Reviewing Revenue

This section provides an overview of reviewing revenue, lists common elements, and discusses how to review revenue plans, review revenue plan events, review as-incurred revenue plans, review revenue details for accounting activities booked to the GL, inquire about amount-based accounting journal entries, and inquire about rate-based accounting journal entries.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CA_AP_MANAGE1 |

View revenue plan activity, both pending and recognized amounts, for any cross-section of the PeopleSoft Contracts system. Update revenue plan status to Pending, Ready, or Reversal in Progress. |

|

|

CA_AP_MGMT_EVENTS |

By event, view amounts that have been recognized to date and are pending. You can update the status for an event, reverse the revenue that was booked for an event, and navigate to the Revenue Plan page. |

|

|

CA_AP_DTL_ASIN |

Inquire about the details for revenue plans with an as-incurred revenue recognition method. From this page, you can review the details of the revenue that has been booked and redistribute that revenue. |

|

|

CA_RVW_PRD_SLS_PNL |

Review billing and revenue pricing details for products sold across the organization. Used to help identify a product’s standalone sales price. |

|

|

RUN_CA_LD_CUR_REV |

Use this process to populate the Review Product Sales page. |

|

|

CA_AP_EVENT_DTL |

Review details for revenue, contract liability, and contract asset for PeopleSoft Contracts fixed-amount accounting activities recorded in GL. |

|

|

CA_ACCT_LINE_JRNL |

Inquire about the details of each journal entry after you have run the Contracts Fixed Amounts Revenue process and your accounting entries have gone through the Journal Generator process and have posted to the GL. |

|

|

CA_ACCT_RATE_JRNL |

Inquire about the accounting entries after you have run the rate-based revenue process (Accounting Rules Engine) and your accounting entries have gone through the Journal Generator Update process and have been posted to the GL. |

|

|

CA_RECON_FF_DIST |

Review the accounting distribution on amount based contract lines. |

|

|

CA_RECON_FF_SUM |

Compare fixed billing and fixed revenue values for contracts. |

Use the Review Revenue - Plans, Review Revenue - Events, and Fixed Amount Revenue History pages to review revenue for fixed-amount contract lines. Use the Review Revenue - As Incurred page to review revenue for rate-based contract lines.

Revenue History

The Fixed Amount Revenue History page enables you to view the accounting distributions of the amounts that have been booked for all fixed amount revenue plans for which PeopleSoft Contracts is managing revenue. The amount-based revenue process loads this page with accounting information for the fixed-amount contract lines associated with apportionment, milestone, and percent complete revenue plans.

The data source for the Fixed Amount Revenue History page is the CA_AP_DST, CA_AP_DFR, and CA_AP_UAR tables.

The accounting distributions for fixed-amount revenue plans is real-time information, because all revenue information for these contract lines is stored within PeopleSoft Contracts.

Warning! You should not make any revenue adjustments to the contract lines for fixed-amount revenue plans outside the PeopleSoft Contracts system (for example, in PeopleSoft Billing, Receivables, or General Ledger), as these changes will not flow back into PeopleSoft Contracts.

Processes for Review Revenue - As Incurred Page

For as-incurred revenue plans, revenue amounts come from PeopleSoft Project Costing and may be adjusted in PeopleSoft Billing or PeopleSoft Receivables. Therefore, the information on the Review Revenue - As Incurred page is not in real time. Any changes made in PeopleSoft Billing are first written back to the revenue rows in PeopleSoft Project Costing. These rows are then picked up by PeopleSoft Contracts in the next run of the rate-based revenue process. Adjustments made in PeopleSoft Receivables are sent to PeopleSoft Project Costing, but PeopleSoft Receivables handles all the accounting. This example walks you through the scenario:

In PeopleSoft Contracts, you enter a contract with a rate-based contract line, and you define a rate plan or rate set and project ID for that contract line.

In PeopleSoft Project Costing, rows for that project ID come into the PROJ_RESOURCE table from source systems and are priced.

As work is performed, the system creates (billable) BIL rows in the PROJ_RESOURCE table. BIL is a PeopleSoft Project Costing analysis type. If the contract Separates As Incurred Billing and Revenue, then rows with analysis type REV will be created in the project costing rate set and they will be used for revenue. If not separated, then BIL rows will be used for both billing and revenue.

When the Contracts to Billing interface is run, PeopleSoft Contracts sends rows to PeopleSoft Billing, and the system creates bill lines on the Billing Worksheet.

When you run the rate-based revenue process (PSA_ACCTGGL), the system selects BIL rows (or REV rows if the contract separates as incurred billing and revenue) with a GL_DISTRIB_STATUS of C(contracts) from the PROJ_RESOURCE table and creates accounting entries. The General Ledger chartfields used on the revenue accounting entries are defined using Accounting Rules.

The PSA_ACCTGGL process places these accounting rows in the CA_ACCT_LN_PC table (to be picked up when you run Journal Generator) and in the CA_AP_PC_DST and CA_AP_PC_UAR tables (to be accessed or displayed by the revenue management pages in PeopleSoft Contracts).

In PeopleSoft Billing, the billing administrator adjusts bill lines in the Billing Worksheet and then marks the worksheet for acceptance.

Once the system accepts the bill, all adjustment rows are written to the PROJ_RES_TMP_BI table. The billing administrator may further adjust the bill before finalization. Upon bill finalization, the additional adjustment rows are written to PROJ_RES_TMP_BI.

The Billing to Project Costing interface process picks up adjustment rows that were written to the PROJ_RES_TMP_BI table, and it places them in the PROJ_RESOURCE table.

Note: The accounting for the adjustment rows in PROJ_RESOURCE comes from the Accounting Rules page setup for the analysis type of the adjustment row, for example, BAJ. You should use the same accounting in the adjustment accounting rules as you defined for the BIL and BLD analysis types.

When you run the rate-based revenue process (PSA_ACCTGGL), the system picks up adjustment rows from PROJ_RESOURCE with a GL_DISTRIB_STATUS of C and books the revenue adjustment that was initiated from billing.

Note: If an adjustment is made on that same bill in PeopleSoft Receivables, PeopleSoft Receivables writes adjustment rows to a temporary table that the Receivables to Projects Application Engine process (PC_AR_TO_PC) picks up and places in the PROJ_RESOURCE table. The accounting is handled in PeopleSoft Receivables.

Analysis Types in PeopleSoft Project Costing

The Receivable Adjustment analysis type is specified on the Installation Options - Project Costing page. After you select an analysis type for receivable adjustments, you must then include that analysis type in the Revenue Analysis Group for it to be picked up by the rate-based revenue process.

See Analysis Types Page.

Field or Control |

Description |

|---|---|

Hold |

Select to search for all revenue plans that have been placed on hold. |

Revenue or Revenue Plan |

Each contract can contain multiple revenue plans. You must select a contract number before you can search by revenue plan. |

Plan Status |

Each revenue plan has a revenue plan status. The status controls the processing that can occur against a revenue plan. |

Search |

Click this button to carry out a search based on the search criteria that you entered. Results appear in the Details or Event Details scroll area. |

Business Unit or BU (business unit) |

PeopleSoft Contracts business unit. |

Contract or Contract No (contract number) |

Contract number. |

Contract Classification |

You can search for revenue plans attached to contracts with a specific contract classification. You select a value for the contract classification when creating a new contract. The contract classification selection determines how the system displays fields and pages in the PeopleSoft Contracts application. Additional functionality is accessible depending on the classification type. Values for the Contract Classification field include: Standard, Internal, Government, and Federal Reimbursable Agreement. |

Customer ID or Cust ID (customer ID) |

Sold to customer ID. |

GL Business Unit |

PeopleSoft General Ledger business unit. |

PC Business Unit |

PeopleSoft Project Costing business unit. |

Processed On |

Last date upon which the system recognized revenue for this revenue plan or event. |

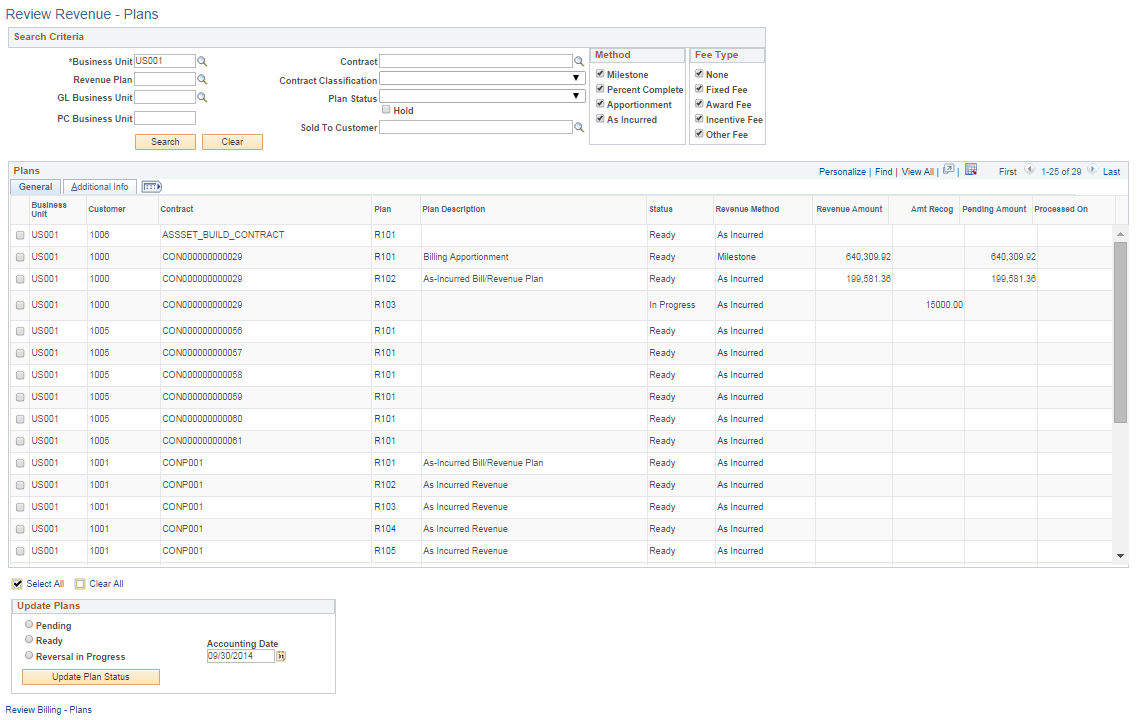

Use the Review Revenue - Plans page (CA_AP_MANAGE1) to view revenue plan activity, both pending and recognized amounts, for any cross-section of the PeopleSoft Contracts system.

Update revenue plan status to Pending, Ready, or Reversal in Progress.

Navigation:

This example illustrates the fields and controls on the Review Revenue - Plans Page. You can find definitions for the fields and controls later on this page.

Search Criteria

Use the fields in the Search Criteria group box to filter your search results by entering specific values in these fields. If you leave all fields blank, the search returns all revenue plans for all Pending and Ready contracts within your system. Results appear in the Revenue Detail scroll area. The system summarizes the results by revenue plan ID, and it displays amounts in the contract or transaction currency. In the case of any as-incurred revenue plans, a row appears for every transaction currency found within a revenue plan.

Note: You must enter a value in the Business Unit field.

Method

Selecting the check box of a revenue recognition method limits your search to include only those revenue plans with a recognition method equal to the recognition methods that you selected. If you leave all check boxes deselected, the system returns all revenue plans matching the rest of your search criteria. Values include: Milestone, Percent Complete, Apportionment, and As Incurred.

Fee Type

To view revenue plans, you must select a value of None in the Fee Type group box. For contracts with a classification of Government, you can select other values in this field.

Plans: General Tab

Field or Control |

Description |

|---|---|

(check box) |

Select if you want to update the status for this revenue plan to Pending, Ready, or Reversal in Progress. Depending on your selection in the Update Plans group box, when you click the Update Plan Status button, the system updates the status of the revenue plan. |

Plan |

Click this link to review and update revenue plan events or place the entire revenue plan on hold. |

Status |

Displays the status of the revenue plan. The status controls the processing that can occur against a revenue plan. |

Revenue Method |

For revenue plans with a revenue recognition method of Apportionment, Milestone, and % Complete, click to access the Review Revenue - Events page, where you can view and update the status of events or projects associated with the revenue plan. For revenue plans with a revenue recognition method of As Incurred, click to access the Review Revenue - As Incurred page, where you can review booked revenue and redistribute revenue. |

Revenue Amount (total amount) |

Displays the total revenue amount for the revenue plan associated with the contract. |

Amt Recog (amount recognized) |

Amount of revenue that has been recognized to date for this revenue plan. Click the link to view the accounting entries made for this amount. This link does not appear for revenue plans with a revenue recognition method of As Incurred. |

Pending Amount |

Displays the pending revenue amount, which is the total amount minus the amount recognized. |

Processed On |

Displays the last time the revenue was processed for the plan. |

Update Plans

The status for each row in the Search Results half of the page can be changed from Ready to Pending or from Pending to Ready. You can update the status of multiple revenue plans at the same time by selecting the new status (either Pending or Ready), selecting the check box next to the appropriate revenue plans, clicking the Update Plan Status button, and saving. You also use this group box to reverse revenue plans.

Field or Control |

Description |

|---|---|

Pending |

Select to update the status of the selected Ready event to Pending. |

Ready |

Select to update the status of the selected Pending event to Ready. |

Reversal in Progress |

Select to reverse a revenue plan. You can reverse plans in a status of In Progress or Completed only. |

Accounting Date |

Enter a date for the system to use as the accounting date for the reversing entries. |

Update Plan Status |

Click to update the revenue plan status of the selected contract lines in the Revenue Detail: General tab with the Pending, Ready, or Reversal in Progress status that you selected. If you selected the Reversal in Progress option, clicking this button initiates the reversal for the revenue plan. |

Plans: Additional Info Tab

Select the Additional Info tab.

Field or Control |

Description |

|---|---|

Redistrib (redistribute revenue) |

Click this link to redistribute revenue for this revenue plan to a different set of PeopleSoft General Ledger ChartFields. |

Review Billing - Plans

Click the Review Billing - Plans link to access the Review Billing - Plans page.

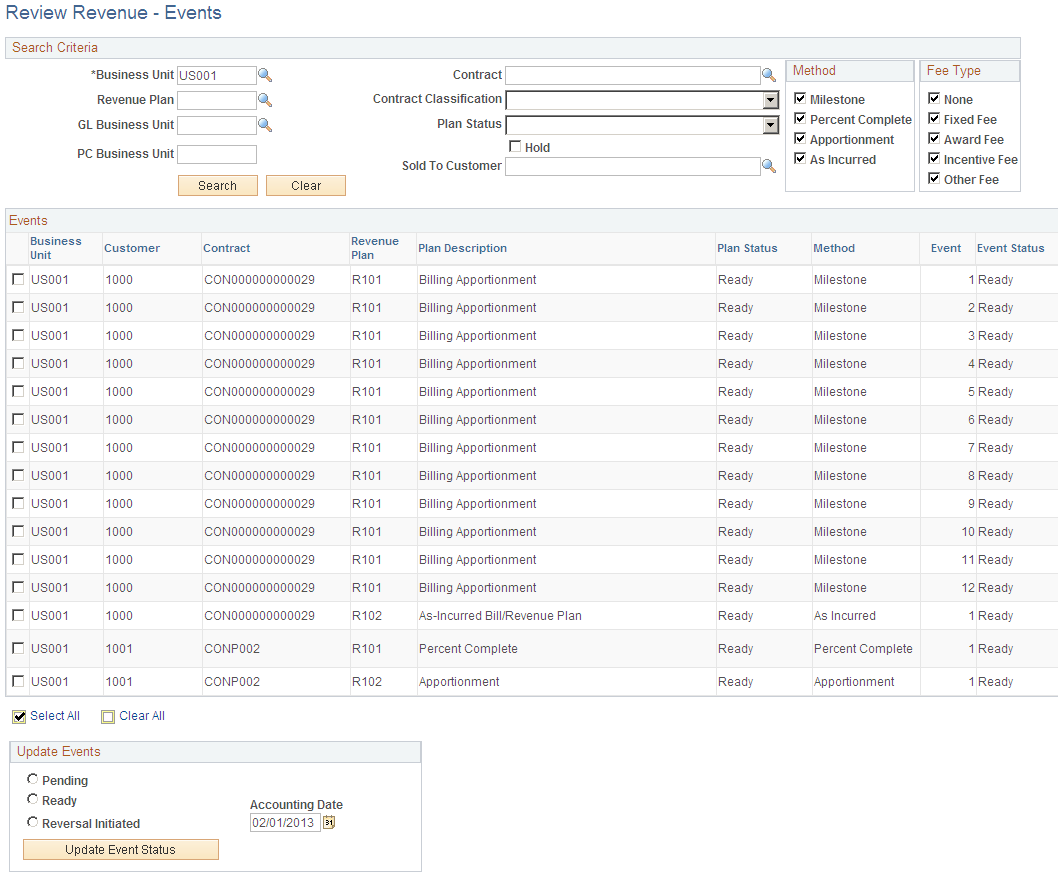

Use the Review Revenue - Events page (CA_AP_MGMT_EVENTS) to by event, view amounts that have been recognized to date and are pending.

You can update the status for an event, reverse the revenue that was booked for an event, and navigate to the Revenue Plan page.

Navigation:

This example illustrates the fields and controls on the Review Revenue - Events page. You can find definitions for the fields and controls later on this page.

Search Criteria

Use the fields in the Search Criteria group box to filter search results by entering specific values in these fields. If you leave all fields blank, the search returns all revenue plan events for all Ready and Pending contracts within your system. Search results appear in the Revenue Detail scroll area. Amounts appear in the contract or transaction currency. In the case of any as-incurred revenue plan events, a row appears for every transaction currency found within a revenue plan event.

Note: You must enter a value in the Business Unit field.

Method

Selecting the check box of a revenue recognition method limits your search to include only those revenue plans with a recognition method equal to the recognition methods that you selected. If you leave all check boxes deselected, the system returns all revenue plans matching the rest of your search criteria. Values include: Milestone, Percent Complete, Apportionment, and As Incurred.

Fee Type

To view revenue plan events, you must select a value of None in the Fee Type group box. For contracts with a classification of Government, you can select other values in this field.

Events

Field or Control |

Description |

|---|---|

(check box) |

Select if you want to update the status for this revenue event to Pending, Ready, or Reversal Initiated. Depending on your selection in the Update Events group box, when you click the Update Event Status button, the system updates the status of the revenue event. |

Revenue Plan |

Displays the revenue plan associated with the revenue event. |

Plan Status |

Displays the status of the revenue plan. The status controls the processing that can occur against a revenue plan. |

Method |

Displays the revenue recognition method associated with the revenue event. |

Event |

Displays the event number for this revenue recognition event. Each revenue plan contains one or more revenue plan events. Revenue plan events depict how much revenue to recognize based on the revenue plan event status. |

Event Status |

Displays the event status for the revenue event. Controls your ability to enter information for, and the processing that occurs against, an event. Available revenue plan event statuses are: Pending, Ready, In Progress, Completed, and Reversed. Pending and Ready are the only statuses that you can set manually. Other statuses are set as a result of a system process. |

Hold |

Indicates whether this revenue event is tied to a revenue plan that has been placed on hold. |

Hold Date |

Displays the date on which the revenue plan was put on hold, if this revenue event is tied to a revenue plan that has been placed on hold. |

Amount |

Displays the total amount for the revenue recognition event associated with this row. |

Update Events

The status for each row in the Search Results half of the page can be changed from Ready to Pending or from Pending to Ready. You can update the status of multiple revenue plan events at the same time by selecting the new status (either Pending or Ready), selecting the check box next to the appropriate revenue plans, clicking the Update Plan Status button, and saving. You also use this group box to reverse revenue plan events.

Field or Control |

Description |

|---|---|

Pending |

Select to update the status of the selected Ready event to Pending. |

Ready |

Select to update the status of the selected Pending event to Ready. |

Reversal Initiated |

Select to reverse events. You can reverse events in a status of In Progress or Completed only. Note: You cannot events on Percent Complete revenue plans. |

Accounting Date |

Enter a date for the system to use as the accounting date for the reversing entries. |

Update Event Status |

Click to update the event status of the selected contract lines Events group box with the pending, ready, or reversal initiated status that you selected. If you selected the Reversal Initiated option, clicking this button initiates the reversal for the revenue event. |

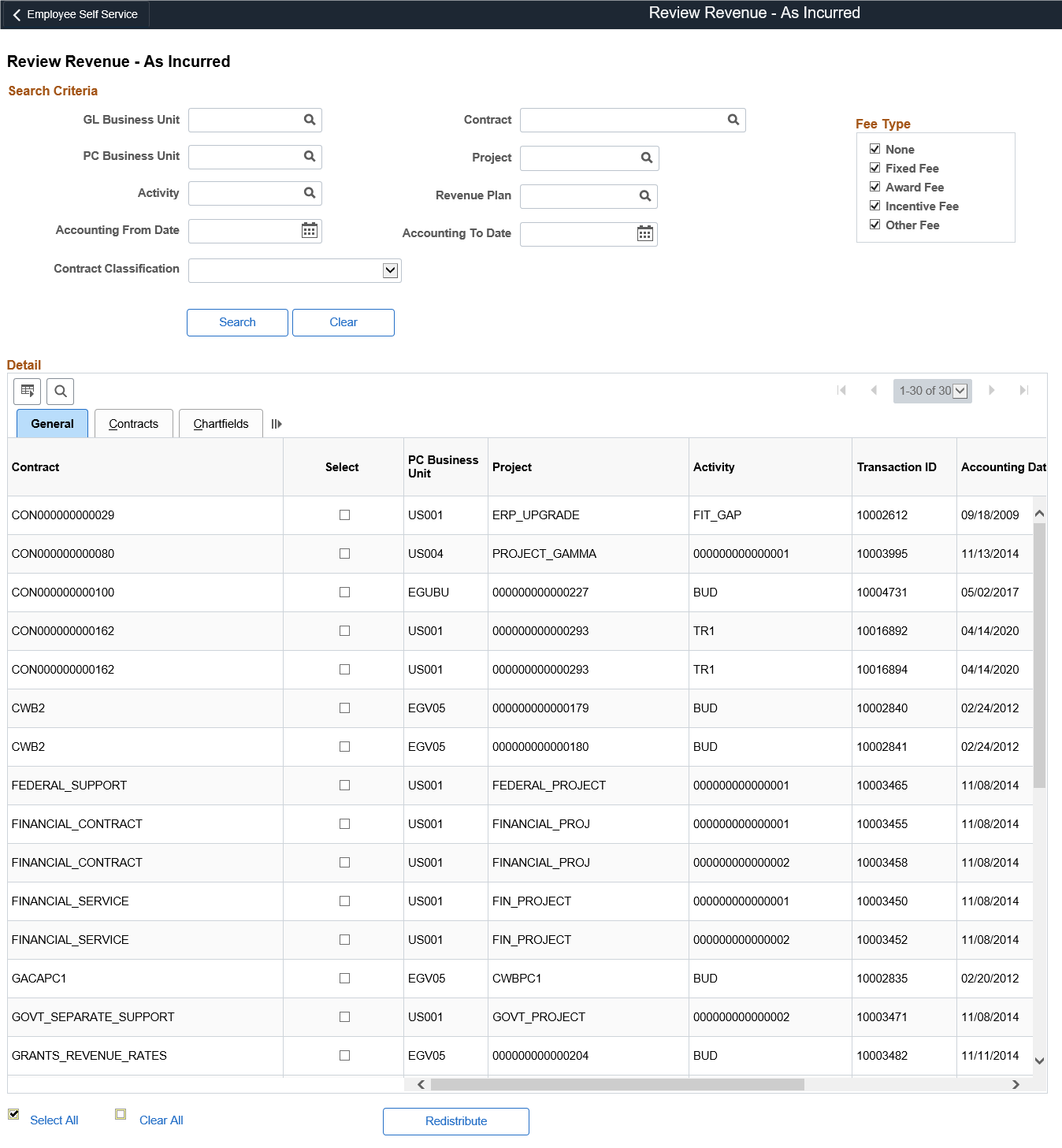

Use the Review Revenue - As Incurred page (CA_AP_DTL_ASIN) to inquire about the details for revenue plans with an as-incurred revenue recognition method.

From this page, you can review the details of the revenue that has been booked and redistribute that revenue.

Navigation:

Click the Method link for a specific revenue plan on the Review Revenue - Plans page.

This example illustrates the fields and controls on the Review Revenue - As Incurred page. You can find definitions for the fields and controls later on this page.

Search Criteria

Use the fields in the Search Criteria group box to filter search results by entering specific values in these fields. If you leave all fields blank, the search returns all revenue plans for all Active contracts within your system. Click the Search button to carry out a search based on the search criteria that you entered. Search results appear in the Details scroll area. Amounts appear in the contract or transaction currency. For as-incurred revenue plan events, a row appears for every transaction currency found within a revenue plan event.

Fee Type

To view as incurred revenue, you must select a value of None in the Fee Type group box. For contracts with a classification of Government, you can select other values in this field.

Detail: General Tab

Field or Control |

Description |

|---|---|

(check box) |

Select this check box if you want to redistribute the revenue that has been booked for a row. |

PC Business Unit |

Displays the value that you specified in the Search Criteria group box. |

Project |

Displays the name of the project with which this billing is associated. A single project can be associated with multiple contracts. |

Activity ID |

Displays the ID with which this billing is associated. Contract lines are linked to projects at the activity level—directly or indirectly. Each activity ID can be associated with only one rate-based contract line. |

Transaction ID |

Displays the ID with which this billing is associated. |

Accounting Date |

Displays the accounting date, which reflects the accounting period in which entries were booked. |

Discount ID |

Displays the discount ID, if this row is associated with a discount ID. |

Amount |

Displays the amount of revenue that was recognized for this row. |

Field or Control |

Description |

|---|---|

Select All |

Select this check box to select all the rows for redistribution. |

Clear All |

Select this check box to clear all the selected rows for redistribution. |

Redistribute |

Click this button to redistribute the revenue for the rows that you selected on the General tab of the Detail scroll area. For each matching row, the system creates a reversal row with a new sequence number and the existing key values. The system also creates another row with a new sequence number, and new set of redistribution ChartField values specified by the user. |

Detail: Contract Tab

Field or Control |

Description |

|---|---|

Contract Line Num (contract line number) |

Displays the contract line that you associated with the revenue plan for this project/activity ID. Each project is linked to a contract line; each contract line is assigned to a revenue plan. |

Distribution Type |

Each different type of accounting distribution entry is distinguished by distribution type. Examples include revenue, contract liability, contract asset, interunit credit, and interunit debit. |

PostSeq# (posting sequence number) |

When you have multiple accounting entries for the same contract line, revenue recognition event, and distribution type, such as when you split revenue across departments, the system uses a posting sequence number to make them unique. |

Reversing Entry |

Indicates if this entry was redistributed. |

Detail: Chartfields Tab

Displays all the ChartFields associated with each accounting distribution line.

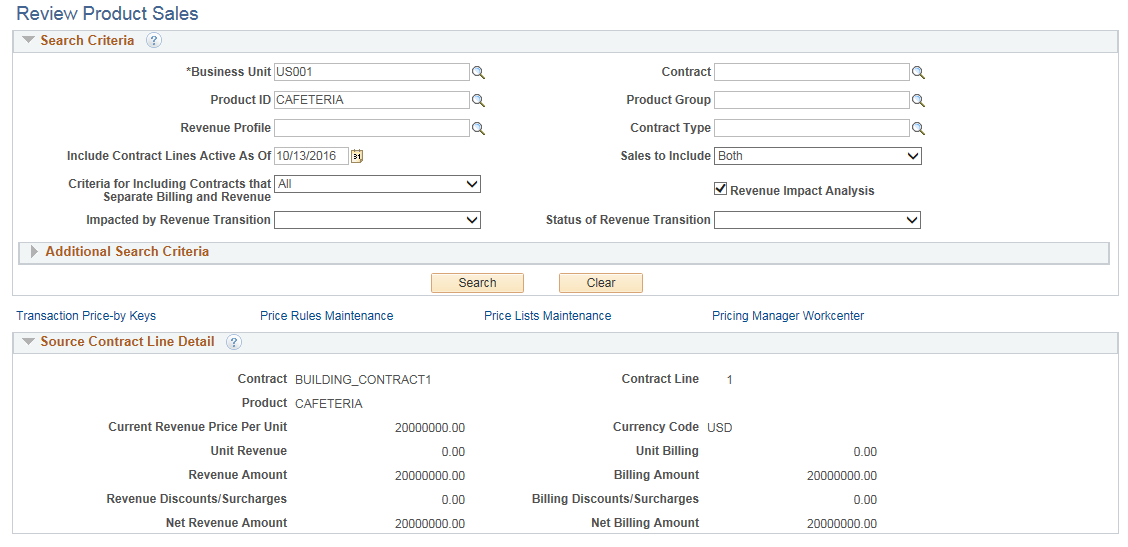

Use the Review Product Sales page (CA_RVW_PRD_SLS_PNL) to review billing and revenue pricing details from contracts across the organization including comparison with the Current Revenue Price for the product as defined in Order Management and the Enterprise Pricer.

This comparison of product prices on historical contract sales to the current revenue price provides users with a basis to change (or retain) the current revenue price for a product. The decision to change or retain a product’s revenue price impacts pricing and revenue allocation on future contracts. This page can be accessed via Related Actions on several pages.

This page can be used to review products sold on a standalone basis, as defined by the Standalone Sale check box on the contract line, and/or it can be used to review sales of products on other contract lines, NOT identified as a standalone sale. See Defining Contract Lines

To assist with the transition of contracts to the new revenue accounting standard, use this page to review the potential impact of new revenue pricing on your existing contract base.

Navigation:

. Select Review Product Sales from the Related Actions menu for the contract line.

. Select Review Product Sales from the Related Actions menu for the contract line.

. Select Review Product Sales from the Related Actions menu for the contract line.

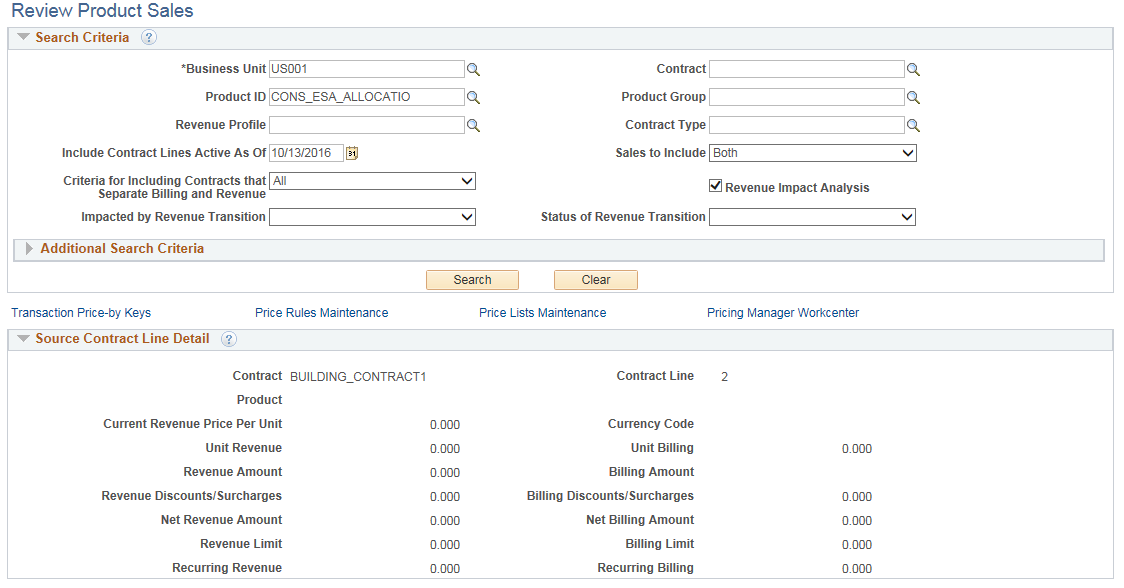

This example illustrates the fields and controls on the Review Product Sales page. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Review Product Sales page — From Actions Menu on an Amount Based line. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Review Product Sales page — From Actions Menu on a Rate Based Line. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Business Unit |

Enter required Business Unit. If this page is accessed via the Related Actions then the Business Unit of the source contract is defaulted to this field. |

Product ID |

Enter Product ID. If this page is accessed via the Related Actions then the Product ID of the source contract line is defaulted to this field. To review multiple products across the business unit, leave product blank. |

Include Contract Lines Active As Of |

Enter suitable date. This field is populated with the current date initially. |

Sales to Include |

Select from the given options:

|

Criteria for Including Contracts that Separate Billing and Revenue |

Select from the given options:

|

Impacted by Revenue Transition |

Use this criteria to filter contracts with a particular impact. Values are:

|

Revenue Impact Analysis |

Select the check box to display the Revenue Impact tab in the Product Sales Detail grid. |

Status of Revenue Transition |

Use this criteria to filter contracts with a particular revenue transition status. Values are:

|

Transaction Price-by Keys |

Click link to open the Price-by Key Field page in the Enterprise Pricer. This page lists the product and contract attributes available to use as criteria in determining product pricing for revenue in the Enterprise Pricer. |

Price Rules Maintenance |

Click link to open the Price Rule page in the Enterprise Pricer. |

Price Lists Maintenance |

Click link to open the Price List page. |

Pricing Manager WorkCenter |

Click link to open the Pricing Manager WorkCenter page. |

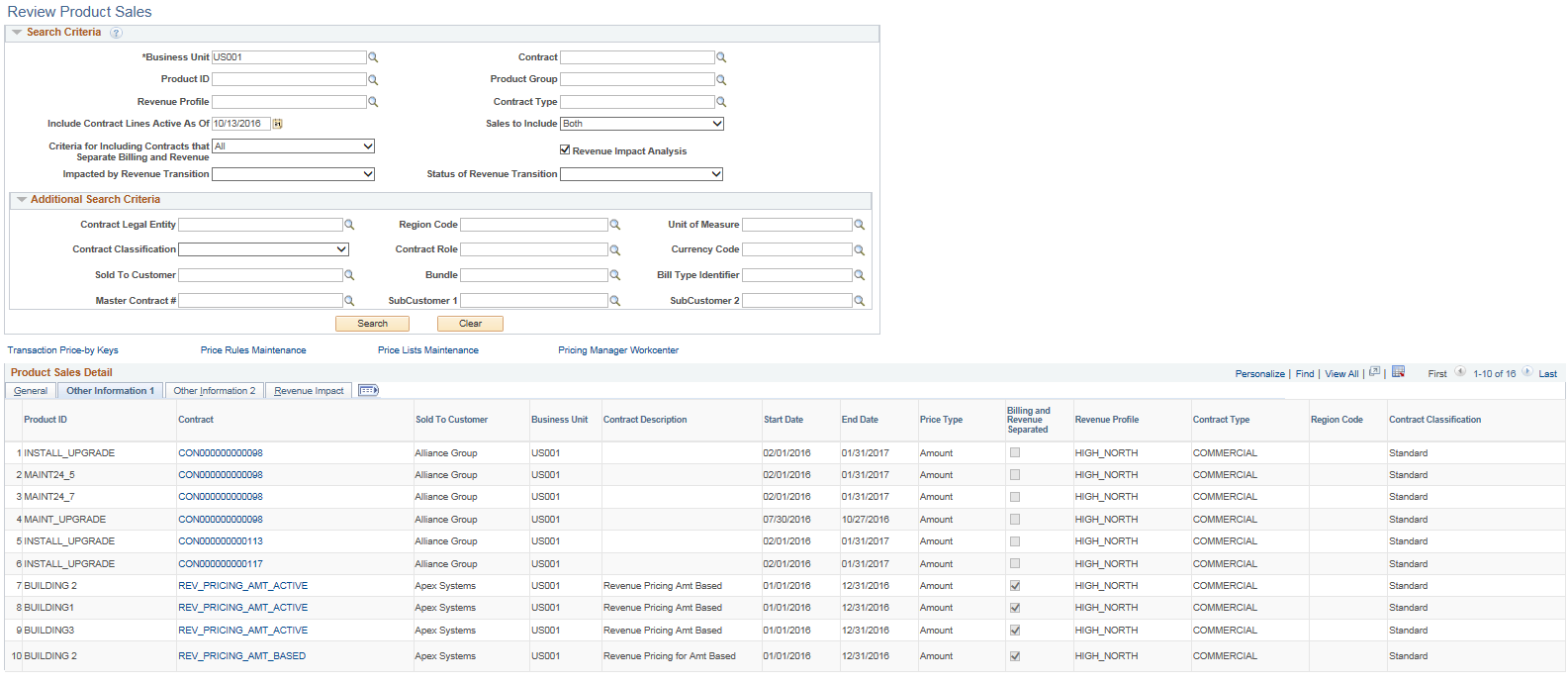

Product Sales Detail — General

The fields displayed in this grid include billing and revenue amounts from the contract line and the Current Revenue Price Per Unit for the product as defined in Order Management and the Enterprise Pricer. Data in this grid is pre-populated via the Load Current Revenue Price process. Data can be viewed online, downloaded to excel or queried from the table using PeopleSoft Query.

Field or Control |

Description |

|---|---|

Current Revenue Price Per Unit |

Displays the product’s revenue price as defined in Order Management and the Enterprise Pricer based on contract and product attributes. |

Note: The Enterprise Pricer uses pricing configuration identified to the RP (revenue pricing) transaction code. Also, note that the Current Revenue Price Per Unit will equal the Unit Revenue price on the contract line since percent based products are not included in the Enterprise Pricer.

Product Sales Detail — Other Information 1

This example illustrates the fields and controls on the Review Product Sales page — Other Information 1. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Start Date |

Displays the contract line start date. |

End Date |

Displays the contract line end date. |

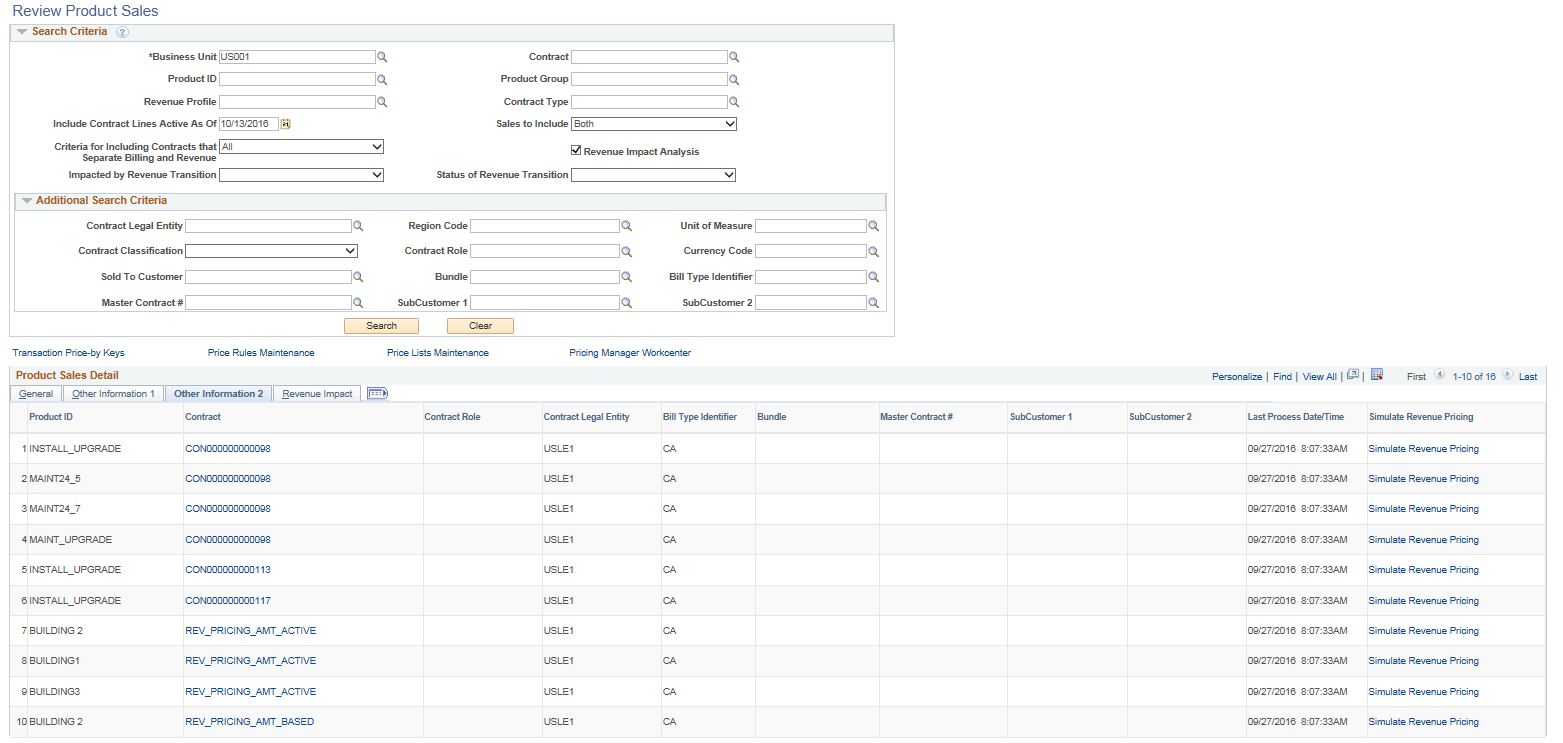

Product Sales Detail — Other Information 2

This example illustrates the fields and controls on the Review Product Sales page — Other Information 2. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Last Process Date/Time |

Displays the last date and time the load process was run. |

Simulate Revenue Pricing |

Click link to open the Pricing Simulator page. The information displayed on this page is pre-populated based on the source contract/contract line. |

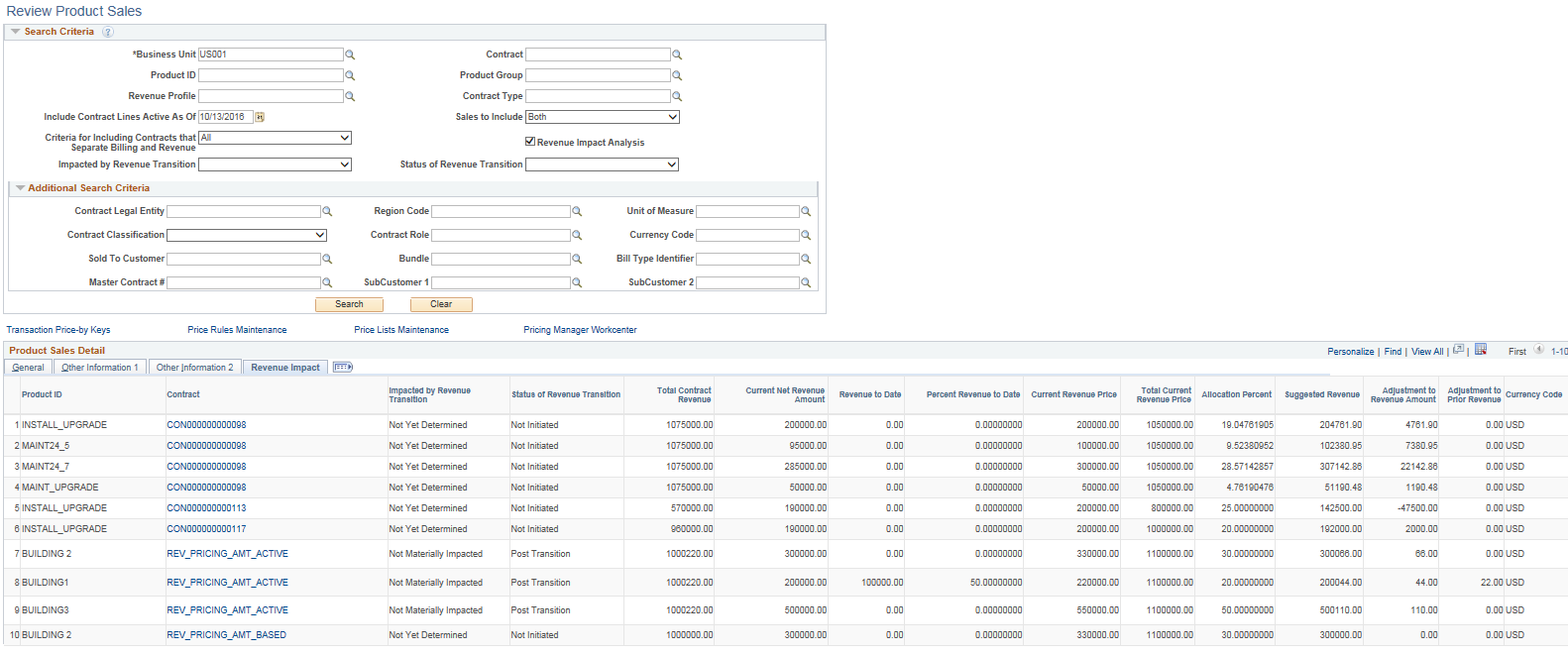

Product Sales Detail — Revenue Impact

The Revenue Impact tab details the potential impact of new revenue pricing (standalone sales pricing) on a existing contract. To begin using the analysis, standalone sales prices for your products should be entered in Order Management and the Enterprise Pricer. The analysis produces a suggested revenue allocation across contract lines using the current standalone sale price as the basis for the allocation much like it would if the contract were created today. In addition, the page compares a new suggested revenue amount to the existing revenue amount on the contract line and displays a suggested adjustment. A portion of this adjustment is identified to prior periods based on the amount of revenue already recognized.

This tab appears only if the Revenue Impact Analysis check box is selected.

This example illustrates the fields and controls on the Product Sales Detail — Revenue Impact. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Total Contract Revenue |

Displays the sum of Total Revenue Amount of the contract and the Revenue Adjustment amount from Revenue Transition Status section of the Contract General page. |

Current Net Revenue Amount |

Displays the Net Revenue Amount for amount/percent based lines, Revenue Limit for rate based lines, and Recurring Revenue for recurring lines. |

Revenue to Date |

Displays the revenue recognized to date. This is used in calculating the Percentage of Revenue to Date. |

Percent Revenue to Date |

Displays the percentage of total revenue recognized to date as Revenue to Date divided by the Net Revenue Amount. |

Allocation Percent |

For each contract line on the contract, the system calculates the relative percentage of the individual contract line to the total of all contract lines on the contract using the current standalone sales price as a basis. |

Suggested Revenue |

System calculates suggested revenue by multiplying Total Revenue by the Relative Percentage for the line. In doing so, the system suggests an allocation of revenue to the contract line much as would if the contract were being created today. |

Adjustment to Revenue Amount |

System calculates difference between the existing current revenue amount on the line and the new suggested revenue amount for the line. |

Adjustment to Prior Revenue |

The adjustment to prior revenue is calculated by multiplying the Adjustment to Revenue Amount by the Percentage of Revenue to Date. In doing so, the analysis identifies a portion of adjustment to revenue to prior periods. The analysis assumes no change in the timing of revenue recognition. |

Use the Load Current Revenue Price page (RUN_CA_LD_CUR_REV) to launch the Load Current Revenue Price process. This process populates the CA_PRDSAL_TBL table with this information and then displayed on the Review Product Sales page. The level of processing (and reporting data) is the contract line. When the load process runs, based on the contract criteria selected, data for a contract/contract line is deleted and replaced with current data. Previous analyses are not stored in the system. The process provides an option to purge data as well. With this option, you can purge entire sets of data from a previous analysis without replacement. You might use this option to purge older contracts that ended long ago. This helps reduce table size improving online processing in the Review Product Sales page. Care should be taken when running the load or purge process with access limited to users with proper knowledge and authority.

Navigation:

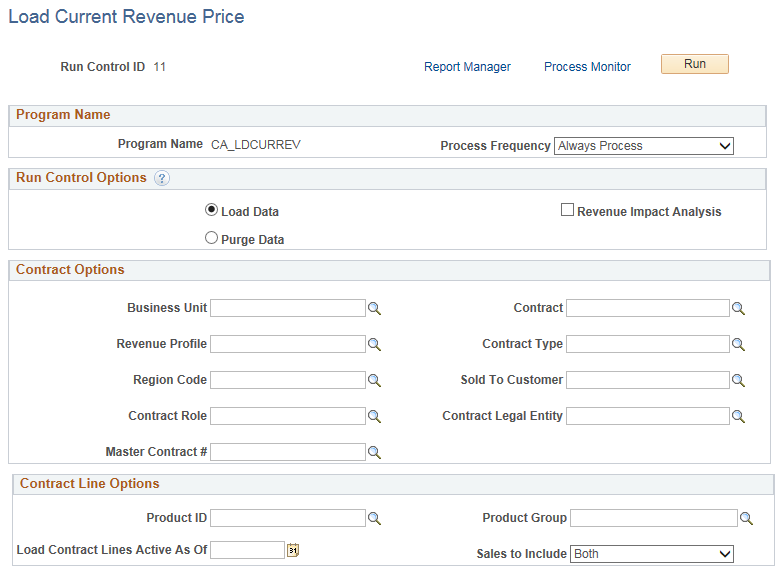

This example illustrates the fields and controls on the Load Current Revenue Price - Load Data page. You can find definitions for the fields and controls later on this page.

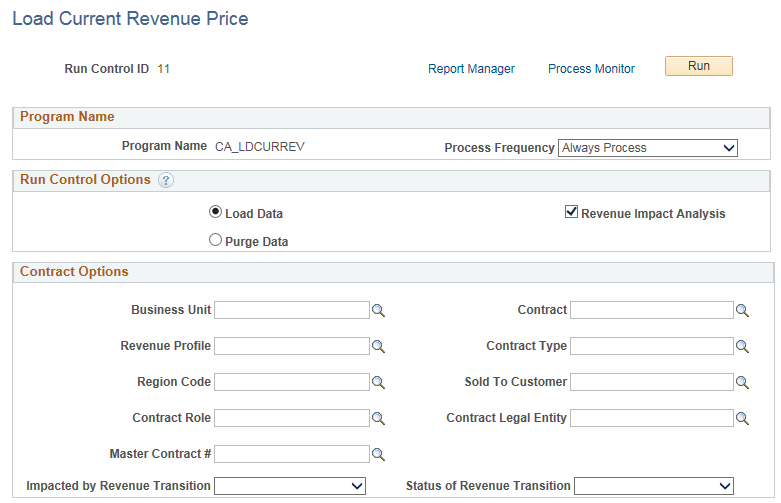

This example illustrates the fields and controls on the Load Current Revenue Price - Load Data page. You can find definitions for the fields and controls later on this page.

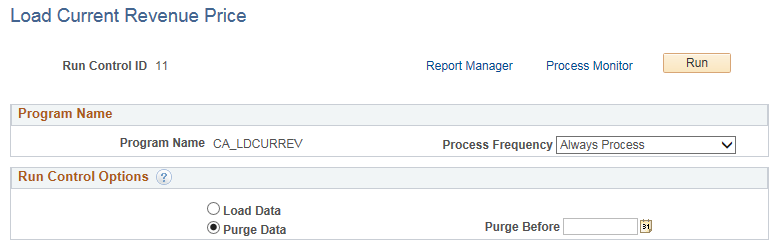

This example illustrates the fields and controls on the Load Current Revenue Price - Purge Data page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Process Frequency |

Select from the given options:

|

Load Data |

Select this option to load contract line billing and revenue pricing data into a reporting table CA_PRDSAL_TBL which is then used for analysis on the Review Product Sales page. On selecting this option the Contract Options grid will be visible and enterable. For all contract /contract lines included in the load, any previous analysis of the line will be deleted and replaced with current data. |

Purge Data |

Select this option to purge the data from the Review Product Sales page. |

Purge Before |

All information dated prior to the purge date will be deleted. |

Revenue Impact Analysis |

Select this check box to calculate the values for the fields on the Review Product Sales — Revenue Impact tab. On selecting this check box the Impacted by Revenue Transition and Status of Revenue Transition fields are displayed. The Contract Line Options group box is hidden. |

Contract Options

For a complete analysis of contract pricing, you should run this process at as high of a level as is manageable such as at the Business Unit. To the extent lower level contract fields are used as criteria, only contracts meeting such specific criteria will be refreshed. Other contracts that are similar that do not meet the specific criteria on the run control page will not be deleted and are not refreshed.

Field or Control |

Description |

|---|---|

Impacted by Revenue Transition |

Select one of the given values to include only contracts with a particular impact:

|

Status of Revenue Transition |

Select one of the given values to include only contracts with a particular transition status:

|

Contract Line Options

Field or Control |

Description |

|---|---|

Load Contract Lines Active As Of |

Enter a date to include contract lines active as of a specific date. The process will include contract lines where the date entered here is between the contract line start date and end date. If no date is mentioned then all the contract lines will be selected for processing. |

Sales to Include |

Select from the given options:

|

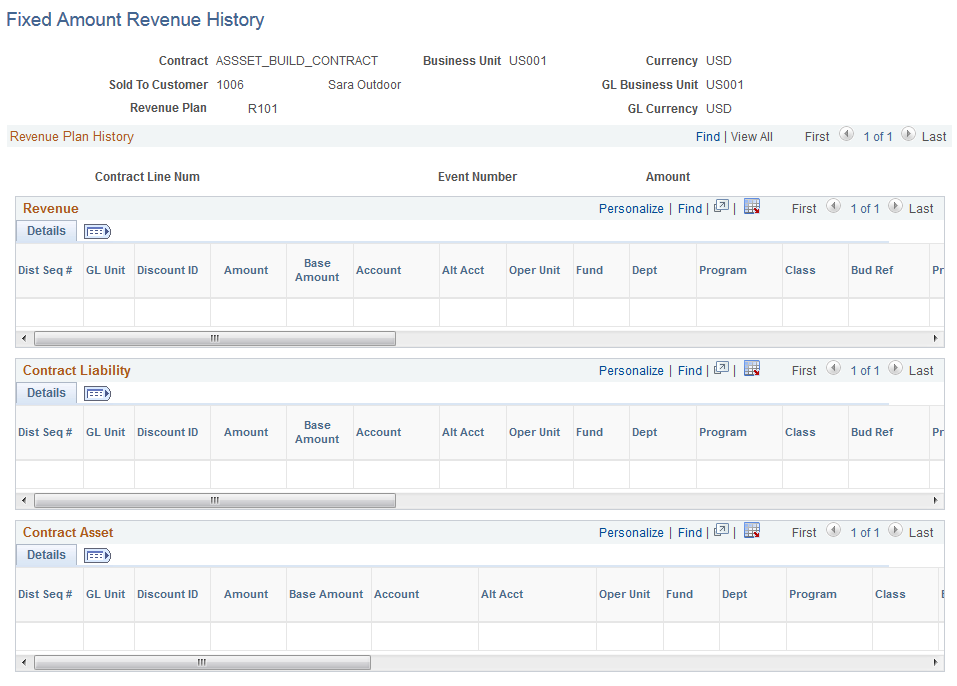

Use the Fixed Amount Revenue History page (CA_AP_EVENT_DTL) to review the revenue details for contract liability, revenue, and contract asset for PeopleSoft Contracts fixed amount accounting activities that have been recorded in GL.

Navigation:

This example illustrates the fields and controls on the Fixed Amount Revenue History page. You can find definitions for the fields and controls later on this page.

Note: The Fixed Amount Revenue History page displays accounting entries for amount-based contract lines only.

Field or Control |

Description |

|---|---|

Currency |

Displays the currency code for the contract. |

GL Business Unit |

Displays the PeopleSoft General Ledger business unit established for the PeopleSoft Contracts business unit. |

Revenue Plan |

Displays the revenue plan ID number. Each contract can contain multiple revenue plans. |

GL Currency |

Displays the currency code for the PeopleSoft General Ledger business unit associated with the PeopleSoft Contracts business unit. |

Revenue Plan History

Field or Control |

Description |

|---|---|

Dist Seq # (distribution sequence number) |

Each accounting distribution entry is identified by a unique distribution sequence number. |

GL Unit |

Displays the PeopleSoft General Ledger business unit where accounting was booked. |

Discount ID |

Displays the discount ID, if this row is associated with a discount ID. |

Amount |

Displays in the contract currency the amount of revenue that was recognized for this row. |

Base Amount |

Displays the amount of the line in the base currency of the PeopleSoft General Ledger business unit. |

Stat (statistics) |

Displays the statistics code, if you created statistical entries for the line. |

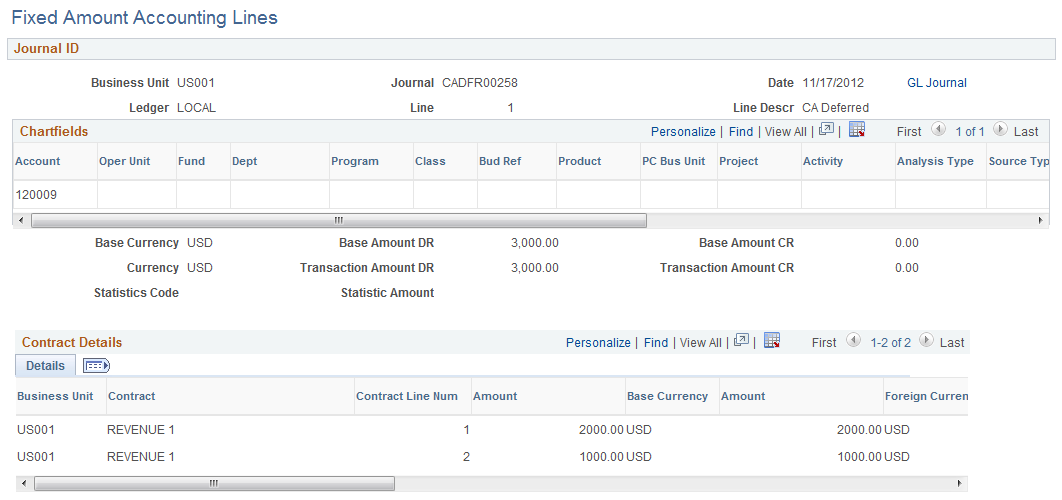

Use the Fixed Amount Accounting Lines page (CA_ACCT_LINE_JRNL) to inquire about the details of each journal entry after you have run the Contracts Fixed Amounts Revenue process and your accounting entries have gone through the Journal Generator process and have posted to the GL.

Navigation:

This example illustrates the fields and controls on the Fixed Amount Accounting Lines Page. You can find definitions for the fields and controls later on this page.

Your contracts accounting entries must have posted successfully to the GL by the Journal Generator process in order to view them on this page.

Field or Control |

Description |

|---|---|

Unit |

Displays the PeopleSoft General Ledger business unit. |

Journal |

Displays the PeopleSoft General Ledger journal ID. |

Line Descr (line description) |

Displays the journal line description, if you entered a line description when you created the line. |

GL Journal |

Click to access the journal for this accounting line. |

Project |

Displays the PeopleSoft Project Costing project ID. |

Affiliate |

Displays the other PeopleSoft General Ledger business unit for interunit accounting entries. |

Statistic Amount and Stat |

Displays the statistical amount and statistical code if you created statistical entries for the line. |

Base Amount |

Displays the amount of the line in the base currency of the PeopleSoft General Ledger business unit unless you display debits and credits separately. |

Base Amount DR (base amount debit) or Base Amount CR (base amount credit) |

If you display debits and credits separately, these fields display the amounts in the base currency of the business unit. |

Item Amount |

Displays the item amount for each accounting line, unless you enabled the Display Separate Debit/Credit in Subsystem option on the Operator Preferences - Overall page. |

Amount |

Displays the monetary amount of the line in the base currency (Currency Code), if you are not displaying the debits and credits separately. |

Transaction Amount DR (transaction debit amount) or Transaction Amount CR (transaction credit amount) |

Displays the amounts in the base currency of the business unit, if you are displaying the debits and credits separately. |

Amount |

Displays the foreign amount in the amount of the transaction in the entry currency (Foreign Currency Code) unless you enabled the Display Separate Debit/Credit in Subsystem option on the User Preferences - Overall Preferences page. If you enabled the Display Separate Debit/Credit in Subsystem option, the Debit Amount or the Credit Amount and currency appear for each accounting line. |

Note: If you are not displaying separate debits and credits, negative amounts indicate a credit to the account and positive amounts indicate a debit.

Use the As Incurred Accounting Lines page (CA_ACCT_RATE_JRNL) to inquire about the accounting entries after you have run the rate-based revenue process (Accounting Rules Engine) and your accounting entries have gone through the Journal Generator Update process and have been posted to the GL.

Navigation:

Note: Your contracts accounting entries must have successfully been posted to the GL by the Journal Generator process to view them here.

The fields on this page are the same as those on the Contract Acct Line Jrnl page.

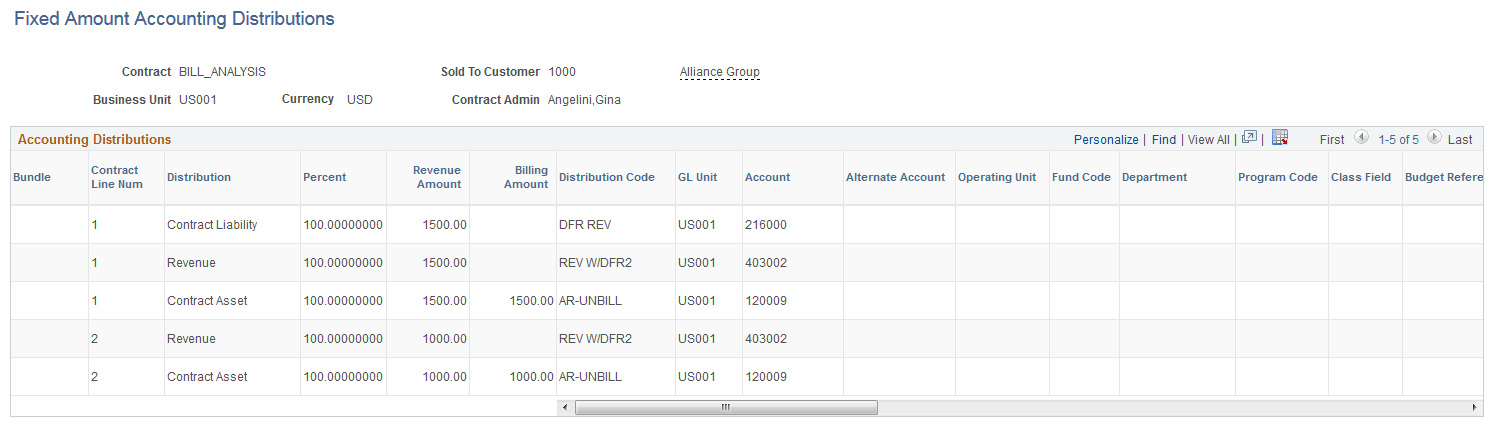

Use the Fixed Amount Accounting Distributions page (CA_RECON_FF_DIST) to view accounting distribution detail for contract lines. Contract lines are grouped based on the Bundle attribute.

Navigation:

This example illustrates the fields and controls on the Fixed Amount Accounting Distributions Page. You can find definitions for the fields and controls later on this page.

Use the fields in the Search Criteria group box to filter your search results by entering specific values in these fields.

Click any Contract hyperlink to navigate to the Fixed Amount Accounting Distributions page.

Field or Control |

Description |

|---|---|

Bundle |

Displays the bundle name for the contract line. |

Revenue Amount |

Displays the revenue amount of the line distribution. |

Billing Amount |

Displays the billing amount of the line distribution. |

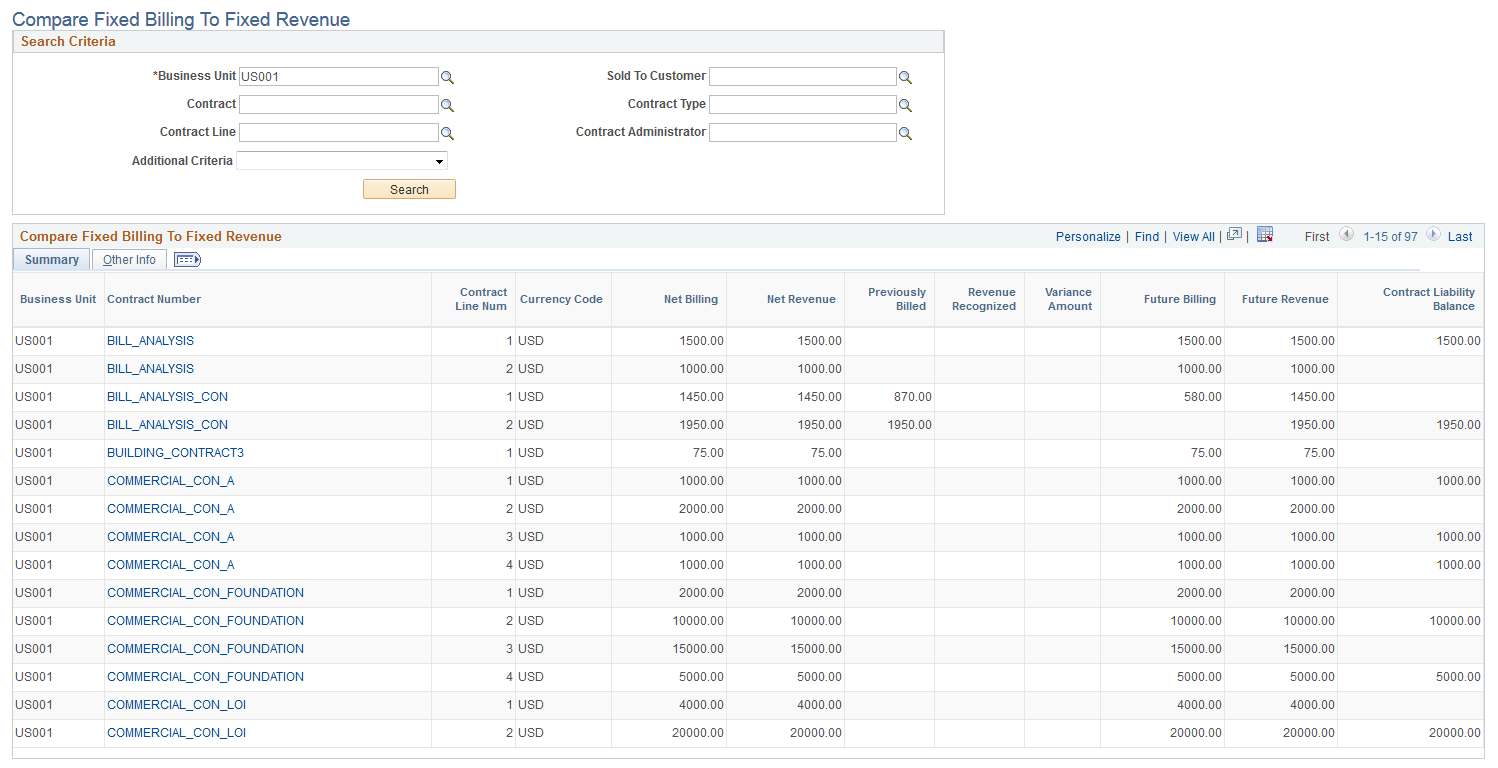

Use the Compare Fixed Billing To Fixed Revenue page (CA_RECON_FF_SUM) to compare fixed billing and fixed revenue values across contracts and contract lines. Use search criteria to review a more specific population of contracts.

Navigation:

This example illustrates the fields and controls on the Compare Fixed Billing To Fixed Revenue Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Additional Criteria |

Select from the given options further define the criteria for review :

|

Net Billing |

Displays the net billing amount allocated to the contract line. |

Net Revenue |

Displays the net revenue amount allocated to the contract line. |

Previously Billed |

Displays the total billed amount. |

Revenue Recognized |

Displays the total revenue amount recorded in GL. |

Variance Amount |

Displays difference between the billed amount and the revenue recognized. |

Future Billing |

Displays the future billing amount calculated as net billing amount for the line minus the previously billed amount for the line. |

Future Revenue |

Displays the future revenue amount calculated as net revenue amount for the line minus the revenue previously recognized for the line. |

Contract Liability Balance |

Displays the contract liability balance calculated by reducing the Net Revenue by the revenue previously recognized. |