Defining Depreciation Bonus Information

To set up depreciation bonus information, use the Depreciation Bonus (AM_DEPR_BONUS) component.

Use the Depreciation Bonus component to define Depreciation Bonus values. Depreciation Bonus values are then selected at the Asset level or Asset Profile level for qualifying assets based on depreciation bonus legislation.

This topic discusses how to define depreciation bonus information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

AM_DEPR_BONUS_INFO |

Modify the delivered Bonus Depreciation options, if necessary, or add new Bonus Depreciation values to accommodate depreciation bonus legislation changes. |

Use the Depreciation Bonus page (AM_DEPR_BONUS_INFO) to modify the delivered Bonus Depreciation options, if necessary, or add new Bonus Depreciation values to accommodate depreciation bonus legislation changes.

Navigation:

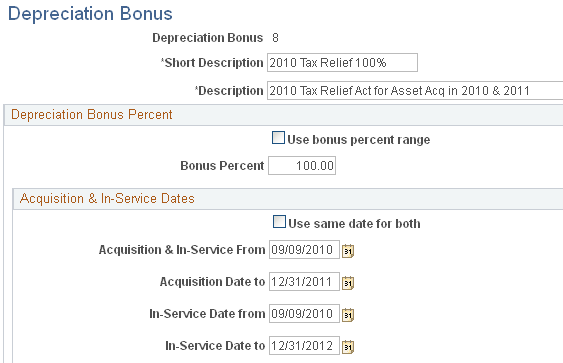

This example illustrates the fields and controls on the Depreciation Bonus Page. You can find definitions for the fields and controls later on this page.

Use the Depreciation Bonus Info page to add new depreciation bonus values or to modify existing values to accommodate new legislation. You are then able to assign the Depreciation Bonus definitions to assets or asset profiles.

See Book - Tax Page.

See Asset Profiles - Tax Page.

Although PeopleSoft Asset Management delivers several depreciation bonus values based on prior legislation, the Depreciation Bonus component gives you the flexibility to create your own Depreciation Bonus definitions in order to accommodate individual organization needs as well as new legislative changes.

Field or Control |

Description |

|---|---|

Depreciation Bonus |

Select (or supply) the Depreciation Bonus value to modify or add a new Depreciation Bonus value. The value can be 0 to 9 or A to Z. |

Use bonus percent range |

Select this check box to use a range of bonus percent values. When selected, the Bonus Percent To field appears. |

Bonus Percent |

Enter the percent amount of the depreciation bonus to be applied to the book(s) for a given asset profile. The amount depends on the Depreciation Bonus type, the acquisition date and in service date of the asset as well as state or local application of the depreciation allowance. For example, if your state adopted the bonus depreciation as a percentage of the Federal percentage, the amount may be calculated as an amount other than the federally allowed percentage. |

Acquisition & In-Service Dates

Field or Control |

Description |

|---|---|

Use same date for both |

Select this check box when the asset acquisition date range is the same as the in-service date range. When selected, only one row appears for Acquisition & In-Service date range. |

Acquisition & In-Service From |

Enter the first date of the allowable range from which the asset is to be acquired and in-service in order to take advantage of the depreciation bonus. |

Acquisition Date to |

Enter the end of the allowable acquisition date range in order to take advantage of the depreciation bonus. This field becomes Acquisition & In-Service To when the Use same date for both field is selected. |

In-Service Date from and In-Service Date to |

Enter the allowable in-service date range for assets to take be able to take advantage of the depreciation bonus. This row appears when the Use same date for both check box is deselected. |