Setting Up Depreciation Conventions

To set up depreciation conventions, use the Depr Convention Builder (CONV_BLDR_PNLG), Depr Convention Definition (DEPR_CONVENTION), Depr Convention Multiple Copy (CONV_COPY_ALL_COMP), and Depr Convention Single Copy (CONV_COPY_PNLG) components.

This topic provides an overview of depreciation conventions and discusses how to set up Depreciation Conventions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CONV_BLDR_PNL |

Create a depreciation convention. Generate depreciation conventions based on monthly accounting calendars. |

|

|

CONVENTION_DEFN |

Modify a convention that you have built, or add a new convention and enter all the dates associated with it. It is recommended that you use the Convention Builder page to add a new convention. |

|

|

Depreciation Convention Single Copy |

CONV_COPY_PNL |

Copy one convention from a SetID or calendar to another SetID or calendar. |

|

Depreciation Convention Multiple Copy |

CONV_COPY_ALL_PAGE |

Copy all conventions associated with a SetID or calendar to another SetID or calendar. |

Depreciation conventions, in combination with an asset's placed-in-service date, determine when depreciation starts. For example, where a following month convention is used and an asset is placed in service on February 1, depreciation begins on March 1. PeopleSoft Asset Management delivers a wide selection of depreciation tables, including depreciation conventions. Before you set up your own Depreciation Conventions table, review the delivered tables to determine if you can use them as delivered or if modifications are required.

PeopleSoft Asset Management provides a series of pages that enable you to:

Define a depreciation convention and automatically generate start, end, and begin depreciation dates based on a selected calendar.

Modify the dates associated with a convention without regenerating it.

Copy conventions associated with a SetID or calendar:

Copy one convention associated with a SetID or calendar to another SetID or calendar.

Copy all conventions associated with a SetID or calendar to another SetID or calendar.

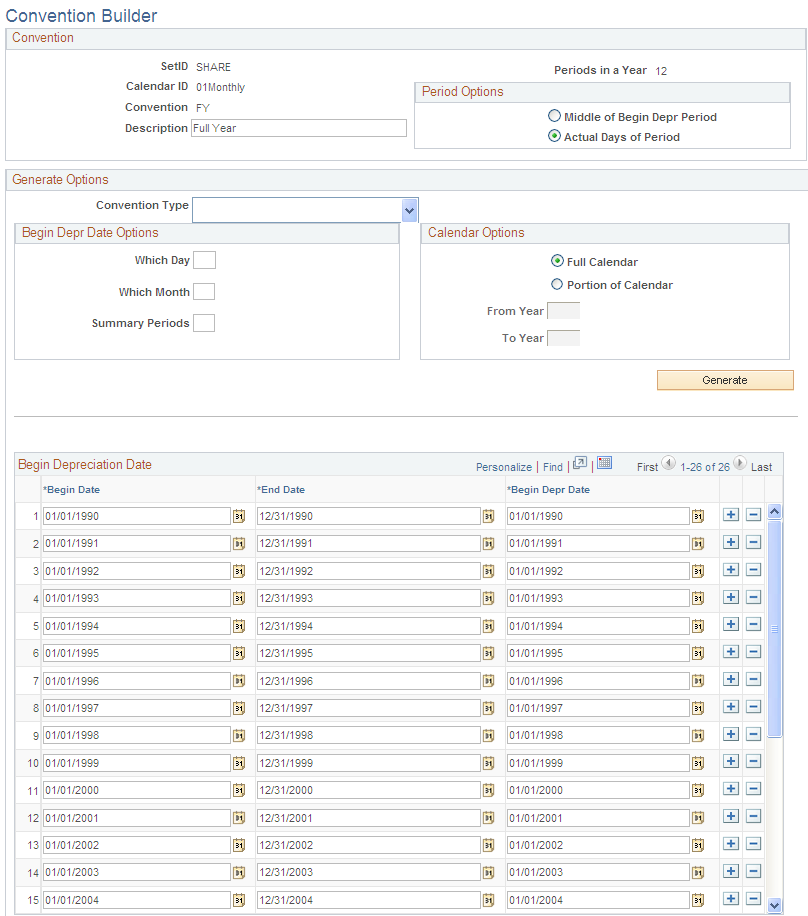

Use the Convention Builder page (CONV_BLDR_PNL) to create a depreciation convention.

Generate depreciation conventions based on monthly accounting calendars.

Navigation:

This example illustrates the fields and controls on the Convention Builder page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Period Options |

Select Mid Period or Days. Use Days to begin depreciation based on the value specified in the Begin Date field. Use Mid Period for mid-month and mid-quarter conventions. |

Generate Options

This table summarizes how the system determines the begin depreciation date for each convention type, and indicates which fields can be overridden:

|

Convention Type |

Begin Depreciation Date |

|---|---|

|

Mid Month |

15 appears by default for Which Day; the begin depreciation date is day 15 of the calendar period. You can override Which Day. |

|

End of Month |

Uses the end date of the month as the begin depreciation date. You cannot override this. |

|

End of Quarter |

Uses the end date of the quarter as the begin depreciation date. You cannot override this. |

|

End of Year |

Uses the end date of the year as the begin depreciation date. You cannot override this. |

|

Following Month |

Adds one day to the end day of the month, and identifies this as the begin depreciation date. You cannot override this. |

|

Full Year |

Uses the current day of the current month as the begin depreciation date. You cannot override this. |

|

Half Year |

1 appears by default for Which Day; 7 appears by default for Which Month, so day 1 of period 7 in the calendar is the begin depreciation date. You can override Which Day and Which Month. |

|

Mid Quarter |

15 appears by default for Which Day; 2 appears by default for Which Month, so day 15 of the second month in the quarter is the begin depreciation date. You can override Which Day only. |

|

User Defined |

No defaults are provided. Specify values for Which Day, Which Month, and Summary Periods. |

Begin Depr Date Options

Enter the options for which to begin depreciation for those conventions that you can override:

Field or Control |

Description |

|---|---|

Which Day |

Enter the numerical day of the month when depreciation is to begin. |

Which Month |

Enter the numerical month when depreciation is to begin. |

Summary Periods |

Specify how many months will be grouped or summarized into one period of the year. For example, if the Summary Periods value is 1, there will be 1 month per 1 period and there will be a total of 12 periods in one year. If the Summary Periods value is 3, there will be 3 months in 1 period and there will be a total of 4 periods in one year. |

An example of beginning depreciation date options is as follows:

Summary Periods = 3 (three months in one period)

Which Month = 2 (second month within the period)

Which Day = 15 (15th day of the second month)

|

Period |

Begin Date |

End Date |

Begin Depr Date |

|---|---|---|---|

|

Period 1 |

January 1, 2009 |

March 31, 2009 |

February 15, 2009 |

|

Period 2 |

April 1, 2009 |

June 30, 2009 |

May 15, 2009 |

|

Period 3 |

July 1, 2009 |

September 30, 2009 |

August 15, 2009 |

|

Period 4 |

October 1, 2009 |

December 31, 2009 |

November 15, 2009 |

|

Period 5 (next year) |

January 1, 2010 |

March 31, 2010 |

February 15, 2010 |

Calendar Options

Field or Control |

Description |

|---|---|

Full Calendar |

Select to build conventions for all years. When selecting this option, the From Year and To Year fields are unavailable. |

Portion of Calendar |

Select to build conventions for the years that you specify. When selecting this option, supply the From Year and To Year fields. |

Click the Generate button to build the conventions based upon the options that you selected.

Use the Convention Definition page (CONVENTION_DEFN) to modify a convention that you have built, or add a new convention and enter all the dates associated with it.

Navigation:

Select System Maintained to use standard depreciation conventions that are delivered with and maintained by the PeopleSoft system.

Note: You cannot enter the from date, to date, or the begin depreciation date for system-maintained depreciation conventions.