Setting Up Draft Processing

To set up your draft processing, use the following components:

Draft Sight Codes (APD_SIGHT_CODE_COM)

Stamp Tax (APD_STAMP_TAX_COM)

This section lists common elements and discusses how to create draft sight codes and stamp tax definition. It also discusses how to specify stamp tax minimization rules.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

APD_SIGHT_CODE_PNL |

Create, modify, or view available draft sight codes. |

|

|

APD_STAMP_TAX_PNL |

View default settings for draft optimization, including a description for the tax table, the stamp tax amount range, the stamp tax minimization amount for each range and stamp tax currency, the draft amount range, the applicable currency, and the maximum value of the draft before it is split. |

|

|

APD_STAMP_TAXR_PNL |

Create, modify, or view the stamp tax minimization rules. |

Field or Control |

Description |

|---|---|

Currency |

Displays the payment currency. |

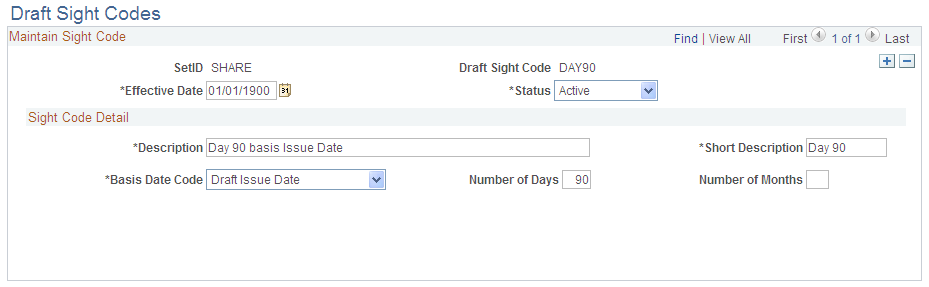

Use the Draft Sight Codes page (APD_SIGHT_CODE_PNL) to create, modify, or view available draft sight codes.

Navigation:

This example illustrates the fields and controls on the Draft Sight Codes page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

SetID |

Displays the bank SetID for the supplier's bank account. |

Draft Sight Code |

Displays a user-defined value that represents the draft payment terms to which you and your supplier agree. |

Effective Date |

Specify the beginning date that the sight code is in effect. |

Status |

Specify whether the status of the sight code is active or inactive. |

Sight Code Detail

Field or Control |

Description |

|---|---|

Basis Date Code |

Specifies the scheduled due date for the draft. It is used to calculate the draft maturity date: Invoice DT (invoice date): Uses the invoice date on the voucher as the basis date. Issue Date: Uses the scheduled due date as a basis date. |

Number of Days |

Enter the number of days from the basis date on which the draft matures. |

Number of Months |

Enter the number of months from the basis date on which the draft matures. |

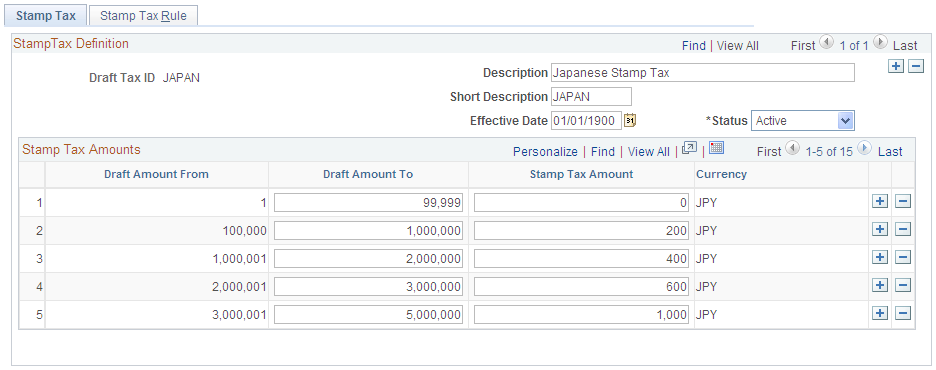

Use the Stamp Tax page (APD_STAMP_TAX_PNL) to view default settings for draft optimization, including a description for the tax table, the stamp tax amount range, the stamp tax minimization amount for each range and stamp tax currency, the draft amount range, the applicable currency, and the maximum value of the draft before it is split.

Navigation:

This example illustrates the fields and controls on the Stamp Tax page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Draft Amount From |

Displays the beginning of the draft amount range. When you define the stamp tax amounts, the system calculates the value in this field based on the value that you enter in the Draft Amount To field, plus one. The first line displays the draft amount from 1. |

Stamp Tax Amount |

Enter the amount of the stamp tax that the system applies to drafts in the desired draft amount from and draft amount to range. |

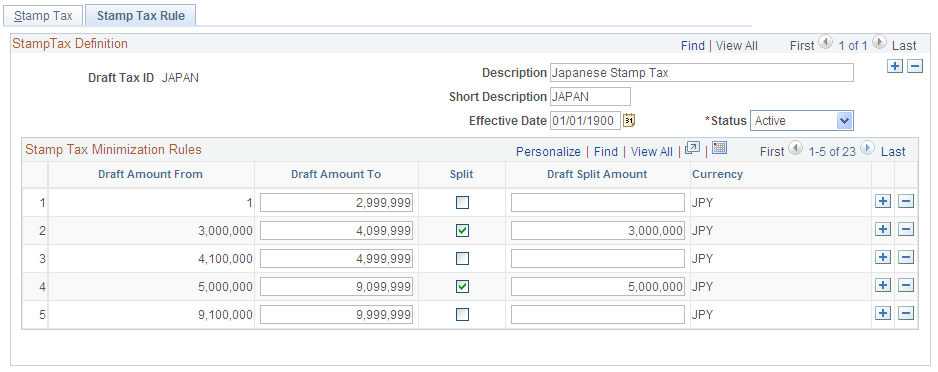

Use the Stamp Tax Rule page (APD_STAMP_TAXR_PNL) to create, modify, or view the stamp tax minimization rules.

Navigation:

This example illustrates the fields and controls on the Stamp Tax Rule page. You can find definitions for the fields and controls later on this page.

Stamp Tax Minimization Rules

During the Draft Staging Application Engine process (AP_DFT_PROC), the values in the Stamp Tax table determine where the draft payment is split.

Field or Control |

Description |

|---|---|

Split |

Selecting this check box activates the Draft Split Amount field, where you enter the maximum value that the draft in the selected draft amount range should reach before it is split. |