Setting Up Direct Debit Profiles

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DD_PROFILE |

Create direct debit profiles. |

To set up direct debit profiles, use the Direct Debit Profile component (DD_PROFILE).

Direct debit profiles define the processing characteristics for the Create Direct Debits Application Engine process (AR_DIRDEBIT). You assign a profile to each bill to customer who pays for direct debits.

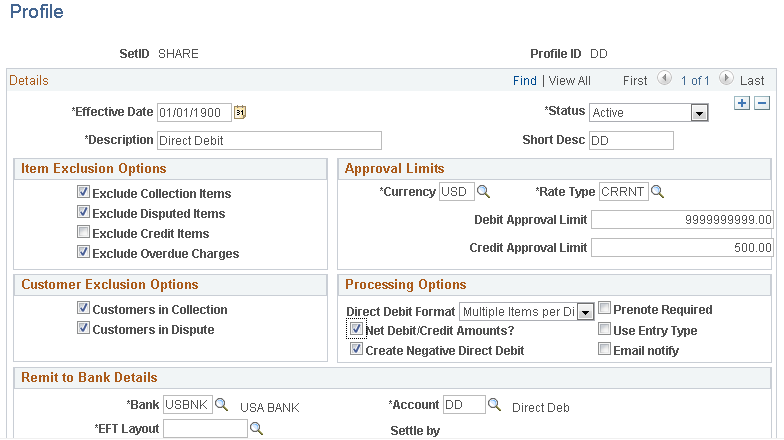

Use the Direct Debit Profile - Profile page (DD_PROFILE) to create direct debit profiles, select item and customer exclusion options, define approval limits and processing options.

Navigation:

This example illustrates the fields and controls on the Direct Debit Profile - Profile page. You can find definitions for the fields and controls later on this page.

Item Exclusion Options

Use the check boxes in the Item Exclusion Options group box to prevent the Create Direct Debits process from selecting certain types of items when it creates direct debits and builds the worksheet.

Customer Exclusion Options

Use the check boxes in the Customer Exclusion Options group box to prevent the Create Direct Debits process from selecting items for customers who are in collection or dispute.

Approval Limits

The values that you enter in the Approval Limits group box determine whether the Create Direct Debits process automatically approves a direct debit or a direct credit. If the direct debit amount is within the approval limits, it assigns the status of Accepted. If the process does not approve the direct debit because it is over the approval limit, it assigns the status of Pending Approval.

Field or Control |

Description |

|---|---|

Currency and Rate Type |

Enter the currency and rate type for the profile. If the currency of the items in the direct debit differs from the currency in the profile, the Create Direct Debits process uses the rate type to convert the amount for comparison. |

Debit Approval Limit |

Enter the maximum amount that a direct debit can be for the Create Direct Debits process to approve it. |

Credit Approval Limit |

Enter the maximum amount that a direct credit can be for the Create Direct Debits process to approve it. |

Processing Options

Field or Control |

Description |

|---|---|

Direct Debit Format |

Select a format option. Values are:

|

Prenote Required |

Select this check box to enable you to create, transmit, and receive confirmation of direct debit prenotes. The PeopleSoft Receivables Direct Debit Application Engine (AR_DIRDEBIT) processes these prenotes, which help to eliminate additional processing or handling fees due to the transmission of incorrect customer account information to the customer's bank. Prenotes also reduce any delays in receivable collections. Note: If this check box is selected, the system verifies that the selected EFT Layout that you select can be used to transmit prenotes. |

Net Debit/Credit Amounts? |

Select to have the Create Direct Debits process create one direct debit that corresponds to the net of all debit and credit open items for the selected business unit, customer, due date, and currency. This field is not available if the Exclude Credit Items field is selected. |

Use Entry Type |

Select to use the direct debit profile that you assigned to the entry type for the item on the Entry Type page instead of the direct debit profile that you assigned to the bill to customer. The Create Direct Debits process selects only items for which the entry type matches the direct debit profile that you select on the run control page and the process uses that profile to determine the processing options. Note: If you do not assign a direct debit profile to an entry type, the system uses the direct debit profile that you assigned to the bill to customer. |

Create Negative Direct Debit |

Select to indicate that the Create Direct Debit process (AR_DIRDEBIT) creates negative direct debits. For this field to appear, you must select the Net Debit/Credit Amounts? field. For more information about the Create Direct Debit process: |

Email Notify |

Select to indicate that the Bill To customer should receive a remittance advice through e-mail. This applies to all Bill To customers who are associated with this direct debit profile Also enables the delivery of Direct Debit (DD) remittance advice information to a customer contact using e-mail. You must select this check box in the Direct Debit profile and set up a customer contact in order to notify the assigned customer contact that the customer's bank has been instructed to withdraw money from the customer's account in their bank. Note: An e-mail is also sent when a canceled direct debit is reprocessed. However, the system does not send an e-mail when a direct debit payment cancellation occurs. |

Remit to Bank Details

Field or Control |

Description |

|---|---|

Bank and Account |

Enter the bank ID and account number into which the funds are deposited. |

EFT Layout (electronic funds transfer layout) |

Select the EFT layout that you use to request the funds. The system populates this field with the default EFT layout that you assigned to the bank account on the Collection Methods page. Override the layout if needed. Important! If you selected the Prenote Required check box on this page, the system runs an edit to verify that the EFT layout is valid for prenotes. |

Field or Control |

Description |

|---|---|

Settle by |

Displays the remittance method that you assigned to the EFT layout on the Collection Methods page for the bank account. Values are: 01 Financial Gateway: Sends the settlement request through the Financial Gateway option in PeopleSoft Cash Management. The Financial Gateway option creates the EFT files and submits them to the bank. You receive acknowledgement statuses from the Financial Gateway option. 02 Format EFT: Generates an EFT file in PeopleSoft Receivables, which you send to the bank manually or through a third-party integration. The Create Direct Debits process assigns the remittance method to each direct debit that it creates. When you run the processes to create direct debits, each process checks the Settle by field for the direct debit to determine whether to process the direct debit. |