Understanding Accounting Entries for Multicurrency Transactions

If you enter pending items or payments in a currency other than the business unit base currency, accounting entries carry currency information. PeopleSoft Receivables displays accounting entries as follows:

|

Entry Type |

Currency Type |

|---|---|

|

Receivables entries. |

Entry and business unit base currencies. |

|

Cash entries. |

Payment and business unit base currencies. |

|

User-defined entries. |

Entry and business unit base currencies. |

|

Realized or unrealized gain/loss entries. |

Base currency. |

You can display the totals on the Accounting Entries page in the entry, payment, or base currency.

You create accounting entries for unrealized gain or loss when you run the Receivables Revaluation Application Engine process (AR_REVAL). Accounting entries are also created when you run the Receivables Update process.

The accounting entries generated show both realized gain or loss, and unrealized gain or loss. The system creates accounting entries for realized gain or loss based on the items paid on the maintenance or payment worksheets.

For a partial payment, the system calculates realized gain or loss based on the payment amount.

The system stores realized gain and loss accounting entries in the Item Distribution (PS_ITEM_DST) table along with other accounting entries generated by the system. It stores unrealized gain or loss accounting entries in their own table (PS_RVL_ACCTG_LN_AR). The Journal Generator process creates and writes journal entries to the Journal Line table (PS_JRNL_LN) and the Journal Header (PS_JRNL_HEADER) table in the process of selecting and summarizing accounting entries in general ledger journal entries.

Note: The Journal Generator processes unrealized gain or loss accounting entries as a separate request.

If you select the multibook option on the Installation Options - Overall page, the Receivables Update process creates accounting entries for both the primary ledger and secondary ledgers, including translation ledgers. Each ledger may have a different currency. Secondary ledgers have the same foreign amount currency as the primary ledgers. Translation ledgers create accounting differently than primary and secondary ledgers. When a translation ledger is created, the base currency of the primary ledger becomes the transaction or foreign currency of the translation ledger. This amount is then converted to the base currency of the translation ledger.

Example

Suppose that you enter an item in EUR for a business unit whose base currency is CAD. The base currency for the secondary ledger is EUR. The base currency for the translation ledger is USD. In this case, the process would create entries in these currencies:

|

Ledger |

Foreign Currency (Transaction Currency) |

Base Currency |

|---|---|---|

|

Primary Ledger |

EUR |

CAD |

|

Secondary Ledger |

EUR |

EUR |

|

Translation Ledger |

CAD |

USD |

Note: Multibook functionality does not apply to direct journal payments. Therefore, secondary lines are not created for direct journals.

Rate Types for Secondary Ledgers

The method that the system uses to obtain the rate type for secondary ledgers varies based on the type of transaction. This table shows how it obtains the rate types for the different types of transactions.

|

Transaction Type |

Method |

|---|---|

|

Online pending item entry |

The system does the following:

|

|

Payment worksheets |

The system does the following:

|

|

Maintenance worksheets |

The system does the following:

|

|

Transfer worksheets |

The system does the following:

|

|

Customer-initiated drafts |

The system does the following:

|

|

Supplier-initiated drafts |

The system does the following:

|

|

Direct debits |

The system does the following:

|

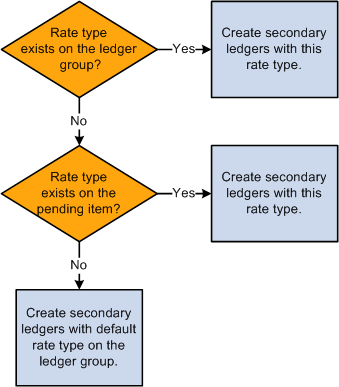

The following flowchart shows how the system obtains the rate type for the secondary ledger entries.

This flowchart shows how the system obtains the rate type for the secondary ledger entries. If the rate type exists in the ledger group, then secondary ledgers are created with that rate type. If the rate type exists in a pending item, then secondary ledgers are created with that rate type. If the rate type does not exist in the ledger group or in the pending item, then secondary ledgers are created with the default rate type of the ledger group.