Defining Financial Processing for PeopleSoft Asset Management

Use the Asset Categories (CATEGORY_DEFN) component to define financial processing in PeopleSoft Asset Management.

This topic provides an overview of financial processing, lists the pages to define financial processing and describes how to define financial processing for PeopleSoft Asset Management.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CATEGORY_DEFN |

Establish asset categories, which classify assets by type for accounting entry purposes. Typically, these categories reflect how assets are reported on balance sheets. Examples of commonly used asset categories are Furniture and Fixtures, Machinery and Equipment Office Equipment, Leasehold Improvements, and so forth. |

|

|

Inflation Information Page |

CATEGORY_SEC |

Establish an inflation adjustment factor by selecting the market index and rate to apply. |

|

Asset Categories Report |

RUN_AMAS1100 |

Run a report on asset categories. |

|

COST_TYPE_DEFN |

Define cost types. |

|

|

Financing Codes |

FINANCING_CD |

Define financing codes to help you analyze your debit and credit relationships for capital-intensive and government projects. For example, you could set up codes to identify bonds, such as IRBs, IDBs, and TEBs. |

|

Indexes |

AM_INDEX_TBL |

Set up an index, which is used to remeasure assets according to set percentages. Gain and loss on retirement is then calculated by using the resulting net book value. Indexes are usually maintained by regulatory agencies, but you can set up your own as well. You can set up rates to associate with indexes on the Defining Market Rates page. |

|

C.A.P. Types (capital acquisition plan types) |

CAP_TYPE |

Set up C.A.P. types. If you are using Asset Budgeting, you set up codes to be used with the C.A.P. function. You can also use C.A.P. type codes to track assets acquired as part of a C.A.P. |

|

AM_CLEREC_RQST |

Run the process to reconcile the clearing account that is created by trackable assets from feeder systems against the expense account. |

|

|

Review Expense Entries |

ASSET_NF_DIST |

Run a report to show the capitalization status of assets based upon criteria selection. |

PeopleSoft Asset Management enables you to apply various attributes to assets for financial reporting purposes, such as categories, cost types, financing codes, and indexes. The purpose of defining these asset attributes is to help refine asset information into meaningful information blocks.

The combination of asset category and transaction code determines into which accounts an asset transaction is entered. Asset category is required.

To group assets by class for reporting or informational purposes only, use the asset class field.

Cost types represent different cost components of an asset, such as materials, labor, and overhead. For example, you can differentiate between the cost of building an asset and its market value by allocating the cost of production to one cost type and the margin of profit to another cost type. Cost type, in combination with asset category and transaction code, determines into which accounts the costs are entered in the general ledger.

Use indexes to remeasure assets according to set percentages. An index may consist of several subindexes, each of which has a separate index amount. You can set up a subindex for each asset category, with amounts that correspond to the inflation or valuation percentages for that year.

You also use indexes and subindexes to calculate replacement costs for assets. Tying an index, such as the consumer price index (CPI), to an asset profile enables replacement cost to be updated in adjustment, partial InterUnit transfer, partial retirement, and partial reinstatement transactions. Revaluation indexes are usually dictated by regulatory agencies, but you can also set up your own.

In compliance with Financial Accounting Standards (FAS) 157, which establishes U. S. guidelines for measuring the fair values of assets and liabilities, PeopleSoft Asset Management provides a framework by which to designate the appropriate valuation method for proper fair value valuation processing. Asset Management also supports fair value processing for international organizations.

PeopleSoft Asset Management validates capitalization limits when you add assets. At the business unit or book level, indicate whether validation should occur against a specific limit or against a table where you have stored step limit amounts and specified various messages for assets whose costs fall below these steps. You can also specify incremental valuation thresholds that identify the asset as a low value asset and how it should be treated during processing. The capitalization limit table accommodates the processing requirements of various countries. In some countries, a low value asset must be fully depreciated in the year of acquisition; in others, a low value asset may be added but must be taken as an expense.

PeopleSoft Asset Management can also determine capitalization status of an asset based on its cost according to capitalization thresholds that you define. When adding new assets, either online or batch, the system automatically classifies them according to their cost into capital assets, non capital assets or expense assets. You create a Capitalization Threshold for each profile of asset that you want to evaluate and associate it with that asset profile. Processes are available to validate capitalization status and deal with adjustments to the original cost, reconcile any potential clearing account with feeder systems, and access reports and audit trails to facilitate control of these transactions.

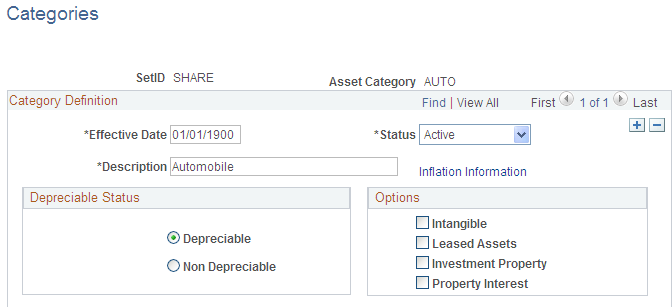

Use the Categories page (CATEGORY_DEFN) to establish asset categories, which classify assets by type for accounting entry purposes.

Typically, these categories reflect how assets are reported on balance sheets. Examples of commonly used asset categories are Furniture and Fixtures, Machinery and Equipment Office Equipment, Leasehold Improvements, and so forth.

Navigation:

This example illustrates the fields and controls on the Categories page. You can find definitions for the fields and controls later on this page.

Complete the appropriate fields for each asset category. Identify the depreciable status as Depreciable or Non Depreciable.You can optionally associate inflation processing information with the category.

See Setting Up Asset Profiles.

Options

These options drive the accounting entries to display in the accounting entry template. When possible, assign these options at the asset category level to alleviate this identification at the individual asset level. Identification at the category or profile level is also necessary for handling batch transactions where there is no use intervention.

Field or Control |

Description |

|---|---|

Intangible |

Select if the asset category applies to intangible assets. |

Leased Assets |

Select if the asset category applies to leased assets. |

Related Lease Category |

Select suitable lease category value from the given list. Only if Leased Asset option is selected this field is displayed. It denotes the default asset category assigned to assets upon lease reclassification. This is an optional field. The default asset category assigned upon lease reclassification can be overridden at the asset level. |

Investment Property |

Select if the asset category applies to assets that are considered investment property as defined by International Accounting Standards (IAS) 40. This selection can be used in conjunction with the Leased Assets check box if the category applies to leased assets that are also investment property. However, you cannot select the Intangible check box and the Investment Property check box in combination. A warning message appears in the event that you select this invalid combination. |

Property Interest |

Select if the asset category applies to an operating lease that meets the conditions for investment property as defined by IAS 40. Operating leases that fall under this category are not treated as operating leases according to Financial Accounting Standards (FAS) 13, which are normally expensed, but rather as capital leases for accounting purposes (capitalized and amortized over the lease term). The Leased Asset check box must also be selected when selecting this option. A message alert appears upon saving the page if the Property Interest check box is selected without the selection of the Leased Assets check box. |

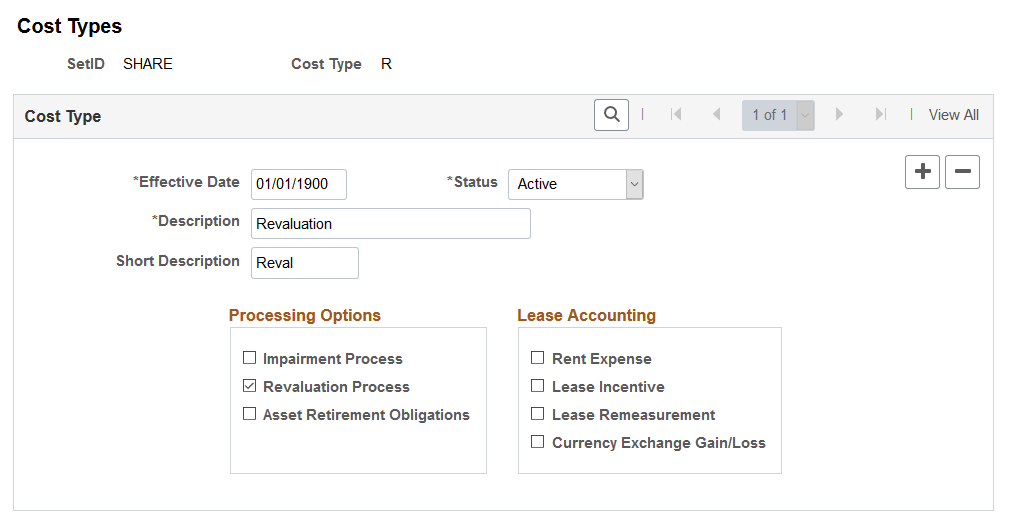

Use the Cost Types page (COST_TYPE_DEFN) to define cost types.

Navigation:

This example illustrates the fields and controls on the Cost Types page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Impairment Process |

Select to use this cost type for impairment. Selecting this check box displays impairment related accounts at the accounting entry template level. This field is not displayed if impairment options are not selected on the Installation Options - Asset Management page. Note: This option cannot be selected with the Revaluation Process option for a single cost type. |

Revaluation Process |

Select to use this cost type for revaluation. Selecting this check box displays revaluation related accounts at the accounting entry template level. This field is not displayed if revaluation options are not selected on the Installation Options - Asset Management page. Note: This option cannot be selected with the Impairment Process option for a single cost type. |

Asset Retirement Obligations |

Select to use this cost type for ARO (asset retirement obligation) processing. Selecting this check box displays ARO-related accounts at the accounting entry template level. This field is not displayed if ARO options are not selected on the Installation Options - Asset Management page. Note: This option cannot be selected with the Impairment Process option or the Revaluation Process option for a single cost type. |

Rent Expense |

Select to use this cost type for rent expense. |

Lease Incentive |

Select to use this cost type for lease incentive. |

Lease Remeasurement |

Select to use this cost type for lease remeasurement. |

Currency Exchange Gain/Loss |

Select to use this cost type for currency exchange gains and losses. |

Note: When selecting a cost type for processing, you should update the accounting entry templates because new accounting entries need to be set up for these transactions.

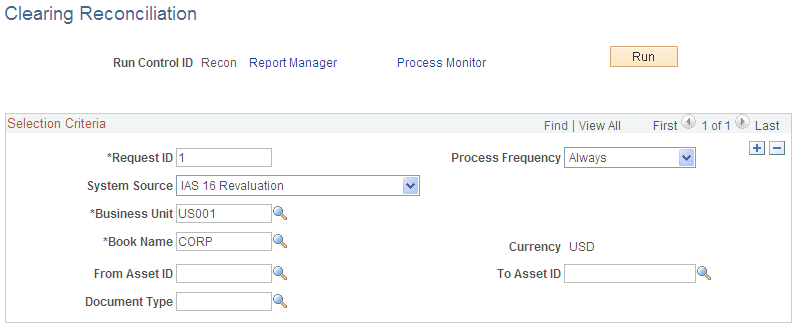

When an asset is deemed trackable by the capitalization threshold process, the asset ID is generated but in fact no accounting activities take place. Additionally, when assets are added through feeder sources, it is likely to debit the Fixed Account and credit a Clearing account that was previously debited at the source accounting. The Clearing Reconciliation process provides a way to balance out (credit) the clearing account that was previously debited at the source product accounting and debit the expense account. This is not applicable to the trackable assets that are entered directly into Asset Management with no clearing account at all. In this instance, the expense account is most likely debited when the asset is added.

This process checks the non capital cost lines, determines the expense and clearing accounts from the accounting entry templates and inserts rows into the staging table (DIST_LN) to be loaded as journal entries into general ledger for posting.

Use the Clearing Reconciliation page (AM_CLEREC_RQST) to run the process to reconcile the clearing account that is created by trackable assets from feeder systems against the expense account.

Navigation:

This example illustrates the fields and controls on the Clearing Reconciliation page. You can find definitions for the fields and controls later on this page.

This process creates the clearing accounting entries from the non capitalized assets that have the selected system source. For each non capital row that matches the criteria, an entry is generated in the DIST_LN table that credit the clearing account and debit the expense account according to the accounting entry template for the EX distribution type. This distribution type is available for the ADD and ADJ accounting entry templates for those template IDs that have the capitalization threshold enabled.