Setting Up PeopleSoft Payables Withholding Reports

Withholding reporting is processed from the Withholding Report table. Oracle delivers with the system a number of predefined reports for use with various types of withholding. You can access these reports via the Report Definition component.

Note: (USA) Do not modify delivered U.S. 1099 reports.

To set up withholding reporting, use the Report Definition component (WTHD_RPT_DFN).

This section discusses how to specify withholding report selection criteria and specify process type and name.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

WTHD_RPT_DFN |

Specify selection criteria for withholding reports. Define the layout of the withholding reports based on your tax authority's reporting and filing requirements. |

|

|

WTHD_RPT_DFN2 |

Specify the process type and name of the process you are using to populate the Withholding Report table for each withholding report you define. |

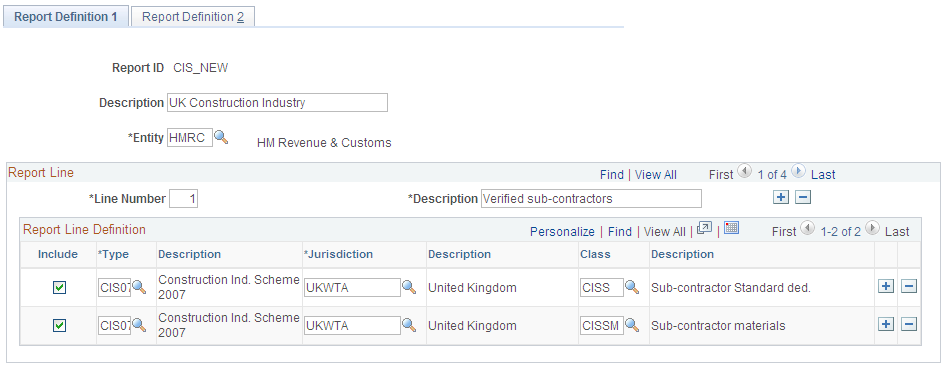

Use the Report Definition 1 page (WTHD_RPT_DFN) to specify selection criteria for withholding reports.

Define the layout of the withholding reports based on your tax authority's reporting and filing requirements.

Navigation:

This example illustrates the fields and controls on the Report Definition 1 page. You can find definitions for the fields and controls later on this page.

Each report line is generally equivalent to a "box" on the withholding entity's withholding form. Enter a line for each withholding class combination you report separately on the report.

Field or Control |

Description |

|---|---|

Include |

Select this check box at the beginning of the line for each withholding class combination you are including in the report. |

Use the Report Definition 2 page (WTHD_RPT_DFN2) to specify the process type and name of the process you are using to populate the Withholding Report table for each withholding report you define.

Navigation:

Specify the process type and process name you are using to generate the report.

Note: (USA) For U.S. withholding, you must use the system-delivered report IDs US_REPORT, US_REPORTG, and US_REPORTI for 1099–Misc, 1099–G, and 1099–INT respectively.