Reviewing ARO Processing Results

PeopleSoft Asset Management delivers the following inquiries by which to review ARO processing results:

Expense Schedule

Expense Schedule by Period

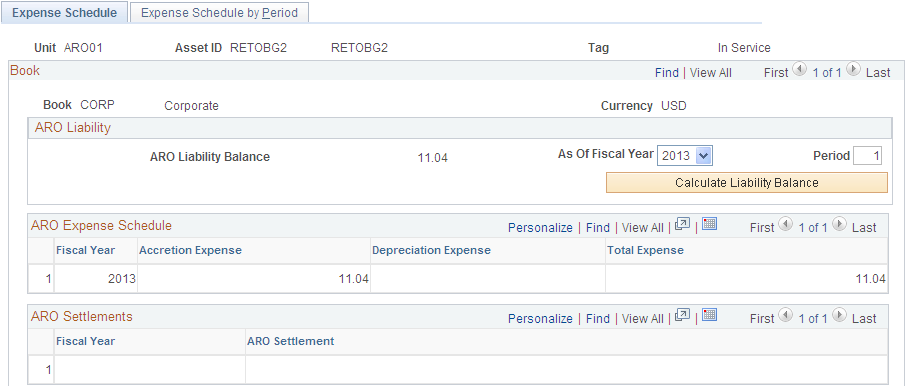

Use the Expense Schedule page (ARO_EXP_SCHED_YR ) to view the ARO-related accretion and depreciation expense for an asset by year to verify results

Navigation:

This example illustrates the fields and controls on the Expense Schedule Page. You can find definitions for the fields and controls later on this page.

The schedule of expenses related to asset retirement obligations includes accretion expense for the liability and depreciation expense for the associated asset retirement cost. If the ARO liability has been settled, the ARO Settlement and associated fiscal year appear.

Field or Control |

Description |

|---|---|

ARO Liability Balance |

Displays the resulting calculation for the asset ID: (Initial Measurement +/- Re-measurements or settlements) + Accretion Expense.) |

Fiscal Year |

Select the fiscal year for which you want to review resulting values for the asset. |

Period |

Enter the period for which you want to review resulting values for the asset. |

Calculate Liability Balance |

Click this button to calculate the ARO liability balance as of the selected fiscal year and period. |

ARO Expense Schedule

View the Accretion, Depreciation, and Total Expense related to ARO for the asset by fiscal year. You can click the Fiscal Year link to access the expense detail for the entire year.

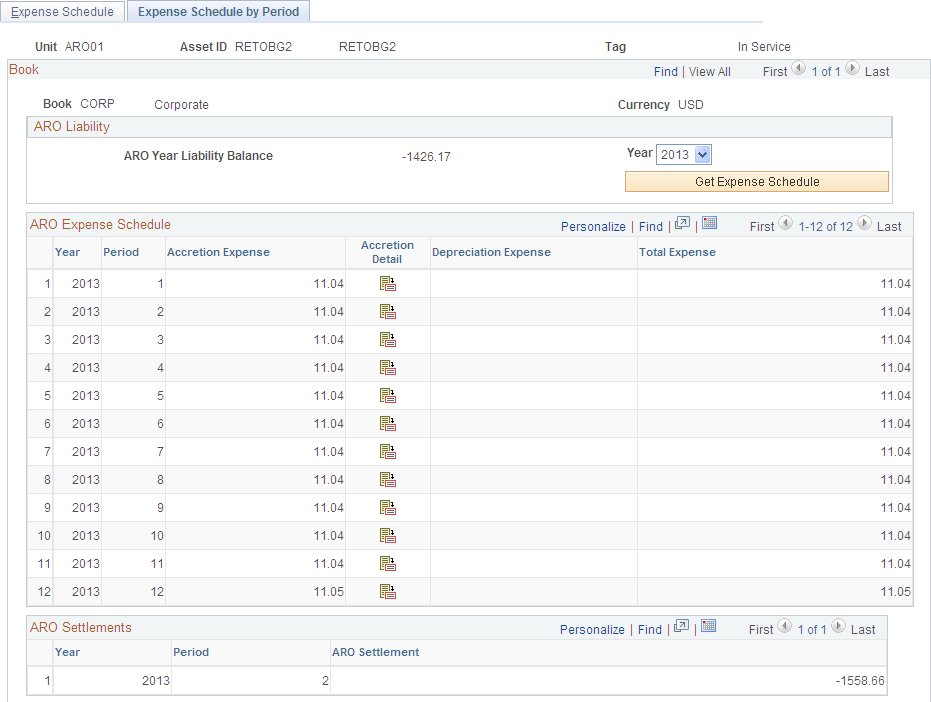

Use the Expense Schedule by Period page (ARO_EXP_SCHED_PD) to view the ARO-related accretion and depreciation expense for an asset by period to verify results.

Navigation:

This example illustrates the fields and controls on the Expense Schedule by Period Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

ARO Year Liability Balance |

Displays the resulting calculation for the asset ID: (Initial Measurement +/- Re-measurements or settlements) + Accretion Expense.) |

Year |

Select expense schedule year. |

Get Expense Schedule |

Click this button to populate or refresh the ARO Expense Schedule and ARO Settlements data for the selected year. |

ARO Expense Schedule

Field or Control |

Description |

|---|---|

Year |

Displays the selected year for viewing expense schedule detail. |

Period |

Displays the calendar periods within the selected year for which data exists. |

Accretion Expense, Depreciation Expense, and Total Expense |

Displays the Accretion, Depreciation, and Total expenses for each period of the selected year. |

Accretion Detail |

Click the Accretion Detail icon to view the accretion expense detail by sequence number for the period. The sequence field represents the ARO sequence number that is used to identify incremental liability incurred subsequent to the initial measurement. |

Asset retirement obligations can be settled partially or in full. When an asset is retired and the asset retirement obligation is settled, the difference between the asset retirement obligation liability and the amount actually incurred is to be recognized as either a gain or loss. If the actual cost is greater than the ARO liability, a loss is recognized, and if the actual cost is less than the asset retirement obligation liability, a gain is recognized.

Use the Retire/Reinstate Asset component or the Disposal Worksheet component to record the settlement of asset retirement obligations.

See Understanding Asset Retirement Using the Disposal Worksheet

Accounting Entities for Settlement of Asset Retirement Obligation

The following tables present the scenarios for accounting entries of ARO Settlement:

|

Settlement of ARO Without Recognized Gain or Loss: |

Debit |

Credit |

|---|---|---|

|

ARO Liability |

XXXX |

|

|

ARO Settlement |

XXXX |

|

Settlement of ARO with Recognized Gain |

Debit |

Credit |

|---|---|---|

|

ARO Liability |

XXXX |

|

|

ARO Settlement |

XXXX |

|

|

Gain on Settlement of ARO |

XXXX |

|

Settlement of ARO with Recognized Loss |

Debit |

Credit |

|---|---|---|

|

ARO Liability |

XXXX |

|

|

ARO Settlement |

XXXX |

|

|

Loss on Settlement of ARO |

XXXX |

|

Removal of Capitalized ARC |

Debit |

Credit |

|---|---|---|

|

Accumulated Depreciation |

XXXX |

|

|

Long-lived Asset (ARC) |

XXXX |

PeopleSoft Asset Management delivers the following ARO reports:

Asset Retirement Obligations (AMARORPT01 BI Publisher report) – This report identifies the beginning and ending aggregate carrying amount of an asset retirement obligation and provides the information to assist in preparing disclosures in accordance with Financial Accounting Standards.

ARO Pending Settlement (AMARORPT02 BI Publisher report) – This report identifies outstanding asset retirement obligation settlements and provides Asset Managers and Asset Accountants with visibility to those assets retired but pending remediation.

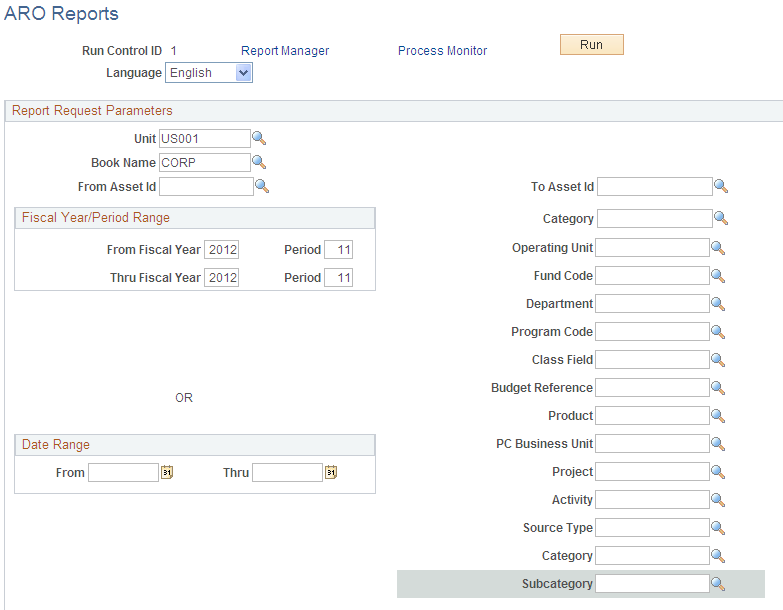

Use the ARO Reports page (AM_ARO_RPT_RQST) to run reports that provide ARO compliance information.

Navigation:

This example illustrates the fields and controls on the ARO Reports Page. You can find definitions for the fields and controls later on this page.

Select from any or all of the report request parameters to produce the ARO reports by business unit, book name, and range of asset IDs. You can limit the report period by entering a range of fiscal years and periods or select any date range.

You can further limit your resulting report data by specifying any of the ChartField values, including the Project Costing ChartFields.