Resolving Credit Card Payment Exceptions

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

AR_CRCARD_WORKBNCH |

Select credit card payments and perform mass actions on credit card payments. |

This section describes how to unpost credit card payments and offers examples of handling disputed credit card charges under the following conditions:

The customer disputes a charge with their credit card company.

The customer claims the wrong credit card was charged.

The customer questions application of the payment.

The credit card payment is denied.

The customer disputes the amount of the charge.

For example, the customer was billed in error or overcharged, or a problem with the order resulted, such as the goods were damaged or not received.

As credit card worksheets are authorized and settled, the system generates payment groups from the worksheets. To unpost a credit card payment, use the PeopleSoft Receivables payment unpost components. Once a worksheet is unposted, use the credit card worksheet to reapply items.

Example 1: Customer Disputes a Charge with Their Credit Card Company

In this example, the transaction is completely processed, which means that cash was received by your bank and accounting entries were made in PeopleSoft Receivables. The customer's credit card company credits the customer's account and debits your bank. Perform the following steps:

Unpost the payment group with the credit card payment and then run the Receivables Update process.

Delete the deposit containing the payment.

Example 2: Customer Claims the Wrong Credit Card Was Charged

In this example, the transaction is completely processed. Perform the following steps:

Unpost the payment group that contains the credit card payment.

Run the Receivables Update process.

Use the credit card worksheet to issue a credit to the original credit card by creating an on-account item for the credit card payment.

Complete the authorization and settlement process.

Run the Receivables Update process again.

Debit the correct credit card by creating a new credit card payment using the correct credit card account.

Complete the authorization and settlement process on the new credit card payment.

Run the Receivables Update process.

Example 3: Customer Questions Application of the Payment

In this example, the customer wants the credit card payment reapplied. No credit is issued. Perform the following steps:

Unpost the credit card payment group that contains the credit card payment.

Run the Receivables Update process.

Reapply the credit card payment using the credit card worksheet. Authorization and settlement is not required, however, a separate transaction is required to pay for additional items.

Example 4: Credit Card Payment Is Denied

In this example, the credit card transaction is denied by the third-party authorizing authority. Use the Credit Card Workbench page to take further action. You can take three different actions in this scenario:

Resubmit the transaction. Perform the following steps:

Correct any incorrect information based on the code return from the payment processor.

Resubmit the transaction for authorization and settlement.

Change the payment method for the item if the customer does not want to pay by credit card. You must delete the credit card worksheet data.

Call for manual authorization and enter the approval code online.

Example 5: Customer Disputes the Amount of the Charge

You can take three different actions in this scenario:

Issue a credit memo from PeopleSoft Billing.

If the credit is settled in PeopleSoft Billing, create a credit item and payment from PeopleSoft Receivables and then close them.

If credit is not settled in PeopleSoft Billing, that is, the credit card item was created in PeopleSoft Receivables, perform the following steps:

Credit the customer's credit card.

Leave as a credit memo to be picked up in next automated credit card run.

Match with debits on the maintenance worksheet.

Refund the disputed amount through PeopleSoft Payables.

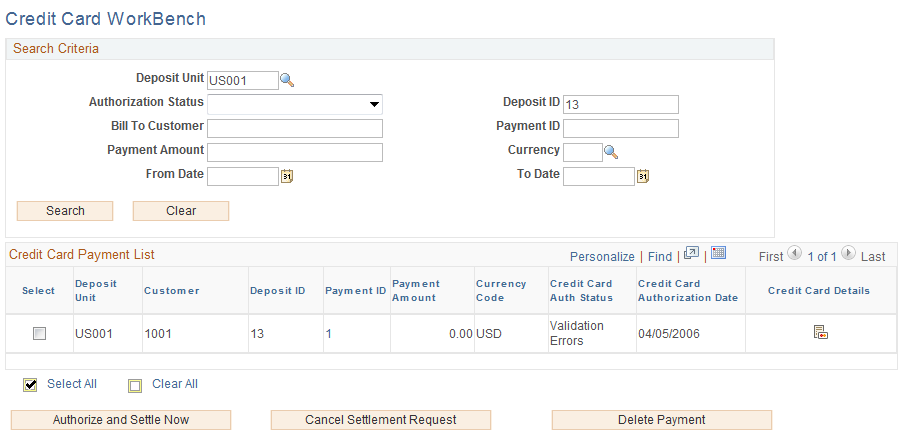

Use the Credit Card Workbench page (AR_CRCARD_WORKBNCH) to select credit card payments and perform mass actions on credit card payments.

Navigation:

This example illustrates the fields and controls on the Credit Card Workbench page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Authorization Status |

Select the authorization status of the credit card payments that will appear in the Credit Card Payment List area. Values are: Authorized and Billed Deleted after Settlement Denied Manually Approved/Settled No Action Pending Approval Processing Unprocessed/Retry Validation Errors Zero Payment for maintenance |

From Date and To Date |

Enter the date range that identifies when the credit card payments were created. |

Search |

Click to populate the Credit Card Payment List area with data based on the information entered in the Search Criteria region. |

Clear |

Click to clear the information in the Search Criteria region. |

Payment ID |

Displays the remit sequence for the item on the Credit Card Worksheet Application page. Click the link to access the Credit Card Worksheet Application page. |

Credit Card Auth Status (credit card authorization status) |

Displays the authorization status of the credit card payment. |

Credit Card Authorization Date |

Displays the date the authorization was received from the third party authorizing authority. |

Authorize and Settle Now |

Click to submit all selected credit card worksheets for authorization and settlement. Until the authorization and settlement process completes, the credit card worksheets are not available for selection, and they have a credit card authorization status of Processing. |

Cancel Settlement Request |

Click to cancel the settlement request for the selected credit card worksheets that have not been authorized and settled. This button sets the Credit Card Authorization Status to No Action. The canceled credit card worksheets are not selected by the Credit Card Processor, however, you can update a canceled credit card worksheet. |

Delete Payment |

Click to delete all selected credit card payments. The selected items in the worksheet are available for selection in other credit card worksheets. This option is only available for

If the deposit does not contain any other payments, the system also deletes the deposit. If another payment exists in the deposit, the system subtracts the deleted payment amount from the deposit total. |