Entering Online Vouchers With VAT

VAT information for vouchers defaults through the PeopleSoft Payables control hierarchy. When you enter VAT-applicable vouchers online, you can review and override VAT defaults at the voucher header, voucher line, and voucher distribution line levels. You may specify that VAT defaults on lower levels be reset based on any overrides made at the higher levels. You can also enter a VAT amount for the voucher header and review VAT calculations before you save the voucher.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

VCHR_VAT_HD_EXP |

Review and, if applicable, override the voucher's VAT settings. |

|

|

VCHR_LINE_VAT_SEC1 |

Review, and if applicable, override VAT defaults for the voucher line. Enter Intrastat information for Intrastat-applicable vouchers. |

|

|

DISTRIB_LN_VAT_SEC |

Review, and if applicable, override VAT defaults for the distribution line. |

|

|

VCHR_VAT_SM_EXP |

Review the VAT amounts summarized by VAT rate. This page provides a preliminary view of the VAT calculations based on the parameters that have defaulted (or been manually updated), as well as the amounts entered. You can also link from this page to the VAT header, line, and distribution line defaults pages. |

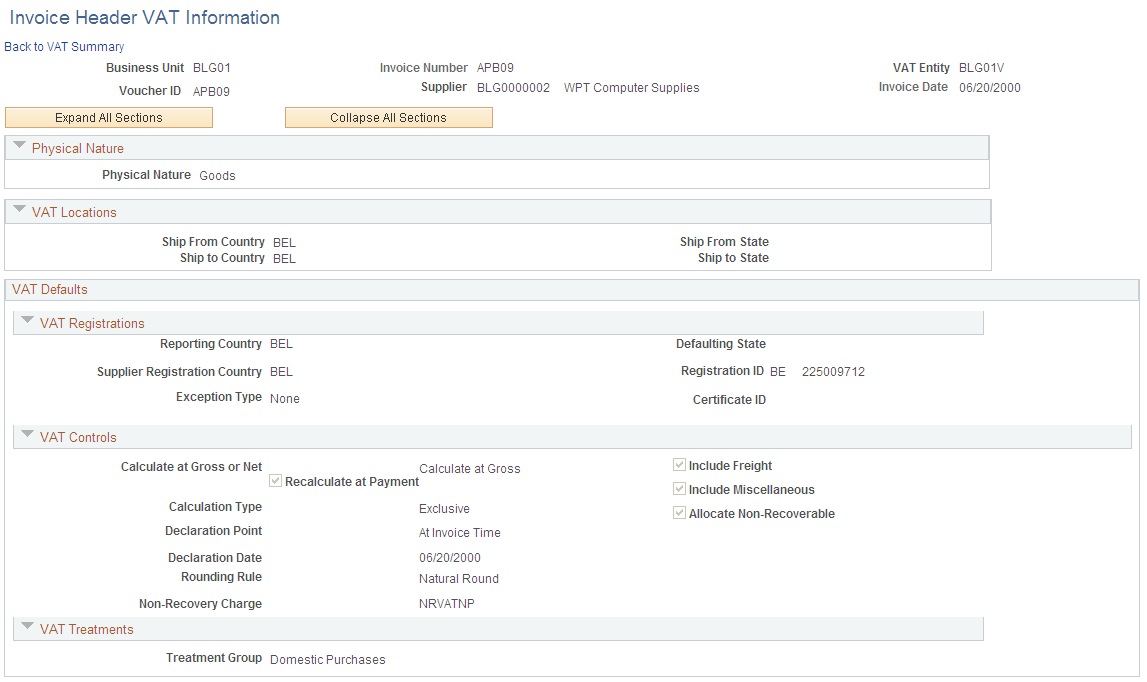

Use the Invoice Header VAT Information page (VCHR_VAT_HD_EXP) to review and, if applicable, override the voucher's VAT settings.

Navigation:

Click the VAT Summary link on the Invoice Information page.

Click the Transfer to VAT Header link on the Invoice VAT Summary Information page.

This example illustrates the fields and controls on the Invoice Header VAT Information page. You can find definitions for the fields and controls later on this page.

Note: Because complex algorithms are used to obtain the VAT voucher header defaults, avoid overriding these values whenever possible. If you do change any values on this page, be aware that values that appear lower down on the page can be dependent on values that appear higher up on the page. For example, if you override the VAT reporting country, all other VAT default fields that appear lower down on the page will have to be changed to the default values defined for the new VAT reporting country. You should therefore work from top to bottom and click the Adjust Affected VAT Defaults button in the Adjust/Reset VAT Defaults collapsible region each time you change a value. This automatically updates any dependent values that appear on the page, and avoids updating values that you have already overridden.

Physical Nature

Field or Control |

Description |

|---|---|

Physical Nature |

Indicates whether an object is a good or a service. For many countries there is a requirement to report the sale and/or purchase of goods separately from services. The system defaults this value from the supplier or PeopleSoft Payables business unit, depending on the transaction. |

Change Physical Nature |

Click to override the default physical nature value for this invoice. The system resets all of the VAT defaulting for this level only. |

VAT Locations

The following terms appear only when the transaction is for a service: Location Country, Location State, Supplier Location Country, Supplier Location State, Service Performed Country, and Service Performed State.

Field or Control |

Description |

|---|---|

Location Country |

Shows the PeopleSoft Payables business unit country. |

Location State |

Shows the PeopleSoft Payables business unit state. This field is applicable only in a VAT environment that tracks the tax by regional subunit of a country, such as a province or state. |

Supplier Location Country |

Shows the supplier location country. |

Supplier Location State |

Shows the supplier location state. |

Service Performed Country |

Depending on the services performed flag setting in the VAT defaulting hierarchy (for example at the supplier or business unit level), the system sets the value for this field as follows:

|

Service Performed State |

Depending on the services performed flag setting in the VAT defaulting hierarchy (for example the supplier or business unit level), the system sets the value for this field as follows:

This field is applicable only in a VAT environment that tracks the tax by regional subunit of a country, such as a province or state. |

Ship From Country |

Shows the country from which the good or service is shipped. In the case of transactions involving goods or freight service transactions, this is used to determine the VAT treatment. |

Ship From State |

Shows the state from which the good or service is shipped. In the case of transactions involving goods or freight service transactions, this is used to determine the VAT treatment. This field is applicable only in a VAT environment that tracks the tax by regional subunit of a country, such as a province or state. |

Ship To Country |

Shows the country to which the good or service is shipped. In the case of transactions involving goods or freight service transactions, this is used to determine the VAT treatment. Note: This value must be identical to the country of the Ship To ID on the voucher line. |

Ship To State |

Shows the state to which the good or service is shipped. In the case of transactions involving goods or freight service transactions, this is used to determine the VAT treatment. This field is applicable only in a VAT environment that tracks the tax by regional subunit of a country, such as a province or state. |

VAT Service Specific Defaults

This region displays only when the transaction is for a service.

Field or Control |

Description |

|---|---|

Service Type |

Displays the VAT service type of Freight or Other. The value in this field determines whether or not the special rules for freight transport within the European Union apply. The value comes from the VAT default hierarchy. |

Place of Supply Driver |

Displays the usual place of supply (meaning, the place where VAT is usually liable) for the service. This value is used to help determine the place of supply country and the VAT treatment. Options are: Buyer's Countries, Supplier's Countries, or Where Physically Performed. The system derives the value from the VAT default hierarchy. |

VAT Registrations

Field or Control |

Description |

|---|---|

Reporting Country |

Shows the country for which this VAT will be reported. This is the VAT Entity or VAT registration country and determines many of the VAT defaults. |

Defaulting State |

If the reporting country requires that VAT be tracked by state or province, this field displays the state within the reporting country that is used to retrieve values from the VAT Defaults table. |

Supplier Registration Country and Supplier Registration ID |

Registration country and ID of the supplier taken from the supplier information. |

Exception Type |

Where applicable, exception granted for the VAT entity. Options are: None, Exonerated, or Suspended. This value is obtained from the VAT entity registration for the VAT reporting country. |

Certificate ID |

If applicable, displays the ID of the VAT exception certificate that may have been issued to the VAT entity. |

VAT Controls

Field or Control |

Description |

|---|---|

Calculate at Gross or Net |

Shows how VAT is calculated. The default value comes from the VAT entity driver. Options are: Gross: The system calculates VAT before it applies any early payment discounts. Net: The system calculates VAT after it deducts early payment discounts. If there are two percentage discounts, the system uses the larger of the two when it calculates VAT. The system will not use discount amounts, only discount percentages. |

Recalculate at Payment |

If you are calculating VAT at gross, select this check box to enable VAT recalculation at payment time to allow for any early payment discounts. This causes the system to adjust the VAT amount at the time of payment if the discount has been taken. This value is set on the VAT entity driver and defaults from the VAT hierarchy. Note: If Voucher VAT Controls is set to Calculate at Gross and the Recalculate at Payment option is selected, the Discount calculations include the VAT amount. If Calculate at Gross and the Recalculate at Payment option is not selected, the Discount calculations are based on the Voucher amount. This option is not applicable when Voucher VAT Controls is set to Calculate at Net. See an example of Accounting Entry Calculations at the end of this section. |

Calculation Type |

Indicates the type of VAT calculation. Options are: Exclusive: The VAT amount is stated separately from the merchandise amount on the invoice, and is added to the total merchandise amount to obtain the voucher gross amount. The total VAT amount is entered on the voucher header. Inclusive: The VAT is included in the merchandise amount specified for each line and is not stated separately. No separate VAT amount is entered on the voucher header. This value is set on the AP Options driver and defaults through the VAT hierarchy (voucher origin, control group, supplier, and supplier location.) |

Declaration Point |

For a good or a service, shows when you want VAT transaction information to be recognized for reporting purposes. Options are: Acctg Date (accounting date): VAT is recognized on accounting date. Delivery: VAT is recognized on delivery. Invoice: VAT is recognized at time of invoice. Payment: VAT is recognized at time of payment. This value is set on the VAT entity registration driver and defaults through the VAT hierarchy (PeopleSoft Payables business unit options, voucher origin, control group, supplier, and supplier location.) |

Declaration Date |

Shows the date on which the VAT is recognized. It defaults from the accounting date when the Declaration Point is Acctg Date (accounting date). You cannot override this date, however, you may modify the accounting date on the Invoice Information page. It defaults from the shipment date, receipt date, or invoice date, in that order, when the Declaration Point is Delivery. You may override this date. It defaults from the invoice date when the Declaration Point is Invoice. You may override this date. |

Rounding Rule |

Shows the VAT rounding rule. The value comes from the VAT country driver and defaults through the VAT hierarchy. Options are: Natural Round: Amounts are rounded normally (up or down) to the precision specified for the currency code. For example, for a currency defined with two decimal places, 157.4659 would round up to 157.47, but 157.4649 would round down to 157.46. Round Down: Amounts are rounded down. For example, for a currency defined with two decimal places, 157.4699 would round down to 157.46. Round Up: Rounds up and limits rounding precision to one additional decimal place. For example, for a currency defined with 2 decimal places, 157.4659 would round up to 157.47, but 157.4609 would be rounded down to 157.46. |

Non-Recovery Charge |

Shows the charge code for the non-recoverable VAT. The values default from the Procurement Control - Non-Merch Charges page. |

Calc on Advance Payments (calculate on advance payments) |

Select for the system to calculate VAT on advance payments for vouchers of the Prepaid Voucher voucher style. The value is derived from the VAT entity registration driver. Important! You must specify the correct declaration point option when defining VAT defaults for the system to automatically and correctly perform this calculation. On the VAT Defaults Setup page for the VAT driver type Entity Registration, select the VAT for advance payment check boxes. |

Include Freight |

Select for the system to include any freight amounts in the VAT basis by calculating VAT on the merchandise amount plus any freight amount. This option is only available for exclusive VAT calculation. The value comes from the VAT entity registration driver. |

Include Miscellaneous |

Select for the system to include any miscellaneous charge amounts in the VAT basis by calculating VAT on the merchandise amount plus any miscellaneous charge amount. This option is only available for exclusive VAT calculation. The value comes from the VAT entity registration driver. |

In Reporting Currency |

Select to enter the VAT amount in the VAT reporting currency. You enter the VAT amount by clicking the Enter Reporting Amounts link to open the VAT Reporting Currency Amounts page, where you can enter the total VAT amount and the total VAT applicable amount in the reporting currency, and the applicable exchange rate. The system automatically calculates the VAT based on this exchange rate on saving the page. The In Reporting Currency value comes from the VAT entity registration driver. Note: This option is only available if the Amounts in Reporting Currency option for the VAT entity registration driver in the VAT Defaults table is set to Y. Additionally, the VAT Treatment Group for the voucher must be Domestic Purchases and the transaction currency for the voucher must be different from the VAT reporting currency |

Enter Reporting Amounts |

Click to open the VAT Reporting Currency Amounts page on which you can enter the total VAT applicable amount and the total VAT amount in the VAT reporting currency. The system automatically calculates the exchange rate. |

Allocate Non-Recoverable |

This check box is applicable only when non-recoverable VAT is not being prorated. When non-recoverable VAT is not being prorated, the system obtains the account and alternate account for the non-recoverable VAT accounting entry from the VAT accounting template associated with the VAT code. If this check box is selected, the other, non-account ChartFields will be obtained based on the ChartField inheritance options that have been defined for non-recoverable VAT. For each ChartField, these options allow you to specify whether the ChartField value is inherited from the expense distribution line, whether the value comes from the business unit defaults, or whether the value comes from the VAT accounting template. If this check box is not selected, the other, non-account ChartFields are all obtained from the VAT accounting entry template. The value of this check box comes from the Procurement Control component. |

VAT Treatments

Field or Control |

Description |

|---|---|

Place of Supply Country |

Displays the country in which the VAT is liable. This field appears only when the transaction is for services. |

Treatment Group |

Displays the appropriate VAT treatment group. Options are: Domestic Purchases, European Union Purchases, Imports, No VAT Processing, and Out of Scope. Within Oracle's PeopleSoft applications, detail VAT treatment values on the transaction lines, which come from complex algorithms, are used for applying the precise defaults applicable to the transaction lines. Each of these detail VAT treatment values are associated with a VAT treatment group. The system tracks the VAT treatment group on the header enabling individual transaction lines to be grouped together into invoices during batch processes and to validate the detail line VAT treatment values on the transaction lines. |

Adjust/Reset VAT Defaults

Any changes you make to fields on this page may affect VAT defaults on this page. For accuracy and consistency, use the following fields and buttons to adjust affected VAT defaults or to reset all VAT defaults. Adjusting or resetting VAT defaults will only affect fields within the VAT Defaults group box.

Field or Control |

Description |

|---|---|

Adjust Affected VAT Defaults |

Click this button to have the system adjust the VAT defaults that are affected by your changes, after you have selected the affected levels. All changes you have made to VAT Defaults on this page that affect other VAT Defaults on this page will be retained. Oracle recommends that you always click the Adjust Affected VAT Defaults button after changing any defaults on the VAT page. As values that appear lower down on the page can be dependent on values that appear higher up on the page, you should work from top to bottom and click the Adjust Affected VAT Defaults button in the Adjust/Reset VAT Defaults collapsible region as needed. This avoids updating values that you have already overridden. |

|

Click the List of fields to be selected icon to view a list of all of the fields whose values will be adjusted if you click the Adjust Affected VAT Defaults button. |

Levels |

Select the levels to which you want the action to apply before you click the Reset All VAT Defaults button: All lower levels: Reset the VAT defaults for the voucher line and the voucher distribution line. This and all lower levels: Reset the defaults for the voucher header, the voucher line, and the voucher distribution line. This level only: Reset the defaults for the voucher header only. |

Reset All VAT Defaults |

Click to reset any fields that you may have overridden on this page (including those that you changed by clicking the Adjust Affected VAT Defaults button) back to the original defaults before you save the page. Depending on your selection in the Level field, the VAT default values will be reset for the voucher header, the voucher line, the distribution line, or all three. Note: Reset completely redetermines the VAT defaults. If you have changed a VAT driver field, resetting VAT defaults does not necessarily return the original default values. Rather, it resets all of the default values based on the new driver value. |

Example of Accounting Entry Calculations

This example shows the calculation of accounting entries when Recalculate at Payment option is selected and when not selected. Consider a voucher amount of 1000 with a recoverable VAT of 5% and a prompt payment discount of 2% if payment is made within 10 days.

|

Type of Accounting Entries |

Detail |

Accounting Entries - Recalculate at Payment option is selected |

Accounting Entries - Recalculate at Payment option is not selected |

|---|---|---|---|

|

Accrual accounting entries |

Voucher amount |

1000 |

1000 |

|

Accrual accounting entries |

VAT |

50 |

50 |

|

Accrual accounting entries |

Net amount payable |

-1050 |

-1050 |

|

Payment Accounting Entries |

Amount payable to Supplier |

1050 |

1050 |

|

Payment Accounting Entries |

Bank |

-1029 |

1030 |

|

Payment Accounting Entries |

Discount |

-21 |

20 |

|

VAT Adjustment Accounting Entries for Discount |

VAT |

-1 |

No entries are passed |

|

VAT Adjustment Accounting Entries for Discount |

VAT |

1 |

No entries are passed |

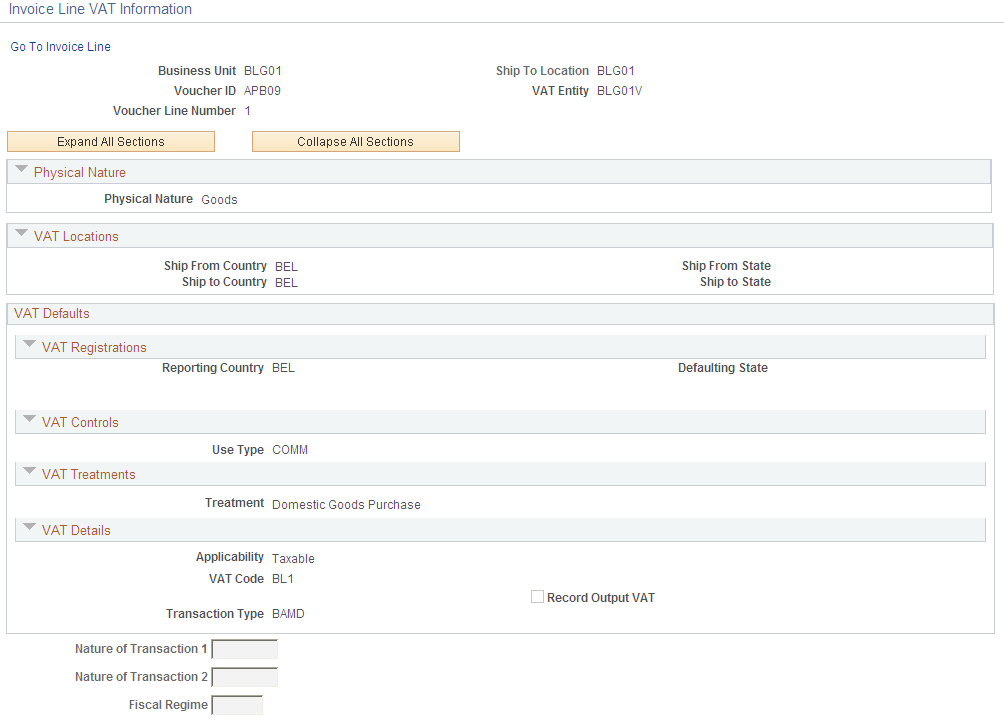

Use the Invoice Line VAT Information page (VCHR_LINE_VAT_SEC1) to review, and if applicable, override VAT defaults for the voucher line.

Enter Intrastat information for Intrastat-applicable vouchers.

Navigation:

Click the Invoice Line VAT link in the Invoice Lines scroll area on the Invoice Information page. This link appears as the VAT/Intrastat link for adjustment voucher lines.

This example illustrates the fields and controls on the Invoice Line VAT Information page. You can find definitions for the fields and controls later on this page.

Note: Because complex algorithms are used to obtain the VAT defaults, avoid overriding these values whenever possible. If you do change any values on this page, be aware that values that appear lower down on the page can be dependent on values that appear higher up on the page. For example, if you override VAT applicability, the VAT code and transaction type will also have to be changed. You should therefore work from top to bottom and click the Adjust Affected VAT Defaults button in the Adjust/Reset VAT Defaults collapsible region as needed. This automatically updates any dependent values that appear on the page, and avoids updating values that you have already overridden.

Physical Nature

The fields displayed are the same as those described for the Invoice Header VAT Information page.

VAT Locations

The fields displayed are the same as those described for the Invoice Header VAT Information page.

VAT Service Specific Defaults

Field or Control |

Description |

|---|---|

Service Type |

Displays the VAT service type of Freight or Other if the transaction is for a service. The value in this field determines whether or not the special rules for freight transport within the European Union apply. The value comes from the VAT default hierarchy. |

Place of Supply Driver |

Displays the usual place of supply (meaning, the place where VAT is usually liable) for the service if the transaction is for a service. This value is used to help determine the place of supply country and the VAT treatment. Options are: Buyer's Countries, Supplier's Countries, or Where Physically Performed. The value comes from the VAT default hierarchy. |

VAT Registrations

Many of these fields are the same as those described for the Invoice Header VAT Information page. Others include:

Field or Control |

Description |

|---|---|

Reporting Country |

Shows the country for which this VAT will be reported. This is the VAT Entity VAT registration country and determines many of the VAT defaults. |

Defaulting State |

Displays the state within the reporting country for which an associated value is retrieved from the VAT defaults table if the reporting country requires that VAT be tracked by state or province. |

VAT Controls

Field or Control |

Description |

|---|---|

Use Type |

Determines the split between recoverable (taxable) and nonrecoverable (nontaxable) VAT. For the Canadian public sector, the use type also determines the rebate of the nonrecoverable VAT. VAT rebates are calculated based on statutory rebate rates that are established for each Public Service Body. The value comes from the VAT default hierarchy—specifically, Payables Options, voucher origin, control group, supplier location, and item. |

VAT Treatments

Field or Control |

Description |

|---|---|

Place of Supply Country |

Displays the country in which the VAT is liable. The value comes from complex algorithms. This field appears only when the transaction is for services. |

Treatment |

Select the appropriate VAT treatment, but only if the algorithms did not return the correct value. Options are: Domestic Goods Purchases: This refers to the purchase of goods where the supplier and customer are located in the same country. Domestic Services Purchases: This refers to the purchase of services where the supplier and customer are located in the same country. Domestic Reverse Chg Purchase: This refers to the purchase of goods subject to the domestic reverse charge. Transaction lines flagged for the reverse charge should have the reverse charge applied if the overall total of the reverse charge goods on the invoice is equal to or greater than the threshold amount specified for the VAT reporting country. EU Goods Purchase: This refers to goods purchased within the European Union (EU). EU Service Purchase: This refers to services purchased within the European Union (EU). No VAT Processing: No VAT is processed for this voucher line. Outside of Scope: This is outside the scope of VAT. Self-Assess Goods Import: This refers to imported goods for which the customer is self-assessing the VAT. The supplier is not registered to collect VAT but the customer is liable to pay VAT to the VAT authority. Self-Assess Service Import: This refers to imported services for which the customer is self-assessing the VAT. The supplier is not registered to collect VAT but the customer is liable to pay VAT to the VAT authority. Zero-rated Goods Import: This refers to imported goods subject to zero-rate VAT. Within Oracle's PeopleSoft applications, detail VAT treatment values on the transaction lines are used for applying the precise defaults applicable to the transaction lines. |

VAT Details

Field or Control |

Description |

|---|---|

Applicability |

Shows the VAT status. Options are: Taxable, Exempt (not subject to VAT), and Outside of Scope of VAT. The value comes from an algorithm that uses the VAT Applicable default, the treatment, and the exception type. |

VAT Code |

Shows the VAT code that defines the rate at which VAT is calculated for this line. The value comes from an algorithm that uses the treatment and applicability to retrieve the applicable VAT Code default from the VAT default hierarchy. |

Transaction Type |

Shows the code that categorizes and classifies this transaction for VAT reporting and accounting. The value comes from an algorithm that uses the treatment and applicability to retrieve the applicable Transaction Type from the VAT default hierarchy. |

Record Output VAT |

Select this check box to enable voucher entry when VAT is not included on the invoice but is payable to your VAT authority rather than the supplier. In this case, you will be accounting for both input and output VAT for the purchase. This will be the case for an Intra-EU Acquisition or when you must account for output VAT on a service supplied by a foreign supplier. This is also referred to as self-assessing for VAT. The value comes from an algorithm that uses the treatment and applicability to retrieve the applicable value from the PeopleSoft delivered VAT system setup data. |

Adjust/Reset VAT Defaults

The fields displayed are the same as those described for the Invoice Header VAT Information page. If you select a Level value of This and all lower levels, the reset action will apply to the voucher line and the voucher distribution line. If you select a Level value of All lower levels, the reset action will apply only to the voucher distribution line.

Intrastat

This group box appears only for adjustment vouchers in a VAT environment. You use this information to record financial adjustments to transactions involving the movement of goods within the European Union.

Field or Control |

Description |

|---|---|

Nature of Transaction 1 and Nature of Transaction 2 |

Enter the Nature of Transaction 1 and Nature of Transaction 2 codes applicable to the financial adjustment. |

Fiscal Regime |

For countries that require Fiscal Regime on the Intrastat return, enter the Fiscal Regime applicable to the financial adjustment |

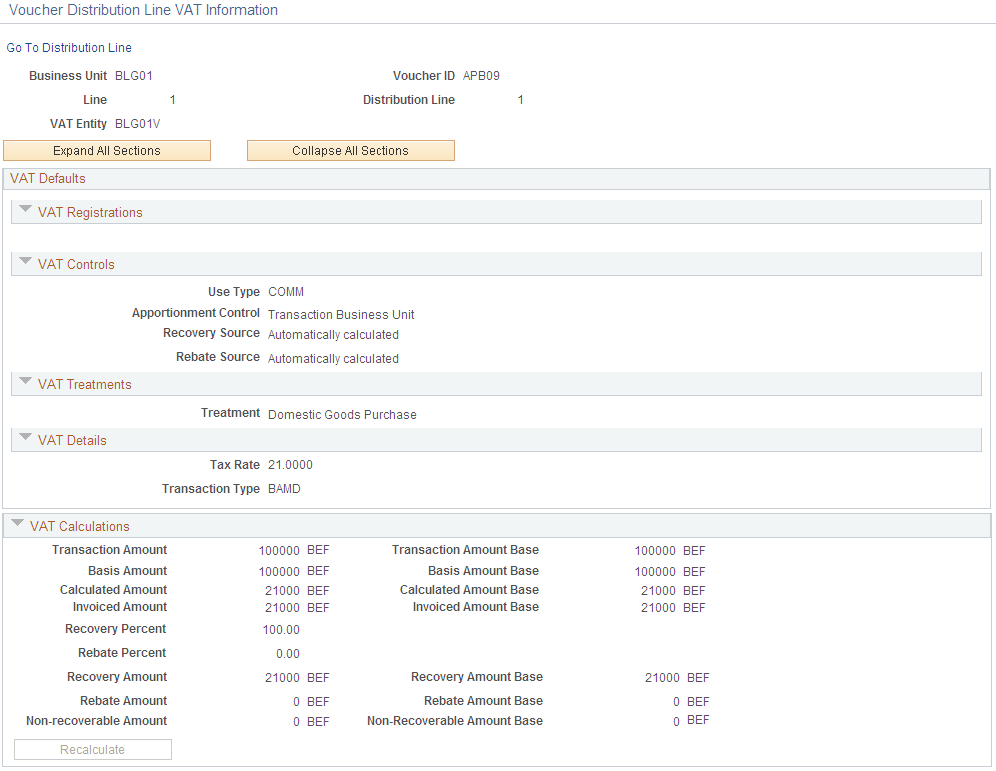

Use the Voucher Distribution Line VAT Information page (DISTRIB_LN_VAT_SEC) to review, and if applicable, override VAT defaults for the distribution line.

Navigation:

Click the VAT link on the VAT tab in the Distribution Lines scroll area on the Invoice Information page, then click the VAT link for the distribution line row.

This example illustrates the fields and controls on the Voucher Distribution Line VAT Information page. You can find definitions for the fields and controls later on this page.

VAT Defaults

Field or Control |

Description |

|---|---|

Use Type |

Displays the use type which determines the split between recoverable (taxable) and nonrecoverable (nontaxable) VAT. For the Canadian public sector, the use type also determines the rebate of the nonrecoverable VAT. VAT rebates are calculated based on statutory rebate rates that are established for each Public Service Body. The value comes from the VAT default hierarchy — specifically, PeopleSoft Payables Options, voucher origin, control group, supplier location, and item. |

Apportionment Control |

Select the option to be used when searching for VAT apportionment information. The default value comes from the Payables Business Unit driver. Options include: Dist GL BU (Distribution GL Business Unit): If you select this value, the system uses the general ledger business unit on the distribution line to search for the taxable and exempt percentages. Txn BU (Transaction Business Unit): If you select this value, the system uses the PeopleSoft Payables business unit for the voucher to search for the taxable and exempt percentages Txn GL BU (Transaction GL Business Unit): If you select this value, the system uses the general ledger business unit to which the PeopleSoft Payables business unit is mapped to search for the taxable and exempt percentages. |

Recovery Source |

Select one of the following values: Automatic: The system determines which percentages to use based on the VAT use type on the voucher line. Use the Recalculate button to calculate the VAT recovery percent. Manual: Select if you want to override the percentage that defaults from the VAT use type. You can enter the percentage of VAT entered that is recoverable. For both options, the system-calculated percentage is based on the VAT use type and VAT apportionment for the ChartFields on the distribution line. The availability of this field is dependent on the Allow Override Recovery/Rebate option specified on the AP Options VAT driver in the VAT Defaults table. |

(CAN) Rebate Source |

Select one of the following values: Automatic: The system determines which percentages to use based on the VAT use type that has an associated Public Service Body code. Use the Recalculate button to calculate the VAT rebate percent. Manual: Select if you want to override the percentage that defaults from the VAT use type. When you do, you can enter the percentage that is used to calculate the rebate. For both options, the system-calculated percentage is based on the VAT use type and VAT apportionment for the ChartFields on the distribution line. The availability of this field is dependent on the Allow Override Recovery/Rebate option specified on the AP Options VAT driver in the VAT Defaults table. |

Treatment |

Displays the VAT treatment. This defaults from the invoice line. |

Transaction Type |

Categorizes VAT amounts by business transaction types (for example, a domestic purchase, an import from another VAT country, or a purchase for resale). These codes are required for reporting purposes and default onto the distribution line through the VAT defaulting hierarchy. |

Recovery Percent |

Enter the percentage in this field if you set the recovery source to Manual. |

(CAN) Rebate Percent |

Enter the percentage in this field if you set the rebate source to Manual. |

VAT Calculations

Field or Control |

Description |

|---|---|

Transaction Amount |

Enter the amount of the transaction in the transaction currency. If the control total amount has been entered on the pending item, the system automatically populates this field with a value from the pending item for the first VAT line. |

Transaction Amount Base |

Displays the amount of the transaction in the base currency. |

Basis Amount |

Displays the amount on which the VAT is calculated in the transaction currency. If VAT is being calculated at Net, this amount is net of any discounts. |

Basis Amount Base |

Displays the amount on which the VAT is calculated in the base currency. If VAT is being calculated at net, this amount is net of any discounts. |

Calculated Amount |

Displays the system calculated VAT amount in the transaction currency. |

Calculated Amount Base |

Displays the system calculated VAT amount in the base currency. |

Invoiced Amount |

Displays the system calculated VAT amount recorded to the invoice. |

Invoiced Amount Base |

Displays the system calculated VAT amount recorded to the invoice, in the base currency. |

Recovery Percent |

Displays the system calculated VAT recovery percentage. If you set the recovery source to Manual, enter the percentage in this field. |

(CAN) Rebate Percent |

Displays the system calculated VAT rebate percentage. If you set the rebate source to Manual, enter the percentage in this field. |

Recovery Amount |

Displays the system calculated VAT recovery amount. |

Recovery Amount Base |

Displays the system calculated VAT recovery amount in the base currency. |

Rebate Amount |

Displays the system calculated VAT rebate amount. |

Rebate Amount Base |

Displays the system calculated VAT rebate amount in the base currency. |

Non-recoverable Amount |

Displays the non-recoverable system calculated VAT amount. |

Non-Recoverable Amount Base |

Displays the non-recoverable system calculated VAT amount in the base currency. |

Recalculate |

Click to recalculate the VAT for the line. |

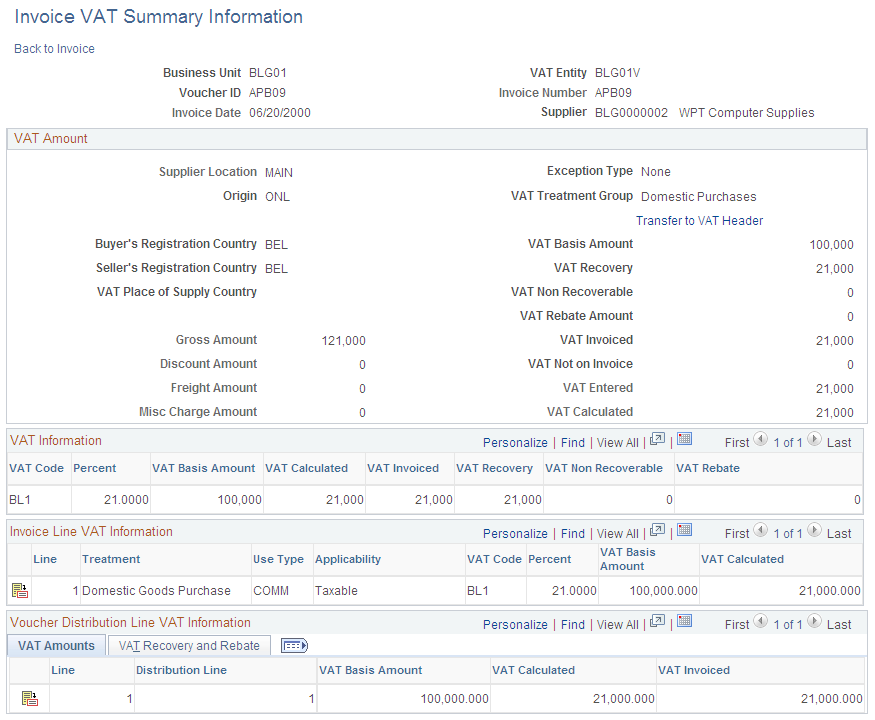

Use the Invoice VAT Summary Information page (VCHR_VAT_SM_EXP) to review the VAT amounts summarized by VAT rate.

This page provides a preliminary view of the VAT calculations based on the parameters that have defaulted (or been manually updated), as well as the amounts entered. You can also link from this page to the VAT header, line, and distribution line defaults pages.

Navigation:

Click the VAT Summary link on the Invoice Information page.

This example illustrates the fields and controls on the Invoice VAT Summary Information page. You can find definitions for the fields and controls later on this page.

The best approach for applying VAT to your vouchers is to wait until you have completed entering all other voucher information, and then either let the system apply the VAT defaults at save time or navigate to any of the VAT pages to allow the VAT defaults to be applied. However, at any point during voucher entry, you can use the VAT Summary page to review the VAT settings for the invoice. The top of the page displays the VAT header default settings and below that you can view the VAT settings by VAT code, VAT line, and VAT distribution line. You may navigate to the VAT Header, VAT Line and VAT Distribution Line pages from here as well.

If you edit VAT information on the VAT Header, VAT Line and VAT Distribution Line pages the system automatically recalculates the VAT amounts that display on the Invoice VAT Summary Information page.

Note: Many of the fields on this page are the same as those on the voucher VAT defaults pages. Only fields that do not appear on those pages or that behave in ways particular to this page are discussed here.

Field or Control |

Description |

|---|---|

Transfer to VAT Header |

Click to open the Invoice Header VAT Information page on which you can review and, if applicable, override VAT header default values. |

VAT Information

The calculated fields that appear in this grid are the subtotals for each VAT Code on the voucher.

Field or Control |

Description |

|---|---|

Percent |

Displays the tax percentage applied to the transaction. The VAT percent defaults from the VAT code. |

VAT Basis Amount |

Shows the amount upon which VAT is calculated. |

VAT Calculated |

Shows the system calculated VAT amount. The system calculates the VAT amount based on your VAT transaction amount and the VAT percentage. |

VAT Invoiced |

Shows the amount of VAT on the invoice. |

VAT Recovery |

Shows the amount of VAT that is recoverable. |

VAT Non Recoverable |

Shows the amount of VAT that is non-recoverable. |

(CAN) VAT Rebate Amount |

Shows the VAT rebate amount. This is only for Canadian public service bodies. |

Invoice Line VAT Information

This grid displays the VAT treatment, use type, applicability, code, and rate (percent), along with the VAT basis and calculated amounts for each voucher line. These fields are all defined either in the VAT Information section immediately above, or in the discussion of the Invoice Line VAT Information page.

Field or Control |

Description |

|---|---|

|

Click to access the Invoice Line VAT Information page, where you can review, and if applicable, override default voucher line VAT settings. If a driver higher up in the default hierarchy, such as Ship to ID or Item, changes after the invoice line defaults have been applied, a red triangle icon appears instead. |

Voucher Distribution Line VAT Information

This grid displays the VAT basis, calculated and invoiced VAT amounts for each distribution line, along with the recovery percentage, recovery amount, rebate percentage, and rebate amount. These fields are all defined either in the VAT Information section, above, or in the discussion of the Invoice Distribution Line VAT Information page.

Each distribution line number functions as a link to the Invoice Distribution Line VAT Information page for the distribution line. On this page you can review, and if applicable, override default distribution line VAT settings.

Field or Control |

Description |

|---|---|

|

Click to access the Voucher Distribution Line VAT Information page, where you can review, and if applicable, override default voucher distribution line VAT settings. If a driver higher up in the default hierarchy, such as Ship to ID or Item, changes after the distribution line defaults have been applied, a red triangle icon appears instead. |