will be recorded for this transaction in the transaction currency. If the calculated VAT amount has been overridden, this will be the entered override VAT amount; otherwise, this amount will be the calculated amount. |

Recalculate |

Click to recalculate the Basis Amount, Calculated Amount, and Recorded Amount fields based on the changes made to VAT defaults. This button performs the same action as the calculate button on the expense line grid. |

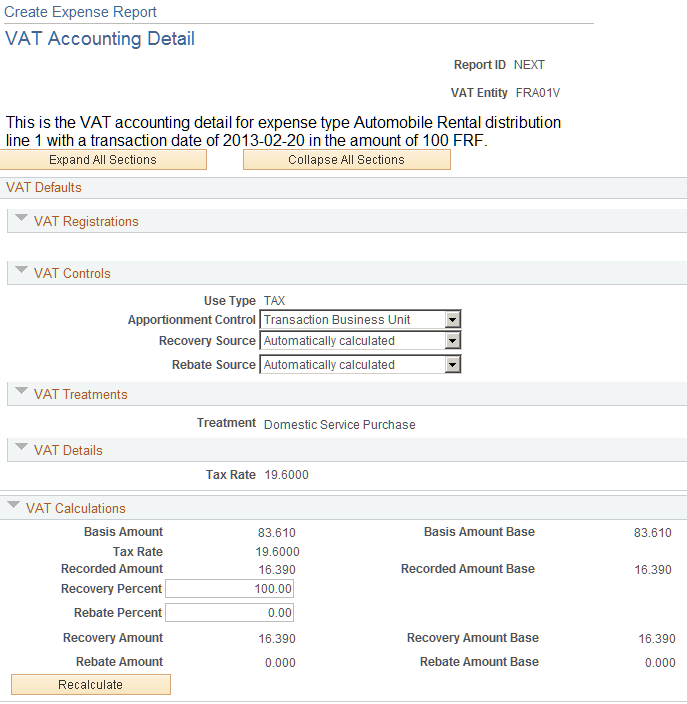

Use the Create Expense Report - VAT Accounting Detail page (TE_SHEET_ACCTG_VAT) to view or change VAT accounting details.

Navigation:

From the Create (or Modify) Expense Report page, expand the Accounting Details section. Select the VAT Info tab, and then click the VAT Detail icon.

This example illustrates the fields and controls on the Create Expense Report - VAT Accounting Detail page.

VAT Defaults - VAT Controls

Field or Control |

Description |

|---|---|

Use Type |

Displays the value from the VAT Information for Expense [type] page. You cannot modify this field. |

Apportionment Control |

Displays the default value from the PeopleSoft Expenses business unit VAT driver within the VAT defaults table. Select the option to use when searching for VAT apportionment information. Values are:

|

Recovery Source |

Select one of the following options:

|

Rebate Source |

Select one of the following values:

Note: The availability of the Recovery and Rebate Source fields is dependent on the Allow Override Recovery/Rebate check box that you set on the expenses business unit VAT driver in the VAT Defaults table. For Automatic, the system-calculated percentages are based on the VAT use type or VAT apportionment for the ChartFields on the distribution line. |

Reclaim Percent |

When the expense line has a foreign VAT treatment, you can specify a VAT reclaim percent. VAT recovery and VAT rebate are not available for foreign VAT treatments, and you cannot modify those fields. |

VAT Treatments

This section displays the VAT treatment, which is provided by default from the VAT Information For Expense [type] page.

VAT Calculations

Field or Control |

Description |

|---|---|

Basis Amount |

Displays the amount on which the VAT is calculated in the employee business unit's base currency. |

Basis Amount Base |

Displays the amount on which the VAT is calculated in the base currency for the business unit entered in the distribution line. |

Tax Rate |

Displays the applicable VAT percentage. |

Recorded Amount |

Displays the amount of VAT that will be recorded for this transaction in the employee business unit's base currency. If the calculated VAT amount has been overridden, this will be the entered override; otherwise, this amount will be the calculated VAT amount. |

Recorded Amount Base |

Displays the amount of VAT that will be recorded for this transaction in the base currency for the business unit entered in the distribution line. If the calculated VAT amount has been overridden, this amount will be the entered override VAT amount; otherwise, it will be the calculated VAT amount. |

Recovery Percent |

Indicates the rate used to recover domestic VAT. |

Rebate Percent |

Indicates the rate used to calculate the rebate amount. |

Recovery Amount |

VAT recovery amount calculated by the system based on the VAT recovery percentage. |

Recovery Amount Base |

VAT recovery amount in the base currency for the business unit entered in the distribution line. |

Rebate Amount |

The calculated rebate amount expressed in the employee business unit's base currency. |

Rebate Amount Base |

The calculated rebate amount expressed in the base currency for the business unit entered in the distribution line. |

Reclaim Amount |

The calculated reclaim amount expressed in the employee business unit's base currency. |

Reclaim Amount Base |

The calculated reclaim amount expressed in the base currency for the business unit entered in the distribution line. |

Recalculate |

Click to recalculate the recovery, rebate, and reclaim amounts. |