Remitting Drafts to the Bank

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DR_REMIT_SEL_IC |

Build a draft remittance worksheet. When you build the worksheet, you have the option of discounting drafts for payment before the due date. |

|

|

Available Credit Page |

DR_REMIT_CRED_SEC |

Determine if credit is available at the bank to discount more drafts. See the Draft Remittance Selection Page. |

|

DR_REMIT_WORKS_IC |

Select drafts that are ready for remittance. |

|

|

DR_REMIT_WS_SEC_IC |

View or change remittance information for the drafts. |

|

|

DRAFT_FEE_SEC |

Enter bank fees for discounted drafts. |

|

|

RUN_FIN2025_DR |

Run the Format EFT Files process (FIN2025) that creates the remittance (EFT file) that is sent to the bank. |

|

|

RUN_FIN2025 |

Define the run parameters for the EFT File Cover Sheet report (FSX2025). Use the report to create a cover letter for the EFT file if the bank requires one. |

|

|

DR_EFT_CANCEL |

Cancel the EFT file before you transmit it to the bank, if you need to change a draft after creating an EFT file. After you cancel the EFT file and change the draft, you can then create a new one. This page is available only if you generated an EFT file. |

|

|

EFT_DR_INBOUND |

Run the AR_DRAFT_BNK process to load and process the bank EFT file. |

|

|

DR_IN_BANK_FILE |

Change details for a payment record in a bank EFT file so that the record matches an existing draft. |

|

|

Detail Page |

DR_IN_BANK_SEC |

View details about the issuer and customer's bank ID, branch, and account number. |

|

EFT_DR_EXCEPT |

Define the run parameters for the EFT Draft Inbound Exception report (ARX3210X). Use this report to see a list of exceptions that were found in the bank EFT file for a specific reason. |

|

|

Remittance/Discount Form Page |

DRAFT_REMIT_FORMS |

Define the run parameters for the Remittance/Discount Forms report (AR32103). Submit this SQR report to a bank to inform the bank of the drafts that need to be collected from the customer's bank. See PeopleSoft Receivables Reports: A to Z for more information. |

When you remit drafts to the bank, you indicate when you want to receive funds for the draft, either before the due date for a discounted amount or on the due date for the full amount.

To remit drafts to the bank:

Build a draft remittance worksheet.

Use a draft remittance worksheet to select drafts.

(Optional) Change remittance details.

(Optional) Enter bank fees for discounted drafts.

Create the EFT file for remitting drafts.

(Optional) Create an EFT file cover sheet.

(Optional) Cancel an EFT file for draft remittances.

(Optional) Receive confirmation from the bank.

(Optional) Correct drafts not matched in the bank EFT file.

(Optional) Run the EFT Draft Inbound Exception report.

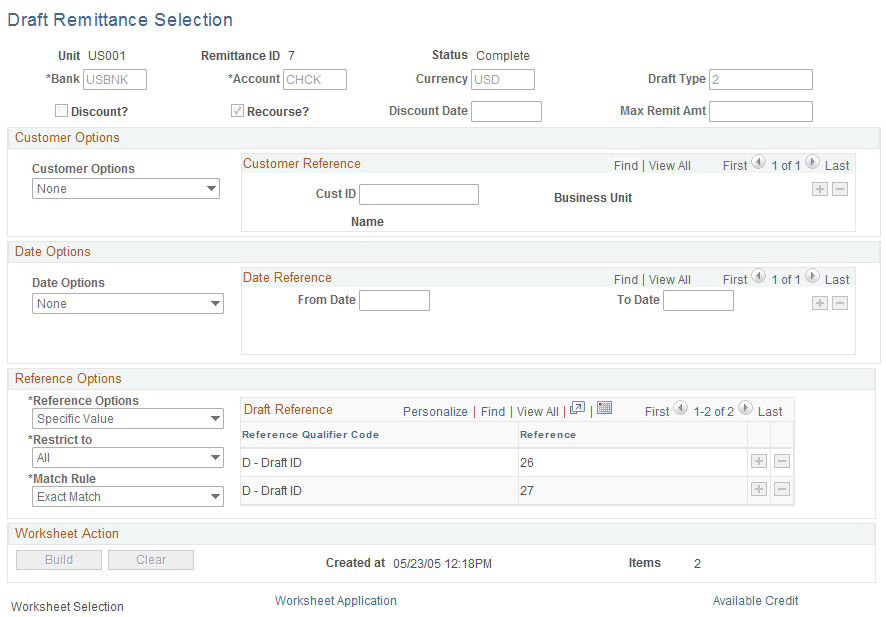

Use the Draft Remittance Selection page (DR_REMIT_SEL_IC) to build a draft remittance worksheet.

When you build the worksheet, you have the option of discounting drafts for payment before the due date.

Navigation:

This example illustrates the fields and controls on the Draft Remittance Selection page. You can find definitions for the fields and controls later on this page.

Worksheets are cumulative. As long as you do not clear the worksheet, you can keep expanding it by selecting additional criteria. Each time you build a worksheet, the drafts you previously selected remain and the system adds drafts that meet the new criteria to the worksheet.

Field or Control |

Description |

|---|---|

Bank and Account |

Enter a bank code and account number. The bank account must have a draft collection method defined on the External Accounts - Collection Method page. |

Currency |

Displays the default currency of the bank account. Change the currency as needed. |

Draft Type |

Select a draft type to limit the worksheet to specific types of drafts. If you leave this field blank, the worksheet includes only drafts that allow discounts. If you select a draft type that does not allow discounts, you cannot enter discount information in the other fields. |

Discount? |

Select to discount all drafts in the remittance for early payment. |

Recourse? |

Select if you are still responsible for the draft amount up until the original due date of the draft. In other words, the amount appears as a liability on your books until your bank receives the funds. |

Discount Date |

Enter a discount date after selecting the Discount? check box. |

Max Remit Amt (maximum remittance amount) |

Enter the maximum remittance amount that you will send to the bank. If the total of the drafts exceeds this amount, you receive a warning message when you mark the worksheet Complete. The amount displays in the currency for the bank account. |

Available Credit |

Click this link to access the Available Credit page (DR_REMIT_CRED_SEC), where you can determine if you have enough credit left with the bank to discount more drafts. |

Customer Options

Use these options to create a worksheet with drafts for a particular customer ID. When you specify a customer, the name of the customer appears and the Customer Options field changes to Customer Drafts. The system includes all the customer's drafts in the worksheet.

Date Options

Use these options to create a worksheet with drafts that have a specific date range.

Field or Control |

Description |

|---|---|

Date Options |

When you specify a date range, the Date Options field changes to Due Date Range. You can change the selection to Accounting Date Range. |

Reference Options

Field or Control |

Description |

|---|---|

Reference Qualifier Code |

Enter the type of information used to identify the drafts. Then, use the Reference and To Reference fields to fill in the details. Options are: B - Customer Bank: Enter your customer's bank account and branch. D - Draft ID: Enter a draft ID. G - Customer Group: Enter a customer group code. R - Draft Reference: Enter a draft document reference number. |

Reference Options and Match Rule |

Options are Specific Value (to match specific values) or None. If you select Specific Value, use the Match Rule field to select Exact Match or Like Match. Like Match compares the beginning characters. For example, a like match of 24% includes all items beginning with 24. |

Restrict To |

Select how reference information should be combined with other selection options to determine which drafts appear in the worksheet. Options are: All: Builds a worksheet with only drafts that meet the reference criteria with no reference to the other options. Customer Only: Builds a worksheet with drafts that match the reference criteria and belong to the specified customers. Date Only: Builds a worksheet with drafts that match the reference criteria and are in the specified date range. Customer and Date: Builds a worksheet with drafts that match the reference criteria, belong to the specified customers, and are in the specified date range. |

Worksheet Action

Field or Control |

Description |

|---|---|

Build |

Click to build a draft remittance worksheet. |

Clear |

Click to remove all drafts from an existing worksheet. |

Use the Draft Remittance Application page (DR_REMIT_WORKS_IC) to select drafts that are ready for remittance.

Navigation:

This example illustrates the fields and controls on the Draft Remittance Application page. You can find definitions for the fields and controls later on this page.

By default, the check box next to each draft is selected. If you do not want to remit a draft, deselect its check box.

Field or Control |

Description |

|---|---|

Due Date |

Displays the date that you expect the bank to receive payment. If the draft is a discounted draft, the bank deposits the funds in the account on the discount date. |

Bank Fees |

Click to open a page where you can enter bank fees for discounted drafts. |

Complete |

Click to approve all selected drafts for remittance and to mark the worksheet as complete. |

Cancel |

Click to cancel the remittance. You can then include the drafts in a new worksheet. |

Edit |

After you click Complete (and before posting), click to edit drafts. Then, click Complete again to mark the worksheet complete. |

Amount and Count |

Displays the total amount and count of the drafts that you selected. |

Max Remit Amt (maximum remittance amount) |

Displays the maximum remittance amount that you can send to the bank. You indicate this number when you build the worksheet. |

Difference |

Displays the difference between the maximum remittance amount and the amount of the selected drafts. |

Min Remit Amt (minimum remittance amount) |

Displays the minimum amount the bank will let you remit if the drafts are discounted. You specify this amount on the Collection Methods page. |

Difference |

Displays the difference between the amount of the selected drafts and the minimum remittance amount. |

Details |

Click to access the Remittance Details page (DR_REMIT_WS_SEC_IC), where you can change remittance details for a draft. |

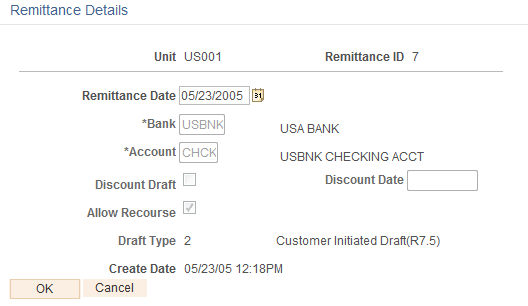

Use the Remittance Details page (DR_REMIT_WS_SEC_IC) to view or change remittance information for the drafts.

Navigation:

Click the Details link on the Draft Remittance Application page.

This example illustrates the fields and controls on the Remittance Details page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Remittance Date |

Enter the date that you remit the draft to the bank for payment. Override today's date, if needed. |

Bank and Account |

Change the bank account to which you submit the draft, if needed. |

Discount Draft |

If this check box is selected, you can change the discount date for discounted drafts. |

Allow Recourse |

If selected, you are still responsible for the draft amount up until the original due date of the draft. In other words, the amount appears as a liability on your books until your bank receives the funds. |

Use the Bank Fees page (DRAFT_FEE_SEC) to enter bank fees for discounted drafts.

Navigation:

Click the Bank Fees link on the Draft Remittance Application page.

Field or Control |

Description |

|---|---|

Pay Amt (payment amount) |

Enter the amount of each fee that the bank charges for discounted drafts. The default currency is the draft currency. |

Entry Type and Reason |

Displays the default entry type for fees come from the business unit. Enter an entry reason, if needed. |

When you post the remittance worksheet, the system adds an item for each bank fee and generates the accounting entries for the bank fees on the discount date.

Use the Create EFT File page (RUN_FIN2025_DR) to run the Format EFT Files process (FIN2025) that creates the remittance (EFT file) that is sent to the bank.

Navigation:

To prevent funds from being collected more than one time, you can select a draft remittance for inclusion in an EFT file only once.

Note: EFT file layouts differ from country to country. The organization that receives the EFT file from your customer should be able to furnish you with the appropriate layout specifications.

The location of the file when the process completes depends on the output destination options that you selected in the process definition for the Format EFT Files process.

If the output destination is User Defined, the location depends on the parameters you enter on the Process Scheduler Request page and can be one of the following:

|

Output Type Destination Options |

Location |

|---|---|

|

Output type: Web |

The file is in the location that you defined for the {FILEPREFIX} variable for SETENV.SQC in %PS_HOME%\sqr\. |

|

Output type: file Output destination: blank |

The file is in the location that you defined for the {FILEPREFIX} variable for SETENV.SQC in %PS_HOME%\sqr\. |

|

Output type: file Output destination: a folder path, such as C:\temp\EFT files |

The file is in the folder path that you specified, such as C:\temp\EFT files\. |

If the output destination for the Format EFT Files process is Process Definition, the location is the folder that you defined for the output definition for the process definition.

If the output destination for the process definition is Process Type Definition, the location is the folder that you defined for the output definition for the SQR process type definition.

Use the Create EFT File Cover Sheet page (RUN_FIN2025) to define the run parameters for the EFT File Cover Sheet report (FSX2025).

Use the report to create a cover letter for the EFT file if the bank requires one.

Navigation:

Field or Control |

Description |

|---|---|

Language Option |

You specify whether the cover sheet is in a Specified Language or the Recipient's Language, and then select the Language Code. |

EFT Layout Code |

Enter the code for the type of EFT file used to submit the draft. |

Process Instance |

Displays the number of the process instance that created the EFT file. |

Use the Cancel EFT File page (DR_EFT_CANCEL) to cancel the EFT file before you transmit it to the bank, if you need to change a draft after creating an EFT file.

After you cancel the EFT file and change the draft, you can then create a new one. This page is available only if you generated an EFT file.

Navigation:

Click Cancel Draft EFT File.

Use the Inbound Bank EFT File page (EFT_DR_INBOUND) to run the AR_DRAFT_BNK process to load and process the bank EFT file.

Navigation:

Field or Control |

Description |

|---|---|

EFT Layout Code and File Name |

Enter the EFT layout code and the file name for the EFT file for which you are trying to determine whether the payment collection was successful. |

If the payment collection was not successful, the AR_DRAFT_BANK process changes the status of the draft to Void on the Draft Control record (DRAFT_CONTROL). The next time you run the Receivables Update process, it generates the appropriate accounting entries to reverse the payment.

Use the Inbound Bank EFT File for Drafts page (DR_IN_BANK_FILE) to change details for a payment record in a bank EFT file so that the record matches an existing draft.

Navigation:

The EFT Transactions grid contains a list of payment records that were in the bank EFT file that the AR_DRAFT_BANK process could not match to drafts in the system. You need to determine which draft in the system matches a payment record and update the information so that it matches a draft. When you save the page, the system changes the status of the draft based on the reason code assigned to the payment record.

Field or Control |

Description |

|---|---|

Unit or Draft ID |

Enter the business unit or draft ID of the draft on the system that matches the payment record. |

Reason Code |

If the reason code on the payment record does not match a reason code on your system, change the code to match the appropriate code defined on your system. |

Use the Bank Remit Exception Report page (EFT_DR_EXCEPT) to define the run parameters for the EFT Draft Inbound Exception report (ARX3210X).

Use this report to see a list of exceptions that were found in the bank EFT file for a specific reason.

Navigation:

Field or Control |

Description |

|---|---|

EFT Layout Code |

Enter the EFT file layout code for the EFT files that you submitted to the bank whose exceptions you want to include in the report. |

Reason Code |

Enter the code that identifies the reason why the collection failed. |