Generating Risk Scores

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUN_AR_RISK |

Run the Request Risk Scoring Application Engine process (AR_RISK) |

Risk score definitions include these:

Term |

Definition |

|---|---|

Scoring Element |

Describes the type of scoring data used to make up a scoring rule. For example, balance due or DSO30. |

Scoring Group |

A group of related scoring elements, such as, system defined history or aging |

Scoring Rule |

A user-defined rule which can consist of one or more scoring elements used to compute a risk score for a customer or group of customers. |

The Request Risk Scoring Application Engine process (AR_RISK) is used to compute the risk score for a customer or group of customers using the scoring rules that you set up in the Risk Scoring Rule component (Set Up Financials/Supply Chain, Product Related, Receivables, Credit/Collections, Risk Scoring Rule). You should run the AR_RISK program as part of a nightly batch run after the ARUPDATE and AR_AGING processes have completed. The AR_RISK program relies on updated history and aging information to compute the most accurate risk score.

The customers are loaded by SetID, customer group or specific customer, depending on your selections on the Compute Risk Scores run control page. The business units are loaded based on the customers that were loaded. The risk scoring rules are loaded in a hierarchical fashion, similar to assessment rules used by the Condition Monitor. The user also has the option to run the risk scoring process for only one rule by entering the override risk score id on the Compute Risk Scores run control page.

After all the customers and rules are loaded into temporary tables, the program processes each type of scoring group necessary based on the rules selected. Each section retrieves the relevant data to compute the score and stores the data in a temp table. Amounts are converted to the anchor currency defined on the risk scoring rule using the anchor date and rate type selected on the Compute Risk Scores run control page. Once all of the scoring groups are processed and the data is stored in temp tables, a risk score is computed for each scoring element by comparing the data to the range values defined on the risk scoring rule. The computation is risk score = (risk range value * (risk scoring weight / 100)). The individual element scores are summed for the overall customer score and the PS_CUST_CREDIT table is updated with the customer risk score.

Here is an example of how the hierarchical Risk Scoring processing (AR_RISK) works:

You run the AR_RISK program using customer 1000.

The program:

Looks for a risk rule defined for customer 1000.

If a risk rule is found, the program selects the first one and quits the selection process for this customer.

If a risk rule is not found, the program looks for a risk rule defined for a customer group to which customer 1000 belongs.

If a risk rule is found for this customer group, select the first one and quit the selection process for this customer.

If a risk rule is not found for this customer group, look for a rule defined for a SetID to which customer 1000 belongs.

If a risk rule is found for this SetID, select the first one and quit the selection process for this customer.

If a risk rule is not found for this SetID, the program will issue a message indicating that no rule has been found.

These are examples of how the Risk Score process calculated risk scores for Customer A and Customer B.

|

Customer A |

|||||||

|---|---|---|---|---|---|---|---|

|

Scoring Group |

Element |

Customer Metrics |

Range Low |

Range High |

Range Value |

Scoring Weight (%) |

Score Weight * Value |

|

System Defined History |

AVGDAYS (Average Days Late) |

50 |

-99999 36 57 |

35 56 99999 |

1 2 3 |

0.15 |

0.30 |

|

Aging Information |

06 121+ (121+ days aging category) |

8,000 |

-999,999,999 1001 10,001 |

1000 10,000 999,999,999 |

5 10 15 |

0.85 |

8.50 |

|

Total Score: |

8.80 |

||||||

|

Customer B |

|||||||

|---|---|---|---|---|---|---|---|

|

Scoring Group |

Element |

Customer Metrics |

Range Low |

Range High |

Range Value |

Scoring (%) |

Score Weight * Value |

|

System Defined History |

AVGDAYS (Average Days Late |

30 |

-99,999 36 57 |

35 56 99,999 |

1 2 3 |

0.15 |

0.15 |

|

Aging Information |

06 121+ (121+ days aging category |

10,000 |

-999,999,999 1001 10,001 |

1000 10,000 999,999,999 |

5 10 15 |

0.85 |

8.50 |

|

Total Score: |

8.65 |

||||||

This table describes how risk scoring element data is derived for use in the Risk Scoring process.

|

Risk Scoring Group |

Risk Scoring Element |

Description |

|---|---|---|

|

System Defined History |

All History Elements |

The Risk Scoring process selects the HIST_AMT or HIST_COUNT from CUST_HISTORY table for either the FY/Period based on the run date of the risk scoring process or the user-entered FY/Period, which is an option on the Run Risk Scoring Process page. The HIST_AMT is used when the System Defined History element is amount-based such as PAST_DUE. The HIST_COUNT is used when the element is days-based such as AVG_DAYS_LATE. Note: If the element is amount-based and more than one currency exists in the CUST_HISTORY table, the amount will be converted to the currency selected on the risk scoring rule. You must run Aging or ARUPDATE and select the history options before the CUST_HISTORY table is populated with current FY/Period data. Aging updates some of the System Defined History elements and ARUPDATE updates some of the System Defined History elements. See System Defined History Page. Once the process selects the HIST_AMT or HIST_COUNT, the selected value is summed by:

The process compares the summed amount to the risk ranges to determine the range value. |

|

User Defined History |

All User Defined History Elements |

Same as System Defined History. |

|

Aging |

The Risk Scoring process selects the AGING_AMT from CUST_AGING table for the: BU, Customer, Aging ID and Aging Category.

Note: The aging elements are amount based and will be converted to the currency selected on the risk score rule if more than one currency exists in the CUST_AGING table. You should run Aging prior to Risk Scoring to ensure that the most current Aging data exists in the CUST_AGING table. Once the Risk Scoring process selects the AGING_AMT, it is summed by SETID, RISK_SCORE_ID, CUST_ID, RISK_SCORE_GRP, RISK_SCORE_ELEMENT and AGING_ID.

The summed amount is compared to the risk ranges to determine the range value. |

|

|

Item |

Large Amount Past Due Item |

This risk scoring element refers to the item with the largest amount that is past due. The Risk Scoring process selects all of the amounts from PS_ITEM that are less than or equal to the current date for open items (IT-01 only). Next, it selects the maximum amount and compares this amount to the risk ranges to determine the range value. Note: The item amounts will be converted to the currency selected on the risk scoring rule if more than one currency exists in the PS_ITEM table. |

|

Item |

Date of Oldest Item |

This risk scoring element refers to the item with the highest number of days late and is over a specified minimum amount. You enter the minimum threshold amount on the risk scoring rule. For example, the oldest item that has an amount greater than $1000 USD. The Risk Scoring process selects the maximum days that an item is past due based on the due date in PS_ITEM for open items (IT-01 only) and the item balance is greater than or equal to the threshold amount entered on the risk scoring rule. The maximum days selected that meets the above criteria is compared to the risk ranges to determine the range value. |

|

Customer Activity |

Approaching Credit Limit Percent |

This risk scoring element refers to the percentage of the customer balance that is approaching the credit limit. Note: You must set up the customer credit information for the processing of this element to return any data. This formula is used to calculate the percentage of the customer balance that is over the credit limit. Percent over credit

limit = CUST_CREDIT. ANCHOR_CR_LIMIT * (1 + CUST_CREDIT.CUSTCR_PCT_OVR/100

)/ PS_CUST_DATA.BAL_AMT

The risk scoring processes compares this percentage over credit limit to the risk ranges to determine the range value. |

|

Customer Activity |

Exceeded Credit Limit |

This risk scoring element refers to whether the customer has exceeded their credit limit. The Risk Scoring process selects the customer balance from PS_CUST_DATA and compares it to the credit limit from the CUST_CREDIT table. Note: You must set up the customer credit information for the processing of this element to return any data. This formula is used to determine if the customer has exceeded the credit limit: ( (CUST_CREDIT.ANCHOR_CR_LIMIT

* (1 + C.CUSTCR_PCT_OVR/100)) - PS_CUST_DATA.BAL_AMT < 0 )

If the customer exceeds the credit limit, the Risk Scoring process sets the scoring element value to Y (yes) and uses the range value for Y. If the customer does not exceed the credit limit, the Risk Scoring process sets the scoring element value to N (no) and uses the range value for N. |

|

Customer Activity |

Credit Hold |

This risk scoring element refers to whether a customer is on credit hold. If the customer exists in the view PS_AR_CUST_CRHD_VW then it is on credit hold and the Risk Scoring process sets the flag to Y (yes) and uses the range value for Y on the Risk Scoring Rule details page. If the customer does not exist in the view PS_AR_CUST_CRHD_VW, the Risk Scoring process sets the value to N (no) and uses the range value for N. |

|

Customer Activity |

Balance Due |

This risk scoring element refers to the customer balance due. The Risk Scoring process selects and sums the PS_CUST_DATA.BAL_AMT and compares that amount to the risk ranges that appear the Risk Range Detail page associated with the Risk Scoring Rule to determine the range value. |

|

Customer Activity |

Percent of Balance Past Due |

This risk scoring element refers to the percentage of the customer balance that is past due. The Risk Scoring process selects and sums the PS_ITEM.BAL_AMT_BASE field for open items where the due date is less than the current date. It divides the past due balance by the total customer balance to determine the percentage that is past due. It compares this percentage to the risk ranges that appear on the Risk Range Detail page associated with the Risk Scoring Rule to determine the range value. |

|

Customer Table |

All Elements |

Select the risk scoring element from the PS_CUSTOMER table for the customers selected for risk scoring and compare that data against the risk ranges to determine the range value. |

|

Customer D&B Table (customer Dun & Bradstreet table) |

All Elements |

The Risk Scoring process selects the element from the PS_CUST_DB table for the customers selected for risk scoring and compares that data against the risk ranges to determine the range value. Note: The PS_CUST_ID_NBRS.STD_ID_NUM record field was used to obtain the DB number for lookup on the CUST_DB table. The STD_ID_NUM_QUAL = 'DNS' field was used to determine which STD_ID_NUM to retrieve from the PS_CUST_ID_NBRS table. |

|

Ratios |

Debt Ratio |

The Risk Scoring process divides the total current liabilities by the total current assets based on this formula: PS_CUST_DB.DB_TOT_CUR_LIAB

/ PS_CUST_DB.DB_CUR_ASET

|

|

Ratios |

Asset Turnovers |

The Risk Scoring process divides the sales by the total current assets based on this formula: PS_CUST_DB. DB_SALES

/ PS_CUST_DB. DB_TOT_ASET

|

|

Ratios |

ROE (Return on Equity) |

The Risk Scoring process divides the net income by the total current assets and subtracts the total current liabilities based on this formula: (PS_CUST_DB.NET_INCM

/ PS_CUST_DB. DB_TOT_ASET) - PS_CUST_DB. DB_TOT_CUR_LIAB

|

|

Ratios |

Acid Test Ratio |

The Risk Scoring process subtracts inventory from the total assets and divide by the total current liabilities based on this formula: (PS_CUST_DB.DB_TOT_ASET

- PS_CUST_DB.DB_INVENTORY) / PS_CUST_DB.DB_TOT_CUR_LIAB

|

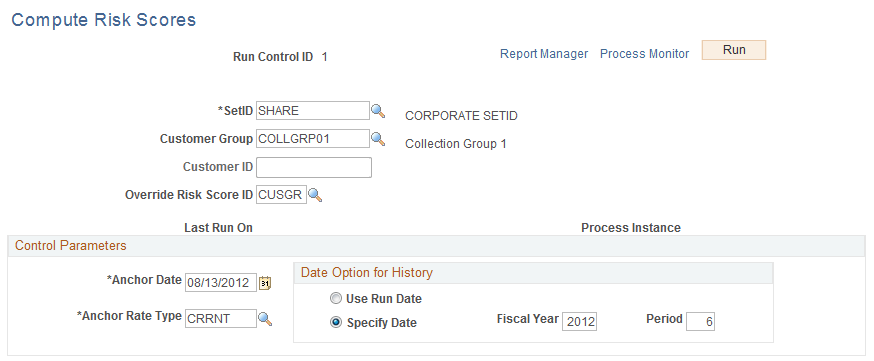

Use the Compute Risk Scores page (RUN_AR_RISK) to run the Request Risk Scoring Application Engine process (AR_RISK).

Navigation:

This example illustrates the fields and controls on the Compute Risk Scores page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Override Risk Score ID |

Select a risk score id if you want to run the risk scoring process for only one risk scoring rule. If you select a value for this field, the risk score process will only process this selected rule and will override the risk score processing hierarchy that runs based on your selection of a SetID value and Customer Group or Customer ID. Leave this field blank if you want to process all rules that apply based on the selection criteria. |

Anchor Date |

Select the date to apply to the currency conversion when processing this risk score. The currency is derived from the risk score rule. This is a required field. |

Anchor Rate Type |

Select the rate type to apply to the currency conversion when processing this risk score. This is a required field. |

Date Option for History |

Select one of these dates to use for retrieving history data:

|